Expected Returns 8 – The Credit Premium

Today’s post is the eighth in our series looking at papers by Antti Ilmanen, as a prelude to tackling his magnum opus, Expected Returns.

Story so far

We’ve looked at seven papers, a blog article and a slide deck so far.

- The lessons learned had become as long as a blog article in themselves, so I have moved them to a separate master page here.

The Credit Premium

We are working our way through a pamphlet produced by the CFA Institute and based around extracts from Antti’s book Expected Returns.

- So far we’ve looked at equities and bonds.

Today it’s the turn of credits – non-government bonds with a risk of failure (the credit risk).

- Investment-grade credits only outperform Treasuries by 0.2% to 0.5% pa

- This is poor compensation for lower liquidity, poorer diversification from equities and losses when you don’t want them.

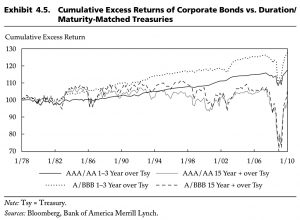

- Long-dated corporate bonds do especially badly.

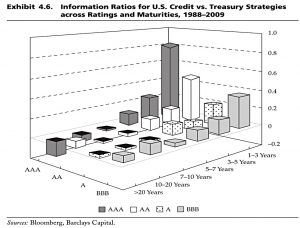

- Short-dated, top-rated bonds have a good Sharpe ratio but perform badly in financial crises.

- BB-rated bonds perform best, probably because of forced selling by institutional (index) investors).

- CCC bonds perform the worst though they do well in bull markets.

- Speculative (high yield) bonds behave quite like equity.

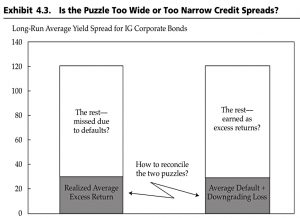

- Spreads overstate the advantage of credits because they ignore defaults, downgrades and calling rights (effectively options held by the issuer).

- Antti suspects that credits are a structurally overpriced asset class.

But explaining the difference between ex-ante returns (spreads) and ex-post returns is not simple.

For buy-and-hold investors, it is sufficient to adjust credit spreads for embedded options and expected default losses.

However, for active investors, (1) downgrading bias [down grades are more likely than upgrades for high quality bonds – and more impactful] and (2) trading activity due to index changes can further reduce expected returns.

Moreover, within-sample widening of general credit spreads can cause capital losses that reduce investors’ realized returns.

Excess returns

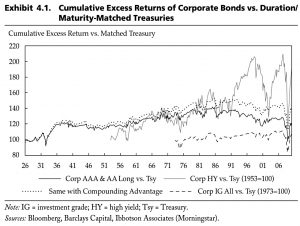

Note that the excess returns in the longest continuous data series all came before 1970.

Short corporate bonds – particularly high rated ones – consistently beat Treasuries.

- Antti attributes this to investor constraints (some people must hold Treasuries) and investor preferences (for superior liquidity and safe haven qualities).

- Leveraged investors are further impacted by the borrowing spread, reducing the Sharpe ratio from 0.7 to 0.4.

This is a form of the carry trade.

- Note that the payoff for this strategy is similar to that of writing put options.

Spreads

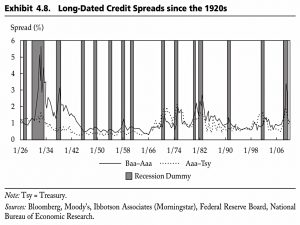

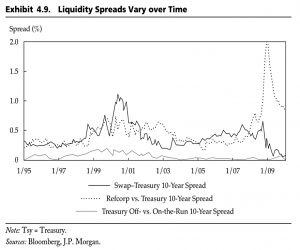

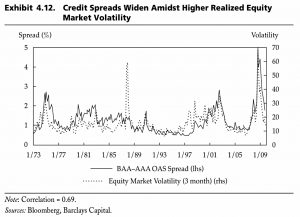

Credit spreads vary significantly over time.

- Lower-rated bonds show a counter-cyclical variation.

Spreads from the Depression have never been matched since.

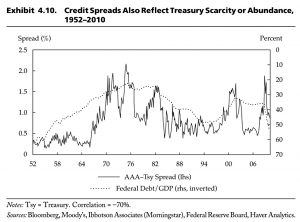

Spreads are also impacted by the scarcity or abundance of Treasuries,

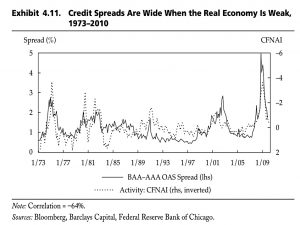

And they are wide when the economy is weak.

The link between ex ante equity yields and corporate yields is weak. Corporate spreads appear more closely related to equity market volatility and to recent realized losses in equity markets.

Defaults

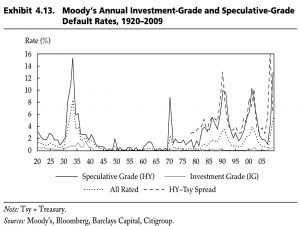

Defaults are really only a significant factor for high yield bonds.

- As expected, defaults peak near recessions.

Forecasts

Antt has a few comments on how to predict returns from credits:

- Wide credit spreads are the strongest bullish indicators.

- High implied volatilities—both equity market volatility and interest rate volatility—are also bullish, partly reflecting the contemporaneous correlation between volatility and

spread levels.- Weak real activity and a low profits/GDP ratio are bearish predictors.

- The two best growth predictors in financial markets give a mixed message -steep yield curves predict high credit returns, while strong equity markets (somewhat unexpectedly) predict low credit returns.

- Credit bonds appear to exhibit short-term momentum and longer-term reversal patterns.

- Finally, fiscal deficit concerns predict corporate bond outperformance versus Treasuries.

Conclusions

In general, corporate bonds offer lower returns than might be expected.

- The exceptions are high-rated short bonds and BB bonds that some investors can’t buy.

Antti agrees with Swenson that corporates may not deserve a strategic allocation, but they make a good tactical investment when spreads narrow during an economic recovery.

- Thus wide spreads are a buy indicator.

Until next time.