Weekly Roundup, 10th January 2022

We begin today’s Weekly Roundup with Hindsight Capital.

Hindsight

At the end of each year, John Authers looks back at the trades which would have made the most money for his hypothetical fund Hindsight Capital.

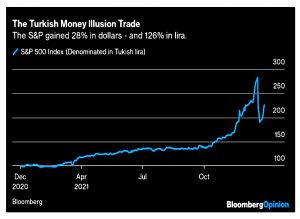

The first trade was to buy the S&P 500 priced in Turkish Lira (more on this currency crisis later).

- This boosted the 28% gain to 126%.

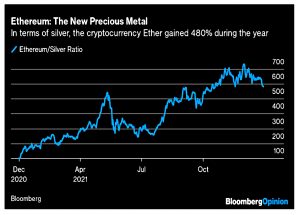

The big (and “easy”) crypto winner was ETH, and this buy was funded from shorting silver (down 13%).

- This turned a 400% win into 480%.

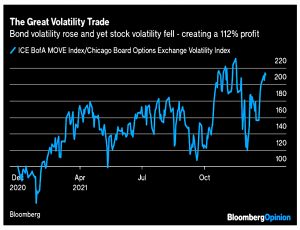

There was also a volatility trade – stock volatility (VIX) fell and bond volatility (MOVE) rose:

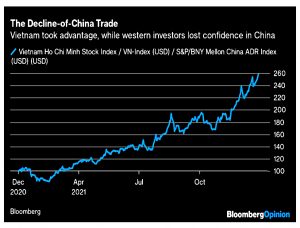

Next up is long Vietnam, short China:

And long US property, short Chinese property debt:

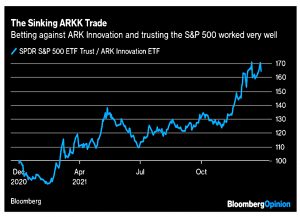

And long the S&P, short the ARK Innovation fund:

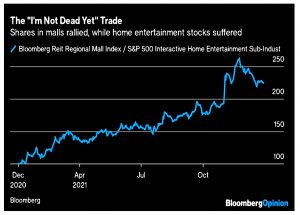

Next, we come to the pandemic-influenced trades.

- As the economy reopened, you could make money by shorting the home entertainment sector and buying the regional mall index.

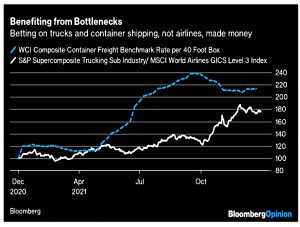

At the same time, supply chains broke and you could make money by buying freight companies and shorting airlines:

We also drank more coffee and less beer:

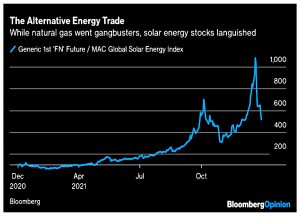

Finally, clean energy flopped back last year. Hindsight went long gas and short solar:

And long oil, short clean energy:

Hindsight is a wonderful thing.

Limited gains

John Redwood warned investors that they should brace for limited gains in 2022.

- His own fund had limited gains in 2021 (7.7%, even less than me).

He expects the world to get used to living with Covid in 2022, and that inflation will peak in the spring.

- Central banks will raise interest rates a little and money printing will slow/end (depending on location).

Cold War tensions between the West and China and Russia will continue, feeding into supply chain disruption and choked gas supplies for Europe.

- John doesn’t expect invasions of Taiwan or Ukraine (the trouble in Kazakhstan hadn’t started when he was writing).

China and other emerging markets will also dissent from the Western party line on getting to net zero.

- It’s also possible that the US will use its own fossil resources for competitive advantage.

This will make 2022 a more difficult year for investors. My base case assumes low positive returns for the year from the current portfolio. I will be watching out for too much inflation, too much policy tightening or too much international tension as any of these could flip us into a bear market. If one of these bad scenarios emerged, it would be necessary to further reduce risks in the portfolio by holding more in cash and low-risk bonds.

More virus problems would delay the toughening of the policy response, which would favour digital firms and delay the recovery in travel, hospitality and personal services.

Shaky foundations

Merryn Somerset Webb said that the equity bull market was heading into 2022 on a shaky foundation and that a lot would need to go right for a fourth successive year of double-digit returns.

2021 was not an obvious year for stock market success:

- rolling lockdowns as vaccines failed to prevent infections (though deaths were greatly reduced)

- soaring budget deficits and levels of public debt

- rising energy prices

- supply chain issues (including a blocked Suez canal)

- rising inflation and labour shortages

But there was some good news:

- continued QE (government debt self-purchases via money printing)

- rising corporate earnings (though not enough to keep PE ratios low)

What do we need for a good 2022?

You will need Covid to be recognised as an endemic and manageable virus that

is a background to policy rather than the full focus of it.

Omicron obviously helps with this, since it is milder and more transmissible.

We also need inflation to fall and GDP to rise.

- These are more difficult, given a tight labour market and rising energy prices.

