HFEA 8 – Leveraged Neapolitan Portfolio and Factor Tank

Today’s post is another in our series on Leveraged Portfolios. We look at applying leverage to OP’s Neapolitan Portfolio and take a quick look at the Factor Tank Portfolio.

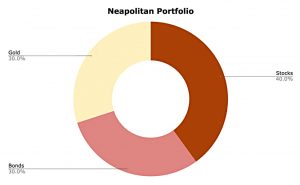

Neapolitan Portfolio

As with the last article in this series, we’re going to be looking at a couple of blog posts from Optimized Portfolio.

- This time around, we’re actually looking at portfolios designed by OP.

First up is the Neapolitan, which is OP’s answer to the All-Weather Portfolio.

- OP uses “the 3 best diversifiers with the lowest correlations among them are stocks, long treasury bonds, and gold”.

These are split 40/30/30, with the tilt to stocks.

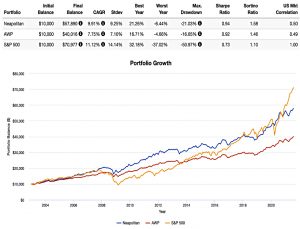

The NP shows higher returns than the AWP, with slightly more volatility and a slightly large max drawdown.

- The backtest period was very favourable for the S&P 500, which outperformed both portfolios (though with much more volatility and much larger drawdowns).

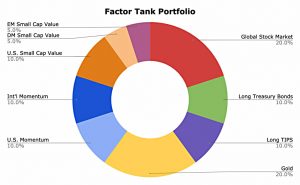

Factor Tank Portfolio

We’re going to take a detour now, to look at OP’s “maximum diversification” portfolio.

He calls it the Factor Tank, and it looks like this:

- 20% Global Stock Market

- 10% U.S. Small Cap Value

- 5% Developed Markets (ex-US) Small Cap Value

- 5% Emerging Markets Small Cap Value

- 10% U.S. Momentum

- 10% International Momentum

- 10% Long U.S. Treasury Bonds (STRIPS)

- 10% Long TIPS

- 20% Gold

This adds the momentum factor as well as small-cap and value.

- It works out to 60% stocks, 20% bonds and 20% gold.

I like the look of this portfolio, but unfortunately, a lot of the funds that OP uses are pretty new, and so his backtest only goes back to 2016.

- Even worse, this period was good for the S&P 500, and poor for the size and value factors.

So performance is poor, though the FT portfolio does have lower volatility and max drawdown (and unfortunately, also a lower Sharpe).

- Time will tell on this one, I guess.

Another problem in the context of today’s article is that this portfolio would be difficult (impossible?) to lever up using ETFs.

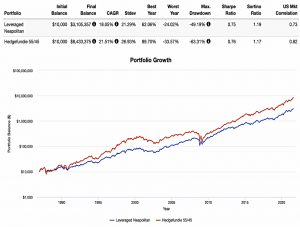

Leveraged NP

We can lever up the NP, though. Here’s OP’s version:

- UPRO 40% – 3x S&P 500

- TMF 30% – 3x long treasury bonds

- UGL 30% – 2x gold (no 3x gold funds available)

This is similar to the original HFEA portfolio, but with a chunk of gold.

The leveraged NP underperforms HFEA as you might expect.

- The volatility is lower, as is the max drawdown and the Sharpes are very similar.

That’s it for today – we’ve looked at another flavour of HFEA that will factor into our eventual portfolio design.

- For the next article, I am thinking about diving into the original Bogleheads bulletin board threads to see if we can find any show-stoppers.

Until next time.