Irregular Roundup, 18th March 2024

We begin today’s Irregular Roundup with rents.

Contents

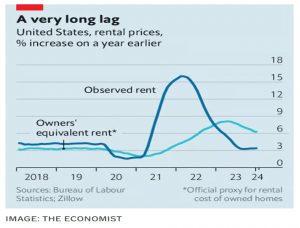

Rent and inflation

The Economist looked at how housing is incorporated into the consumer price index (CPI) and why the methodology might delay the widely hoped-for interest rate cuts.

- Property prices don’t feed into the figures, since houses are seen as a capital expenditure (or possibly an investment).

- Nor do mortgage payments, which vary with interest rates as well as house prices (and in the US at least, are complicated by the availability of 30-year fixed-rate loans).

Instead, the statisticians use rent – but not just real rent paid by renters.

- They calculate as well how much it would cost owners of property to rent the place they live in – a number they call owner’s equivalent rent (OER).

OER is the biggest component of CPI at around 25%.

- Real rents are just 8% of the figure (because two-thirds of Americans are owner-occupiers).

OER is also weighted to “single-family homes”, which is what most people live in.

- Unfortunately, not many renters rent this kind of property.

The January CPI figure was a rise of 0.3% on the month, of which nearly half was from OER.

- But the rise in OER was much bigger than that in direct rents.

OER inflation is running well above pure rent inflation. Continued tightness in the market for single-family homes ensures the divergence will probably continue for some time, and this in turn will place upward pressure on general measures of inflation. It may well deter the Fed from cutting interest rates any time soon.

A (luxury) handbag

The Economist also looked at the luxury handbag market, which is plagued by counterfeits, and suffers from the same information asymmetries as the original “market for lemons” (second-hand cars).

Handbags are a big and growing market:

LVMH sold about €10bn-worth ($13bn) of leather goods in 2013. By 2023 it was selling €42bn-worth—a 320% increase in just ten years. (The global economy, by contrast, grew by only 30%.)

Reselling platforms add around $200 bn to sales of handbags and clothes.

These numbers have attracted “super fakes” from China, at around 10% of the retail price.

The market for secondhand luxury bags is now vast, widespread and complicated enough that those interested in buying a genuine handbag risk being swindled.

And as with Akerlof’s Nobel prize-winning paper of 1971, sellers know more than buyers.

- So buyers offer the value of a bad car (a lemon) because they can’t be sure they will get a good one.

Unable to fetch a fair price, sellers of good cars will withdraw, further driving down prices. Gresham’s law will assert itself: just as bad money chases out good, lemons chase out solid cars. As such, the market for decent used cars may vanish entirely.

And it’s the same with bags:

The seller will know if they bought their bag from a boutique on Fifth Avenue, ordered it via WeChat or even picked it up on Canal Street—but their potential buyer will not.

An obvious solution is a third-party quality check – a mechanic or dealer, or handbag resale platform. But not all resellers can be trusted:

- Chanel recently sued “What Goes Around Comes Around” (WGACA) for selling counterfeits with stolen “authenticity cards” and was awarded $4M.

Now Chanel is suing “the RealReal”, but it’s not all upside for the manufacturers.

A robust resale market provides an additional reason to buy a luxury bag. Whereas a white t-shirt is a pure consumption good, likely to be used until worn out and discarded, a fine handbag is closer to buying a car: the product is an asset that depreciates over time, yet still holds value.

It would be worth Chanel coming up with a better way to authenticate.

- This would fix the wider economic issue, that buyers and sellers of perfectly good items can’t strike a fair deal.

Low vol

Buttonwood said that investors get risk wrong.

- He means that more volatile stocks do not outperform.

Attitudes to risk are difficult to measure, and so price volatility is often used as a proxy for risk.

High volatility raises the chances of getting an extreme result: in investment terms, an enormous gain or a crushing loss. You can gauge a stock’s volatility by looking at how wildly it has moved in the past or, alternatively, how expensive it is to insure it against big jumps in the future.

Substituting volatility for risk (and forcing a normal distribution of returns) leads us to Modern Portfolio Theory (MPT – not so Modern now, as it was invented by Harry Markowitz in 1952).

- This says that taking more risk should lead to higher returns.

The rest of the article takes a stock-centric angle, using results from the Global Investment Returns Yearbook (currently sponsored by UBS) authored by Elroy Dimson, Paul Marsh and Mike Staunton.

For medium and low volatilities [of US and UK stocks] returns are clustered, with volatility having barely any discernible effect. Among the riskiest stocks, things are even worse [for adherents of MPT]. Far from offering outsized returns, they dramatically underperformed the rest.