And rising bond yields could divert more cash into bonds.

Merryn is not optimistic:

2022 might be less dangerous for your health than 2021, but I suspect it might be more dangerous to your wealth.

Three questions

Philip Coggan looked at the three question that dominate investment:

- What is the risk-free rate of return that investors can now secure?

- What future return is it reasonable to expect?

- And what is the prudent level to take or “draw down” from a pension fund or saving scheme?

These are good questions, but they are not easy to answer.

Take the risk-free rate. This could be defined as the return on short-term bank deposits (virtually zero at the time of writing), the yield on two-year Treasury bonds (0.6 per cent) or 10-year bonds (1.44 per cent).

I tend to use the 10-year yield (1.13% in the UK today) in most calculations, but sometimes I use the rate on instant access savngs accounts (0.6% today).

- The risk-free rate is very low today, and crucially, lower than inflatuion.

Even inflation-linked bonds will lose you money – bonds today are a “return-free risk”.

WIth yields low, so are corporate borrowing costs, and one of these yields is used in most pricing calculations.

- This leads to high asset prices and company pension deficits (which in turn leads to more bond buying as trustees try to match future liabilities).

The standard way to estimate stock returns it add a risk premium to the government bond yield.

- This is historically 4% pa, which added to the minus 1% pa from linkers gives us a future return of 3% pa.

This is low, and valuations are high – which usually mean that future returns wil be low.

- The CAPE (not a great predictor of future returns) has only been higher during the dotcom boom of 2000.

Yet there remains a lot of enthusisam for stocks.

If returns are low, those planning high drawdown levels (companies and individuals) will need to rethink.

- The safest approach is to save/contribut more, but this is rarely discussed.

Investors are bombarded with information about which stocks or mutual funds to pick in the hope of beating the market. Too little time is devoted to discussing how much money they should set aside in the first place.

Turkish Lira

The Economist described how Recep Tayyip Erdogan, prime minister and president of Turkey for the last nineteen years, is taking on the laws of economics.

As some emerging economies raised interest rates to fight inflation, Turkey went in the other direction. Despite inflation topping 21% in November, its president pressed the central bank to cut interest rates by five percentage points, to 14%, in keeping with his ludicrous belief that higher rates cause inflation rather than fight it.

Turks have moved money into dollars and euros crashing the exchange rate from eight Turkish lire to the dollar in August to 18 by December.

- So now Erdogan – from his $600M palace, built in 2014 – has introduced a deposit scheme that insures against further deterioration in the exchange rate if depositors keep their cash in lira for at least three months.

This was followed by a sharp rally in the exchange rate, but then it started to fall again.

- The $7bn of buying by the central bank caused the rally, not the claimed $3 bn of lira deposits.

Even if the scheme could stabilise the lira, there would be problems:

The rising cost of Turkish goods would not be offset by a cheaper lira. That would erode Turkey’s competitiveness, undermine its trade balance and leave it dangerously reliant on foreign borrowing to bridge the gap between its imports and exports.

Failure would be worse:

Turkey’s taxpayers will be on the hook for bailing out its depositors. That could require painful cuts elsewhere. Alternatively, the government will have to print more money. A scheme to compensate people for currency debasement would end up only debasing it further.

It feels like the IMF – and externally-imposed austerity – are not far away.

Leaving London

George Hammond reported that Londoners spent a record £55 bn in 2021 on buying properties outside the capital.

The coronavirus pandemic sparked a rush for more living space [and] has realigned housing preferences, with potentially serious consequences for the city’s population and housing market.

As well as the demand for home offices, city flats have been impacted by the post-Grenfell cladding-safety crisis.

- Although it’s hard to know whether a change like this will stick forever, it was certainly my own experience last year that London property failed by a large margin to keep up with price growth in the rest of the country.

Londoners bought 112,780 homes outside the City, slightly down on the 2007 record of 113,640.

- Since prices have risen since then, the 2007 spending level of £36.6 bn was smashed.

The majority buying outside Greater London remained within the capital’s orbit. Almost half bought in the south-east and a quarter in the east of England. The commuter towns of Dartford, St Albans and Elmbridge were particular hotspots.

People have historically tended to leave London in their mid-30s to start and raise families in larger and more affordable houses.

- The city’s population was sustained/increased by immigration and high birth rates.

So sustained outflows and reduced post-Brexit immigration could lead to downward pressure on rents and prices in the capital.

- I hope not.

Quick Links

I have nine for you this week, the first seven from The Economist:

- The Economist asked how big in media Apple wants to be

- And looked at how the UK government is trying to protect national security

- And wondered whether the cloud business will eat the 5G telecoms industry.

- The newspaper also worried that EU green rules will do little to tackle climate change

- But thought that their green “taxonomy” could go global.

- The Economist also explained why Germans are so jittery about nuclear power

- And worried about the Democrats’ hare-brained schemes to control inflation.

- Alpha Architect explained what mutual fund investors really care about

- And Moxie gave his first impressions of Web3.

Until next time.

Hindsight is indeed a wonderful thing; very interesting to see it enumerated!