Irregular Roundup, 22nd January 2024

We begin today’s Weekly Roundup with inflation.

Contents

Inflation

UK inflation ticked up to 4% in December (from 3.9% in November) apparently driven by increases in the cost of fags and booze.

- Clothing, air travel and entertainment also increased but food and non-alcoholic drink prices fell.

The forecast was for a fall to 3.8%, but even worse, core inflation was flat at 5.1% – the first month since July 2023 that core hadn’t fallen.

- Services inflation increased from 6.3% to 6.4% (but goods inflation is now down to 1.9%, the lowest since April 2021).

Sterling rose as expectations of an interest rate cut in May receded, and the FTSE-100 fell by 1.4%.

For Ruffer, Jasmine Yeo questioned whether inflation has been tamed.

- The market still seems to believe that recession has been avoided and inflation will fall to the 2% target and stay there.

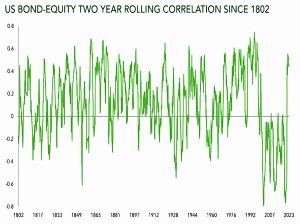

The chart shows the rolling two-year correlation between bonds and stocks.

- For the two decades to 2022, it was negative but this is not normally the case.

The period between 2001 and 2022 (spanning the majority of the careers of most working in the industry today) has been anomalous in its consistency. A key driving force of this anomaly? The absence of inflation.

Our view is that we have entered a new regime of inflation volatility, with periods of high inflation (like 2021-2022) followed by aggressive disinflation (as was the case in 2023).

Which would mean a positive correlation between stocks and bonds.

It is nearly impossible to distinguish between a ‘normalisation’ back to a world of low, stable inflation and a disinflationary leg within a regime of inflation volatility. So we would argue investors should have exposure to both.

They are talking their book here, positioning Ruffer as an uncorrelated alternative fund.

- Which is how I use it.

Hikelandia

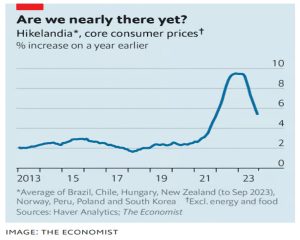

The Economist notes that the countries which first raised interest rates (Brazil, Chile, Hungary, New Zealand, Norway, Peru, Poland and South Korea, collectively termed Hikelandia) are now starting to cut them.

Hikelandian inflation is still far too high, but it is falling fast. Policymakers in Hikelandia

have reduced borrowing costs by about a percentage point on average from the peak last year. And if Hikelandia’s hawkish central bankers are now cutting rates, others may soon follow.

One per cent mortgages

It has been reported that the latest scheme to prop up house prices (sorry, improve access to the housing market for young people) will be mortgages with a 1% deposit for first-time buyers.

- This could be announced in the March Budget.

I think this is a bad idea because of the high risk of negative equity (losses on which will presumably be absorbed by the government ie. the taxpayer ie. people like me) and/or mortgage prisoners, but I am more concerned with the artificial/dishonest debate around UK housing.

We are told two things:

- We need to build more houses, and

- A house price crash would be a good thing.

We probably do need more houses, but what we really need are more houses where the jobs are.

- Building more where the jobs are at present is difficult/expensive, so perhaps an alternative/parallel approach might be to create jobs where there are currently plenty of houses.

A house price crash won’t happen (in nominal terms at least) since there aren’t enough forced sellers to accept offers 30% below the current level.

- And more importantly, the economy depends on stable house prices.

For most people, their home is their only asset, and a 30% haircut will change behaviour.

- And the banks would be insolvent if the assets they loaned against dropped by a third.

Compo

In the FT, Moira O’Neill argued that the limit of the financial services compensation scheme needs to be reviewed.

- She has previously suggested that investors tidy up their pensions and ISAs by consolidating onto a single platform.

It’s also cheaper to operate fewer accounts.

- But since platforms can go bust, and the FSCS limit is just £85K, this seems risky.

In fact, the compensation is designed to target cash losses – funds and shares should be held in nominee accounts and ring-fenced from platform failures – but you never know.

Detractors point out that this segregation is least likely to offer protection at the time you need it most. A firm on the edge of collapse may have shaky records that make it difficult to identify customers’ holdings or, worse, might be tempted to “borrow” client assets to tide it over.

In practice, you need to trade off costs and ease of admin against the risks.

- Ignoring legacy accounts yet to be closed or combined, my partner and I operate six ISAs and six SIPPs between us.

