Irregular Roundup, 2nd January 2024

We begin today’s Weekly Roundup with Hindsight Capital.

Hindsight

Every year, John Authers writes about Hindsight Capital, a fictitious firm able to place the trades that would have performed the best in the preceding year.

- This year he wrote three articles, including a warm-up around the post-Covid trades that Hindsight couldn’t make (since they can only trade indices).

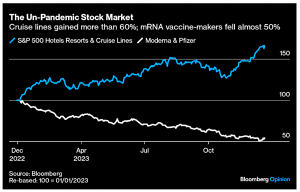

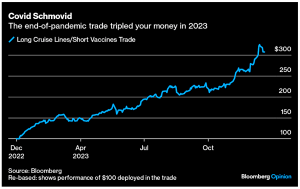

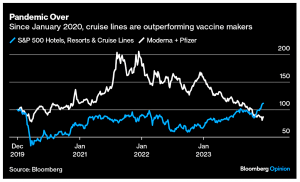

Hotels and cruise lines gained 66%, whilst vaccine-makers lost 46%.

Combining the two trades (long/short) tripled your money.

John also notes that the tourism stocks are in better shape than they were before the pandemic.

- The vaccine makers are worse off than before they saved the world.

The other two articles deal with Hindsight.

For 2023, the essential points to grasp were that the US would not go into recession, that China would not rebound from its Covid-era restrictions particularly fast, and that the conflict between Russia and Ukraine would cease to have a significant impact on energy prices. Seeing the conflict coming between Israel and Hamas would not, it turns out, have helped identify any great opportunities or avoid risks.

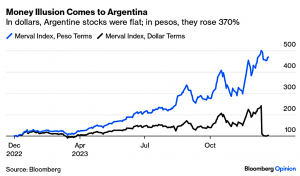

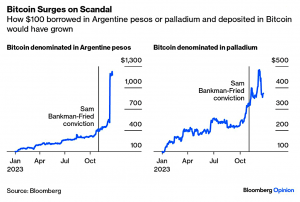

The first trade was the dollar against the Argentine Peso.

Hindsight’s team likes to move offices, basing itself where the currency is due to fall. By denominating in the world’s weakest currency, Hindsight Capital gave every one of its trades a boost.

Trade number two was long the Magnificent 7 and short China.

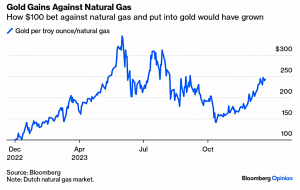

Trade number three was long gold, short natural gas.

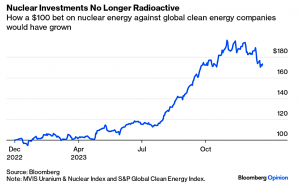

Trade four was long uranium and nuclear power, short clean energy.

Trade five was long bitcoin, short palladium (or pesos).

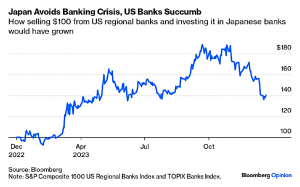

Trade six was long Japanese banks, short of US regional banks.

Trade seven was the Mexican Japanese carry trade (borrowing yen and putting them to work in pesos, or the Brazilian real).

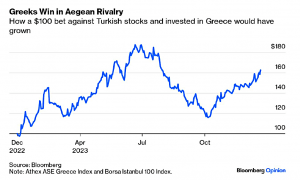

Trade eight was long Greece, short Turkey.

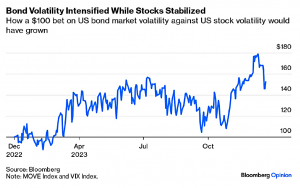

Trade nine was long bond volatility (Move) and short equity volatility (VIX).

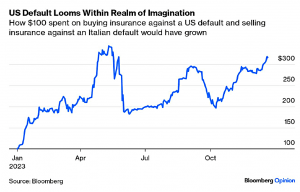

Trade ten was buy insurance against US default and sell insurance against Italian default.

Despite the massive (and guaranteed) success of Hindsight, John cautions against trying to copy them:

Hindsight takes enormous risks, which nobody should if they cannot foresee the future. It’s not remotely plausible to make returns as good as these in real time, and it would be dangerous to try.

But perhaps there are a few lessons to be learned:

It’s always a good idea to ask yourself: “What do I know, that most people are wrong about?” Answer this correctly, and you will make money. In 2023, anyone who allocated their assets on the assumption that there would be no US recession would have done very well.

Hedge funds

In his Adventurous Investor newsletter, David Stevenson said that hedge funds might make sense after all.

Hedge funds do have decent risk-adjusted returns, but they are expensive, and:

The real problem is that many hedge funds have a high correlation to equity markets: during equity markets’ worst ten months, hedge funds on average lost money and provided no portfolio protection.

David quotes Dylan Grice of Calderwood Capital:

Apart from the tech bust in the early 2000s, they [hedgefunds] have drawdown in sync with equity markets. Bonds, in contrast, have protected portfolios more effectively during such periods, the notable exception being in 2022.

