Rabener on Alternatives as Diversifiers

Today’s post looks at a note from Finomial on the topic of using alternative ETFs to improve diversification.

Finominal

The note came out in December 2022 and was written by Nicolas Rabener.

- Nicolas used to trade under the Factor Research brand, but his firm now has the name Finominal.

Against the background of a terrible year for the traditional 60/40 portfolio, the note looks at ten alternative funds (from the US) and finds that only one of these improves the Sharpe ratio of a 60/40 portfolio.

- This is despite the low correlations of the funds to the base portfolio.

The implication is that you need to be careful with correlations in fund selection.

The Contenders

Here are the ten funds (9 x ETFs and one mutual fund) that Nicolas selected:

- IQ Hedge Multi-Strategy Tracker ETF (QAI): $639m AUM – seeks to replicate multi-strategy hedge funds

- IQ Hedge Macro Tracker ETF (MCRO): $3m AUM – seeks to replicate global macro hedge funds

- Hull Tactical US ETF (HTUS): $23m AUM – tactical asset allocation strategy

- BlackRock Strategic Income Opportunities Portfolio (BSIKX): $39,000m AUM – seeks to provide access to alternative credit

- SPDR SSgA Multi-Asset Real Return ETF (RLY): $570m AUM – seeks to generate real returns

- IQ Merger Arbitrage ETF (MNA): $550m AUM – seeks to replicate merger arbitrage hedge funds

- WisdomTree Managed Futures Strategy Fund (WTMF): $130m AUM – seeks to replicate CTAs

- Invesco DB G10 Currency Harvest Fund (DBV): $43m AUM – seeks to provide currency carry

- Cambria Tail Risk ETF (TAIL): $324m AUM – tail risk strategy

- AGFiQ U.S. Market Neutral Anti-Beta Fund (BTAL): $383m AUM – long low beta & short high beta stocks

I monitor most of these funds for diversification purposes, and I even own a few of them – so I am very interested in Nicolas’s results. (( I’m not aware of any way for UK investors to own US mutual funds, so I only track nine of the ten, and only six before reading Nicolas’ note ))

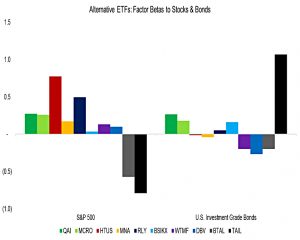

Factor analysis

The first step is a factor exposure analysis against the S&P 500 and US bonds.

- There is quite a spread of exposures (from positive to negative) which means the 10 funds are diverse amongst themselves.

The high exposure of HTUS to stocks is to be expected:

HTUS pursues a tactical asset allocation strategy by being long or short the S&P 500, or holding cash.

Nicolas has analysed these TAA ETFs in detail in other notes, and I will cover this in a future article.

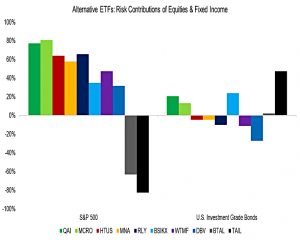

Risk

The next step is to look at risk contributions.

- Stocks are more volatile than bonds, so as expected, the stock contributions get bigger and the bond contributions get smaller.

Alternative strategies like QAI or MCRO had low betas to the S&P 500, but most of their risk can be attributed to equities, which suggests that these strategies are not particularly alternative.

Negative risk makes no sense in general, but these are risk contributions derived from beta, and it’s worth distinguishing between negative and positive beta.

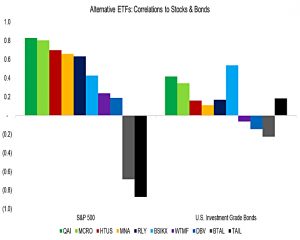

Correlations

The correlations match pretty well with the risk contributions.

Five out of the ten alternative ETFs had correlations larger than 0.5 to the S&P 500, which implies their diversification benefits were limited. However, the remaining five products had low to negative correlations.

BSIKX has a high correlation to bonds, but I’m not interested in this fund. (( As I can’t buy it from the UK ))

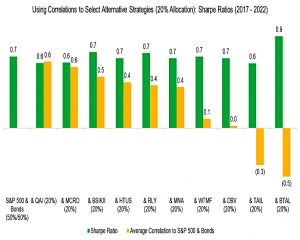

Twenty per cent

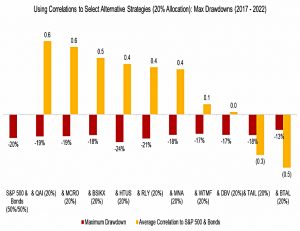

Next, Nicolas adds a 20% allocation to each of these funds to a base portfolio of 50% stocks and 50% bonds.

- Surprisingly, even the funds with low or negative correlations (eg. TAIL) did not improve the Sharpe ratio (SR).

The exception was BTAL, which had a negative correlation and boosted the SR.

Drawdowns

The worst drawdown for the 60/40 portfolio (or the 50/50 one) during the previous five years was in 2022 (20% for 50/50).

Although some of the alternative products would have reduced this drawdown marginally, there seems to be no relationship to the correlations of these products with equities and bonds, except for BTAL.

I am interested in marginal drawdown benefits, but these are pretty marginal.

- I have to wonder whether the last five years are typical, however – it has felt like a simple macro and central bank-driven environment that flips from risk-on to risk-off.

Perhaps longer-term results would be more impactful.

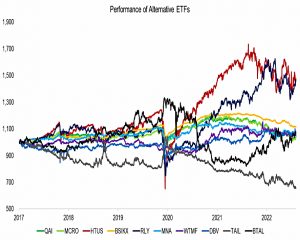

Nicolas puts the lack of diversification over five years down to the performance of the funds:

Some like the HTUS and RLY provided positive returns over the last five years, albeit less than the S&P 500 and were highly correlated to equities, which does not improve Sharpe ratios.

Others like DBV or TAIL were negatively correlated, but had zero to negative returns, which was also not helpful as volatility and returns decreased proportionally.

Or as he puts it – “being alternative is not enough”.

Conclusions

Nicolas concludes that using correction as a basis for diversifying strategies provides mixed results.

- It’s hard to disagree entirely, but I think that the time period under consideration (2017 to 2022) is unusual, and small benefits are better than no benefits (or even negative benefits).

I will continue to track these funds, and I’m likely to invest in a subset of them wherever they look promising.

- This will never be a core strategy for me (since I can’t buy these funds within UK tax shelters) and I have modest diversification expectations in any case.

This note has pointed me to three more from Finominal on the topic of alternatives, so I’ll be back with another article on these in due course.

- Until next time.