Irregular Roundup, 2nd April 2024

We begin today’s Irregular Roundup with inflation.

Inflation

The Economist said that America can’t escape inflation worries.

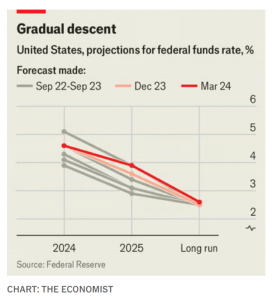

- The Fed has been able to freeze rates for eight months now, but the last part of the quest to return inflation to 2% pa is proving difficult.

The central bank is sticking to its projection of three cuts in 2024, but at the latest meeting in March, the projection for 2025 was reduced from four cuts to three.

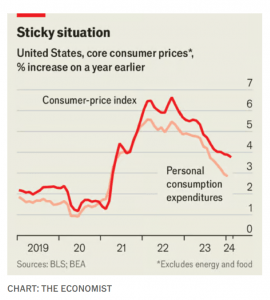

Core inflation is proving particularly sticky.

In both January and February it rose at a monthly clip of roughly 0.4%, a rate which, if sustained for a full year, would lead to annual inflation of about 5%—far too high for comfort for the Fed.

If this persisted, the next rate change might be a raise rather than a cut.

The Fed prefers the Personal Consumption Expenditures (PCE) number, which comes out a couple of weeks later than CPI.

The CPI is more rigid, with its components adjusted annually; the PCEis in effect adjusted every month, reflecting, for example, whether consumers substitute cheaper apples for dearer oranges.

Housing is a third of CPI but only 15% of PCE.

- PCE is still trending down nicely.

If this continues, and unemployment remains low, we can expect to eventually hit a neutral rate of interest which is currently calculated to be 0.6% above inflation (so 2.6%).

NHS Support

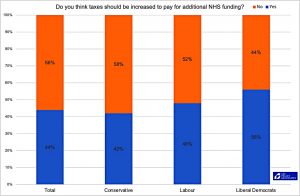

The always interesting Dan Neidle from Tax Policy Associates wrote about public attitudes to paying more tax in order to provide more funding to the NHS.

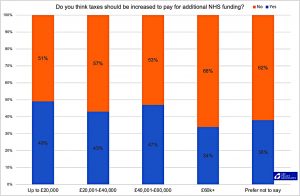

- He found that a majority was against paying more tax, and few of those in favour were willing to pay more than an extra £100 pa.

Against a backdrop of a peacetime high tax burden, this might not seem surprising, but you wouldn’t come to this conclusion from listening to the mainstream media.

- Each winter, we hear that the NHS is in crisis and that more money is the solution.

But the majority of people (56%) don’t agree.

- Women are even more opposed, at 60%.

- Wales is the most opposed region, at 68%.

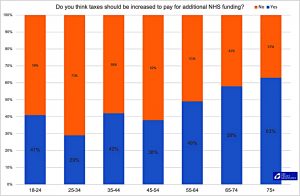

The age breakdown is less surprising, with older people (who can be expected to use the NHS more, and who on average will pay less income tax) more willing to add more NHS funding from taxation.

Nor is it a shock that higher earners (above £60K pa) are less willing to pay more tax.

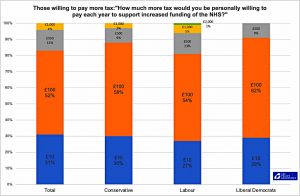

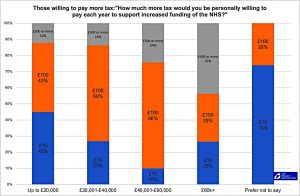

More than 80% of those who want to raise taxes are willing to pay more tax personally, but not very much.

- 83% would like to pay £100 pa or less, and only 4% are willing to pay more than £1,000 pa.

Income did make a difference, with 43% of those earning more than £60K pa willing to pay £500 pa or more.

- But even within that income bracket, it’s still a minority.

Age, region and educational level didn’t make much difference.

Dan is a lefty, so he’s not over the moon about the results:

This is a political problem for those of us who wish to see significantly expanded public services, because every country in the world which spends more than the UK on public services (as a % of GDP) taxes the average worker more than the UK.

This might explain why, despite widespread unhappiness with the state of the NHS, politicians are so unwilling to raise taxes significantly.

A second post from Dan looked at a proposal I hadn’t noticed – the Lib Dems are proposing a 4% tax on share buybacks.

- Of course, the likelihood of the Lib Dems holding power after the election is even lower than that of the Tories winning again, but Dan points out that the tax would raise much less than the £2bn that the Lib Dems claim, and that it might raise almost nothing.

Dan regularly looks at left-wing tax proposals and bemoans their naivety.

The US has had a 1% tax on buybacks since 2022.

- Around 50% of the US market is held by US retail investors and foreign investors, both of whom gain from a buyback relative to a dividend (which is taxed more highly).

We can make a rough estimate that paying profit out as a buyback rather than a dividend means a reduction in overall US tax paid of somewhere between 4% and 14% of the amount of the buyback.

Since the new tax is lower than this benefit the level of buybacks hasn’t been significantly impacted.

- A tax of 4% or higher would be expected to have more of an impact.

It is probably not a coincidence that President Biden is now proposing to increase the tax to 4% (although this has little chance of becoming law in the current US political environment).

The dynamics here in the UK are a little different.

