Weekly Roundup, 1st October 2022

We begin today’s Weekly Roundup with the energy crisis.

Dunkirk moment

In FT Adviser, Simoney Kyriakou reported on a joint statement from Ros Altmann and Frank Field warning that the energy crisis is a Dunkirk moment, (( Apparently this is a crisis situation that requires a desperate last effort – or a retreat – to avoid certain failure )) and that “tax tinkering” (the media dig at Truss’ supposed plans) won’t do.

Field was minister for welfare reform under Tony Blair and was chairman of the work and pensions select committee for four years until 2019. Altmann succeeded Steve Webb as pensions minister in 2015 under David Cameron.

It’s unfortunate that the Tory leadership election – triggered by a morals issue unrelated to economic management – has tied the government’s hands in terms of responding to the energy crisis.

- The delay has allowed the media to whip up a frenzy when a response was always in the works, but there we are.

The statement said:

Government action on energy crisis must recognise this is a Dunkirk moment – patching up won’t do, radical action is vital. Any new package must recognise two factors.

The first is direct action to reduce energy costs is superior to handouts as it also lowers CPI, RPI and wage inflation with wide economic benefits.

Second, privatisation has failed and radical reform of energy pricing throughout the economy is needed. Consumers who are being forced to pay well over the cost of production and also for collapsed energy suppliers through soaring costs and higher standing charges.

Not such a bipartisan view then, if we have to re-nationalise after forty years.

- I agree that reducing energy costs (to the consumer, and perhaps to some businesses – it will take a long time to reduce the cost of the underlying product) is better than a handout.

But it seems to me that the chosen regulatory framework – with a common price paid to all producers, and dozens of tiny suppliers incentivised to lock into long-term arrangements beyond their control – is what has failed.

They added:

We are concerned that indiscriminately doling out more taxpayer money will not help all those in need. We recommend action to reduce price rises directly.

This could entail freezing costs this winter or capping the increase at 5 per cent, which means six to nine months of subsidies rather than billions of pounds in handouts to households.

It also means ensuring super-normal profits of non-gas energy suppliers can benefit consumers, not shareholders.

More anti-capitalist rhetoric. When exactly are shareholders allowed to benefit?

Active managers

In the FT, Blue Whale fund manager Stephen Yiu argued that most active fund managers should quit, since they fail to deliver returns for UK retail investors.

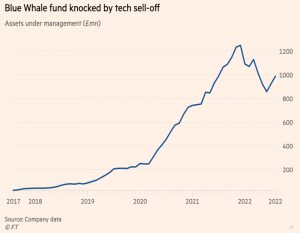

- Blue Whale was funded by Peter Hargreaves of HL fame (who seeded the firm with £25M and now has £150M invested) and reached a peak value of £1.2 bn at the start of this year.

Yiu was previously a fund manager for larger companies including Artemis and Hargreaves Lansdown. He said:

What I would like to see is lots of people in passive, lots of high conviction managers and get rid of everything in between. I think that would be very healthy.

He argues that most funds don’t devote enough manpower to stock-picking, and end up as closet trackers.

There is a lot of career risk if you don’t have enough resources. You’re really betting your career on the back of 25 stocks, and it can go wrong.

Private investors should instead seek out funds with high active share (deviation from the index).

- That’s hard to argue with, but it’s not a guarantee of outperformance.

Fund managers have styles, and sometimes these styles are in favour, and sometimes they are not.

- Blue Whale itself was hit this year when its tech favourites crashed.

The only way to benefit is to structure a balanced portfolio of active managers to complement your passive funds, and potentially reduce volatility.

- Top-down asset allocation is the key.

There’s also the danger of the start fund manager (like Woodford, and now Train and Smith – and Yiu himself), which Yiu acknowledges:

It’s too simplistic to say: ‘He’s a genius. I’ll give him all my money and I have nothing to worry about for 20 years’,” he said. “It’s not just about star manager culture. It’s about blind belief.

King Dollar

Shaun Richards of NotAYesMansEconomics looked at the impact of King Dollar (dollar strength).

- The Yen has moved through 140 and the Euro is below parity; meanwhile, the £ stands at $1.15.

- The Fed’s trade-weighted index has risen from 113.8 a year ago to 123.2 today.

One big issue is that commodities are priced in dollars, and so the rest of us (with weaker currencies) pay more for them.

The other is that emerging markets often issue debt in dollars when the world begins to lose faith in the local currency. The St Louis Fed noted last year:

Dollar-denominated debt makes up around 17% of total government debt in select Latin American economies, which far outstrips the 3% in select Asian economies. Moreover, for some countries, such as Colombia and Argentina, the share of dollar-denominated debt is even higher: over 30% of government debt in Colombia and 55% of government debt in Argentina.

