Irregular Roundup, 4th September 2023

We begin today’s Weekly Roundup with CGT.

Wealth tax

In the Investors’ Chronicle, Bearbull considered the possibility that CGT has become a wealth tax in all but name.

While CGT is a minor tax – in 2022-23 it raised £18bn,or barely more than 2 per cent of the total tax take – its receipts are growing fast. Ten years ago, they were just £4bn and the Office for Budget Responsibility, reckons CGT will raise £26bn in 2027-28.

The government clearly sees it as a nice little earner, having halved the annual allowance from £12.3K to £6K for the current tax year and £3K from next year.

- We also now have high inflation, which means that a lot of gains are phantom, to begin with.

We also used to have indexation (from 1982 to 1998):

The gain on the sale of a qualifying asset was calculated by linking its cost to inflation during the period it was owned. Buy a shareholding for £10,000 in January 1990 and sell it for £15,000 in January 1995 and the profit, rather than being £5,000, was £2,800 to take account of the 22 per cent uplift in retail prices during that period.

The restrictions mean that more “ordinary” people (usually taken to mean basic rate taxpayers) are being caught.

- In 202/32, basic rate payers were 37% of the total caught in the net (though they only paid 4% of the total CGT collected).

When Gordon Brown removed indexation, he said it was necessary because of the low-inflation environment (3.5% at the time).

- He replaced it with a taper based on the holding period for the asset, punishing active traders.

But ten years later, he scrapped the taper (though he did cut the CGT rate from a taxpayer’s marginal income tax rate to a flat 18%.

- It’s now 20%, and 28% for residential property (other than a primary residence).

BearBull tests the current system against a “rational” CGT, as featured in Tax By Design, a 2011 review of the UK tax system from economics Nobel Prize winner Sire James Mirrlees.

- The report predates this blog and I’m grateful to BearBull for bringing it to my attention – I plan to review it in more detail in a future post.

Tax by Design presumed that tax must be levied only on real profit. So all capital invested would receive a notional risk-free rate of return, which, in effect, was the reward for choosing to save rather than to spend.

Tax losses would be created if actual returns were less than the risk-free amount. Post-allowance profit wouldthen be taxed at an investor’s marginal tax rate.

Using marginal rates removes the incentive to convert income to capital or vice versa.

- The downside of indexation to the notional risk-free rate would be onerous record-keeping (which CGT demands anyway, at least for investing and trading accounts).

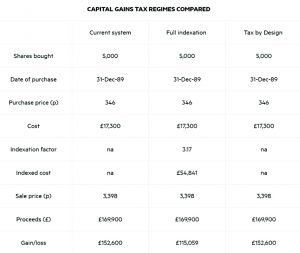

BearBull uses a theoretical trade to illustrate the three systems:

A purchase of 5,000 shares in drinks distributor Diageo (DGE) at the end of 1989, when the price was 346p, and a sale just now at £33.98.

One snag with this analysis is that BearBull has to estimate the Tax by Design indexation:

The amount shown is the product of the holding’s average value and income being generated at 3 per cent interest, roughly the average interest rate on 10-year UK government bonds over the relevant period.

That sounds fair enough.

The detail of how risk-free returns are calculated matters greatly since the risk-free component comprises a big part of an investment’s total return; in this particular case, well over half the £118,000 generated.

Of course, which indexation method proves to be better will depend on whether inflation is higher than the risk-free rate. But as BearBull points out:

The risk-free rate should include both the time value of money as well as inflation.

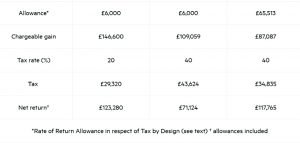

Ironically, the best result for the investor comes from the current CGT system, since the tax rate is 20% rather than an assumed marginal rate of 40%.

- This will be true for many (most?) investors but leaves some scope for tax-planning.

This worries BearBull:

If indexation both produces the best tax yield for governments and is sorely missed by investors in these high-inflation times, then why wouldn’t the government seek to restore it?

Fund manager performance

In the FT, Moira O’Niell warned against fund manager claims of top performance.

- New research from Asset Risk Consultants (ARC) looked at 350K investor portfolios from 140 investment managers and found that 94% of managers could claim top-quartile performance by carefully selecting their criteria for that claim.

