Weekly Roundup, 19th September 2018

We begin today’s Weekly Roundup in the FT, with James Pickford. He was looking at UK property as an investment.

Contents

UK Property

James Pickford worries that a house price crash could be looming.

- With Brexit looming, Buy-to-Let taxes (including stamp duty) increasing for small operators, and potentially mortgage rates increasing, the market has stalled.

Mark Carney is reported to have said this week that a “no-deal Brexit” (( There’s no such thing, really )) would mean that prices would fall 35% (relative to non-Brexit conditions) in three years.

- That’s quite the claim, but it has as much chance of being correct as any other forecast.

- Affordability remains relatively good as long as interest rates stay low.

The Economist thinks that it wasn’t a forecast, but a reference to an (extreme though not impossible) scenario with the stress testing of banks exposed to mortgages.

It probably wouldn’t lead to first-time buyers snapping up cheaper London homes, given the potential accompanying changes in unemployment, inflation and interest rates.

- Buyers also have to assemble large deposits and pass affordability stress tests up to hypothetical interest rates of 7% pa.

A fall that steep could in fact cause significant damage to the economy, as it would put buyers over the last several years under water.

James reported on a property panel held at last week’s FT Weekend Festival.

- There is still price growth in Manchester and Liverpool, even if London prices are falling.

- Other towns like Glasgow and newcastle are below 2008 prices.

- Transaction levels are flat nationally over four years, but down in London.

- The gap between asking and selling prices is only 2.5% in Manchester and Birmingham, but is stuck at 10% in London.

- “Off-market sales” have become popular in areas where prices have fallen (eg. the Invisible Homes website in Fulham).

- The renovation / flipping trend (inspired by TV shows) may be coming to an end as there are few remaining properties available.

- Brexit will dampen sales until June 2019.

I am worried about price falls myself, but largely in the case of a Corbyn government.

- But as always, with crisis comes opportunity.

I probably have one upwards (more expensive, if not larger) house move left in me.

- If prices fall 35% it might be time to put the plan into action.

Midterm miracle

Ken Fisher was back with more market optimism, this time about the US midterm elections miracle that few investors believe in.

- Apparently Ken told us four years ago about the 87% miracle.

There is an 87% chance of a bump in markets over the three quarters beginning with the midterm year fourth quarter (which starts next month).

The vote is on November 6th, but Ken expects political gridlock afterwards.

- And the markets love gridlock.

The crisis

Merryn focused on the economic pain that the post-crisis cure has stored up.

- At the time, bank bailouts and QE seemed like the right idea, but 12 years from the start of the crisis, (( Dated from the US property peak )) she’s not so sure.

Perhaps a very deep but probably short recession would have been better in the long term.

- There would have been asset price falls, but also new growth.

The “wealth effect” from higher asset prices has failed to drive consumption and recovery as well as was hoped.

- Savers have miserable returns on cash deposits (but then again, holding cash is bad).

- And low interest rates mean that pension pots generate low levels of safe income (from annuities).

Merryn fears that the end result would be the neutering of capitalism, “the greatest poverty destroying system ever”.

- Now that really would be a disaster.

John Authers thinks that a decade is not long enough to judge the implications of the crisis.

- This is a reference to Zhou Enlai’s 1972 comment that it was too soon to assess the implications of the French Revolution of 1789. (( It seems he was really referring to the student uprisings of 1968 ))

John’s imaginary hedge fund Hindsight Capital (which can see the future) bought US stocks the day before Lehman’s collapsed, and has done very well.

- Combining this with a short on energy (down 85%) produces a 1,660% return.

- Netflix is even better (8,700%).

Of course, the first few years of these strategies were difficult, and it would have taken guts to go for them.

- Gold and Treasury bonds would be the safe option.

- They worked well for a while, but are negative after 10 years.

The markets currently have great confidence in the US, and less in the rest of the world.

- But John doubts that a decade of low interest rates can have no severe long-term consequences.

Electoral reform

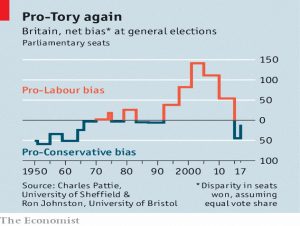

The Economist looked at UK electoral bias, and forthcoming reforms.

There are two key issues:

- Labour voters are clumped together in cities, so can win fewer constituencies with larger majorities.

- Constituency sizes are uneven, and the population drift away from depressed areas means that Labour does well in areas where they are small.

These effects work in opposite directions, so the outcome can go either way.

- The chart shows how this “bias” has varied since the Second World War.

But there’s another point which is also usually left out of similar discussions about the US electoral college system.

- Two years ago, Trump won with a minority of the popular vote.

But equating the vote with victory is only one way of looking at fairness.

There are obvious problems with a lot of people living in a small area running a large country.

- The US system (50 states of wildly varying sizes) is a poor stab at fixing this.

The UK system – 600 constituencies of equal size – is a much better approach.

- The non-perfect correlation with the popular vote masks its true purpose, which is to establish the legitimacy of the government through geographic inclusivity.

Bonkers policies

Labour has announced that it will force companies to hand shares to their workers.

- No figures were given for this partial nationalisation, but a few percent was the consensus view.

This is a bonkers plan, and coupled with Labour’s increased corporation tax, will drive firms from the UK just when we need them (post-Brexit).

Over in the States, Bernie Sanders can out-McDonnell McDonnell:

- He’s introduced the “Stop Bad Employers by Zeroing Out Subsidies” or Stop BEZOS bill.

This would force firms to to fund the welfare benefits enjoyed by their workers.

- It’s basically a head tax, and would destroy low-skill jobs, particularly for single parents.

Back to the UK, where the Liberals announced that – were they ever to be elected to power again – they would replace inheritance tax with a gift tax.

- Not a bad idea, apart from the lifetime exemption of only £125K.

- Anything above that would be taxed as income on the recipient.

Capital gains and dividends would also be brought into the income tax system, and tax-free lump sum on pensions would be capped (at £40K!).

The proceeds would go to a sovereign wealth fund that would “invest in public services” and “fund lifelong learning”.

Annuities

For some reason, Hargreaves Lansdown has been suggesting that now is a good time to buy an annuity.

DB pension ratios

A pensions “expert” has suggested that the government might up the multiplier used to translate a DB pension into the LTA assessment.

- It’s currently 20 times the annual payment but he suggests 30 or 40 times would be better.

From our favourite SWR of 3.25% pa, 31 sounds about right to me.

It’s not about fairness, of course, it’s about raising more tax “to save the NHS”.

- Much better to scrap the LTA entirely, if you ask me.

Care enrolment

Having enjoyed a decent level of success with auto-enrolment for workplace pensions, there are reports that the government is considering a similar approach to social care funding.

- The idea is that you would pay each year into a fund (like NICs) to pay for any social care you might eventually need.

Not a bad idea for the long-term, but it leaves us with the next 50 years to get through somehow.

Care ISAs (an IHT-free savings pot) and Care Pensions (drawdown plus insurance) are also being considered.

Quick links

I have nine for you this week:

- The Economist looked at how tech firms are disrupting the US property market.

- Flirting with Models provided a primer on trend following in equities.

- Dual Momentum looked at the perils of data mining.

- He also looked at the reopening of the IPO pipeline.

- Merryn did the same in the FT, with a focus on new trusts.

- The Adventurous Investor wondered whether HgCapital was still a core holding.

- A Wealth of Common Sense asked whether software was eating value investing.

- The UK Value Investor gave beginners a 5-step guide to dividend investing, and

- Musing on Markets looked at the Trillion Dollar Companies.

Until next time.