Buying Bitcoin in the UK – Part 4

Today’s post is the fourth in a series on buying bitcoin in the UK.

Contents

The Story So Far

- Interest in Bitcoin is at an all-time high, as is the BTC price itself ($38K as I write this).

- There has also been a lot more positive sentiment from institutional investors recently.

- So long-term DIY investors might want a small permanent allocation (say 1%) to bitcoin.

- You can get a form of crypto using UK funds like RICA, BCHM and BLOK.

- Or stocks like ARB, MODE, TRD, KR1 and COIN

UK retail crypto derivatives ban

- The UK regulator (the FCA) recently (January 2021) banned the sale of crypto derivatives to retail investors.

- This removed both tax-efficient ways of gaining exposure to BTC:

- ETFs (strictly, ETPs) within a SIPP

- Spread-bets

- So you’ll need to pay 20% capital gains tax on your profits.

- Unless these are below £12.3K pa (the annual CGT allowance).

- One way to theoretically access your crypto profits without paying tax would be to take out a loan against them.

- Another potential way around the FCA ban is to become a “professional” spread bettor at one brokerage.

- The key downside is that you lose the negative balance protection introduced a few years ago – retail investors can’t lose more money than they hold in their spread-betting account.

- To qualify as a professional, you need an overall portfolio worth €500K – SIPPs, ISAs and cash all count, but property and company pensions are excluded.

- You also need to place 40 trades of significant size over a year, which in turn required a spread-bet account size of around £50K to £60K.

Buying bitcoin

- The process of buying and storing bitcoin directly has three steps:

- You open an account with a crypto broker (also known as a cryptocurrency exchange)

- You transfer fiat money (£) into the account

- You buy crypto with that £ balance (we’ll assume BTC)

- There are reports that some UK banks take a dim view of crypto transactions, so tread carefully.

- At this point you have three options:

- You can leave it with the broker – hardcore crypto HODLrs won’t do this (“not your keys, not your crypto”) but beginners may not care, especially for small balances

- You can move it into a software wallet on your phone or PC – this will have public and private keys so that people can send you money and you can access your stash

- You can move it offline into a hardware wallet (costing £50 or more to buy); this comes with a 12- to 24-word “seed phrase” which allows the wallet to (re-)generate your keys.

- The seed phrase needs to be physically stored and protected (eg. against theft and fire).

- You can also buy bitcoin within a UK limited company

- Foxy Monkey’s broker recommendation is Binance

- Be warned that there’s a fair amount of paperwork required to open your account

Apps

Only Ziglu and Revolut can be used today on an Android phone in the UK to trade crypto.

- So Ziglu is the leader until the Android version of the Mode app appears.

Hardware wallets

You have two entry-level choices, each easily available from Amazon:

The Trezor One is £53, comes in black, white or grey.

The Ledger Nano S is £54 and comes in black and silver.

Hot wallets

Before we look at crypto brokers, a quick detour into software wallets, also known as “hot” wallets because they are connected to the internet.

- These could be useful to those who don’t have enough crypto to justify a hardware wallet.

Investopedia recommends three for 2021:

- Exodus

- Electrum and

- Mycelium

Exodus is recommended for beginners, though it has the drawback of not being open source.

- This means you are trusting the developers – rather than the community – on security.

Exodus works with the Trezor hardware wallet.

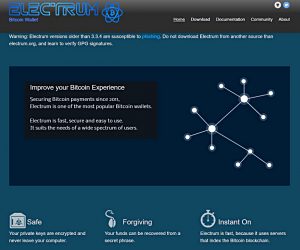

Electrum is recommended for more advanced users who are only interested in bitcoin.

- It’s open-source, has higher security than most hot wallets and works with Trezor and Ledger.

Mycelium is a mobile-only wallet.

- It’s open-source and works with Trezor and Ledger.

