Irregular Roundup, 13th March 2024

We begin today’s Irregular Roundup with the end of an era.

The golden age of stocks

The Economist said that a golden age for stocks is drawing to a close.

- The US, Europe, India and Japan (and bitcoin) are all setting records despite interest rate rises, protectionism, trade wars and actual wars.

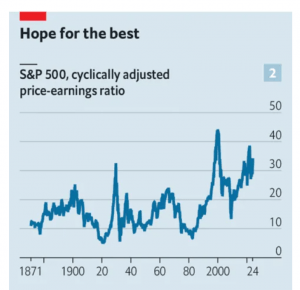

The US market could be in a bubble, based on valuations, concentration and value spreads.

The value of the top 10% of American firms as a proportion of the whole market has not been as high since the crash that was one cause of the Depression in the 1930s.

On the other hand, the US economy is growing and lots of companies are reporting strong profits.

- And we also have the optimism/frenzy around AI and its potential impacts on productivity.

The lesson from other fundamental technologies is that it takes time to work out how to exploit them. Businesses talk non-stop about generative AI but it remains at the experimental stage.

And you still have to pick the winners:

Even if AI is destined to transform societies utterly, today’s investors may struggle to pick which companies will make money. Believers in the dotcom boom were not wrong about the transformative power of the internet—but they still lost their shirts.

The Economist doesn’t think that valuations can go much higher, or that profits can take a bigger share of the economy.

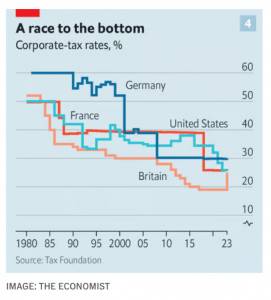

Their outsize growth in recent decades was a one-off, caused by the falling cost of borrowing and taxes.

Those tailwinds are likely to turn into headwinds from here.

Under realistic assumptions about what will happen to valuations, interest and taxes, to generate even modest real equity returns of 4% a year over the next decade, America’s firms would need to increase their underlying profits by around 6% a year, close to their best ever post-war performance.

The next ten years are unlikely to repeat the golden age.

- The Economist backs up this idea with reference to a Federal Reserve paper from Michael Smolyansky which warns of the “end of an era” and “significantly lower profit growth and stock returns in the future” (AQR and Goldman have published similar views).

Mirroring Mr Smolyansky, we find that in America the difference in profit growth between the 1962-1989 period and the 1989-2019 period is “entirely due to the decline in interest and corporate-tax rates”.

The same goes for the rest of the developed world.

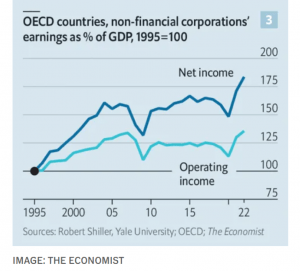

The surge in net profits is really an artefact of lower taxes and interest bills. Measures of underlying profits have grown less impressively.

David Stevenson picked up on the Smolyansky paper in his Adventurous Investor newsletter.

Smolyansky suggests that US investors in particular have benefitted from a big one-off gift of lower tax rates and low interest rates.

Both of those are now in question and we should expect market returns to closely match underlying corporate profits growth which is running at 2% per annum. Yikes.

He quotes from the paper directly:

My central finding is that the 30-year period before the pandemic was exceptional. During these years, both interest rates and corporate tax rates declined substantially. This had the mechanical effect of significantly boosting corporate profit growth.

Specifically, I find that the reduction ininterest and corporate tax rates was responsible for over 40 percent of theg rowth in real corporate profits from 1989 to 2019. Moreover, the decline in risk-free rates over this period explains the entirety of the expansion in price-to-earnings (P/E) multiples.

Together, these two factors therefore account for the majority of this period’s exceptional stock market performance.

And tax and interest rates can’t be relied upon in the future.

- All we have left is GDP growth (for which the 2% pa estimate might be optimistic).

A future return from stocks of 2% real pa would have serious implications for most people’s retirement plans.

- I’m increasingly coming to the conclusion that long-only, buy-and-hold passive investing might not work in the future.

Granola

A couple of weeks ago, I’d never heard of the Granola stocks, but since then I’ve seen half a dozen articles on the topic.

- These EU stocks are being touted as the continent’s answer to the Magnificent Seven in the US.

Morningstar first alerted me to the list:

- GSK (GSK)

- Roche (RHHBY)

- ASML (ASML)

- Nestle (NSRGY)

- Novartis (NVS)

- Novo Nordisk (NVO)

- L’Oreal (LRLCY)

- LVMH Moët Hennessy Louis Vuitton (LVMUY)

- AstraZeneca (AZN)

- SAP (SAP)

- Sanofi (SNY)

Except for NVO, it looks like a pretty stodgy bunch and just two of the eleven are listed in the UK.

- There’s also a worrying concentration in healthcare.

