Where next for Trend? – Man Group

Today’s post looks at a recent paper from Man Group on the outlook for trend following.

Contents

Recent performance

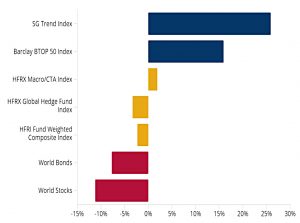

Trend-following indices, such as the SG Trend and Barclay BTOP50, have posted their best year-to-end-May returns since 2000, against a backdrop of poor performance from traditional asset classes such as equities and bonds.

This is partly due to the reappearance of inflation, which has produced strong upward trends in many commodities and led to weak stocks and bonds.

- Trend is well known to do well during inflation and stock crashes.

The BTOP50 and SG Trend indices have 20 and 10 constituents, respectively, which suggests there is considerable dispersion between trend-following managers in 2022. This could be down to various factors – risk targets, market allocations, models and trading speed, etc.

MAN is able to dig into this issue because they run multiple trend programmes and are able to compare the results and uncover the drivers.

2022 Drivers

Pure trend strategies trading the largest futures markets have been the star performers. Macro-economic themes are driving markets; inflation, central bank activity, war, supply chain disruption, de-globalisation and post-pandemic recovery.

Macro-sensitive futures and “traditional” CTAs would be expected to benefit.

‘Non-traditional’ or ‘alternative market’ trend-followers generally boast a wider range of price drivers and better diversification through trading a broad range of typically over-the-counter (‘OTC’) markets such as emerging market interest-rate swaps or European hydro-electric power markets.

The extra-diversification of non-traditional trend-following could be working against it.

Crisis vs non-crisis

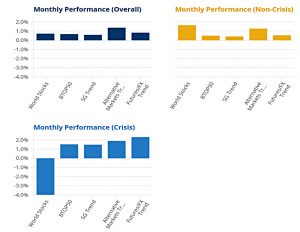

More generally, MAN expects (the more diversified) alternative trend to outperform traditional, though largely during non-crisis periods.

- Alternative trends did not outperform during the 2008 and 2020 crises.

‘Crisis’ typically relates to developed markets, most often equities. Global futures markets should be the instruments of choice for a trend-follower if an investor seeks a crisis hedge.

Crisis alpha from short bonds

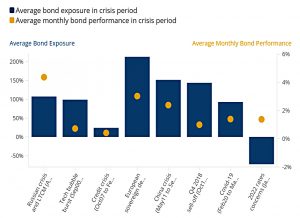

Trend following – and its crisis alpha – are usually associated with long bond positions:

- The longest-lived trend-following managers have been around for four decades, during which time yields have been in secular decline, so trend-followers should have been mostly long bonds;

- In a crisis, for which we infer a crisis in risk assets, there is often a flight-to-quality of bonds – particularly high quality government bonds.

2022 has been very bad for bonds:

Almost twice as bad as the 1995 drawdown, and around three times historic volatility. In fact, 2022 represents a bond rout.

But of course, trend can make money when a market is going down, and this year a negative bond exposure has led to a positive contribution from bonds.

Outlook for trend

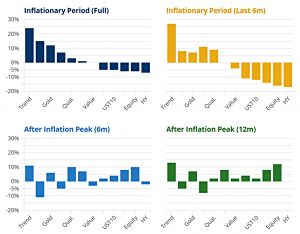

Trend-following is not only a robust performer in inflationary periods in general, but also in the last six months of the episode, as well as in the 6- and 12-month timeframes following inflation’s peak.

MAN summarise the performance of various asset classes as inflation peaks and subsides:

- From Good to Good: Trend, Gold, TIPS and Quality

- From Good to Bad: Commods Eq. Mom.

- From Bad to Good: US Equity, UST10, 60/40

- From Bad to Bad: HY

For trend, the takeaway is:

We don’t need to be able to predict when an inflationary period may peak or end. Given sufficient time, trend-following strategies are likely to adopt the market direction.

MAN also note that higher inflation means more volatility.

- They promise a future note on trend’s “long vol” characteristics.

That’s it for today.

- Trend does well in a crisis, during and after inflation, and even when bonds and stocks fall together.

What’s not to like?

- Until next time.