Weekly Roundup, 7th January 2020

We begin today’s Weekly Roundup in the FT with Lucy Warwick-Ching, who was writing about wills.

Contents

Wills

According to Lucy, more than half of British adults have not made a will (I am one of them).

She had a list of ten things to think about – here are the most important points:

- Getting married revokes all previous wills, and you need to make a new one.

- If you die intestate, your spouse gets £250K and your children get the rest.

- Divorce does not revoke earlier wills.

- But it does remove your former spouse as a beneficiary.

- There is no such thing as a common-law spouse.

- You need a will to enable your cohabiting partner to benefit from your estate.

- A valid will needs a handwritten signature and two witnesses who are not beneficiaries.

- You also need to have adequate mental capacity when you make the will, though the Court of Protection can also issue a “statutory will”.

- If you help a relative to die, you cannot benefit from their will.

- Family members can challenge your will.

- The UK has no rules on provisions for family members (unlike France and Italy), but dependents can still claim if they have financial need.

- Wills are public documents, once you have died.

- You can write a (non-binding) letter of wishes to go alongside your will if you would prefer to keep certain things confidential.

- If a couple dies together, the eldest is deemed to have died first (the commorientes rule).

- If you leave 10% of your estate to charity, your IHT rate is reduced to 36% (from 40%).

- And the gift itself is also free of IHT.

Hindsight Capital

Each year, John Authers presents the results from Hindsight Capital, a mythical hedge fund that knows in advance how its trades will turn out.

- To avoid infinite profits, no intra-year trading is allowed, single stocks are outlawed, and leverage cannot be used (though shorting is okay).

There also needs to be rationale for the trade – no profiting from natural disasters.

Since 2020 is the start of a new decade, this year John provided a ten-year review.

The key trades were:

- Long software, short energy (1871% return)

- Long the S&P 500, in Norwegian Krone (450%)

- Long US banks, short Eurozone banks (595%)

- Long Bitcoin, measured in grams of gold (7.1M per cent gain)

- 60/40 US stocks/bonds (198% – the benchmark return)

- Quoted indexers (LSE, S&P Global and MSCI) – 899% return

- Long Chinese consumer staples, short Chinese energy (905%)

- Long US industrials, short Chinese industrials (268%)

- Long north Eurozone periphery (Denmark and Latvia) short south Eurozone periphery (Greece and Cyprus) = 2500%

- Long Amazon/Jeff Bezos, short America Movil/Carlos Slim (2150%)

- Long precious metals, short industrial metals (75%)

As for 2019 alone, John admits that you would not need Hindsight’s services.

- Long anything did just fine.

Top funds

In the FT, Emma Agyemang had a similar article looking back at the best funds of 2019.

- It was a good year, with 2,533 out of 2582 funds showing a positive return.

Gold funds dominated:

- Charteris Gold & Precious Metals made 52%

- Ruffer Gold returned 44%

Other strong sectors included UK mid-cap and smaller companies, despite Brexit uncertainties.

- Aberdeen Standard UK Smaller Companies was up 46%

- Franklin UK Mid Cap returned 42%

Absolute return funds were among the worst performers.

- Garraway Absolute Equity returned minus 57%

- BMO Equity Market Neutral was down 30%

- And Oxeye Hedged Income lost 22.5%

As we all know, Woodford had a bad year.

- The renamed LF Equity Income fund was down 22%

Factor Olympics

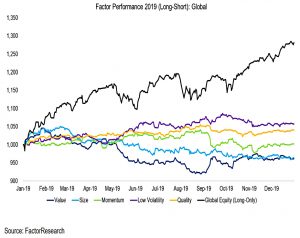

Our third look back comes from Nicolas Rabener at Factor Research, who wrote about the 2019 “factor Olympics”.

- Low Volatity did best and Value did worst, despite a brief rally in Q3.

- This was the same result as in 2018.

Of course, the best idea in a bumper year like 2019 is simply to remain long global stocks.

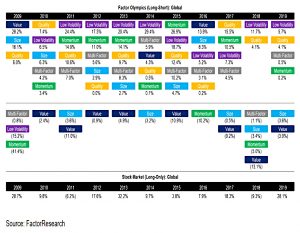

Here’s the 10-year picture:

As with the more familiar multi-asset quilt, there’s a fair degree of performance rotation.

- And it has been a lost decade for Value investors.

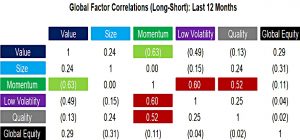

One-year inter-factor correlations generally look okay, though Momentum was highly correlated to Low Volatility and Quality and negatively correlated to Value.

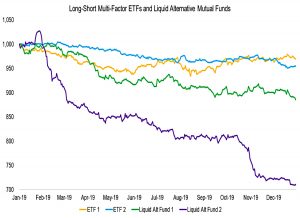

Long-short multi-factor and liquid alternative funds performed badly. Nicolas notes:

The performance of a theoretical global long-short multi-factor portfolio would have been barely positive before costs and negative after fees in 2019, so theory and reality reconcile.

Predicting 2020

Looking forward, the Economist looked at what to expect in 2020, based on markets and models.

- Trump is odds on to complete his first term but only evens to win a second.

- Brexit is going to happen.

- Bitcoin and oil are likely to fall in price.

- A US recession is unlikely.

- The S&P 500 probably won’t fall by more than 10%.

Minimum wage

The Economist also reported on a new study which suggests that higher minimum wages hit poorer bosses’ pockets.

- Previous studies have found that a higher minimum wage tends to decrease employment among the least-skilled workers – firms downsize to cut costs.

But they also find that pay for the remaining workers goes up.

- So where does that money come from?

It looks like it comes from the profits of smaller and less-profitable companies.

The more low-wage workers a company employed, they found, the more its profits declined. Companies with 60-80% of staff earning the minimum wage saw their profits cut by almost half.

Firms with relatively low profits disproportionately employed minimum-wage workers.

Which means that a higher minimum wage can be less progressive than raising taxes.

- This is more support for the earned-income tax credit used in the US and UK (effectively negative income tax for low-paid workers).

Alternatives could include a rebate for employers or a threshold on sales or profits below which minimum wage rules don’t apply.

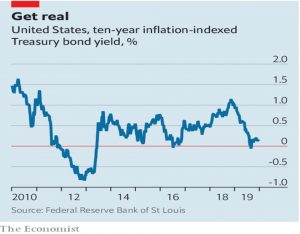

Inflation-linked bonds

Buttonwood advised us all to buy inflation-linked bonds as a protection against the sudden return of inflation.

- Conventional bonds (and stocks) do badly when inflation surges.

He rightly comments that:

The reasons for quiescent inflation in the face of low unemployment and the secular decline in interest rates are not fully understood.

Which means that the risk that inflation could return might be underestimated.

The only snag with his plan is that yields on linkers are almost zero at the moment.

- So I think I’ll just hold a little extra cash instead.

Quick Links

I have seven for you this week, the first four of which are from Alpha Architect:

- They looked at international evidence on factor premiums

- And at the market impact of rebalancing factor strategies

- And at whether active investing is doomed as a negative-sum game

- And at a unified method for asset allocation and factor allocation

- Musings on Markets wrote about the Big Market Delusion

- The Economist looked at electric vehicle wars in China

- And the FT reported that fund managers will demand that British Bosses increase their level of skin in the game.

Until next time.