How America Invests – Vanguard

Today’s post is a look at a report from Vanguard on how the five million people on their platform (in the US) invest their money.

Contents

How America Invests

Here’s how Karen Risi, MD in the Vanguard Retail Investor Group, introduced the new report:

Vanguard has been researching investor behavior for decades. This year, we’ve

expanded our research and thought leadership with the introduction of How America

Invests—a comprehensive look at individual investors and an evolution in our

understanding of investor behavior.

How America Saves, an analysis of workplace investment schemes, has been published for nineteen years.

Headlines

The report looks at 5.1 million US households over the period from 2015 through 2019 – a relatively benign period in the markets.

- Total assets were close to $2 trn.

It’s important to note that Vanguard knows nothing about their customers’ non-Vanguard assets:

Households in our sample may have financial assets in banks, in workplace retirement plans, and with other investment providers.

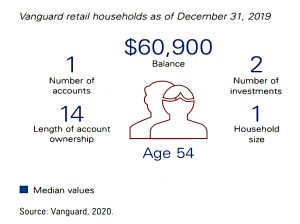

Here’s what the average Vanguard household looked like:

- 14-year tenure (time with Vanguard) is impressive.

- The $61K balance and just two investments are less so.

The key findings are:

- Almost everyone has some stock allocation.

- The average allocation is 63%.

- But 16% of households have no stocks, and 22% have at least 98% stocks.

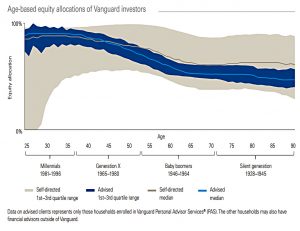

- Investors become more conservative with age.

- Those in their 20s and 30s have a 90% stock allocation, whilst retirement age accounts hold 60% stocks on average (66% for boomers).

- There is also a notable group of millennials (around a quarter) with cautious portfolios.

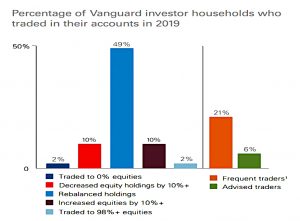

- Most people stick to their target asset allocations and rebalance accordingly.

- Only a minority are active traders – fewer than 25% trade in a given year.

- Frequent traders are older, longer-tenured and have significantly more assets than average.

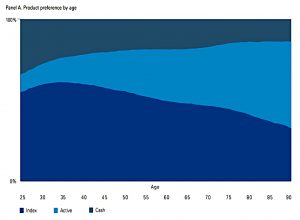

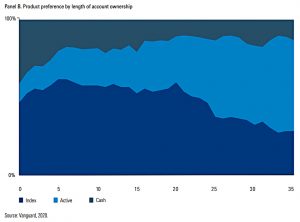

- More people have index funds than have active investments.

- And portfolios are becoming more index-oriented.

- Active investors tend to be older and longer-tenured, perhaps because active strategies were more popular when these customers started to invest.

- Mutual funds are much more popular than ETFs

- 80% of households hold mutual funds, down from 87% in 2015.

- 13% hold ETFs and 13% hold individual stocks.

- Most ETF holders have less than 25% of assets in ETFs.

- Some millennials with short tenure (three years) have ETF-only portfolios.

- Most individual stockholders also use them as diversifiers (minority holdings).

- The small number of stock enthusiasts are generally in their mid-50s and have smaller than average account balances.

- About 20% of households use target-date funds, usually alongside other investments.

- Most US investors exhibit home bias

- Only 19% of assets are invested internationally.

- Older and longer-tenured households have the most home bias and advised households – and those that use target-date funds – have the lowest.

Asset allocation

Vanguard provides a breakdown by household weighting and by asset weighting. Here’s the methodology:

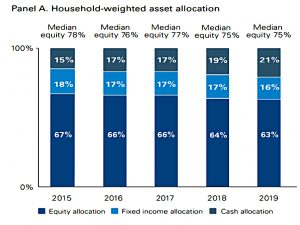

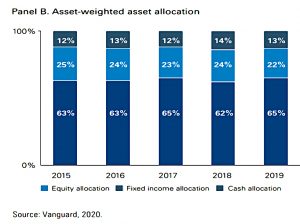

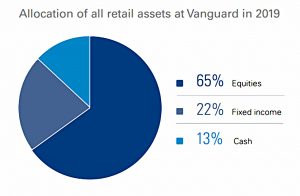

The average household allocation is 63% stocks, 16% bonds and 21% cash, with a median equity allocation of 75%:

By assets, 65% is in stocks, 22% in bonds and 13% in cash.

