Weekly Roundup, 9th July 2019

We begin today’s Weekly Roundup in the FT with Tim Harford, who was explaining that average is not the same as perfect.

Contents

Average not perfect

I have to say that before Tim’s article, it had never occurred to me that people might confuse the two.

Tim explains that we don’t know who invented the mean:

- In 1635 it was still being used to define the mid-point of a range,

- But by 1668 it was well accepted as the average of a set of values.

The mean has two main benefits:

- It simplifies data, allowing the observer to appreciate the significance of results rather than be swamped by their detail, and

- It eliminates errors of measurement since these will not usually be systematic.

Tim’s original point that average is not perfect is a response to Adolphe Quetelet who in the 1830s proposed that the average soldier (from body measurements) would be the ideal soldier.

- The error here is that variations in one direction are positive (larger, stronger) and in the other direction they are negative (smaller, weaker).

This didn’t stop industrial designers producing machines and environments suited for the average person.

A parallel can be drawn today in the use of volatility as a proxy for risk.

- Few people care about upside volatility since it makes them richer.

Interestingly, today’s woke society is moving ever closer to Quetelet’s error.

- Variations in all directions are once again to be celebrated, whatever their consequences.

Passing the baton

John Lee wrote about passing the baton to the next generation of investors.

- He established share portfolios for his daughters as far back as 1981, when the elder girl was five years old.

He is somewhat disappointed that 40 years later they have little interest in their stocks (though they enjoy the dividends).

- To this end, John has produced a pamphlet aimed at teenagers entitled Yummi Yoghurt — A First Taste of Stock Market Investment.

John says that his elder daughter and her husband have now become environmentally conscious and have carried out an ethical review of their portfolio.

- That’s something, I suppose, though it means that Air Partner, BBA Aviation and Concurrent Technologies had to be sold.

The money was reinvested in Tarsus and PZ Cussons.

State pension problems

Josephine Cumbo looked at problems with state pension projections.

- Back in May, the government owned up to problems with the projections from the online service, which has been used more than 12M times.

It seems that around 3% of the forecasts were wrong.

- That’s around 360,000 forecasts.

The government says that the errors will be fixed, but it hasn’t said by when.

The errors seem to revolve around people who received paper forecasts before the online system went live.

- Where the two forecasts differ, it is the online (higher) forecast that is wrong.

From a personal perspective, that’s good news.

- I was too young to get a written forecast, but I check my online forecast each year.

At the same time, those most at risk of errors are members of DB schemes with “complex work histories” (believed to be code for those who were contracted out of SERPS).

- Which sounds like me.

The error seems to be that the contracting out reduction is not as large as it should be, because of gaps in some people’s NI records.

- My own penalty amounts to around a decade of lost contributions so I hope that’s big enough.

US wealth tax

In a special “what if” supplement, the Economist looked at the consequences of the US introducing a wealth tax.

- Piketty proposed a wealth tax in his 2014 book “Capital in the 21st Century”.

Now presidential candidate Elizabeth Warren has backed one, too.

- She wants to charge 2% pa above $50M, and 3% pa above $1bn.

The first problem is that the tax could be unconstitutional.

- “Direct” federal taxes need to levied in proportion to the population of each state, which this one would not be – so her lawyers would argue that it is not a direct tax.

The plan hopes to raise $210 bn pa – an extra 1% of GDP – from just 75,000 households.

- Of course, few tax raises deliver the hoped-for revenue, as the behaviour of the newly-taxed changes.

Twelve countries had wealth taxes in 1990, but by 2017 eight of these had abandoned them.

There are three main issues:

- It’s hard to value assets accurately (though the US does already value houses for property tax, unlike most countries).

- Art, antiques and private business will provide the most problems, and valuations will be disputed in court.

- Avoidance – people will shift into whatever assets don’t count, causing bubbles in these.

- People will also move money offshore and create complicated legal structures to obscure wealth.

- Combating such avoidance has been found to be administratively expensive.

- Warren plans a 40% “exit tax” for those who renounce their citizenship.

- Economic impact – with average real returns on investment of 5% pa, a 3% tax is the equivalent of a 60% income tax rate.

- That is bound to impact entrepreneurship and saving, things which are generally seen as beneficial to society.

