Weekly Roundup, 31st August 2021

We begin today’s Weekly Roundup with a look at ETFs.

ETFs

In the FT, Robin Wigglesworth said that ETFs have become much more than passive index trackers.

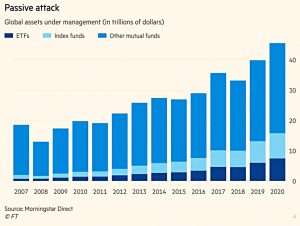

They aren’t the market leaders by a long chalk:

Globally, there are more than 70,000 mutual funds with combined assets of almost $40tn. The combined private equity and hedge fund industries can muster maybe a fifth of that. Despite a decade of rampant growth, there is still just $9tn in ETFs.

But firms are starting to convert their active mutual funds over to the ETF structure:

- Dimensional converted $29 bn worth earlier this summer.

- JP Morgan announced this month that four funds worth $10 bn would convert.

Bloomberg Intelligence’s ETF analysts reckon that more than $1tn of mutual funds could be transformed into ETFs in the coming decade.

And more ETFs are being issued – 199 vs 109 new mutual funds in 1H21.

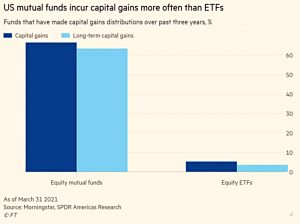

One reason (in the US) is tax efficiency – there are no ongoing capital gains events.

- But their distribution (via exchanges) is also much simpler.

And in the US, many ETFs are commission-free.

But they are also flexible, spanning the range from S&P 500 trackers to Cathie Wood’s hyper-growth actively-managed ARK funds (and even anti-ARK funds which will short the same stocks).

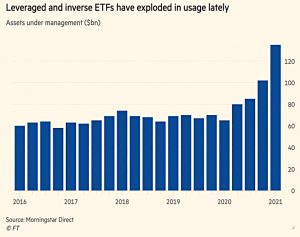

- There are also derivative-based funds, including short and leveraged funds.

Robin accepts that people are doing some silly things within the structure, but:

At some point, critics need to stop blaming the wrapper for all that ails markets and instead point the finger at people that put dumb or dangerous stuff inside it, or invest without understanding what they are buying.

I think that’s quite optimistic.

Retail traders

Buttonwood looked at the role of retail traders.

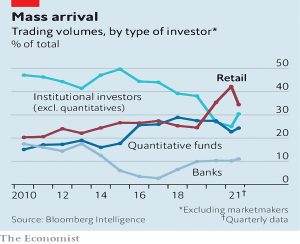

- After a decade of drifting towards passive index funds, active retail traders are back, thanks to Tesla, crypto, GameStop, Robinhood (zero commissions and options trading) and lockdown.

Between October 2019 and February 2020 trading volumes at retail brokers almost doubled from a low level, before doubling again once lockdowns began.

In 2019 around 59m Americans had accounts with one of seven of the largest brokers. This number has surged since to 95m, as 17m new accounts were opened in 2020 and 20m were set up this year.

Retail trading flows are up from 25% to more than 40% in 1Q21.

- The share of US stocks held by households fell from the 1970s until 2015 but is now back up to 38%.

At the same time, the share of the S&P 500 held in passive funds continues to rise, and now stands at 18.3%.

And not all retail accounts are day traders:

On average the 32m account holders at Charles Schwab trade around four times a month. This is more active than Vanguard customers (three-quarters of them do not trade at all in a year) but leisurely compared with the 34 or so trades that the 1.5m customers of Interactive Brokers make every month.

Triple Lock

In FT Adviser, Amy Austin looked at the threat to the state pension triple lock.

- The bounce-back in earnings from the pandemic hit last year means that pensions are on track for a record uplift next month.

At the same time, the UK state pension is pitifully low relative to earnings (the lowest in the OECD club of rich countries) and still lower than it was in 1979.

Figures from the Pension Policy Institute showed that since 2010, the basic state pension has been worth a mere 19 per cent of average earnings, while the new state pension is worth 24.8 per cent.

Just Group pointed out that even the 8% project rise would leave the pension short of the £10.8K minimum income standard recommended by the Joseph Rowntree Foundation.

Just Group CEO Stephen Lowe said:

While to many an 8 per cent increase in the state pension will seem extraordinarily generous, our analysis shows even this level of uplift would still not give single pensioners an income the public thinks provides an acceptable minimum standard of living.

