AQR on Managed Futures

Today’s post looks at a 2022 note from AQR on Managed Futures.

AQR

The note is written by Cliff Asness, the founder and head of AQR, and is called ” The Raisons d’être of Managed Futures”.

- Cliff is talking his own book here, but that doesn’t mean that we as private investors can’t learn something.

I don’t believe that a UK private investor can invest directly in AQR’s funds (there is a US mutual fund, but I don’t know how to buy that, and there’s no ETF.

- So today will be something of an academic exercise unless I can come up with a good proxy for the AQR approach.

Managed Futures

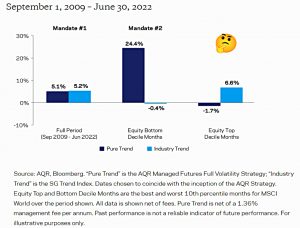

Managed Futures strategies have an implicit [dual mandate] – 1) deliver positive returns on average and 2) generate especially attractive returns during large equity market drawdowns.

Cliff’s point is that the MF industry (AQR excepted) optimises for one at the expense of the other.

Both the industry trend and the AQR “Pure” trend provide positive returns, but only AQR outperforms during equity downturns.

- The right-most set of bars shows that industry trend does well when stocks are doing well, which is not what you would expect.

GFC

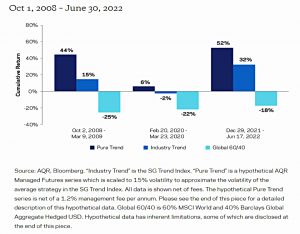

Since the Global Financial Crisis (GFC), times have been tough for trend.

Markets trending less than normal (i.e., a challenge for Mandate #1) and few tails [bad times] to hedge (i.e., little need for Mandate #2) has been a desultory combination.

As a result, much of the industry seems to have moved away from the core strategy.

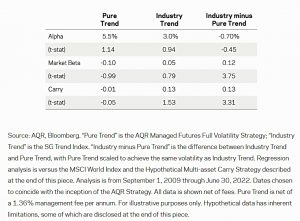

Regression analysis from September 2009 to June 2022 shows that pure trend (AQR) has been a slight hedge to the market and industry trend (the SG Trend Index) has been slightly the opposite.

Many managed futures managers try to improve their Sharpe ratios and realized total returns by adding carry strategies. That’s fine if you’re trying to improve Mandate #1, but carry is often a “risk on” strategy. Thus, it can become a real problem when it comes to Mandate #2.

The alpha gap in pure trend’s favour is exacerbated by the industry trend allocation to carry strategies.

Drawdowns

This chart looks at performance across the three worst drawdowns since 2007 and throws in the 60/40 portfolio as a benchmark.

The average drawdown of 60/40 across the three is -22%. The average return of Pure Trend is 34%, meaning a 10% allocation to Pure Trend saved 5.6% on average. Industry Trend saved you a bit more than half that.

Explanation

It’s no mystery that lots of funds have softened their approach:

In good times (e.g., most of the post-GFC period), the kinds of managed futures everybody likes best are the ones with the highest average return (as opposed to ones having the best defensive characteristics).

Illiquids

Cliff also worries about the smoothing effect of illiquids such as private equity:

What you often get is a mirage of lower volatility and lower market risk, even though the underlying economic exposures are pretty much the same.

Smoothing returns helps conceal market drops that quickly recover, like the COVID shock. However, it can’t help against a very protracted bear market where eventually you need to mark your positions.

Pure trend works well in these situations.

Innovation

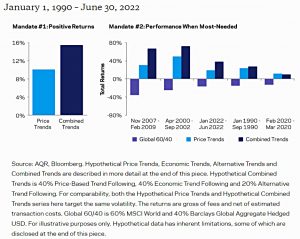

Cliff does approve of two possible improvements to managed futures, which he says have return characteristics that support the dual mandate.

First, “alternative” trends:

If you find trend-following to be a pretty persistent and pervasive strategy, then you would expect to find evidence for it even in places you didn’t originally check. And not just in different asset classes, but even in factors themselves.

And second, economic trends:

Managed futures is all about capturing the tendency of markets to gradually incorporate new information. This creates persistent price trends— but it also implies that positioning on the basis of recent news should also be profitable, which means trend-following based on economic fundamentals is worth taking a look at.

This chart shows the (backtest) improvements on offer from incorporating these innovations.

The lessons

Cliff draws a couple of lessons from the post-GFC experience of the MF industry.

The first is that when it comes to alternatives, “above-average returns” doesn’t always mean “better for your portfolio.” Investors need to evaluate how much value a strategy is actually adding. This is especially true amid a bull market, where “beta” can easily be sold as “alpha.”

This could mean sticking with a “losing” strategy when you are worried about the future.

- Chasing performance usually means selling at the bottom.

The second point is that nothing works all the time.

Good strategies have bad times. If they didn’t, they probably shouldn’t be expected to work going forward. Prolonged good times attract large flows and eventually strategies become over-capitalized, and whatever expected return advantage they had is driven down.

Cliff is convincing on the merits of trend in general, pure (AQR) trend in particular, and the potential for alternative and economic trend to improve things further still.

- If only trend was not so difficult for the UK private investor to access (and in the case of AQR and combined trend, presently impossible).

Until next time.