- Proponents of the tax would argue that the government can do more good with the money, but the historical evidence seems clear that this is not the case.

In Warren’s defence here, here $50M starting threshold is high enough that few innovators will be deterred from trying to get at least that rich.

-

- In contrast, the Labour party has regularly proposed UK wealth taxes and land taxes that start at just a couple of million pounds.

The proposed US tax seems unlikely to significantly reduce inequality, but that is not its purpose.

- The Democrats worry that billionaires have captured the political process through their ability to fund lobbying.

There’s little to suggest that’s the case over here.

Japanese pensions

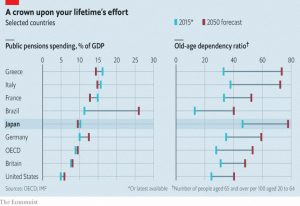

The Economist also reported that the Japanese need to put more aside for their pensions.

- And that they don’t want to take the risk required to secure higher returns.

The system was built on the expectation that people would live until their 70s or 80s. But more than half of Japanese babies today can expect to live to over 100. A quarter of all 60-year-olds will still be alive in 35 years.

Workers aged from 20 to 59 pay a flat rate into the pension system, but there are fewer people paying in and more taking out.

- The proportion of over 65s is expected to rise from 28% to 33% by 2050.

The newspaper notes that Japan’s pension is relatively stingy – though not at stingy as the UK’s.

- Things will get worse (both here and there) as spending won’t increase in line with the ageing population.

Here in the UK that will be managed by gradually increasing the state pension age.

- Japan also plans to raise the retirement age from 65 to 70.

Another problem is that the Japanese are very risk-averse.

- Household savings are mostly in bank accounts that pay zero interest and the assets of elderly households have been almost flat for the last 20 years.

PM Abe has at least persuaded the government pension fund to move half of its assets into stocks.

Private equity

Buttonwood looked at the rise of private capital.

New firms are staying private for longer. The number of public firms in America has declined by more than a third since the 1990s.

This is partly because tech startups need less capital.

- But its also because ideas led firms are often founded by people who don’t want to lose control or face the scrutiny of public markets.

And there is also a greater supply of private capital than there used to be.

- Lower interest rates and yields have driven investors to look for higher returns on venture capital and private equity.

Freetrade has become the first UK broker to get permission from the FCA to trade in fractional shares.

- This sounds like a great innovation, but I’m not sure who really need this.

Even with Freetrade’s £1 trades, the efficient trade size (based on typical portfolio turnover etc.) is around £2,000 and there are few stocks or ETFs that cost that much.

- I suppose it might help monthly savers, or those with very small portfolios.

Lindsell Train

Having been burned for their links to Woodford, Hargreaves Lansdown decided to drop Nick Train’s fund from their Wealth 50 list.

- The related Lindsell Train investment trust immediately fell by 22% in a day.

But it was trading at an extraordinary premium, and it does hold a massive position in the parent asset management company.

- Investors presumably feel that a loss of income from HL loyalists will hit it hard.

Interestingly, Woodford’s Patient Capital Trust has been the most popular purchase recently.

- It’s trading at an enormous discount, but I’m not sure I believe the asset values that it’s discounted against.

Crypto derivatives

The FCA is proposing a retail ban on crypto-derivatives.

- If that includes spread-betting with IG, then it’s a dumb move.

That’s the safest way to play cryptos.

Robo advisors

Regular readers will know that I am pretty disappointed by robo advisors.

- They don’t really offer advice, and they over-charge for index trackers that you could buy more cheaply for yourself.

But now some real robo advisors have been approved:

- Multiply will launch later in the summer, and will. be free (they will make money from product referral fees and commissions).

- MyEva is live already, but only offers workplace pension advice to employees of firms like Unilever, Callvin Klein and the NHS.

Whether they truly offer advice, or just guidance, I don’t know.

Quick links

I have just five for you this week:

- The Economist looked at the dystopia that might result from Too Few Robots

- RunProfits published the second part of its analysis of IPOs

- UK Value Investor wrote about the lessons learned from Selling Vodafone

- Pragmatic Capitalism explained that some bonds aren’t really bonds

- And AQR’s Cliff Assness outed himself as a Quant Cassandra.

Until next time.