Weekly Roundup, 28th November 2022

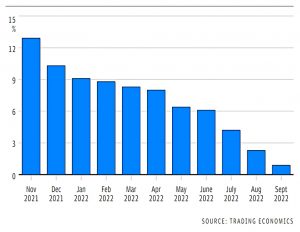

We begin today’s Weekly Roundup with inflation.

Inflation

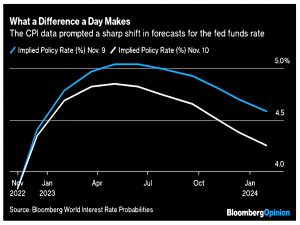

John Authers (( And his co-author, Isabelle Lee )) thought that the peak was in for inflation, but that the market reaction risked overdoing things.

- The October CPI in the US was better than both the previous month and expectations.

It’s been a while since we had such a large positive surprise (early 2020 to be precise).

While both remain very elevated, the trimmed mean has dipped slightly, while sticky price inflation is unchanged. Goods inflation is now falling, which is a necessary but not sufficient condition for bringing overall inflation under control. Services inflation is unnervingly high, but at least it’s ticked down slightly

Expectations for the peak in the Fed funds rate fell to 4.8%, in May 2023.

- This might have been an overreaction – all of the larger one-day shifts in five-year Treasuries were reactions to monetary announcements (by the Fed or the BoE), or to terrible news (the 9/11 attacks, the Lehman collapse).

The Nasdaq also went up 7.5%, for only the fifth time in 20 years.

Two of the others were “dead cat bounce” days in the aftermath of Lehman, and two happened amid the coronavirus confusion of early 2020.

John is not convinced that this is the turning point.

Just because the peak is in, the Fed cannot slouch about getting the inflation number down. It’s still supposed to be committed to getting it to 2%. The extent of the market turn may be not only premature but also self-defeating, in that it makes it harder for the Fed to ease off.

Macro Alf also asked whether this was a turning point, or just a bear market rally (as he did previously in July).

- Powell has said that he’s looking at the 3-month average of the monthly inflation increase.

This currently stands close to 0.5% or close to 6% annualised.

- That’s too high for the Fed to cave in now.

The positive news is that goods disinflation is finally here. The transition from a pandemic, goods-centric world to a post C-19 services driven economy and the decongestion of global supply chains will ensure further weakness in goods prices.

Less good was the fact that 70% of Core CPI components are still running at more than 4% annualised inflation.

- Shelter is a particular drag, which won’t clear for another six months.

Alf sees Core CPI at 4% by June 2023 – still too high for the Fed to feel comfortable.

- But by the end of 2023, he’s predicting 2% inflation and an earnings recession.

He thinks the Fed will be cutting rates in 1H24 and is buying call spreads to express this trade.

- He also expects a 15% drop in house prices and is shorting homebuilders and real estate ETFs.

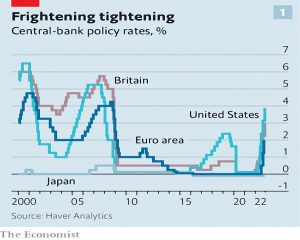

The Economist worried that even a global recession might not bring down inflation.

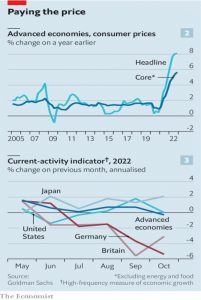

- And a recession does appear to be around the corner.

Deteriorating economic conditions are beginning to show up in “real-time” data. Goldman Sachs publishes a “current-activity indicator”. Last month, for the first time since the initial covid-19 lockdowns in 2020, rich-world economies appeared to shrink.

It might not be a bad one, since rich-country households have money left over from the Covid stimulus.

- Labour markets are weakening but demand has a long way to fall before it meets supply.

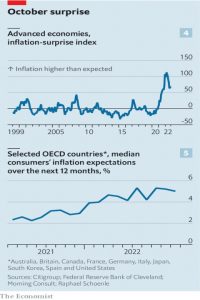

Yet inflation remains high, and upside surprises are still common.

We analysed the consumer baskets of 36 mostly rich countries. In June 60% of prices in the median basket were rising by more than 4% year on year. Now 67% are.

This is partly due to a strong dollar, but also because of rising wages.

- Pay demands are unusually high for the start of a recession.

Inflation expectations are also high.

In the median country the public reckons prices will rise by 5% over the next year, as it has in previous months. American firms currently expect inflation of 7% over the next year, the highest level since the survey began in 2018.

So even as the economy slows, inflation may remain high.

- Governments and central banks will then need to decide just how hard they are prepared to squeeze before the alternative (a potential price spiral) seems more appealing.

Bonds

Quite a few people were looking at bonds.

Cullen Roche wondered whether the bond bottom is finally in.

I am excited about bonds for the first time in a really long time. You can get almost 5% on a 1 year T-Bill. That’s phenomenal.