The name comes from a 2020 Goldman Sachs (GS) report, so I’ve remained ignorant for four years. GS said:

In the US, tech is still likely to remain thelong-term winner. In Europe, it’s more likely to be a combination of structurally strong and/or stablesectors: healthcare, consumer staples, and tech … They might not ALL do well, but they generally havesome growth and/or stability in earnings and [dividend yields] in the 2.0%-2.5% range.

The Granolas (supposedly another acronym like FAANG, but it’s a bit of a stretch) are responsible for 60% of European gains over the last year and had surprisingly outperformed the Mag 7 over the past two years (perhaps until the most recent run-up in the US).

- The Granolas also show lower volatility and smaller drawdowns.

The Granolas are a lot smaller than the Mag 7 – NVO is the largest at $555 bn, whereas six of the Mag 7 are valued at more than a trillion dollars.

- But the Granolas are more diverse – ASML is the only tech stock, and there are also firms from the healthcare, consumer defensive, and consumer cyclical sectors.

The Granolas trade at a forward PE of 31, compared to a European average of 14, whereas the Mag 7 trades at 34 and the US market is at 20.

- The Granolas make up around 25% of the Stoxx EU 600, whereas the Mag 7 are around 33% of the S&P 500.

There are no Granola ETFs as yet, so you are stuck with the Stoxx EU 50 index, which has a 42% allocation.

- The Euro Stoxx 50 index (which sounds pretty similar) has only 27% exposure, rising to 36% in the ESG version of the index.

- The MSCI Europe index has a 22% weighting, and the Stoxx EU 600 has a 20% weighting.

An alternative approach is to buy the pharma or healthcare sectors, as 6 of the 11 Granolas are listed there.

- EU Healthcare ETFs typically have a 70% allocation to the Granolas (but not all of them).

LTA watch

Labour has reportedly given up on its idea of carving out an LTA exemption for doctors (and potentially other public sector workers) when it restores the pension cap (should it win the looming General Election).

- It’s now working on what level to reinstate the LTA at, given the substantial inflation since the last figure was set.

That would rule out the mean but round number of £1M.

- Indexing the LTA’s highest level of £1.8M would probably get us to around £2.5M, but I’m sure Labour feels that is too generous.

- £2M is another nice round number, but it sounds like a lot to most people.

Having an output cap when we already have an input cap (the annual allowance) will always strike me as bonkers, but if I had to bet right now I would go for £1.5M, with a side bet on a precisely calculated uprate of the old £1.073M (let’s guess £1.15M).

- Just as important as the LTA number is transitional protection for money that is already in the pot before the limit is reintroduced, but Labour has said nothing about that.

Hipgnosis

There is more bad news for the Hipgnosis Song Fund (SONG), in which I have a small position.

- An independent valuation by Shot Tower Capital of the fund’s song catalogue has come in more than 25% light.

The valuation was done on a bottom-up basis, looking at recent royalty data from the individual catalogues.

- The mid-point valuation was $1.93 bn (£1.52 bn) – 26% lower than the September 2023 valuation.

Currency movements turned that 26% haircut into a 33% write-down of the dollar NAV.

In even worse news, the reaction from the board was to suspend dividends for the foreseeable future and use any free cash to pay down debt.

- Given that most holders of the fund will be looking for reliable income, this is a pretty extreme measure.

The shares responded by falling to an all-time low of 57.4p. a 38% discount to the new NAV.

- An exit somewhere around 90p still looks possible, but turning a profit on the IPO price is unlikely.

I still think royalty funds are a good idea in principle, but it’s beginning to look like fund manager Merck Mercuriadis overpaid for song assets in the rush to scale up.

- It also looks like the rejection of the Blackstone offer in 2023 was a mistake since Blackstone could now offer the new NAV and pay less than it originally offered.

Quick Links

I have a bumper seventeen for you this week:

- Joachim Klement said that Japan is the playbook, not the exception

- The FT reported that Reddit is casting aside community spirit in search of financial maturity

- And told us to Buy the dip! Or, don’t

- And said that this was An empty Budget for the City

- And wondered Is private equity actually worth it?

- And asked Are structured products to blame for suppressed volatility?

- And said that it is Survival of the fittest for health tech

- Bloomberg pointed out that ADM Gave Itself Some Discounts

- Of Dollars And Data said (about Bitcoin) that More People Buy, Number Go Up

- And asked Can the Typical Person Become a Millionaire?

- JP Morgan said that Zero Carbon Is a Highly Unlikely Outcome

- Fortunes and Frictions asked you to Choose Your Uncertainty

- A Wealth of Common Sense wondered What’s the Investment Case For Gold?

- Alpha Architect looked at Betting on a Short Squeeze as an Investment Strategy

- And wrote about Identifying the Highest Quality Momentum Stocks

- The Economist said that A frenzy of innovation in obesity drugs is underway

- And reported on The battle over the trillion-dollar weight-loss bonanza

Until next time.