Israel, Indonesia and Saudi Arabia also have more than 10% of debt in dollars, and Hong Kong is getting closer to this figure.

- Turkey also has a lot of foreign debt, and its currency has tanked on the bizarre interest rate cuts intended to fight inflation.

On the other hand, Saudi has easy access to dollars because of the energy crisis.

The Fed has also modelled the impact of (10%) dollar appreciation on US GDP:

The direct effects on GDP through net exports are large, with GDP falling over 1-1/2 percent below baseline after three years. Moreover, the effects materialize quite gradually, with over half of the adverse effects on GDP occurring at a horizon of more than a year.

Shaun says we’ve seen 80% of this move already.

Another consequence worth noting is that other central banks tend to follow the relatively hawkish US Fed in raising interest rates, to protect their own currencies.

Canada responded with a 1% [raise, and] the ECB [is] now hinting at an 0.75% increase next week.

HL Fees

In the Investors Chronicle, Dave Baxter had a couple of articles about Hargreaves Lansdown fees.

- The first revealed a secret deal for lower fees with a client who threatened to quit.

The investor had £390K in a SIPP, and he initiated a transfer out.

- When he said that he was switching to Interactive Investor because of their lower fees, he was offered a “customer service check-in call”.

A follow-up email defended the HL discounts on selected funds, plus the (£200 pa) cap on share charges, but it also offered a deal:

We appreciate your loyalty over the years and whilst it is not our standard approach to have individual arrangements – with over 1.7mn clients this would simply be unworkable – in light of your comments, and having reviewed your accounts, I would like to offer you the following special arrangement.

Instead of the standard tiered fund charge (starting at 0.45 per cent) we’ll apply a flat percentage fee of just 0.25 per cent on all managed funds (Oeics/unit trusts) up to the value of £1mn and no charge thereafter.

That’s a decent discount but still, a massive fee – £975 pa for the investor concerned, and a general cap of £2,500 pa if this deal were to be available to the rest of us.

- Which is 12.5 times the cap for shares and ETFs.

He was also asked not to share the deal (a request he obviously didn’t comply with):

As the circumstances of your friends and extended family will differ from your own, we do request that you not share the details of your offer with other people so that we can avoid causing disappointment.

The request for secrecy seems to have had a Streisand effect: the second article shared (unfavourable) reader reactions to it:

I can’t tell you how incensed I am about this secret deal. Knowing now that they do deals with some customers makes me feel that I have been unfairly treated. I guess that as investors we need to vote with our feet.

There’s also the issue of whether offering special deals to certain customers will fly with the FCA, whose Treating Customers Fairly regime says:

All firms must be able to show consistently that fair treatment of customers is at the heart of their business model. Where firms charge different prices to separate groups of consumers, they must consider whether the price charged for the product/service provides fair value for customers in each pricing group.

I guess HL could argue that portfolio size and client loyalty (years with the firm) are relevant factors.

The FCA said:

We are unable to comment on individual firms, but we do expect platforms to treat all of their customers fairly. Our new Consumer Duty will go further by requiring all firms to put their customers’ needs first and ensure their products and services offer fair value.

Despite its high fees, HL has a high client retention rate (92% in the year to June 22).

I recommend AJ Bell for SIPPs (£120 pa) and iWeb and X-O for ISAs (both free).

- And use shares and ETFs rather than OEICs, unless you have a small portfolio.

Wealthfront

UBS has decided not to go through with its purchase of US robo-advisor, which was announced in January.

- Wealthfront has 470K clients and $27 bn in AUM and was to be bought for $1.4 bn.

UBS has now scaled back its investment by 95%, to a $70M loan which is convertible into Wealthfront shares at the original $1.4 bn valuation.

- So Wealthfront will continue as an independent company and expect to be cash-flow positive and EBITDA profitable within a few months.

Comments from both sides were very bland and give little clue as to why the bank has changed its mind.

Quick Links

I have seven for you today, the first three from The Economist:

- The Economist wondered whether the warehouse business is recession-proof?

- And explained why Wall Street is snapping up family homes

- And said that the $300bn Google-Meta advertising duopoly is under attack.

- Alpha Architect asked whether the Stock Market ha Systematically Changed?

- And looked into High-Frequency Consumer Spending Data and the Cross-Section of Stock Returns.

- Net Interest explained how to Harness the Power of Insurance

- And David Stephenson said that as bears swamp tech the time is ripe to think about moonshot bets.

Until next time.