Weekly Roundup, 20th September 2022

We begin today’s Weekly Roundup with inflation.

Inflation

The Economist reported that central bankers are worried that a new era of high inflation is beginning.

- Policymakers at the recent Jackson Hole summit were concerned that the forces which have kept inflation low and stable in recent decades are weakening and in some cases reversing.

Low inflation since the 1980s is partly down to better monetary policy, but also due to benign conditions.

- And now things are changing.

Across rich and emerging economies, public-debt loads have soared over the past two decades. As debt burdens rise, markets may begin to fear that central banks will eventually have to help finance governments’ obligations, say by creating new money to buy bonds. That could erode central-bank credibility and raise the public’s expectations of future inflation.

Governments are also more open to using stimulus, as we saw during the pandemic (and might see again during this winter’s energy crisis).

- This also sets market expectations of more spending and more inflation.

A presentation at the conference suggested that 4% of US inflation came from the 2021 stimulus package (worth $1.9 trn).

There are also demographic issues, with ageing populations and fewer workers.

- This could lead to wage growth, which fuels inflation.

We also have the return of tariffs and a retreat from globalisation and trade, which will hit productivity and production flexibility (again leading to price shocks instead).

On the plus side, ageing populations could save more, which would dampen inflation.

- And some changes driven by the pandemic might boost productivity.

Even central banks’ awareness that they have to sort inflation – and that it will be hard to do for a while – could help.

Pension linking

In the FT, Jane Croft reported on the government’s victory over pension funds challenging the replacement of RPI with CPIH (which is typically lower) in pension indexation from 2030.

Trustees of the BT, Ford and Marks and Spencer pension schemes had brought a judicial review claim against the government. The pension funds, which together represent nearly 450,000 members and £83bn in assets, had argued that [the change] failed to properly take into account the impact on millions of pensioners.

Most of the 10.5M DB pensions in the UK are linked to RPI, including my own.

CPIH uses a geometric mean to aggregate price changes as opposed to the arithmetic mean used in the RPI.

- I prefer geometric means, too, but they are lower than arithmetic ones – in July 2022, RPI was 12.3%, while CPIH was 8.8%.

Mr Justice David Holgate said:

Parliament did not find it necessary to confer or spell out an express power to change the RPI. Given the history and nature of the RPI as an index measuring consumer price inflation, it is obviously implicit in the duty . . . to compile and maintain that index that the UKSA [the UK Statistics Authority] is able to change it.

He also noted that the UKSA did not have to weigh up who were the winners and losers under any change, but rather they should safeguard the quality of official statistics.

Ian Diamond, UKSA CEO, said:

At a time of rising prices, it has never been more important to have accurate and trusted measures of inflation. We have been clear for a number of years that the Retail Prices Index is a very poor measure of inflation, at times greatly overestimating and at other times underestimating changes in consumer prices.

The ruling will also impact long-dated index-linked bonds, with the government saving an estimated £100 bn in interest payments.

- The impact on pensions is calculated to be between 4% and 9% of lifetime benefits.

Technical analysis

Buttonwood looked at technical analysis, or as he called it, “the astrology of finance“.

He’s not a fan:

These methods, though patently mad, have attracted attention lately because of how the S&P 500 has wiggled around. After slumping to a low of 3,637 on June 17th, on August 16th it peaked at an intraday high of around 4,325, a whisker away from its 200-day moving average.

Breaking through the 200-MA would have been a positive sign, but it didn’t and since then stocks have fallen back by 8%.

Buttonwood accepts that mainstream investors (eg. AQR) use technical factors like momentum.

And round numbers have some significance.

Clients tend to place orders near round numbers and derivatives tend to be sold with round “strike prices”. That means it will take a lot more activity for the euro to fall from $1.0001 to $0.9999 than for it to fall from $1.0487 to $1.0485.

And technical levels can be self-fulfilling:

When placing orders [and stop-losses] investors try to figure out where others are placing theirs. If enough investors look at technical levels to inform their behaviour, then they begin to matter.

His true scorn is reserved for more extreme tools, like “Fibonacci retracement levels” and the “Ichimoku cloud”.

He also thinks that the popularity of technical analysis tells you something about the state of the markets:

No one bothers with the chartists’ pretty drawings when the economy is good, profits are high and stocks are moving smoothly higher—nor, indeed, in the depths of a frantic bear market, when prices will plunge through any and all levels technical analysts are wont to draw.

