ii Retirement Survey 2021

Today’s post looks at The Great British Retirement Survey 2021 from interactive investor.

Contents

Retirement Survey 2021

This is the third year of interactive investor’s Great British Retirement Survey.

- The survey was had 10,000 responses this year, and the research was carried out between March and July 2021.

The dominant theme of the report was the impact of Covid and the lockdowns.

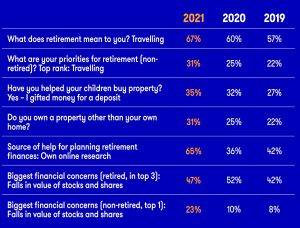

The increased importance of travel is clear, along with more interest in property, a focus on DUY research for financial planning and slightly increased levels of concern about potential stock market falls.

Pandemic

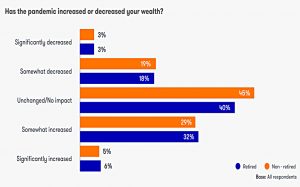

Markets are up since the Covid crash, so it’s not surprising that there have been more winners than losers.

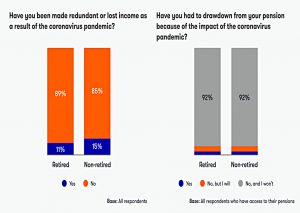

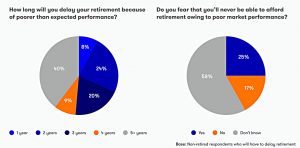

Despite this, a significant minority (10%) claimed that they would have to delay retirement, and half of these said the delay would be four years or more.

A quarter was afraid that they might never be able to retire.

- I must say I’m surprised by this – I find it hard to imagine a portfolio that would be lower at the time of the survey than it would have been pre-Covid.

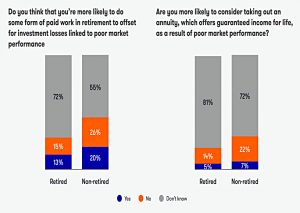

One in five non-retired respondents expected to have to work in retirement in order to make up for their losses.

- On the bright side, very few were tempted by annuities.

Pensions

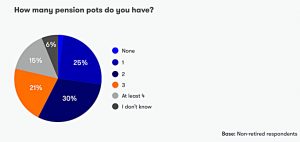

Two-thirds of non-retired respondents have multiple pension pots, as you might expect.

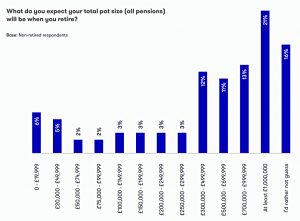

Most people expect to have a pension pot of at least £300K, and 21% expect to have more than £1M.

- Not surprisingly, this meant that a lot of people were unhappy with the shrinking LTA.

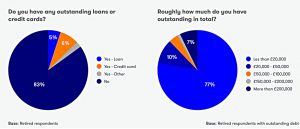

Few retirees had any outstanding debts and the vast majority of those who did owed less than £20K.

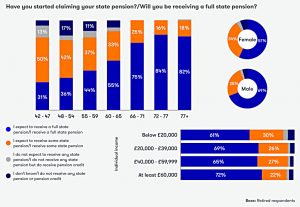

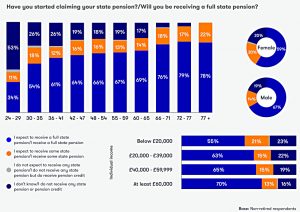

The proportion of people expecting to receive a full or partial state pension increased with age but was only below 50% for those in their twenties.

Those on higher incomes tended to expect more from the state pension.

Retirement income

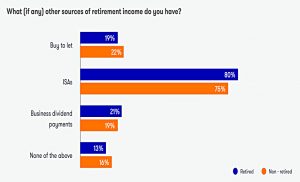

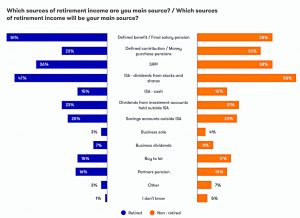

ISAs were by far the most common second source of retirement income, but significant minorities also had access to BTL income and/or dividend payments from businesses (it’s not clear whether these were from public or private companies.

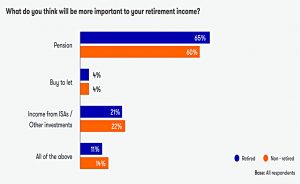

Pensions were the most important source of income for most people, with only a third as many primarily relying on ISAs instead.

Risk

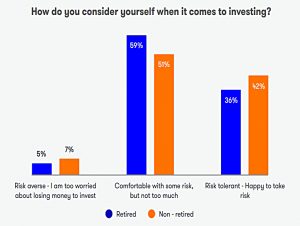

Most respondents placed themselves in the middle of the risk spectrum.

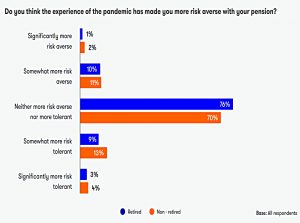

And they claimed that the pandemic had not impacted their risk tolerance.

Ethical investing

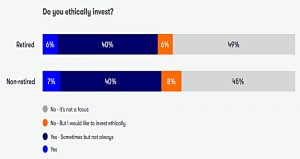

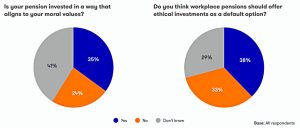

Respondents were split roughly 50:50 between those who invest ethically and those who do not, but only a small minority (6-7%) invested ethically all the time.

There was only moderate pressure for reform of pensions to allow default ethical options.

Information

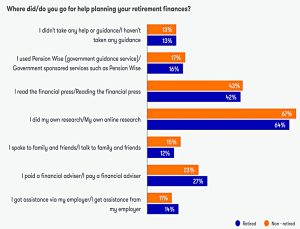

Most respondents took responsibility for their own research (presumably mostly online).

- The financial press was the next most common source, but around a quarter of respondents used or had used an IFA.

The government’s Pension Wise service had been used by only 16-17% of respondents.

Conclusions

The survey is a strange mix of entirely predictable insecurities and some surprises.

The increased focus on travel is no shock after a year of lockdowns.

- The interest in ethical investments was more muted than I expected, given the industry’s obsession with this topic.

Anxieties about potential future market crashes will never disappear, especially not at the end of a bull market lasting a dozen years.

- The fears about having to delay retirement – and in some cases, fears about never being able to afford to retire – as a result of the covid crash are more surprising.

Markets have recovered well from the March 2020 lows, and the only way I can interpret a lasting impact is that some people must have sold at the bottom.

A positive surprise for me was the large proportion of people with usefully-sized pension pots.

- £300K will give you a £10K pa income, which when added to the £9K of the state pension is a decent standard of living.

The worries over the future of the state pension from those under 30 are not new to me, though I think they are misguided.

- There’s no reason for the state pension not to continue, though if longevity resumes its upwards trajectory, I expect the state pension age to rise in tandem (the expectation seems to be that the average person will receive a payout for 10 to 15 years).

Having said that, the current SPA of 67 must seem a long way away when you are in your twenties.

- It’s this feeling that dissuades young people from over-contributing to their pensions and preferring the inferior (other than in respect of the LTA) ISAs instead.

But apart from people impacted by the LTA (which was 20% of the survey respondents), you don’t meet many old people who wish they had put less money into their pensions.

- Until next time.