Crypto exchanges and brokers

In previous articles, we came up with a long list of brokers, trusts and platforms to investigate:

- Coinbase

- Binance

- Gemini

- Bison

- Kraken

- Bittrex

- Bitfinex

- eToro

Coinbase charges a spread of about one-half of one percent (0.50%) for cryptocurrency purchases and cryptocurrency sales.

We also charge a Coinbase Fee (in addition to the spread), which is the greater of (a) a flat fee or (b) a variable percentage fee determined by region, product feature, and payment type.

The flat fee is usually £2.99 and the variable fee for the UK is 1.49%.

- So the flat fee drops out at trades of £250 and greater.

Here’s a new twist – Binance appears to have withdrawal fees measured in BTC. (( Since I looked at Mode in the last article, they have added the same BTC withdrawal fee ))

- They are small (0.0005 maximum) – but with BTC at $40K, that’s a $20 fee.

Trading fees seem to be 0.1%.

So Binance is only competitive at very large transaction sizes.

Gemini has a similar fee structure to Coinbase.

- The transaction fee is capped at £2.25 and then switches to 1.49%.

In addition, there is a “convenience fee” of 0.5%, expressed as a spread.

Bison is run by the Stuttgart Borse, which sounds reassuring (but note I’m not German, so I don’t really know).

At BISON there are no fees for transactions, deposits & withdrawals and the custody of cryptocurrencies. We earn our money through the spread.

The indicative spread is 0.75%, but:

This is subject to fluctuations as it depends on market conditions and the volume of a transaction.

This approach makes Bison very attractive.

- Note that the website is warning of delays to new account validation at the moment.

We charge a fee when your order is executed (matched with another client’s order). The fee ranges from 0% to 0.26% of the total cost (value) of your order and depends on the following:

- The currency pair that is being traded

- Your 30-day trading volume (in USD)

- Whether your order is maker or taker

From the examples in the fees page, Kraken appears to be targeting larger trades from more frequent traders, but 0.26% is a low fee.

Bittrex has a similar fee model to Kraken, but it’s fees are capped at 0.20%.

But there are deposit and withdrawal fees:

Bittrex Global does NOT charge fees for deposits. Please be aware that some tokens or coins require us to move your funds to another address before being credited. This means the coin or token’s network will charge you the normal transaction fee for the fund transfer.

Bittrex Global charges a small fee on withdrawals for a token or coin with a built-in network transfer fee.

There’s no detail on what those fees might be.

- Presumably, they apply to Kraken as well.

Bitfinex has the same fee model as Bittrex – capped at 0.20%.

Their website also has a good explanation of the difference between maker (lower) and taker (higher) fees:

Maker fees are paid when you add liquidity to our order book by placing a limit order under the ticker price for buy and above the ticker price for sell.

Taker fees are paid when you remove liquidity from our order book by placing any order that is executed against an order of the order book.

eToro does not charge any deposit or trading fees other than spreads.

Trading on the eToro platform occurs in USD. If you deposit or withdraw in a foreign currency other than USD, a conversion fee will apply.

eToro charges a $5 fee for withdrawals

The BTC spread is 0.75%.

- The FX conversion from £ to $ is 50 pips for “wire transfers” – with GBP/USD at 13680 as I write, that’s 0.37%.

- For credit cards, “local online banking” and PayPal, it’s still 50 pips (other countries are not so luckily).

There’s also a $10 per month inactivity fee after a year of inactivity.

Conclusions

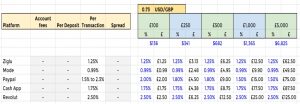

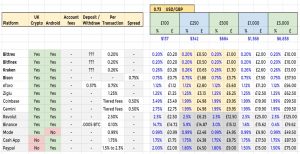

Here’s our updated table of costs.

- In general, the easy to use phone apps are more expensive than the “serious” exchanges.

Bittrex, Bitfinex and Kraken appear quite similar.

- I’ll try to set up accounts with all three, but it shouldn’t matter too much if one or two applications get stuck.

I’ll also try Bison, and a software wallet or two.

- I’ll wait on a hardware wallet until I have around £500 in BTC.

Until next time.