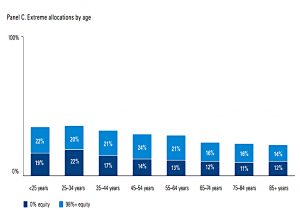

There is also a wide spread of risk levels within each age group.

It is particularly wide among the youngest households, with the interquartile range from 0% to 100% in equity exposure. The experience of severe market downturns like the global financial crisis may have colored their appetite for taking market risk.

But even at age 70, the interquartile range is 37% to 86% stocks.

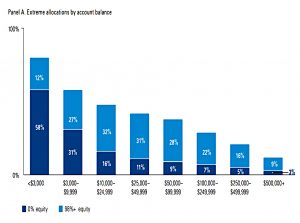

The allocation also varies with account balance:

Lower balance investors have a higher allocation to cash compared with those with higher account balances.

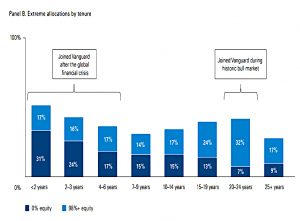

And with tenure:

New investor households also show a lower allocation to equities and a higher allocation to cash than longer-tenured ones. Investor households with less than four years of tenure have about one-third of their portfolios allocated to cash.

Extreme allocations

Almost 40% of investors had what Vanguard calls “extreme allocations”:

Twenty-two per cent had 98% or more of their portfolio in equities, while 16% didn’t hold any equities.

The headline number of 38% is flat since 2015, but the underlying composition has changed:

The composition is shifting, with 98%+ equity allocations declining and investors with zero-equity exposure increasing.

Extreme allocations decline with increasing account size.

The trend by tenure is less clear, but there are bumps of zero equity in younger accounts and high equity in older accounts.

- Vanguard puts this down to the dominant market regime when the accounts were opened (2008 crisis vs bull market).

Extreme allocations are more common within younger households, but the trend is not so extreme as for account size.

Households with all-active portfolios tend to be older and long-tenured. Meanwhile all-index households are younger and have a median account tenure about half that of all-active households, yet they have similar balances.

Households with both active and index products tend to have higher balances. All-cash holders tend to be young, new, and with modest balances.

Home bias

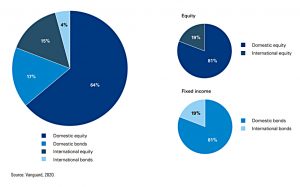

Vanguard retail households show moderate levels of international diversification. 19% of mutual fund and ETF assets are invested internationally, 15% in international equities, and only 4% in international bonds.

The domestic to international ratio is the same for equity and fixed income investments, about 4:1.

Investors with less than $10,000 seem to allocate a little more internationally than other investors. Home bias seems to be strongest among our oldest and longest-tenured investors.

Investors between 25 and 44 years of age, and those who have been investing at Vanguard between 4 and 14 years, allocate the most internationally.

Action guide

As well as the main report, Vanguard has published an Investor Action Guide.

The first recommendation is to make sure that your risk level – and hence your asset allocation – aligns with your goals.

Younger investors typically have around 90% of their portfolios in equities, whereas retirement-age investors typically have equity allocations closer to 60%.

- I would argue that the optimum portfolio for all ages has around 75% stocks.

The second (and related) recommendation was to diversify.

- This means across passive and active strategies, as well as across asset classes – Vanguard sells a lot of low-cost active funds in the US, though this is not a central part of their marketing message here in the UK.

I think the Vanguard average allocation is too low on stocks and too high on bonds and cash.

- And it misses out the many types of alternative asset completely.

The third recommendation was about rebalancing.

- About half of Vanguard’s US customers follow this advice.

I’m a big fan of rebalancing, but you shouldn’t do it too frequently or you will miss out on momentum effects.

- Somewhere between once every eighteen months and once every four years is ideal.

But cashflow rebalancing – where you buy underweights or sell overweights, depending on whether you are in the accumulation or decumulation phase – is fine at any time.

- And so is tolerance-band rebalancing, where you adjust when an allocation drifts from its target by a certain amount (usually 5%, 10% or 20%).

That’s it for today.

- Until next time.