ARC looked at four of the most common time periods: one, three, five and 10 years [to June 30 2023]. It found that 40 per cent of the data contributors could rightly say they delivered top-quartile performance over one of these time periods.

A second trick is to vary the reporting periods by a few months to exclude problematic/volatile periods (such as the Covid crash in 1H20).

if managers can vary the end date on their one-, three-, five- and 10-year figures,between either June 2023 or December 2022, 57 per cent of managers can claim top-quartile performance.

Another trick is to select the best-performing portfolio from within a wide range of portfolios:

Most investment managers are investing lots of portfolios for different types of clients with varying risk profiles, investment mandates, approaches to portfolio construction and differences in holdings.

ARC says by selecting a particular investment solution to showcase performance rather than the average outcome, a majority of discretionary managers can present results that show them to be top-quartile performers.

Moira suggests that investors ask what proportion of the firm’s clients are using the portfolio that is being presented.

Investing for immortals

Joachim Klement looked at how an immortal should invest.

- He started with the principle also used by Nassim Taleb, that things that have already lasted a long time will continue to survive – Joachim calls this the Copernican principle.

You are much less likely to encounter something at the beginning of your life or at the end of your life than somewhere in the middle. You are not special in the sense that right now, right here, you witness the beginning of a new era (say cryptocurrencies) or the end of an era (say the end of economic progress and the beginning of a no growth world).

Joachim’s first idea is to bet on things that exploit behavioural biases in humans – these are unlikely to be eliminated.

- He chooses value and momentum as the most robust strategies.

I think momentum is going to work because people will always be greedy. And value is going to work because when assets have been dropping in value alot, most people will be fearful of these assets.

As far as assets go, he wants to bet on technological progress and human creativity.

The simplest (and in my view best) way to do that is to invest in businesses. Hence, I do want to invest inlisted equity and private equity.

He also wants to invest in something that is liquid and safe and can be used as a medium of exchange.

The longest existing forms of ‘money’ are gold and cash issued by governments.So, I want to hold a diversified collection of gold and a variety of cash in different currencies. I will simply make no forecast on any specific form of money and hold each in equal measure.

And that’s it.

Some investments would not be part of my portfolio: bonds,real estate, hedge funds, art, crypto, etc. I don’t know if they will still be around in a couple of hundred or thousand years.

Now to allocation:

Because I cannot predict which one is going to perform betteror worse, I would put the same amount of money in each of these three buckets [listed equity, private equity,and ‘cash’].

Within equities, I would probably split it 50/50 into a value and a momentum portfolio and within each of these portfolios, I would hold equal amounts in each stock. Within private equity, I would invest in as many different businesses as I can and put the same amount of money in each.

Though of limited practical application (since we are all unfortunately mortal) this all seems reasonable to me.

UK prospects

UK inflation to the end of July fell to 6.8% from 7.9% in June, the lowest figure for a year.

- RPI fell from 10.7% to 9%.

But Core CPI (excluding energy, food, alcohol and tobacco) was unchanged at 6.9% and is now higher than headline CPI.

- This means that another rate hike in September is very likely, and a 0.5% raise rather than the standard 0.25% is possible.

Making that even more likely, the UK also saw wage growth of 7.8%, also above headline CPI.

- Strong wage growth means that inflation is more likely to be persistent.

The third UK number of the month – retail sales – was better, with sales volumes down by 1.2% in July (after a rise of 0.6%) in June.

- Food sales fell by 2.6% while non-food sales fell by 1.7%.

This was bigger than the expected fall of 0.5%, but the fly in the ointment was that unusually wet weather was probably the explanation, reducing footfall and sales of summer clothing.

- Online sales rose by 2.8%.

PayPal

After last week’s report that Revolut was pulling out of crypto in the US, PayPal has “paused” the ability to buy crypto in the UK.

- You can keep existing crypto on the platform (at no charge) and sales are still possible.

PayPal says that it expects to re-enable purchases in early 2024.

- The firm says that the suspension results from new FCA rules that require crypto firms to implement “additional steps before customers can buy crypto”.

Quick Links

I have five for you this week, the first three from The Economist:

- The Economist warned that High bond yields imperil America’s financial stability

- And said that Amazon has Hollywood’s worst shows but its best business mode

- And described how A blunder costs a British town billions

- Discipline Funds said The Labor Market is Not Tight

- And wrote about Jackson Hole – The Future of Inflation and Interest Rates.

Until next time