Weekly Roundup, 22nd February 2021

We begin today’s Weekly Roundup with a look at inflation.

Inflation

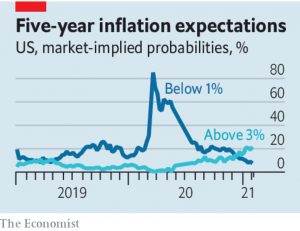

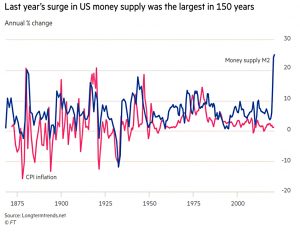

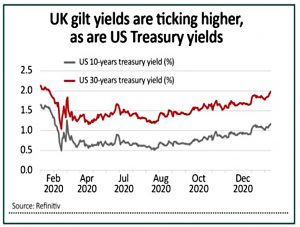

The Economist worried that inflation would disrupt economic policy.

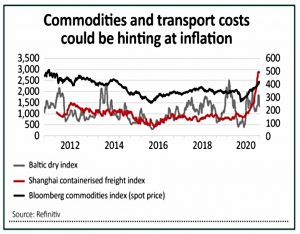

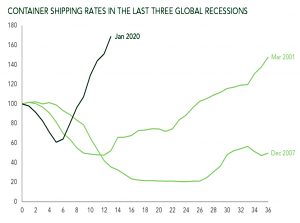

Space on container ships costs 180% more than a year ago and a shortage of semiconductors caused by this year’s boom in demand for tech equipment is disrupting the production of cars, computers and smartphones.

We also have some soft comparables from the start of the pandemic to come in areas like commodities (including oil) and even the end of temporary tax rebates (VAT, rates etc).

Despite the inability of central banks to hit their inflation targets over the past decade, more inflation now is still a problem.

The first issue is that it will choke off further stimulus in areas that still need it (like Europe and Japan).

The second is that despite switching to “average inflation targeting”, the Fed would eventually (perhaps after only a year of “high” inflation) be expected to increase interest rates, which might trigger a recession.

Higher interest rates would also have consequences for bonds, stocks and credits, and would undermine the idea that governments can spend (and hence borrow) as much as they need.

- It’s worth noting that the recent negative stock/bond correlation would probably break down under high inflation, with both asset classes falling together.

This, in turn, would mean that the traditional 60:40 portfolio would offer little protection.

I’ll be back with more on inflation – and what you can do to protect your portfolio – in a future post.

Woodford

The most surprising news of the week was the return of Neil Woodford, who is launching a new firm in Jersey, called Woodford Capital Management Partners (WCMP) with his old business partner Craig Newman.

- The last I heard he had disappeared to China, but perhaps the pandemic got in the way of that plan.

The new firm is advisory only – there won’t be a new UK fund, and it won’t be listed on Hargreaves Lansdown.

- Nor will Woodford be managing a large wodge of money for a company like St James’ Place.

The only current client of the new firm is Acacia Research Corporation, a US corporation which in early-stage life-sciences and biotech companies.

- This is a bold move from Woodford (and Acacia), as it was this type of investment (mainly in the Patient Capital fund, but also and more controversially in the Equity Income fund) which caused all the problems last time.

It turns out that Acacia bought a lot of these assets from Link, the administrator of Woodford’s old funds, which Woodford blames for pulling the plug too quickly.

- Acacia paid £229M for assets it now values at £690M – the difference is money which might theoretically have gone to the holders of the old funds.

Woodford said (( In a Sunday Telegraph interview )) that the assets could be worth even more:

These stocks have already demonstrated the huge potential in the tech and biotech sectors where early stage, patient investment can deliver outstanding value. I am focusing all my energies on identifying value and providing that support.

But he also admitted that these stocks don’t belong in daily-dealing funds aimed at retail investors (ie. OIECs).

- I agree that vehicles like investment trusts and VCTs are far more suitable.

Judging from the WCMP press release, it sounds like Acacia is just the start:

[Acacia is the] cornerstone of a new strategy to rebuild the Woodford investment operation under the WCM brand, serving institutional and high-net-worth investors.

Woodford said:

We’re going to rebuild the Woodford investment operation under a new brand.

I don’t want to, for the rest of my life, hide away and beat myself up about things from the best part of two years ago.I didn’t want what happened to me in 2019 to be the epitaph of my career, I didn’t want it to be the full stop. I’m not trying to rebuild an ego, I just felt I wanted to continue to do the things that I believe in.

I’m very sorry for what I did wrong. What I was responsible for was two years of underperformance – I was the fund manager, the investment strategy was mine, I owned it, and it delivered a period of underperformance.

I can’t be sorry for the things I didn’t do. I didn’t make the decision to suspend the fund, I didn’t make the decision to liquidate the fund. As history will now show, those decisions were incredibly damaging to investors, and they were not mine. They were Link’s decisions.

Hmmm.

Despite being suspended way back in June 2019, Woodford’s old funds have not yet been wound up completely, with £186M of assets trapped and holders looking at substantial losses.

- ShareSoc is backing a lawsuit against Link (hence indirectly backing Woodford’s view) from Leigh Day, one of five firms looking to sue for compensation.

Link said:

Any suggestion that Woodford Investment Management was not aware of the possibility of suspension . . . is incorrect. Insufficient progress was made by WIM in repositioning the fund to allow it to be reopened, and, the decision was taken by Link to move into an orderly wind-up.

