Weekly Roundup, 27th March 2023

We begin today’s Weekly Roundup with inflation.

Contents

Inflation and markets

The Economist had two articles (1 and 2) on the problems facing central banks.

- Their two jobs are bank stability and low inflation, and neither is going well.

- Inflation remains stubborn and the financial system is wobbly.

One issue is that the two jobs are in opposition – the higher interest rates needed to fix inflation are hurting all but the biggest banks.

- Securities portfolios have fallen in value and depositors are fleeing banks that are not “too big to fail”, either for bigger banks or money market funds.

This month the Fed continued with its steepest rate hiking sequence ever, despite calls for a pause following the collapse of SVB and Credit Suisse.

In several cases—after a big bank collapse in 1984, a stockmarket crash in 1987 and a hedge-fund blow-up in 1998—the Fed briefly stopped raising rates or modestly cut them but resumed tightening policy before long.

It’s quite possible that the 2023 rate cists priced in by the markets will not appear until 2024.

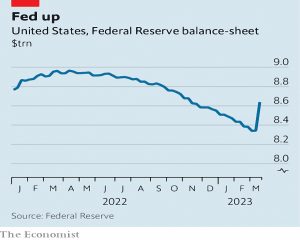

The extra credit provided to banks has put quite a dent into the Fed’s attempts to wind down its balance sheet.

The central bank last year began quantitative tightening, letting a fixed number of maturing bonds roll off its balance-sheet each month, removing liquidity from the banking system.

But for now, it is providing liquidity again.

The new rules introduced after 2008 are not working as planned – instead of winding down Credit Suisse, UBS was pressured to buy it and offered government loans and guarantees.

- As discussed last week, the convertible bonds were written off, but shareholders were paid $3.2 bn.

In the US, Treasury Secretary Janet Yellen has refused blanket insurance for all deposits over $250K, instead offering support on a case-by-case basis.

- One obstacle here is loose capital rules for smaller banks, which means that universal insurance could lead to excessive risk-taking.

It can be argued that the latest hike was unnecessary:

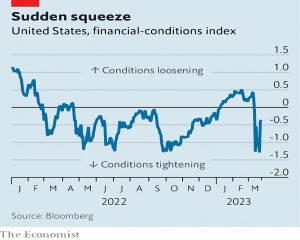

Bank chaos and market turmoil [are] tantamount to rate increases. Financial conditions tightened in the past couple of weeks, equivalent to an extra 1.5 percentage points of rate increases by the Fed, enough to tip the economy into a hard landing.

But another hike is what we got.

Banks

In the FT, Terry Smith explained why he never invests in banks.

- The main reason is leverage.

Banks have a very small amount of equity to support their balance sheet. In the 1982 Latin American debt crisis the large US banks lost all of their cumulative past earnings.

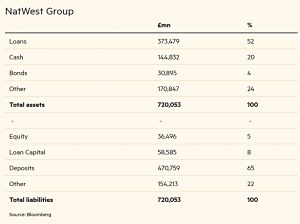

He uses NatWest as an example.

NatWest has £5 of shareholder’s equity to fund £100 of assets — it has gearing or leverage of 20 times. If 10 per cent of the £52 of loans in every £100 of assets prove to be bad then the whole of the shareholders’ equity is more than wiped out.

But as Terry points out, before that happens, depositors will panic, causing a run on the bank (as with SVB recently).

For comparison, the average S&P 500 company has a gearing of two times (their equity is one-third of their assets).

- Banks also have lower returns on equity (ROE – just 10.9% over five years, compared with 17.9% for consumer staples) and lower share price returns (-15.1% pa over the last five years, compared with 12.1% pa for consumer staples).

Terry also doubts that you can protect yourself by choosing a “good” bank since a general panic in the sector can affect anyone.

He tells a story about Hong Kong in the 1980s when a property crisis developed in anticipation of the handover from the UK to China.

There was a local bank which had an awning open over its front window to keep the sun out. It was by a bus stop and as a heavy rain shower developed, the bus queue moved to take shelter under the awning. In the febrile atmosphere passersby thought this was the beginning of a bank run and, as a result, one soon developed.

Terry also thinks that fintechs are replacing bank functions, though I would argue that fintechs suffer from the same lack of confidence in deposit-taking as mainstream banks suffer during a run.

- I use a lot of fintechs, but I wouldn’t deposit more than the government-insured limit with one of them.

Knowing beforehand

Sticking with banks, Joachim Klement wondered whether the collapse of SVB could have been foreseen.

SVB was incompetent enough not to hedge its Treasury portfolio and was forced to sell these Treasuries at a loss once many deposit holders demanded access to their money. Every normal bank [uses] swaps to swap the income from the Treasuries into the income from variable rate bonds.