This is partially a reverse size effect:

The riskiest stocks tended to also be those of corporate minnows, accounting for just 7% of total market value on average. Conversely, the least risky companies were disproportionately likely to be giants, accounting for 41% and 58% of market value in America and Britain respectively.

This makes exploiting the anomaly via a long/short strategy impractical.

In any case, short positions are inherently riskier than long ones, so shorting the market’s jumpiest stocks would be a tough sell to clients.

Though counter-intuitive, this is not a new finding – you can easily buy a low-vol “Smart Beta” ETF.

- And it does not extend across asset classes, which all have roughly equivalent Sharpe Ratios.

Stocks are riskier than bonds, and they provide higher returns.

ISA millionaires

For MoneyWeek, Kalpana Fitzpatrick looked at data from Interactive Investor (II) on the ISA millionaires (IMs) on their platform.

- There are 1,001 of them, up 17% from the 852 last year.

HL has 836 (up from 573) and AJ Bell saw a rise of 119%, but no absolute number of IMs was given.

- There are presumably many more than this, as many investors will split their ISAs across more than one platform.

The average II IM is 74, compared with 57 for all II ISA holders.

- 42% of IMs’ portfolios are in investment trusts (perhaps reflecting their age).

- 38% is in individual stocks

- 11% is in funds (OEICs)

- 5% is in cash

- and just 4% is in ETFs.

My numbers are pretty much the reverse of those – the vast majority of my listed holdings are ETFs, with around 8% in legacy OIECs, 5% in ITs and just 4% in individual stocks (I count my cash separately as it’s not in my stock accounts).

- The average II ISA holder has 36% in stocks, 24% in funds, another 24% in ITs, 8% in cash and 7% in ETFs.

AJ Bell reports that 75% of IM portfolios are in individual stocks.

The Top 10 holdings for II IMs are:

- Alliance Trust

- Scottish Mortgage

- Shell

- GlaxoSmithKline

- Haleon

- Lloyds Banking Group

- National Grid

- BP

- Legal & General

- Vodafone

I find this data pretty shocking – it’s as if the IMs fell asleep in the 1990s.

- ETFs have been available in the UK for 24 years now, but it seems they haven’t caught on with UK private investors to the extent they have in the US and with institutions.

LTA watch

For the FT, Moira O’Neill looked at whether investors should crystallise their pensions before a future Labour government reintroduces the LTA.

- She tells the story of the reader Hamlet (“To crystallise or not to crystallise?”) who has three SIPPs.

- One is crystallised as has used up the the old LTA.

He says:

With an impending election and the likelihood the new rules would be rolled back after the election, I think the best course of action is to crystallise the other two Sipps in April in the hope that following the election there would be no claw back of limits already taken.

If I don’t do this the uncrystallised Sipps will again be above new lifetime limits and could incur higher tax in the future.

Hamlet is assuming that Labour’s plans won’t have any retrospective effect.

- There’s no precedent for retrospective action on pensions, so this is a fair assumption, given the extent to which Starmer and Reeves have been trying to paint themselves as reasonable to date.

Lots of people are in Hamlet’s situation, though I expect most will be giving Labour a bit more time to explain their plans before they crystallise.

- Against that, some pension death benefits will disappear from the 6th of April, and some may be influenced by that.

The other potential downside that that the tax-free cash limit might at some point be raised, leaving a portion that can’t be exploited from crystallised pots.

- But this is likely to be a small amount, and some distance in the future.

HNW eligibility

One thing I missed from this month’s Budget is that the recent changes to the eligibility criteria for high-net-worth and sophisticated investors have been reversed.

The document says:

The government will legislate to reinstate the previous eligibility criteria to qualify as a high net worth or sophisticated investor, and will also carry out further work to review the scope of the exemptions.

The Autumn Statement in 2023 has increased the HNW levels to £170K of income or net assets of £430K.

- Now we are back to £100K and £250K respectively.

Crypto

As Bitcoin hits another all-time high, the FCA has indicated that it wouldn’t object to the creation of crypto-backed ETNs for professional investors on the LSE, starting from 2Q24.

- The regulator remains of the opinion that such products are not suitable for retail investors, who will be banned from buying them.

It’s great to be treated like a child by the nanny.

- There are ways to get BTC exposure, but it should be easier and cheaper.

Quick Links

I have just three for you this week:

- Discipline Funds said that Inflation is Still in a Downtrend

- Alpha Architect explained how to Break Bad Momentum Trends

- And Mauldin Economics kicked off A Valuation Conversation.

Until next time.