Weekly Roundup, 20th June 2022

We begin today’s Weekly Roundup with the Fed’s policy mistake.

Fed Policy Mistake

On Pragmatic Capital, Cullen Roche said that the Fed policy mistake that he warned about has now been made.

- He said way back in May 2021 that the Fed should be raising rates.

I think that rates should have started to rise once we had a Covid vaccine, way back in November 2020.

Cullen says that the Fed is now way behind the curve:

Upward pressure on inflation forced the Fed’s hand to play “catch up” with the risk of overtightening. They had to save face to maintain “credibility” and moved very aggressively, too aggressively, but now they’ve risked exacerbating the slowdown in the other direction.

Cullen is worried:

This feels very similar to early summer of 2008 in that energy prices are surging, the underlying economy is softening and the Fed is focused on inflation when deflation is becoming a legitimate risk.

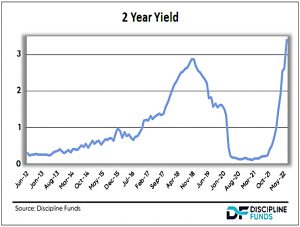

He thinks that inflation has peaked and that the implied path of the Fed Funds Rate (FFR) from the 2-year yield is very sharp (close to 3.5% at the time of writing):

And this sharp rise has occurred when markets are high.

Equity markets and bond markets have adjusted, but the housing market is much, much slower to adjust and much more important. And adjust it must. The math here is very, very ugly.

The median monthly mortgage payment in the US has increased from £1K to 1.8K over the last nine months.

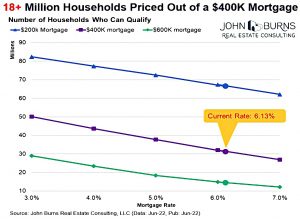

When we look at a $400K mortgage the change in rates from 2.5% to 6.3% reduces the qualifier pool from 50 million households to 30 million households. That’s a 40% decline.

Cullen worries about VC funding and high yield bond issuance and (the lack of) new business formation.

We are still very, very early in this slowdown. These credit market adjustments will takes quarters and perhaps even years to fully play out.

Cullen doesn’t know how bad things will get, but he is not happy:

When the history books are written about the Fed rate management period of 2020-2023 they will question the validity of relying on discretionary interest rate policy in such a haphazard manner. The Fed statement is projecting higher unemployment, slowing GDP, more aggressive near-term rate hikes and….RATE CUTS in 2024.

I used to joke that the Fed would raise rates to cause a recession that they can save us from with lower rates, but now they just outright tell us that’s their plan.

I’ll have more reactions to the Fed decision next week.

Income

In the FT, Merryn Somerset Webb looked at income investments.

- I’ve never understood income (dividend) investing – if you need some cash to spend, you can just sell some of your portfolio.

The good news for those of us looking for income is that there is still plenty of it about. A new report from Stifel points to 25 equity investment trusts in the UK with a current yield of more than 4 per cent. Most have a good long-term record of delivering dividend growth and substantial dividend reserves.

Merryn picked out five trusts:

- City of London (paying 4.5 per cent)

- Merchants (4.8 per cent)

- JPM Claverhouse (4.3 per cent)

- Lowland (4.8 per cent) and

- Murray International (4.2 per cent)

But she had a warning:

Many of these trusts now trade on premiums to their NAV.

Cut your losses?

In a second article, Merryn suggested that staying invested through a bear market beats cutting your losses.

- She quotes work by Liz Ann Sonders at Schwab comparing bear markets with and without a recession.

The average market fall in the no-recession group has been 28 per cent and in 34 per cent with recession — but the recessionary bear markets lasted on average twice as long as the non-recessionary.

But what about cutting your losses?

If you had stuck with stocks after the first 25 per cent fall in markets in 1970, 1974, 2001 and 2008 you would have been even after somewhere between 2 and 4.8 years. If you had dashed for cash after a 25 per cent fall instead, that number rises very substantially — to 5.3 after the crash of 1974, and to very big indeed post-2001, as you are still under water.

It’s not clear when the “dash for cash” investor gets back into the market, or how they decide when the time is right.

Merryn also notes that while we have templates for stock price crashes, we don’t have them for crypto – and the popular descriptions of bitcoin don’t stack up at present.

