Box Spreads for Leverage

Today’s post looks at using options to create box spreads as a cheap form of leverage.

Leverage

This post is part of my series on leverage.

- It took me some time to figure out that the optimum amount of leverage is not zero.

Since stocks generally go up, optimum leverage is closer to 2X.

A lot of my money is in unlisted products, and a lot is in tax-sheltered accounts which make it difficult to access leverage.

- I’m also relatively old and have a modest income, so accessing leverage through property loans (mortgages) is not straightforward.

I also discovered recently that my portfolio has net negative leverage.

- This is because my SIPP accounts attract a tax surcharge above a certain valuation, meaning that I don’t receive the full upside or downside (within limits).

Sources of leverage that are open to me include:

- Spread bets

- Options

- Leveraged ETFs

- Margin loans from bokers

Today we’ll be looking at a specific form of options setup which nets out to work directly as leverage (a loan).

I have two main sources for this:

- A site called Less Wrong (LW) which has some high-quality articles but rarely updates me about new ones.

- I first came across box spreads here in an article by Thomas Kwa but forgot to write about them.

- Big ERN of Early Retirement Now, of SWR and options fame.

Box Spreads

The LW article (from September 2020) is about using a taxable options account to borrow money at less than CD rates.

- An account size of $100K+ is recommended, ideally with portfolio margin (which increases the return).

- Interactive Brokers (IBKR) and TD Ameritrade are the recommended brokers.

LW talks about putting the money into a high-yield CD account to profit from the spread, but I won’t be doing anything like that.

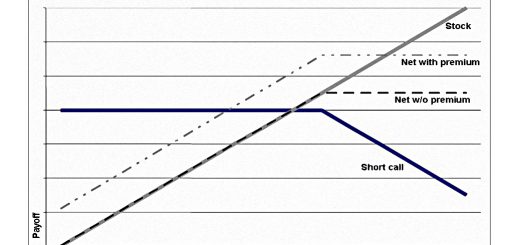

At the core of the strategy is a box spread:

A box spread is a combination of four options which cancel each other out so there is no risk from market movements. ţis allows institutions to lend each other large sums of money: one party sells the box spread for a premium, and pays the loan back on the exercise date up to 3 years later.

The rules are slightly different for retail investors:

As a retail investor, you can’t withdraw the cash from this loan, but you can take out a margin loan from your broker which is financed by this box spread.

So for LW, box spreads provide leverage at margin loan rates (say treasury yields plus 0.3% to 0.5%).

- Two-year yields in the UK are 1.38% at the time of writing, and 2.16% in the US – so this is not screamingly cheap money.

IBKR margin loans work out at around 1% over the Fed Funds Rate, which is currently 0.5% (though likely to go higher in the near future).

- So at first glance, the box spread looks more expensive.

Let’s hope that ERN has better news on this for us later.

Here’s the LW recipe:

- Sell SPX box spreads in a total amount that’s 30-65% of the value of

your account.- The exercise date should be as far in the future as possible, currently 2-3 years.

- Each box spread is worth 100x the spread width; i.e. $10,000 for a 2900/3000 box.

- The legs should be 100-300 points apart to minimize commissions cost.

- The upper strike price should be near-the-money (the current value of the SPX) to maximize liquidity.

You need to sell the box spread using a limit order (because bid-ask spreads are very wide).

- LW provides a spreadsheet to calculate the limit price (we’ll come back to that later).

You also need to use European-style options (available on SPX), which prevent early exercise risk.

- They are also available on XSP (mini-options at one-tenth the size of SPX), at the cost of lower liquidity.

Here’s the example trade:

SELL 5 DEC 15 2023 3000/3300 SPX BOX

The profit graph should look like a flat line because the options cancel each other out.

Execute the trade, and wait for it to be filled. If it isn’t filled within a day or two, slowly walk up the price until it is. (I was filled at 0.32% above the treasury yield.)

LW takes out the cash received from his brokerage account and puts it into CDs.

- I don’t plan on doing that, so I need to check whether the cash from the box spread actually increases my buying power within the brokerage account.

If it doesn’t, I’m not sure at this point how I can take advantage of the “low” borrowing rate.

- Once more, let’s hope for better news from ERN.

Risks

The key risk is having part of your box liquidated because of a violent market move (say a 30% crash).

- I think this is because LW is using his long stock portfolio as collateral for the box trade (having withdrawn the cash from the brokerage account).

Having part of a box spread liquidated is bad for two reasons: Žrst, bid-ask spreads are wide, so you’ll be liquidated at unfavorable prices, and second, holding part of a box spread is extremely risky, often equivalent to >20x leverage.

The only solution LW offers is buying a put option as insurance.

But I think this risk doesn’t apply to us (at least, not directly because of the box spread).

- You also run the risk of your broker changing margin rates etc, but again, most of this risk is from taking the box spread cash out of the brokerage account.

It’s also worth noting (though not strictly a risk) that the nominal value of the options contracts is close to 100X the amount of the cash loan that you obtain.

- In ERN’s example (next section) an $18.4K loan involved four contracts (which cancel each other out) to a value of $1.8M.

ERN

ERN also suggests that 0.3% to 0.5% above Treasuries is the right borrowing rate.

- He uses Boxtrades.com to calibrate his target interest rate – this site shows a log of past SPX box spread trades.

In his example, he gets filled on a 5-year box at 1.68%, which is 0.47% above the 5-year Treasury.

- He expects the Fed Funds Rate to average 1.32% over the next five years.

With an extra spread of 1% for a $100K loan, IBKR would charge 2.37%, significantly more than the box spread.

ERN put the money into preferred shares with a 6.125% yield.

The shares are callable on 12/15/2026, just two days before the box spread loan comes due. Isn’t that convenient? If there were to be called (redeemed) at $25 apiece I’ll have exactly $20,000 available to pay off the box spread loan two days later.

Since the shares trade above par, ERN’s actual return would be 4.65% annualized or 3.92% after tax.

- There’s also credit risk to consider, but this is all investment-specific rather than down to the box spread.

Margin

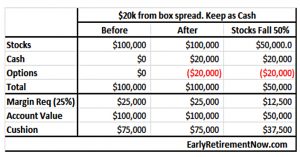

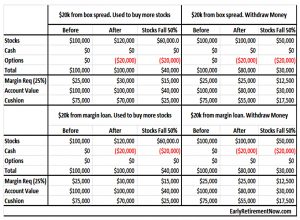

ERN also confirmed that the box spread has no impact on account margin.

- But this assumes that you just leave the cash in the account.

The two most likely options are:

- Buy more stocks (my plan)

- Withdraw the cash (the LW plan)

Either action will shrink your margin cushion.

- And a fall in the market will make things worse.

But the box spread position is the same as if you had used a margin loan.

That’s enough for today.

- I’ll be back in a couple of weeks with another article about how box spreads actually work, and how to place them on a couple of the popular platforms.

Until next time.