So you need to be selective:

If we remove all funds with high equity correlations and remain biased towards smaller managers some interesting properties emerge. Returns surpass those of equity markets, even during the boom of the last 25 years, with less than 25% of the vol and a fraction of the drawdown.

Getting access to these funds is unfortunately not easy for the private investor.

Advice

In the FT, Claer Barrett reported that the most common question from investors in their 30s is “Where can I find a financial adviser?”

Unfortunately, regulated financial advice is expensive, making it almost exclusively the preserve of the already wealthy.

Will the FCA consultation on the advice/guidance boundary help?

I must admit to being sceptical.

- The key differential at the moment is personalisation – generic information can be provided, but specific recommendations can only be given by regulated professionals.

Those who can use the general info properly (we call these people DIY investors) are unlikely to need advice in the first place.

The regulator’s first idea is providing consumers with “targeted support” or a nudge in the right direction. This would likely be free, in the form of more personalised communications from firms they already have a relationship with.

That sounds good, but do people have an existing relationship with a single entity that can see their entire financial situation?

- I know I don’t – I have dozens of accounts and counterparties.

The new rules might mean that the providers of my racier satellite accounts would feel the need to warn me about the riskiness of my portfolio (not realising what a small proportion of my net worth this account represents).

The FCA envisages firms could pinpoint different target markets, and the kinds of issues they’re likely to struggle with. Knowing what “people like you” might do in a similar situation isn’t advice, but it is the kind of sense check many of my younger listeners crave.

That sounds to me like a return to the herd mentality of the days when people took “advice” from their high street bank.

- What we need is a presentation of all the possible options and scenarios, not the one chosen by “people like me” (as if one of my providers would know what sort of person I am).

The second big idea is “simplified advice” — giving one-off, low-cost investment advice to consumers with simpler needs and smaller sums to invest.

The pot limit would be £85K and decumulation (much more complicated than accumulation) would be excluded.

That’s great, but (1) it has proven difficult to implement profitably (see for example Vanguard’s failed attempt at advice and (2) won’t help people with more money and more consequential problems.

- The bottom line is that tailored advice from trained humans is expensive, and people won’t pay for it if they think they can get away without it.

Bitcoin

Buttonwood attempted to explain why bitcoin was up almost 150% in 2023.

- He compared the cryptocurrency to a cockroach.

Crypto prices were crushed by higher interest rates in 2022. The industry’s head has been chopped off: Changpeng Zhao and Sam Bankman-Fried now both await sentencing for financial crimes. Regulators are cracking down. Yet not only has crypto survived, it is once again soaring.

That BTC is not worth zero is in part down to possible future utility (a hard currency in dictatorships, payment systems and ledgers) but surely only a small part.

With each boom-and-bust cycle, it becomes clearer crypto is not a bubble like tulip mania in the 1630s or the craze for Beanie Babies in the 1990s. Its price history looks more like a mountain range than a single peak, and appears closely correlated with tech stocks. Yet it is only moderately correlated with the broader market.

That’s something, but why take on the extra risk (both in terms of volatility and the chance of permanent loss) when you can just invest in a Nasdaq ETF?

A third reason is that a bitcoin ETF could be just around the corner.

- This might tap into huge demand from mainstream investors, and could be a rare case where “buy the rumour and sell the news” does not apply.

A final reason (not mentioned by Buttonwood) is that a halving (of rewards for BTC miners) is due in April.

- Previous halvings have led to (admittedly, temporary) bubbles in the BTC price.

AJ Bell

After the FCA announced a platform review of policies around interest on investor cash holdings, AJ Bell increased its interest rates.

- SIPPs now return 3.45% below £10K, 3.75% up to £100K and 4.45% over £100K

ISA rates are around 1.25% lower across the board.

AJ Bell also announced that trading commissions will drop from £9.95 to £5 per trade, from April 2024.

- Investors who trade more than ten times per month will pay just £3.50 (down from £4.95).

This is not competitive with the “free” and low-cost brokers (such as Trading 212, Stake, Lightyear, Degiro and IBKR), but moves AJ Bell onto the second tier, alongside iWeb and X-O.

It’s good news, but I would like to see the annual custody fee of £120 on a SIPP come down.

IHT

The final budget of this “Conservative” government has been announced for March, and already the speculation around what might be included has begun.

- First up is the abolition of IHT or possibly a cut in the rate of IHT from 40% to 20%.

This has triggered a predictable lefty backlash (including in the FT, which is a sign of the times), so it might not happen.

- If it does, it will be bad news for AIM stocks, which enjoy an IHT exemption.

I only hold 1% of my portfolio in AIM these days, but I will probably move it out before March.

Also under consideration are cuts to the 20% tax rate, and an increase to the 40% tax boundary.

- The latter is my favourite of this week’s three options.

Quick Links

I have six for you this week, the first three from The Economist:

- The Economist looked at Ten business trends for 2024, and forecasts for 15 industries

- And listed Metrics to keep an eye on in 2024, from solar cells to superhero movies

- And told us What the “superforecasters” predict for major events in 2024.

- Alpha Architect looked at The Financial Distress Puzzle

- And asked Are stock returns predictable at different points in time?

- And The Irrelevant Investor provided 10 Predictions for 2024.

Until next time.