Which leaves the middling markets.

Investors who are uneasy about the direction of the markets will reach for the easy reassurance of an eye-catching diagram. The more regularly chartist analysis lands in [my] inbox, the clearer it is that no one has any clue as to why the markets are moving.

House prices

In the FT, Merryn Somerset Webb predicted a UK house price plunge, but it hasn’t started yet:

The latest house price index from Nationwide came out this week and showed prices up 10 per cent on August last year — and £50,000 on average over the past two years. Other indices show something similar.

Volumes are also up, though the stamp duty holiday has some impact here.

Merryn thinks it can’t last because demand will disappear because of the cost of living crisis.

One of the best ways to look at it is in terms of its income tax equivalent: the coming rise is [was] equivalent to adding 9p to the basic rate of income tax.

The job market is strong at the moment, but a recession could change that, and pay rises may not keep up with inflation.

- In addition, mortgage rates are going up as interest rates are hiked to combat inflation.

Zoopla has done the numbers on mortgage rates at 4 per cent. The average first-time buyer outside London will need £12,250 more in income to be able to complete than they did last year. In London it’s £35,000.

Citi forecasts a 15% price fall and Merryn thinks this is conservative.

- I’m not so sure – demand may crash, but only those who are forced to sell will accept 20% less than they could have got a few months earlier.

It will be a different story in real terms, of course – a couple of years of high inflation could bring real prices down by 15%+.

Over in MoneyWeek (ironically edited by Merryn), Ruper Hargreaves argued that the picture is more complicated.

- National rises are above 10% over the last year, but in London, the rise is just 4% (negative after inflation) and has been concentrated in the outer boroughs.

Some inner boroughs have seen property prices decline by as much as 9% (Tower Hamlets).

There’s also variation across property types.

According to UK land registry data, flat prices in London declined 11% between August 2020 and April of this year. In comparison, house prices increased nearly 20%.

I track the Land Registry data at the borough level, but I must admit that I don’t drill down to the level of property types.

- Perhaps I should since the outperformance of houses would improve my returns.

Rupert says that interest rates and the cost of the monthly mortgage repayment are much more important than house prices.

- The rocketing energy price cap might also focus the attention of buyers on the running costs of larger properties.

Stamp duty also works against larger/more expensive houses.

So newer, more energy-efficient properties might be expected to benefit.

- Lower running costs support higher mortgage payments which mean higher prices.

The parts of the market that seem most susceptible to a correction are those that have been so popular in recent years. Buyers fought each other to get hold of larger homes outside cities in 2020 and 2021.

And lots of their two-year fixed mortgages will be up for renewal in the next year.

The holiday home market has also exploded over the past couple of years with demand for properties in coastal regions for outstripping supply. With holidaymakers now returning to international destinations, the demand for staycations may have peaked.

Like Rupert says, the housing market is complicated.

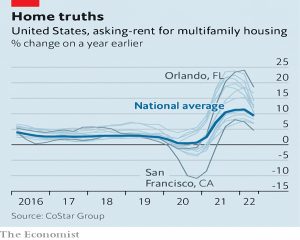

Rent controls

The Economist reported on attempts by American cities to bring in rent controls.

In June lawmakers in South Portland, Maine, voted to limit annual rent increases to 10%. In July Kingston, some 100 miles (160km) north of Manhattan, became the first city in upstate New York to adopt rent controls. On August 1st lawmakers in Pomona, California, voted to cap rent increases at 4%.

Unfortunately, rent controls are a bad idea.

When rents are set artificially low, builders and owners have less incentive to invest in new properties, and greater incentive to convert existing ones to pricey condominiums. This reduces the supply of rental housing and pushes up rents for properties that are not subject to controls. Rent control also tends to benefit rich tenants more than poor ones.

A new study looked at rent controls in St Paul, Minnesota.

The ordinance, which was caused property values in the city to fall by 6-7%. What is more, though the law was intended to help lower-income renters, the benefits went mainly to the rich.

Quick Links

I have just four for you this week:

- Alpha Architect looked at The Short-Duration Equity Premium

- And at How Momentum performed after previous valuations Peaks.

- UK Dividend Stocks asked whether 4imprint is a Good Choice for Dividend Investors

- And OSAM explained Why Fundamentals Matter.

Until next time.