Even a 10 year T-Note starts to look pretty attractive when you start thinking about the probability of long-term inflation. I mean, what are the odds that inflation will run at 4% or higher for 10 years? The historical rate of inflation has been around 3%.

This is somewhat US-specific – as UK private investors we can’t easily invest in our government’s bonds.

Stocks have the potential to be messy in the coming years as housing unfurls, but bonds (especially shorter duration high quality bonds) are starting to look more and more attractive here. It might not be a bottom [yet] because the Fed seems intent on breaking something.

Jasmine Yeo of Ruffer said that the sell-off in US long bonds has presented an opportunity in TIPS.

These bonds now trade at levels last seen in 2016. With real yields now positive, US TIPS look like an attractive risk. If you were offered a return above inflation of almost 2% for the next 30 years, with no default or deflation risk, and in a sovereign, dollar denominated asset, wouldn’t you be tempted?

TIPS also add more inflation protection, though Ruffer thinks inflation is about to peak.

- And they should go up in value once interest rates fall.

This might not be until late 2023, but it’s hard to see much of a stock rally before that happens.

- Bond yields also usually fall during recessions, which is the alternative destination if the Fed tightens too much.

We are in a new structural regime of inflation volatility. Shorter term, we can foresee inflation falling (just not all the way to current central bank targets) and recession risks continuing to rise. As a result, we have positioned the portfolio to navigate an environment where rate hikes will slow or even pause in the next few months.

I’m almost convinced.

For Citywire, David Stevenson felt it was still too early to buy bond funds.

This year is currently the worst for investors in 10-year US Treasury notes since 1788.

That could change if we have a Fed pivot, but Jay Powell’s press conference suggested that is still some way off.

At what point does the need to show credibility in fighting inflation become more important than pushing economies into deep recessions?

Nobody knows, including (David suggests) many policy-makers.

- The snag is inflation – if it stays high, bonds may suffer in parallel with stocks.

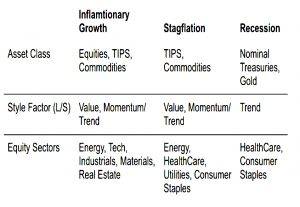

David quotes a framework from Steve Hou at Bloomberg which shows how to invest under various regimes:

We’re currently collectively stuck smack bang in the middle of the Stagflation column with inflation-linked securities (TIPs and linkers) the best option along with volatile commodities, value stocks, and the energy and healthcare sectors.

But if we get a recession, bonds and gold will look good (along with trend).

Chinese deflation

In the Telegraph, Ambrose Evans Pritchard warned that a wave of Chinese deflation will soon be heading our way.

Factory gate prices rolled over in the spring and have been falling in absolute terms for the last three months. Annual core inflation has dropped to 0.6pc.

Shipping costs are also down, and Ambrose expects a wave of cheap imports.

The path of least resistance is to export China’s unemployment to the rest of the world with a beggar-thy-neighbour trade strategy, boosting exports through a stealth devaluation of the renminbi or through (further) covert subsidies.

Ambrose thinks that the BoE is right to hike more slowly than the Fed.

Andrew Bailey was right to rebuke markets last week for betting on implausible levels of inflation next year and for pricing in a Bank Rate well above 5pc – a tightening shock that would set off a housing crash.

A year from now, the Bank of England may look like the one major central bank that refused to lose its head when all around were losing theirs.

I’m not so convinced that inflation will disappear without higher rates, but let’s hope that Ambrose is right.

Freetrade

The Telegraph reported that the “free” stock-trading app Freetrade is looking to raise more cash or even merge with another fintech.

- In reality, the app uses a freemium model where a basic service (of no use to me) tempts people towards paying a monthly subscription for more options.

Freetrade has previously raised money through crowdfunding, and I’m sure that it could do so again, though perhaps not at the scale it needs.

- It also raised £30M in loans back in April.

But it now seems to be pursuing VC investment instead, having failed to raise VC money in 2021, when the firm had a valuation of £700M.

- Valuations are down this year, but so is the willingness of VCs to invest in companies that aren’t profit-making.

Freetrade has a cash burn of around £1M per month and made a loss of £18.2M in the year to September 2021.

Quick Links

I have five for you this week, the first two from The Economist:

- The Economist looked at The new winners and losers in business

- And said that The costs and consequences of Europe’s energy crisis are growing

- Alpha Architect looked at Optimal Trend Following Rules in Two-State Regime-Switching Models

- And asked Does Momentum work in Options Markets?

- Disciplined Systematic Global Macro Views looked at The Bullard framework using the Taylor-Rule.

Until next time.

I think you mean Freetrade, not Freeserve? Probably your autocorrect.

Thanks for the spot. Old age, not autocorrect – Freeserve was a popular internet provider a couple of decades ago.

A few weeks back we chatted at some length about the recent LDI debacle in DB pension schemes.

You might find this parliament video interesting:

https://committees.parliament.uk/event/15694/formal-meeting-oral-evidence-session/

It is also now accompanied with a helpful, downloadable, transcript.

P.S. Freeserve takes me back a bit!!