The industry reaction to the news of Woodford’s return was not positive. Ryan Hughes, head of active portfolios at AJ Bell, said:

The news that Neil Woodford is looking to make a comeback will come as a surprise to many, especially those thousands of embattled investors who are still waiting to get the last of their money back.

With around £200m of money still stuck in his previous fund and original investors back in 2014 sitting on losses of over 25 per cent and many thousands who invested later suffering much bigger losses, there will be little sympathy for Woodford and the comments he made in his [Telegraph] interview.

Rival star fund manager Terry Smith said that Woodford needed to apologise:

If you actually think about what you got wrong, redemption and comebacks can sometimes work for people. They [say]: ‘I have figured it out, I did this wrong, I am very sorry I did that and caused a problem, and now I am going to do this.

Not [by saying]: ‘It wasn’t me, it was somebody else’s fault and I am going to do the same thing again’.

Private investors also reacted badly on boards like The Lemon Fool.

Nor did the FCA seem happy:

Mr Woodford’s new business would need to apply for appropriate permissions before commencing any regulated activity in the UK. In taking any decision on whether to authorise a firm, we consider whether it is ready, willing and organised to comply, on a continuing basis, with our requirements and standards.

That includes, for example, the sustainability of the firm’s business model and the fitness of its management.

And the Jersey Financial Services Commission said:

We are disappointed to see this announcement in advance of either receiving or processing any application from this company for authorisation to conduct licensed business as an investment management firm in Jersey. No application has been received to authorise WCM Partners to operate as an authorised investment management firm in Jersey.

Ethics

We’re still in catchup mode with Joachim Klement. Back in January, he looked at the conflict between ethics and incentives.

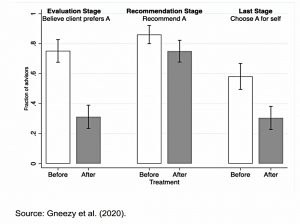

According to a new study, many advisers have to deceive themselves before they can deceive their clients. They have to make themselves honestly believe that the course of action they recommend is indeed the best advice possible.

The study involved investment advisors and two funds, one riskier than the other but with better returns (think bond fund vs equity fund).

- Case one involved evaluating the two funds and recommending one to a client, whilst also disclosing which fund the advisor preferred for themselves.

- Case two involved an advisor bonus for recommending one of the funds.

- In case three the advisor was only told about the incentive after the assessment, but before the advice had been given.

Clearly, the after condition shows that advisors will recommend a fund that they don’t think is suitable and wouldn’t use themselves.

But the real world is the before condition:

- Here the advisors genuinely believe that the fund is better for their clients, to the extent that they are more prepared to use it themselves.

As the unsuitability of the incentivised product is increased, advisors continue to recommend it until a tipping point is reached:

Only when it becomes absolutely impossible to deceive themselves do advisers give in and stop recommending the incentivised product. Few advisers are comfortable with lying to their clients.

Which is good news, but not good enough.

Joachim has previously noted that independent of incentives, advisers eat their own cooking.

The bad news is that advisers are crap at their job. Cient portfolios had miserable performance, because advisers recommended too concentrated and underdiversified portfolios, traded too frequently and favoured expensive funds with high past returns. And they did exactly the same in their own portfolios.

As I have said many times before, financial advisors are not investing experts.

- Their skills are in sales, regulation and client management (encouraging investors to “stay the course”).

Loss aversion

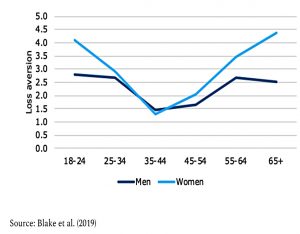

Joachim also looked at loss aversion in a study which used a coin-toss trial.

- On average, subjects wanted a £12.10 prize to risk £10 – this is a loss aversion ratio of 1.21

When the stakes were raised to £1K per toss, loss aversion doubled to 2.41

- Of course, such losses need to be assessed in terms of overall wealth – a (potential) £1K loss means different things to different people.

Loss aversion also varies by age and gender.

- Those below 35 and over 55 are more risk-averse.

And so are women when compared to men (at most ages).

I believe in stocks at all ages, so both tails are of equal significance to me.

- But I’m sure that everyone can agree that the reluctance of people in their twenties to invest in risky assets (stocks) is a problem.

The reason is that they have fewer visible resources (cash, high incomes and property) to fall back on.

- They have oodles of human capital (capacity to earn in the future) but most people ignore that.

- And Covid is likely to make things worse for this group.

Joachim offers two solutions – UBI and government-sponsored venture capital.

- I know which one I like.

Quick Links

I have a bumper thirteen you today. Most are from the Economist and the first three are about SPACs:

- The Spactacular boom on Wall Street

- Why SPACs are Wall Street’s latest craze

- What the SPAC craze means for tech investing

- The newspaper also wrote about an increase in share trading in Amsterdam

- And said that Britain’s fintech crown is under assault

- They explained how Britain decarbonised faster than any other rich country

- And laid out Volkswagen’s electric plans

- And wondered whether Pat Gelsinger can turn Intel around?

- They looked at how to design CEO pay to punish iniquity, not just reward virtue

- Said that the music streaming boom’s end is near

- And noted that the price of Bitcoin has crossed $50,000

- Alpha Architect looked at ESG Factors and Traditional Factors

- And examined whether the R&D Premium is Risk or Mispricing?

Until next time.