Research shows an intergenerational gap in support for the triple lock:

Almost half of savers (46 per cent) believe the state pension triple lock should stay but over 50s are much more likely to want to keep [it] with 59 per cent supporting it compared to about a third (34 per cent) of those under 50.

I’m old and biased, but it seems to me that the triple lock should stay until the pension has reached an acceptable level relative to average earnings.

- Getting everyone to agree on that percentage could be tricky, however.

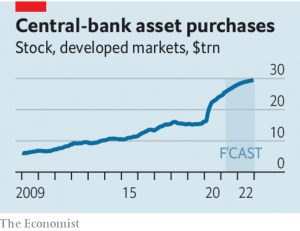

QE

The Economist thought it was about time that central banks made it clear what QE was for, and then reversed it.

- 40% of the projected $28 trn in central bank balance sheets is attributable to the pandemic.

Yet there is only weak evidence that accumulating or holding bonds helps economies much when, as now, financial markets are calm.

QE is rather a signal for when central banks might raise interest rates, and fear of another “taper tantrum” supports its continuation.

- Banks should explain instead that QE is for the crisis, and government spending and tax cuts are more effective once interest rates are already at zero.

The newspaper hopes this would break the link with interest rates, and allow QE to end without a tantrum.

- And shrinking the central balance sheet would reduce the impact of interest rate rises on the public finances.

Stimulus

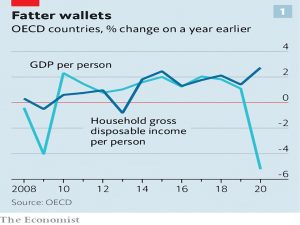

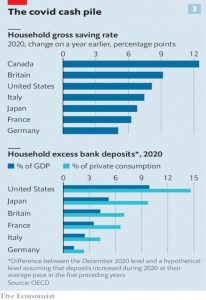

A second article wondered whether the economic recovery would survive the end of the stimulus.

- Real disposable income rose by 3% in 2020 as GDP fell, underpinned by extra benefits worth 2.3% of GDP.

Healthy household finances translate into more demand for goods and services.

- Together with loans, grants and furlough schemes, this led to a fall in corporate bankruptcies in most countries (and perhaps to an increase in the number of future zombie firms).

There is a risk that the end of stimulus will lead to lower spending, higher unemployment and more bankruptcies.

- Households have saved more money, but will they want to spend it when it’s no longer coming in?

The risk of temporarily higher unemployment is also clear, but again the more interesting question is whether people will want to return to their old jobs.

- The example of Australia, which ended its job retention scheme in March, suggest that they will.

A third issue is unpaid corporate and household bills (taxes and rents).

- And unpaid rents might finally lead to evictions, as bans on this process as lifted.

There’s still a lot to play for in this recovery.

Value Investing

Back to FT Advisor, where David Thorpe reported that star fund manager Nick Train thinks that value investing is a “20th-century” idea.

- And that applying traditional valuation metrics to modern digital businesses is a “mistake” and outdated.

Train said in his monthly update letter to clients:

Investors, particularly US investors, understand the value that digital and data companies generate for their owners when they grow. Their capital-intensity is low, meaning returns on capital are high and copious cash generated.

Returns on capital are simply so structurally higher than analogue/bricks-and-mortar businesses that [valuation multiples] we might have regarded as excessive 20 years ago can now justifiably be designated ‘cheap’.

This echoes the comments from a few years ago by Scottish Mortgage’s James Anderson.

Crypto

PayPal announced that its crypto service would be arriving in the UK before the end of August, but it’s still “coming soon” according to my own account.

- Not that I expect to take advantage – the fees involved are enormous.

On top of the minimum 1.5% transaction fee, there’s also an “exchange rate margin”, which according to the Ts & Cs, sounds like it might potentially be a double margin:

PayPal may make a margin on:

- the price at which we Buy or Sell Cryptocurrencies on your behalf from or to our trading Service Provider. This is generally approximately 0.50% of the transaction value, although the actual rate will depend on market conditions; and

- the conversion between pounds sterling and US dollars using our current exchange rate offered to customers which is based on the wholesale currency exchange rate or if required by law or regulation the relevant government reference rate(s).

Too pricey for me, I’m afraid.

Quick Links

I have five for you this week, all from The Economist:

- The newspaper said that the next decade would be tough for Apple

- Because Apple exemplified the era of global capitalism that has now passed.

- In contrast, they thought that Flutter Entertainment was on a roll

- That Amazon’s department store plans are not surprising

- And that innovation has emerged from Bill Ackman’s SPAC woes.

Until next time.