Weekly Roundup, 24th March 2015

We begin today’s Weekly Roundup with a few loose ends from last week’s Budget.

Contents

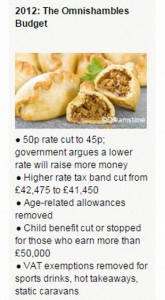

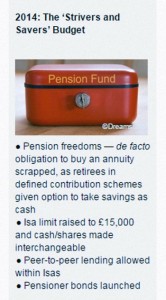

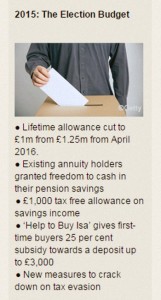

Six budgets of George Osborne

The FT had a nice infographic summarising George Osborne’s six budgets:

Budget 2015 word cloud

I’m not sure where I found this, but the themes of this year’s budget are clear:

P2P interest tax break

Judith Evans in the FT reported that after the speech itself, the Treasury confirmed that interest from P2P lending will be eligible for the new £1K savings allowance. Coupled with the existing ability to write off losses against profits, this will make it attractive to spread £20K around four or five P2P platforms even before the new lending ISA comes into being.

Unfortunately the savings allowance doesn’t come into force until April 2016 ((And we have an election to get through before that)) so I have plenty of time to do my research.

Pensions Lifetime Allowance

I mentioned last week the unfairness of the new £1M pensions lifetime allowance (LTA), in that it penalises DC savers more than DB pensioners. Merryn went into more detail. Because the limit is on the valuation at the time of cashing in the pension (rather than on contributions) it makes long-term planning difficult. Nobody knows how much their contributions will grow over 20 or 30 years.

And even after you start to withdraw, the limit can still hit you. Each Benefit Crystallisation Event (BCE) is assessed against the LTA in force at the time, and the relevant percentage is deducted for each event. If what’s left in your pot keeps growing, you can still run into the 55% penalty tax charge even if you were “safe” when you first entered retirement.

Merryn’s solution was to treat the pension as part of estate planning – make sure you don’t breach the LTA before age 75, then whatever is left when you die can be passed on free of IHT and the 55% penalty tax. ((But still subject to your heirs income tax at their marginal rate)) I think I will be spending as much of mine as I can get through.

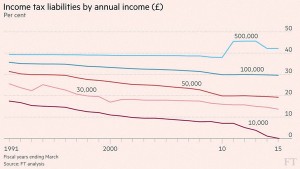

20 years of UK tax rates

Adam Palin’s Chart That Tells A Story was about UK income tax over the past 20 years. The general trend is down, although the tax take from the richest 1% has gone up in recent years. Massive increases in the personal allowance are the key driver.

Of course, the chart shows nominal salaries, and nominal incomes have increased significantly since 1990. Median pre-tax income rose 58% to £22.7K between 1999 and 2015 for example. During this time the higher rate tax threshold only went up by 29%. So fiscal drag means that people won’t feel as much benefit as the chart implies. Higher rate taxpayers increased from 6.5% of the population in 1990 to 16% in 2015.

National insurance contributions (NIC, not shown on the chart) have also increased from 9% to 12%, with the extra rate of 2% above the higher rate threshold also being introduced. For someone on £50K pa, NIC adds another 8% of tax.

Stamp Duty take reduced

Adam also reported on the reduction in the Stamp Duty take following the introduction of the new regime in December. Collections for January and February were 12% down on the same months in 2014, when they hit record levels. The change comes mostly from a reduction in top-end sales, which are penalised by the new system.

Investment Trusts

It was good to see the return of David Stephenson, the Adventurous Investor, to the FT. Admittedly, his column this week wasn’t very adventurous. David was writing about the virtues of Witan Investment Trust. I’m a big fan of investment trusts (ITs) ((Disclosure: I own all of the ITs discussed in this section)) and David often recommends them, but they are usually much more exotic vehicles than Witan.

David starts from the beginning: investors want global exposure to risky asset classes like equities. They want low costs, easy access and cheap regular savings. They want the fund to be owned by its investors. So they want a global IT. David rules out Alliance Trust (more on this later) and plumps for Witan, which is (mostly) a fund-of-funds.

There are 11 underlying managers, of whom 8 have beaten their benchmarks since appointment in 2010. The yield is 2% and the dividend has increased for 40 years. Fees (including the underlying funds) are 0.96%. David also likes Scottish Mortgage, RIT Capital Partners and Personal Assets.

