Weekly Roundup, 17th October 2022

We begin today’s Weekly Roundup with property funds.

Property

One of the consequences of the turmoil in the gilts market (( which also led to the LDI crisis – we will cover this in a separate article )) is that open-ended property funds – run by Schroders, BlackRock and Columbia Threadneedle, and aimed at institutional investors – have gated redemptions after pension funds tried to sell.

- This is the third lock-in of the past six years, after Brexit in 2016 and Covid in 2020.

REITs and listed property companies also sold off in response to higher gilt yields following the mini-Budget.

- But at least REIT investors can sell if they really need to.

Redemptions on closed-end funds can be blocked for up to two years.

The FCA is consulting on whether open-ended property funds are a good idea, but will not decide until the new long-term asset fund (which has a minimum 90-day notice period) has been introduced.

- But for the private investor, there’s no need to wait for the regulator – the moral once again is to only use listed funds when the underlying assets are illiquid.

Another side-effect of higher interest rates on the property market is the impact on buy-to-let (BTL) lending.

- Around half of the 2,000 mortgage products available at the start of September have since been withdrawn.

Even worse, the interest rate used for stress-testing the loans has risen from around 5% pa to more than 8%.

- This is on top of the rental income buffer, usually set at 125% to 150% of the loan interest.

The higher the stress-test rate, the lower the loan-to-value can be set, unless the landlord has the scope to increase rents.

- The impact will be most pronounced in London and the south, where rental yields are lower.

And even those landlords who choose not to borrow more to fund future properties will eventually have to refinance their existing loans.

- So a wave of forced BTL sales is possible.

Redwood

In his regular FT column, John Redwood was worrying about a recession.

- He notes that central banks are determined to “fix” their mistakes of 2021 (when they kept interest rates too low for too long) with an error in the opposite direction – driving rates so high that they trigger a recession.

When asked about this, the Fed replies that tough medicine is needed to cut inflation, their only current priority. Both the Fed and the European Central Bank have clearly signalled their wish to raise rates further, which helped fuel the hectic September sell-off.

As a result, the interest rate on very long-term borrowing is often now lower than the interest rate on shorter-term bonds. This reflects the growing market view that we are heading into a sharp slowdown.

As well as recession, Europe in particular faces energy rationing if the winter is cold, which will further impact industrial production and GDP.

John is not optimistic about markets until we reach the point where the Fed s convinced that inflation is dead and begins to cut rates again.

- But he is looking at bonds:

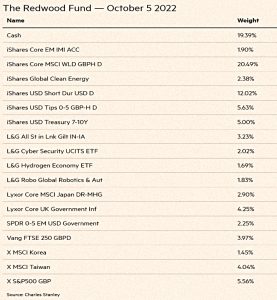

We have had such a sell-off in bonds that I am starting to commit some of the fund’s cash into 10-year Treasuries.

Premium Bonds

From this month, the Premium Bond prize pool has been increased from a nominal (average) rate of 1.4% to 2.2% pa.

- The chances of an individual bond winning a prize in each draw will increase from one in 25K to one in 24K.

Either way, if you have the maximum investment of £50K, you should win an average of two prizes per month.

- Most of these will be the minimum £25, so you can expect to earn £600 over a year (equal to 1.2% pa).

Winnings are tax-free, so this new pot equates to an average interest rate of 3.67% for higher-rate taxpayers.

- And there’s always the remote chance that you might win a significant prize (up to £1M).

The number of £5,000, £10,000, £25,000, £50,000 and £100,000 prizes will almost double, and there will be 19 times as many £50 and £100 prizes.

- The size or number of top prizes hasn’t changed, however.

NS&I CEO Ian Ackerley said:

With over 22 million holders, Premium Bonds are the nation’s favourite savings product and are more popular than ever. It’s great to be able to increase the prize pot and give our customers more chances each month to win tax-free prizes.

This is the second increase to the Premium Bonds prize fund rate that we have made in less than six months. These changes have helped us ensure that Premium Bonds remain attractive, while also ensuring that we continue to balance the interests of savers, taxpayers and the broader financial services sector.

Lightyear

Zero-commission broker Lightyear (set up by a couple of guys from Wise) now has a European investment licence and is planning to launch access to UK and European stocks and ETFs during October.

- I have an account with them, largely because they let you hold your account in dollars (and also in Euros, if you are so inclined), which removes FX charges from the equation when trading US stocks.

Lightyear also has a monthly allowance of £3K which can be converted to dollars for no FX charge.

- This is being removed at the end of the year, so I probably won’t add so much top my account in 2023.

