Expected Returns 3 – Low Returns

Today’s post is the third in our series looking at papers by Antti Ilmanen, as a prelude to tackling his magnum opus, Expected Returns.

Contents

Last time

We’ve looked at two papers so far, and here’s what we’ve found:

- Investors tend to think of expected returns as a function of the asset class.

- This leads them to take on too much equity risk since diversifying assets like bonds have lower returns that would need to be juiced by leverage.

- Diversification (multiple sources of risk which have worked well over long periods) can help, but correlations are higher when things get tough (in crashes)

- There’s also insurance, but this is expensive when it is needed (because it becomes popular)

- Selling volatility gives good returns except in a crash because people over-pay for insurance.

- “Lottery tickets” – the most volatile members of an asset class (eg. small cap blue-sky growth stocks) – generally offer poor returns.

- They are over-priced because of the preference of some investors to chase outsize returns.

- Low volatility stocks outperform in absolute terms and have much better risk-adjusted volatility (a higher Sharpe ratio – SR).

- There is no reward for buying bonds longer than 5 years or riskier than BB.

- Illiquid assets (eg. venture capital, private equity) have higher returns but did badly through the 2008 crisis.

- Diversifying across investment styles may offer greater returns for less risk.

- But styles have lower volatility than stocks, and so they can’t diversify away the equity risk.

- Implementing styles properly also requires the “three dirty words in finance”—leverage, short-selling, and derivatives.

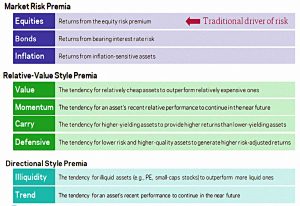

- The four key styles are:

- value

- momentum

- carry (yield – this is closely related to value for stocks)

- defensive (low risk/low beta, so equivalent to low vol) – this style can also be extended to include quality measures.

- Size and illiquidity are also relevant in some assets:

- There are risk-based and behavioural explanations of why factors work

- But choosing between these two explanations is not necessary in order to take advantage

- Leverage constraints (for some investors) may explain why low-risk works

- All styles suffer from drawdowns and periods when they don’t work

- So you should use them all in parallel.

- The composite style premia portfolio is not massively correlated to a 60/40 stock/bond portfolio.

- Value and trend may seem contradictory, but it’s a matter of timescale.

- Trend dominates for up to a year, before mean reversion sets in.

- This means that chasing multi-year returns (as many investors do, even when choosing funds) runs straight into reversal effects.

- Value and trend actually combine well together (recent winners can still be cheap), and they act as good diversifiers for each other.

- Trend-following also protects against tail risk (does well in crashes).

- Limited market timing (“time variation in return sources”) may also increase returns.

- Timing can be based on valuation measures, the macro environment and on investor risk aversion.

- But timing is risky and should, therefore, be a minority component.

My portfolio

My own portfolio has a heavy allocation to equities for a good reason – I need the returns.

- I’m targeting an SWR of 3% to 3.25%, and that means that I need a target allocation to equities of 75% (( In practice, my exposure to expensive London property means that I have to include equity alternatives in that total in order to get anywhere close ))

- I am unwilling to take on the necessary levels of borrowing needed to juice up a true risk parity portfolio (( I can envisage portfolios with 10% to 20% leverage at times, but 100%+ leverage is unthinkable for me ))

On top of a base passive diversified portfolio, with equity allocation matched to the required return, I have two overlays/satellites:

- Style (factors / smart beta)

- Market-timing (tactical asset allocation) based on valuation, macro indicators and investor sentiment.

Low Returns

We’re actually looking at two things today, but they are both about a low return world.

- First up is a presentation by Antti to the PRC conference in Philadelphia in May 2017.

The chart shows that the expected return from the classic 60/40 portfolio has been falling more than 35 years, and is now lower than at any time in the past century.

- With interest rates at historic lows, low-returns for all long-only asset classes are not surprising.

Saving rates

For those still in accumulation, the big takeaway is that higher savings rates will be needed to hit retirement targets.

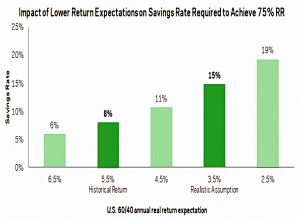

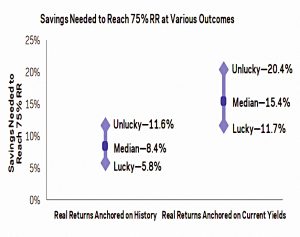

- Based on historical returns, an 8% savings rate could deliver a 75% replacement ratio (of which 45% comes from a DC pot, and 30% from a state pension).

But with more realistic future returns, a 15% savings rate would be required.

And an unlucky saver (bottom 20% of the return distribution) might need to save 20% pa.

Solutions

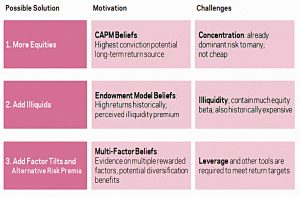

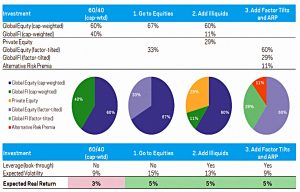

Antti has three solutions:

- More equities

- Illiquids

- Factor tilts and alternative risk premia.

I’m already using each of these.

The suggestions map well to Antti’s list of sources of return.

Here’s a bit more detail on the solutions.