- I am also influenced by the low limit to use mostly market-leading firms or those with top-tier backers (such as iWeb, owned by Lloyds).

It would be great if the FCCS limit was suddenly raised to £1M per account, but an “inflationary” increase from £85K to £100K would make very little difference. Moira agrees:

it’s time to give retired investors drawing down from a Sipp held on a platform the same protection as is given to investors in annuities — namely 100 per cent of value with no upper limit.

Stamp Duty

For Bloomberg, Merryn Somerset Webb said it’s time to get rid of stamp duty on share purchases.

- Every share purchase on the UK Main Market attracts a tax of 0.5%.

On a £10K deal, you might pay £5 in commissions and another £50 in tax.

- Which might be enough to put you off.

Costs are one of the few things you can control in investing and a big factor in your long-term performance,

The tax puts main market stocks at a disadvantage to risky AIM stocks and less risky US stocks (now easily accessible for UK investors) and puts investment trusts at a disadvantage to ETFs.

- It’s one of the main reasons I’ve moved away from both types of assets over the past decade.

And it puts the UK market as a whole at a disadvantage to foreign bourses.

[The] upfront cost is just the beginning. Next up is the long-term effect on share prices as a whole: These should, all other things being equal, be reduced by at least the present value of the expected value of the transaction costs. I say at least because if the tax has the effect of reducing liquidity across the board (by introducing friction to trading), there will be a further discount added.

I would say one for the March budget if only it didn’t bring in £4 bn a year.

Retirement age

At the Davos World Economic Forum, the WEF presented a longevity white paper which suggested that global retirement ages would need to increase by 8.4 years to preserve the existing ratio between working and retired populations.

- With the UK already committed to an increase to 67 over the next few years, that would take us up to 75, which might be a hard sell to the electorate.

The WEF report itself said that less than a quarter of those aged 55 and over would like to work more.

- And by age 75, quite a lot of people would not be up to full-time work.

The WEF said that if retirement ages did not increase, many people would outlive their retirement savings.

InvestEngine SIPP

The low-cost ETF platform InvestEngine (which I use for my company investments) has started trailing a SIPP (no launch date as yet).

- Unfortunately, their custody charge is 0.15%, capped at £200 pa (on a £133K pot) which is more than AJ Bell and Fidelity.

So although I like the platform, I won’t be signing up.

Hipgnosis

The new board of struggling Song royalty fund Hipgnosis (SONG – I hold a small amount) is asking for permission to offer potential bidders payments of up to £20M in costs as an inducement.

It’s related to a “call option” granted to the current fund manager Merck Mercuriadis.

- He (or rather his company Hipgnosis Songs Management – HSM) has the right to buy the 65K song catalogue for fair value if HSM’s contract is terminated (as now looks likely).

This is both a conflict of interest and a deterrent to bidders.

- The cost payment to cover due diligence etc. would be made if HSM trigger the call option.

But since the HSM contract has a 1-year notice period, and the call option clause has a six-month window, we could still be 18 months away from a (costly) resolution.

- On the other hand, Round Hill Music was bought out at a 10% discount to fair value, so in one sense the call option offers an upside to shareholders.

It all sounds like quite a mess to me.

LTAFs

It looks as though there is no demand for Long Term Asset Funds (LTAFs), the limited liquidity vehicles intended to generate interest in illiquid underlying assets like private equity (PE).

- This is hardly a surprise – the only illiquid funds I own are VCTs with a five-year lockup period.

But VCTs come with a chunky up-front tax break that makes the lockup worthwhile.

- LTAFs have no such sweetener, but they do have a 90-day redemption cycle.

I got rid of my OEICs because they have a 2-day redemption cycle, so 90 days sounds horrendous.

PE has a (small) place in portfolios, but it can be better accessed through ETFs and investment trusts.

Only a few LTAFs have been launched to date (by BlackRock, Schroders and Aviva), but more are planned.

- Will anybody buy them?

Quick Links

I have seven for you this week.

- Alpha Architect wrote about Outperforming Cap- (Value-) Weighted and Equal-Weighted Portfolios

- Novel Investor gave us The Negative Checklist

- UK Dividend Stocks had a FTSE 100 valuation and forecast for 2024

- The FT asked Why is it still so hard to build new homes in England?

- Investment Talk told us to Avoid Investors Who…

- Disciplined Systematic Global Macro Views asked Are real rates too high?

- And Of Dollars And Data wondered Should Your Job Determine How You Invest?

Until next time.