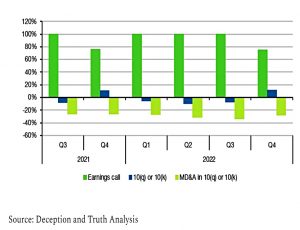

Joachim has a friend called Jason Voss who invented a tool called DATA (Deception and Truth Analysis).

The basic idea is to use natural language processing techniques on regulatory filings and earnings calls to identify sections where management may be deceptive or even lie in order to identify accounting shenanigans long before they become a problem.

SVB management was not deceptive at all at earnings calls because during these events, management can effectively steer the conversation into directions that are more preferred by them.

Regulatory filings are trickier, as they address a broader range of topics.

Management erected a lot of smoke screens in their discussion and these smoke screens became thicker.

Joachim notes that not only did DATA identify the deception, but it also highlighted the impact of rising rates on the balance sheet and its deposits.

- So we could have known beforehand.

No safety

Buttonwood argued that markets can never be made truly safe.

- His argument was that when officials try to prevent an impending crisis, they sow the seeds of the next one.

In response to the collapse of SVB, the Fed has reactivated daily dollar swap lines with Britain, Canada, the euro area, Japan and Switzerland.

The central banks of these economies can now borrow dollars from the Fed at a fixed exchange rate for short periods, backed by their own currencies, and lend them on to local financial firms.

Buttonwood is worried about the generosity of the scheme.

A 30-year Treasury bond issued in 2016 is worth around a quarter less than its face value in the market today, but is valued at face value by the Fed if an institution pledges it as collateral.

The programme could change the understanding of collateral that has built up over the past 150 years.

In particular, long-maturity bonds would become very valuable.

Financial institutions benefit when interest rates fall and their bonds rise in value; and when rates rise and the bonds slump in value, the Fed comes to the rescue.

Which means the system is not safer after all.

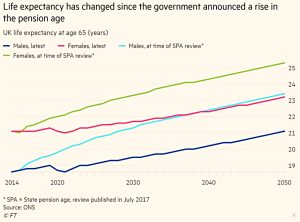

State pension age

Josephine Cumbo and George Parker reported on the government’s decision to delay plans to raise the state pension age.

- The SPA is currently 66 and is due to rise to 68 in 2044.

The government had planned to bring this forward to 2037 to 2039.

- A decision was expected in May this year but has now been pushed back beyond the next general election (though officially the SWP is still saying that a review will be published in May).

There are political considerations – the LTA has just been abolished, and there are riots in France over an increase in the SPA to 64, but there are also new data to consider.

Since the last SPA review in 2017, UK life expectancy has fallen. Former pensions minister Steve Webb, now at LCP, said:

The improvement in life expectancy at retirement that was predicted at the time of the last [pension age] review, basically didn’t happen. [It’s] now two years shorter.

Ros Altmann, another former pensions minister, said that the forecast costs of the state pension are possibly overstated:

This is of course partly due to the pandemic’s impact on older people, but the ongoing NHS backlogs and crisis in elderly care are also likely to prevent a sudden resumption of life expectancy rises.

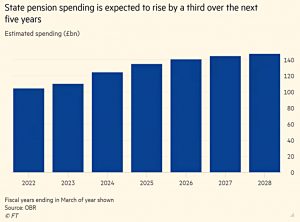

The state pension costs £110 bn at the moment, and the OBR expects this to increase to £148 bn by 2027/28.

Sticking with ISAs

John Lee, sometimes described as the UK’s first ISA millionaire (( But also a Tory peer and former minister and MP )) said that although his ISA has suffered over the last couple of years, he is still a firm believer.

These tax-efficient savings vehicles go back 36 years, to the introduction of Peps in 1987. I am sure I voted for the Finance Act that brought in Peps — though thankfully this did not debar me from actively participating.

He also campaigned for the inclusion of AIM shares (which allow ISAs to become exempt from IHT).

- You can also pass on your ISA to a surviving spouse.

Since 1987, the annual subscription limit has increased from an initial £3K to a much more reasonable £20K.

Dividends within ISAs are tax-free, but one change that John has noticed over the years is a decline in small-cap yields:

Looking back, many of the “small-cap” stocks I invested in were yielding about 6 per cent when I first bought them. Today, most small-caps yield no more than 3 per cent.

The individual stocks John mentions in the article include Anpario, Treatt, Videndum, Secure Trust, Vianet, Christie, Goodwin and Manolete.

Quick Links

I have five for you this week, the first two from The Economist:

- The Economist wrote that As video games grow, they are eating the media

- And explained How TikTok broke social media

- Alpha Architect said that Comparing past and present inflation rates can be tricky

- And looked at Institutional Investors’ Impact on Factor Premiums

- And UK Dividend Stocks reported on the Top 40 High-Yield Blue-Chip UK Stocks

Until next time.