- It isn’t a store of value — bitcoin is 70 per cent off its highs and down 25 per cent in the last five days alone.

- It isn’t an inflation hedge — it would be up 10 per cent this year if it were.

- It isn’t uncorrelated to interest rates.

- It doesn’t provide a hedge to equity markets.

- It isn’t better at shifting money around the place than conventional methods.

- It isn’t environmentally friendly and, crucially, it isn’t easy to use

PensionBee

In FT Adviser, Sonia Rach reported on the waves PensionBee has created in the pension industry.

- PensionBee has offered customers an option to waive checking for extra benefits (and exit fees) on pensions being transferred into the platform.

The offer comes in an email which reads:

With some providers, some older pensions may have exit fees or special benefits, such as guaranteed annuity rates and protected tax free cash. In general, these occur in less than 2 per cent of pensions and exit fees for over 55s are capped at 1 per cent of the pension value.

We give customers the option to waive checking for exit fees and valuable benefits. This means that we won’t check with your provider on either of these things, which can also help to speed things up.

Not surprisingly, IFAs aren’t happy.

Capital Asset Management CEO Alan Smith said:

The waiver form sent to clients is borderline unethical, and certainly poor practice that no regulated adviser could get away with. There are some extremely valuable benefits built into some older pension plans and clients will lose them on transferring their funds – they can be quite complex to understand and therefore many people could do it unknowingly.

PensionBee should refer any complex transfers to independent, regulated advice professionals.

Well, he would say that, wouldn’t he?

James Bogle from Co-Navigate went further:

I find it astonishing that the regulator would allow this. We go to great lengths to ensure a client isn’t missing out on valuable guarantees or being penalised for transferring a pension. This information is often hidden away and not easy to spot unless you know what you’re looking for.

A client might well be comfortable forgoing those guarantees or paying a transfer penalty in the end, but how can you know unless you have an informed conversation with them? To be able to offer speed as a benefit to the client is dangerous and irresponsible.

PensionBee CEO Romi Savova countered:

At PensionBee we take people’s pensions very seriously. Our default approach is to check old pensions for exit fees and special benefits prior to transfer, however, we have had feedback from customers that they have already done these and do not wish for us to check.

Therefore, for low risk pension providers where our customer has provided the policy number and therefore has had the ability to check for exit fees or special benefits themselves, we allow the customer to opt out of our checking process.

So there’s a context issue here.

- Savova said that the email text would be changed to make it clear to who the offer was available.

ESG

FT Adviser reported on a survey from My Pension Expert which has revealed that few people over 40 think about ESG when it comes to their pension.

- 1,003 people over 40 with pensions were surveyed and only 43% knew what ESG meant

Only 9% had included ESG within their investment strategy and only 7% had discussed ESG with a financial advisor.

That said, there was wider support for Government pressure on the topic.

- 45% wanted pension schemes to make ESG information more accessible (( Even though some of these people didn’t understand what the term meant ))

- 43% supported Government pressure towards divestment from investments driving deforestation

- 36% supported policies to force pension schemes to mitigate for climate change

Andrew Megson, executive chairman of My Pension Expert, said:

British enthusiasm for ESG-based retirement strategies, and government policies, is evident. But without the right information, it will be impossible for Britons to make informed investment choices that support their personal ethics.

It is vital that pension providers, schemes and investments make their ESG information available to the public – and this will likely only be achieved with the appropriate reporting guidance and effective education from regulatory bodies, as well as the government itself.

Which isn’t quite backed up by the data.

VCT takeover

Downing has sold its VCT business to Foresight for £18.7M.

- Most people won’t care, but it made me check my diversification across VCT providers.

I have 39 VCTs across 19 groups, averaging 5.3% per provider.

- Downing is at number 8, with 6.3%

- Foresight is at number 9, with 5.2%

The combined entity will have 11.5% of my portfolio, putting it at number two (behind Octopus at 16.2%).

- So I should probably hold off on buying more from them this tax year.

Quick Links

I have five for you this week, the first three from The Economist:

- The Economist said that the structure of the world’s supply chains is changing

- And that Amazon has a rest-of-the-world problem

- And noted that the grandchildren of China’s pre-revolutionary elite are unusually rich.

- Alpha Architect looked at Relative Sentiment and Machine Learning for Tactical Asset Allocation

- And Mauldin Economics said that things will get gradually worse.

Until next time.