CEO Martin Sokk said:

One of our primary missions has always been to offer the people of Europe a low cost way to build a global portfolio. Rolling out this new range of international and local stocks, alongside ETFs, is a very big step towards that.

We couldn’t be happier to bring our customers even more opportunities to build diversified portfolios on Lightyear, consisting of companies closest to their hearts, that they use in their everyday, as well as fund-based instruments.

There’s no explicit mention of the US ETFs that I would be most interested in, though I will double-check later in the month.

Uphold

It looks like free Bitcoin trading has arrived at last (( I can’t be sure, as I haven’t tested it )) – around a year too late.

- Uphold, a trading platform with 10 million customers globally is supporting free trades in many national currencies.

As it happens, I have an Uphold account, though it doesn’t contain any BTC.

- I use a browser called Brave (amongst others) and I am rewarded each month for sitting through ads with an amount of BAT.

The Basic Attention Token is a token for the digital advertising industry which pays publishers for content and users for attention.

- It’s not the path to riches, however – after this year’s crypto crash, my Uphold account is worth around £80 (though it did approach £250 at the end of 2021).

Uphold is connected to 28 crypto exchanges, which should mean that anyone who does want to trade BTC will get a good price.

CEO Simon McLoughlin said:

We believe that there’s now no better place for people to buy and sell Bitcoin. Because crypto markets remain more inefficient than those for more traditional assets such as equities, the price of Bitcoin can still vary by 10-20 bps between trading venues.

Uphold’s smart-routing technology is able to capitalise on these opportunities for customers. This, combined with a goal of onboarding as many people as possible, made it an obvious choice to remove trading fees for Bitcoin on our service.

We’ll keep coming up with powerful and innovative ways to help our customers and make digital assets more accessible and affordable for everyone.

Uphold also offers 0% commissions on cryptocurrency staking. (( Something else that I haven’t tried ))

Fintech

Regional SME lending startup Bank North has failed to secure £50M of new funding at a valuation of £106M in order to secure a full banking licence, and will instead close.

- The initial Series A raise was for £17M at a £25M valuation in 2021, but the venture funding market is tougher this year.

Chairman Ron Emerson said:

With great regret that I have to inform you that the board of Bank North

has decided to initiate a solvent wind-down of the bank, with immediate effect.

Meanwhile, US insurance unicorn Lemonade is launching into the UK market via a contents insurance partnership with Aviva.

- The firm has already ventured into Germany, the Netherlands and France.

CEO Daniel Schreiber said:

Insurance as we know it hails from the UK, as do I. So both professionally and personally bringing Lemonade to the UK is a homecoming of sorts.

We believe the millions of local renters will appreciate what Lemonade has to offer. After all, who doesn’t want instant, transparent, personalised, and mission-driven insurance?

Energy bills

Although the new PM appears to have ruled out explaining to the public how to save energy, the energy providers have teamed up with National Grid (NG) to incentivise off-peak usage.

- The scheme was announced a day after NG warned that their worst-case scenario for the winter involved rolling three-hour blackouts – most likely in the mornings and/or early evenings for consumers.

NG said:

Since last winter the world has fundamentally changed with the invasion of Ukraine by Russia. In the unlikely event that escalation of the situation in Europe means that insufficient gas supply were to be available in Great Britain this would further erode electricity supply margins potentially leading to supply interruptions to customers for short periods.

The new “demand flexibility service” will run from November to March.

- A smart meter will be required as energy usage will be measured every 30 minutes.

Separately, OVO energy is offering £100 (£20 per month from November to March) to customers who cut their usage between 4pm and 7pm to less than 12.5% of their total usage.

- That doesn’t sound like a big enough incentive to me, and I certainly wouldn’t get a smart meter to take advantage of the national scheme.

Quick Links

I have a bumper thirteen for you this week, the first eight from The Economist:

- The Economist said that Energy shocks can have perverse consequences

- And that Credit-default swaps are an unfairly maligned derivative

- And asked Will Elon Musk-owned Twitter end up as a “deal from hell”?

- And notes that The threat of energy blackouts in Britain forces a rethink on gas storage

- And worried that Europe is growing complacent about its energy crisis

- And explained How to get Asia to net zero

- And said that Middle Eastern countries are sitting on an ocean of natural gas

- And asked Have profits peaked at American businesses?

- Alpha Architect looked at Lottery Demand and the Asset Growth Anomaly

- And asked What is the Story Behind Trend Following?

- Mauldin Economics looked at the Pension Sandpile

- UK Dividend Stocks posted their Portfolio 2022 Q3 Update

- And ERN said that The 4% Rule Works Again!

Until next time.