Elsewhere Judith Evans reported on the battle for the Alliance Trust. Elliott Advisors – an activist New York hedge fund – have called a vote at the AGM on 29th April to appoint three non-execs to the board. The existing board, led by Katherine Garrett-Cox, is urging the 50,000 individual shareholders to reject the proposal, claiming the activists just want to turn a quick profit.

The fund has underperformed in recent years and yields only 1.9%. Admin costs have also risen – the board blames this on regulation. The discount to NAV is currently 13%, so it could be that Elliott simply wants to narrow that and sell. Ellliott reportedly proposed share buy backs as one way to do this.

In 2012 Alliance was similarly under attack from Laxey Partners. Shareholders backed the existing board by 80% to 20%, but there were some share buy-backs after that.

Pension freedoms and pension risks

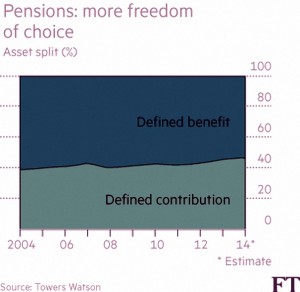

In The Long View, John Authers warns against the risks of pension freedoms and proposes a way forward. He began with the shift from DB to DC pensions in the US and UK. ((Canada, Holland and Japan are still largely DB)) This is a shift of risk from the employer to the employee, which I agree was detrimental to the individual.

John recalls the mis-selling of “personal pensions” in the late 80s and early 90s, and so do I. I was sold one where the upfront commission was more than a year’s contributions, and I never got my money back. Some people did even worse, converting gold-plated public sector plans into these scams.

But the real problem back then was a lack of freedom. A few large insurance firms offered mediocre investment schemes at high prices. Low-cost DIY investment using the wealth of information the internet provides was not even conceivable. Things are much better now.

John also correctly points out the weaknesses of human psychology when it comes to investment – unemotional thinking is difficult. He is also correct to state the importance of a (any) sensible asset allocation and a focus on low fees. John proposes low-cost default pension options which take care of tricky things like asset allocation and rebalancing. I agree, and think this should be provided by central government.

Ideally, we should work towards a system where employer promises should be underwritten by the government in return for year-by-year contributions. Crucially, John also allows for an opt-out. The individual must be free to take extra risks with some or all or their money in the hope of extra returns.

Pension reforms to raise tax?

Over in The Economist they wondered whether the pension reforms might not just be a trojan horse designed to raise tax. Any cashing in of pension pots or sales of annuities are subject to income tax at marginal rates. Between them, the two measures are expected to raise an additional £2bn over the next three years.

The paper also points out the irony of the government not allowing annuity sales to retail investors – this is a product that is “too complex for retail investors to buy, but not too complex for them to sell.”

What are companies for?

The newspaper also took another look at an old debate: what is a company for? In 2000, shareholder value was declared king by two US law professors. Soon after, the collapse of Enron, Arthur Andersen and WorldCom made people think again.

Further, in the US the notion of corporate personhood allows directors the discretion to act in the long-term interests of the firm and against the short-term interests of its shareholders (for example by resisting a takeover bid).

These days there is increasing pressure for companies to deliver broader social benefits. Academics push structures where companies are owned by foundations committed to the public good. The paper rejects this view, arguing that the lack of a “lofty purpose” is the defining feature of corporations, allowing them to evolve from startups to mature businesses.

Changing role of bonds

Finally, Buttonwood looked at the changing role of bonds. Jerome Teilteche of Unigestion, a Swiss fund-management group, argues that negative yields are skewing the risk-reward profile of the asset class and thus their role in a portfolio.

Markets do not follow the traditional bell-curve of statistics. They have fat tails (more extreme events that would be expected) and a negative skew (the rise slowly and fall rapidly). Strategies with negative skew are the “picking up pennies in front of a steamroller” activities that we have described before. Selling puts against an index and buying junk bonds are two examples.

Government bonds are usually the opposite – when the markets crash, they are the safe haven that outperforms. The largest ever real annual loss from bonds was 15.5% in 2009. This compares with a 38.9% loss on equities in 1930, and seven other years with a greater than 20% real loss.

But now government bonds have a negative skew. Yields cannot fall much lower (so prices cannot rise) and there is no income (rather there is a negative one). Yet inflation and rising interest rates could produce a significant fall in prices. Japanese bonds have been like this for a decade, behaving more like junk bonds or equities.

For investors with no restrictions, such assets offer a reward-free risk – there is no reason to hold them. But pension funds and insurance companies are forced holders, and central banks also hold foreign bonds. QE in the EU and Japan also results in purchases. So low and negative yields persist, for who knows how long.

Until next time.