Target date funds

The next section of the presentation looks at target-date funds (TDFs)

- These use “lifestyling” (increasing bonds with age) to prepare for a given retirement date.

In general, this is a bad idea as retirements are now long and annuities such poor value, but there is some merit in lowering stock market exposure for a few years on either side of the retirement date.

Here are Antti’s solutions for common problems with TDFs.

- They all amount to diversification.

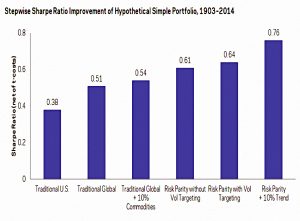

This chart shows how Sharpe ratios increase with increasing diversification.

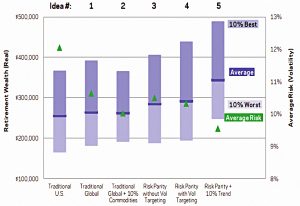

And this one shows how retirement wealth increases with diversification.

- At the same time volatility (in green) is falling.

Investment consulting journal

The year before that presentation, Antti was interviewed by a panel of editors from the Journal of Investment Consulting on the same topic (though not specifically about retirement saving), as part of the Journal’s “Masters Series”.

He was asked about was the role of advisors to institutional investors compared to those who advise retail investors:

I think the critical role for both types of advisors is educating clients about what’s important and what’s feasible.

[They] should avoid over-promising expected returns and help to avoid chasing of multi-year returns, overconfidence and hindsight bias.

Antti thinks that the typical performance evaluation windows of three to five years are likely to lead to underperformance from reversals (mean reversion).

- He also thinks as he has stated in every article so far, that most investors have too much equity risk (leaving aside return targets for a moment).

He would use a fair amount of leverage, but I will only use a little, so I am forced into a high equity allocation.

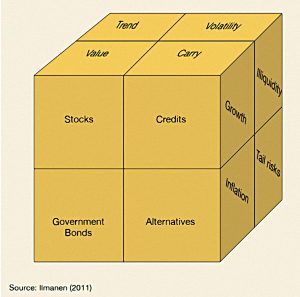

The cube

In his book, Antti argues that investors should use three dimensions to evaluate their portfolios:

- asset classes (front)

- strategy styles (top), and

- risk factors (right side)

- these are fundamental macro factors that are not directly investable

- Antti says that real yield and monetary policy might also have been included here

Tail risks

Since portfolios are dominated (in risk terms) by equities, equity tail risk (of crashes) is most important.

The most popular hedge is index puts, but this has a Sharpe ratio of minus one.

- Antti prefers trend-following, which has a positive SR and has done well in most of the bear markets of the past century.

If a bear market is fairly slow, trend-followers will switch to the bear side.

- With a fast bear, (very expensive) index puts is your best protection.

But if the fast bear is part of an existing downtrend (Antti uses the Brexit vote or the collapse of Lehman Brothers as examples) trend will still do okay.

Suitable trend windows vary from one month to twelve months.

- Above a year, mean reversal patterns start to dominate.

The fact that risky momentum beats the market, and low-risk strategies (which need leverage to produce acceptable returns) also beat the market might seem puzzling.

- The low-vol outperformance can be explained by both leverage aversion and the lottery ticket preference.

Momentum gets away with using riskier stocks by having some as longs and others as shorts (even if the short bets aren’t placed).

- Antti notes that the combinations of momentum and value and also value and quality work well together.

Illiquidity

The panel moved on to liquidity and Antii agreed that there should be a premium for illiquidity.

Interestingly, private equity (PE) earns about 3% pa more than the S&P 500, but this can be explained by their preference for small- and mid-cap value stocks.

- Antti thinks that institutions will overpay for PE’s return-smoothing effect (since PE assets are not marked to market in a downturn), and this offsets the illiquidity premium.

Insurance

In his book, Antti points out that long-term investors have an advantage, and one way they can exploit it is through selling insurance.

- Volatility-selling would be the obvious choice – its the flip side of the expensive index puts we discussed under tail risks.

- You could also sell index puts directly, rather than volatility.

The problem with these strategies is that they lose money at the very worst times, and you need to be certain that you can tolerate the losses.

In this way, the strategy is similar to the currency carry trade – picking up pennies in front of a steamroller, which comes in bad times.

- Note that in stocks, and – to a lesser extent – bonds, carry is a form of value.

In currencies and commodities, it is a separate signal.

Timing

Antti says that he has changed his mind to an extent about market and style timing since the publication of his book.

- He now prefers strategic allocations to asset classes, styles and illiquidity, rather than contrarian rotation based on recent valuations.

A good example of style-timing failure is the inability of the Shiller PE (the CAPE) to outperform buy-and-hold over the last 50 years.

Conclusions

Like last time out, today’s material has been largely reinforcement of ideas we’ve already covered.

- The optimistic projections of pension funds is a new context, but the solutions for improving returns and lowering volatility in a low-return world are the same as before.

The Cube was new to me, as was the explanation for the lack of a liquidity premium in PE. (( As far as these papers go – I heard Antti speak on this topic in 2019 ))

- And his loss of faith in style timing was very interesting – I still hope that market timing in stocks can be useful.

The (selling) insurance strategies are interesting, but probably not for me.

- I see the central problem for the private investor as being able to hold the high allocation to stocks required for decent returns.

Overlays which exacerbate losses during crises are likely to lead to behavioural problems.

In the next article in this series, we’ll look at lottery tickets.

- Until next time.