- UK retail investors hold just 4% of the market via GIAs – another 7% is held in ISAs but dividends are not taxed there

- Almost 60% of the market is held by foreign investors, who are not taxed on dividends or capital gains

- Just 1.4% of the market is held by UK companies – buybacks are worse for them as dividends are not taxed.

We can make a rough estimate that paying profit out as a buyback rather than a dividend means a reduction in overall UK tax paid of less than 1% of the amount paid out. Whilst tax is often cited as a driver of US buybacks, it is not usually cited by market observers as the reason for UK buybacks.

So how much would the proposed tax raise?

The Lib Dems say their 4% tax would raise £2bn annually. All they’ve done is multiply 4% by the approximately £50bn volume of buybacks in 2022 and 2023.

But of course, corporate behaviour would change.

The Lib Dem tax is at least four times greater than the tax benefits of buybacks. A 4% buyback tax will simply result in companies switching from buybacks to dividends.

And 95% of investors receive no tax benefit at all from buybacks, but would bear the cost of the 4% buyback tax – I expect there would be significant shareholder pressure to drop buybacks entirely.

So the tax would probably raise nothing.

Dumb money

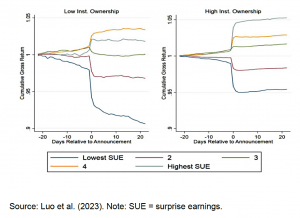

Joachim Klement wrote about the role of dumb money (retail investors) in the post-earnings announcement drift phenomenon.

Retail investors tend to trade on noise and may trade against fundamental information, creating systematic market mispricing and opportunities for‘smarter’ investors.

A new study presents evidence that retail investors act as short-term contrarian investors for momentum and earnings surprises, reducing the efficiency of markets in incorporating news.

Companies with positive earnings surprises tend to drift higher in price for months, especially when they are already close to their 52-week highs.

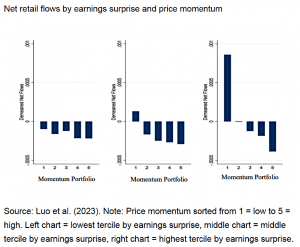

The study looked at the net retail flows relative to the previous quarter’s average in and out of stocks and split them between stocks with high and low earnings surprises as well as high and low price momentum.

The bigger the earnings surprise, the more retail investors prefer to buy stocks with low momentum (and sell stocks with high momentum).

They are hoping that the positive surprise indicates areversal of fortunes for the [low momentum] company and they sell on good news forstocks that have gone up in price a lot.

[So] shares with large earnings surprises and weak price momentum underreact to negative earnings surprises but overreact to positive earnings surprises. Shares with strong price momentum underreact to positive earnings surprises and overreact to negative earning ssurprises.

Which is the opposite of what should happen.

The effect is strongest in shares with low institutional ownership.

The stocks with the lowest earnings surprise and high institutional ownership show no negative post-earnings announcement drift.

Elections

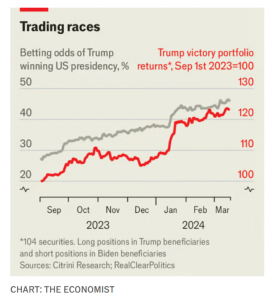

Buttonwood said that it is becoming harder for investors to ignore politics.

- He notes the popularity of green energy and cannabis stocks in 2020 as the odds of a Biden victory increased.

Exchange-traded funds covering the sectors rallied by over 100% from two months before the election to Mr Biden’s inauguration, before later dropping as investors scaled back their optimism.

So what about 2024?

Mr Trump has vowed to end Europe’s freeriding on America’s defence budget; Mr Biden is unlikely to renew tax cuts from Mr Trump’s first term that expire in 2025. Mr Trump would gut Mr Biden’s Inflation Reduction Act (ira), redirecting green spending to fossil fuels. Mr Biden sees Mexico as somewhere to “friendshore”; Mr Trump sees it as a bogeyman.

Baskets of stocks that would prosper under Trump are available on betting markets.

- Based on past experience, you might not need them.

Politics rarely affected overall stockmarket returns, sovereign bonds or currencies. There is no clear relationship between the outcome [of past American presidential elections] and subsequent overall stockmarket performance.

But things are becoming less predictable:

[What if] Mr Trump carries out his threat to replace Jerome Powell, the Federal Reserve chairman. Would bond yields fall on expectations of looser monetary policy, or rise as a Ms-Truss-style “moron risk premium” became baked in? The answer is far from obvious.

Very even-handed reporting from The Economist as usual.

Quick Links

I have nine for you this week:

- AQR looked at Cognitive Dissonance

- A Wealth of Common Sense wrote about The Most Important Concept in Finance

- And asked Are We Living in The Roaring 20s?

- Barry Ritholtz asked What if Everything is Narrative Fallacy?

- Morningstar explained Where International Diversification Works—And Where It Falls Short

- Behavioural Investment said that Everything is Obvious

- The FT was on the hunt for good-value UK stocks

- And concluded that UK stocks are not all that cheap

- And UK Dividend Stocks asked Should you diversify your portfolio by industry or sector?

Until next time.

NHS support findings seem to chime with the general mood of the country as I perceive it: everybody wants more [apparently free] stuff but are not willing to pay for it! IMO, this has almost certainly been reinforced by furlough etc whereby “the government” (whatever people mean by that) paid loads of folks 80% of their pay to sit at home and twiddle their thumbs! This mood is possibly the real sickness!

People have always wanted something for nothing, but Covid (and then the gas price crisis) convinced them that the government now also believes in bailing people out regardless of the consequences.