Irregular Roundup, 4th March 2024

We begin today’s Irregular Roundup with 99% mortgages.

Budget Watch

The pre-budget speculation is ramping up, and the latest nutty wheeze is the government underwriting 99 per cent mortgages for first-time buyers.

PM Rishi Sunak said in a recent interview:

[I] understand people’s anger when that dream [of home ownership] feels too far away for too many, especially the younger generation.

I’m not sure the news scheme would help for long since easier access to lending should quickly inflate house prices.

- A 1% stake in your home also ratchets up your risk of negative equity in even the slightest downturn.

The details of the scheme have yet to be revealed, but lenders are likely to require a premium interest rate for such a low deposit (or perhaps the government will underwrite that, too).

With UK house prices now averaging £285K, first-time buyers would need to save only a £3K deposit to get on the ladder (assuming they can afford to borrow the rest of the asking price).

A second tool in the war on low house prices is a mooted increase in the upper limit for purchases using a lifetime ISA.

- The current limit of £450K is obviously restrictive in London and the South East, but I’m not sure the proposed new limit of £500K would help much.

The LISA exit penalty also appears to be under review, with a cut from 25% to 20% on the cards.

- This would match the penalty to the bonus on the way in, effectively meaning there is no penalty for early withdrawal.

Japan

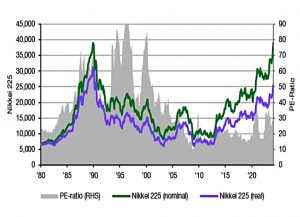

Amongst many others, Joachim Klement reported that the Nikkei 225 has finally recovered its losses from the bursting of the 1989 bubble.

- The maximum drawdown was 79%, but 34 years after the last peak, we have a new one.

Only in nominal terms, of course – we’re still down close to 18% if you take inflation into account.

The gains are dampened for international investors by the yen’s weakness.

- And the S&P 500 is now thirteen times higher than it was in 1989,

All in on stocks

The Economist weighed into the ongoing debate around whether you should hold 100% of your portfolio in stocks.

Aizhan Anarkulova, Scott Cederburg and Michael O’Doherty make the case for a portfolio of 100% equities, an approach that flies in the face of longstanding mainstream advice, which suggests a mixture of stocks and bonds is best.

Why stop at 100%?

- As we’ve discussed previously, some academics argue in favour of leveraging your stock investments.

Ian Ayres and Barry Nalebuff have noted that young people stand to gain the most from the long-run compounding effect of capital growth, but have the least to invest. Thus, youngsters should borrow in order to buy stocks, before deleveraging and diversifying later in life.

The opposition is led by Cliff Asness of quant shop AQR, who argues in favour of a risk parity (RP) approach:

He agrees that a portfolio of stocks has a higher expected return than one of stocks and bonds. But he argues that it might not have a higher return based on risk taken. For investors able to use leverage, Mr Asness argues it is better to choose a portfolio with the best balance of risk and reward, and then to borrow to invest in more of it.

Using leverage allows you to choose between the returns from all stocks but with lower risk (volatility) or the same risk as all stocks, but leading to higher returns.

Even for those who cannot easily borrow, a 100% equity allocation might not offer the best return based on how much risk investors want to take.

I agree with Cliff, but the practical problem for most private investors will be access to cheap borrowing.

The Economist points out that the real issue is that we don’t have enough data to be sure.

- The reliable track record for markets only stretches back to the late nineteenth century.

Less than a hundred and fifty years is not much use when we need to make decisions around an investing career of perhaps 50 years or more.

To address this problem, most investigations use rolling periods that overlap with one another in order to create hundreds or thousands of data points. But because they overlap, the data are not statistically independent, reducing their value if employed for forecasts.

Recent decades – of falling interest rates and increasing market concentration since the 2008 crisis – make sticking to an RP portfolio that doesn’t keep up with the S&P 500 difficult.

- But the real danger would be switching to 100% stocks (or 100% S&P 500, or even worse, 100% Mag 7) just as the outperformance comes to an end.

Diversification is simple, but not easy.

- If there’s nothing in your portfolio that you hate holding, then you aren’t diversified enough.

Gilts Direct

The Debt Management Office (DMO, part of the Treasury) has decided to open gilt auctions (which set the price for new issues) to the public, rather than just institutions.

- PIs will have six days to register their interest, and the first offer closed last week on a 7-year 4% bond maturing in October 2031.

Gilts market maker Winterflood Securities is behind the new scheme and Hargreaves Lansdown (HL) and Interactive Investors (II) are the two platforms that have signed up so far.

- Applying for a new issue means no transaction charges, though custody charges apply within SIPPs and ISAs (and there would be a transaction charge to sell).

Since gilts are exempt from CGT, many investors hold them in a GIA.

- There has been a surge in interest in directly holding bonds since interest rates (and therefore bond yields) increased over the last couple of years.

HL lists 57 gilt issues on its platform and reports a 315% increase in trading volumes over the past year – 25K investors now directly hold a gilt with HL.

- The DMO also has to refinance a lot of debt in the coming years (£277bn in 2024-25), though I’m not convinced that the UK public will take up the slack.

Lots of other countries (including the US, Italy, Belgium and Portugal) already sell bonds directly to the public.

Hargreaves Tim Jacobs said:

This is a first for retail investors and gives them fair access to gilts in the primary market under favourable terms. We think there will be significant demand. Muted equity markets and higher interest rates have led to a significant rise in client demand for fixed interest products.

The conventional auction process for Gilts is designed for institutions and may not be suitable for someretail investors. However, the new process invites retail investors to participate with favourable terms. It’s another example of retail investors being taken seriously — they are finally getting a seat at the table.

John Dobson of Interactive Investor said:

By providing early access, investors get in at the average price and do not have to worry about secondary market movements and the spread on buying and selling.

Andrew Stancliffe of Winterflood said:

We think this is the best way to provide an institutional level of access to a retail investor.

Downsizing

For the Time, Johanna Noble looked at why pensioners aren’t downsizing, and came up with four reasons.

- Why should they?

Pensioners are not commodities: their sole purpose is not to make room for families and live on meagre budgets so that they can leave an inheritance.

- People are attached to their properties.

When you have spent years in a property, it’s not just a house but your home. It’s where you saw your children take their first steps, where you got so used to jumping over that creaky floorboard on the landing that you do it without thinking. It’s where you had the best and the worst times of your life.

- It’s expensive. Stamp duty is a factor here, especially in London and the South, but there are also estate agent and conveyancing fees – why pay a five- or six-figure bill that you don’t have to?

- There are few suitable properties to move to.

Many want to stay in the area where they have friends and family. And not everyone wants to move to a retirement flat (which often comes with its own problems, including high service charges). The perfect solution for many would be a two-bedroom bungalow, but these are scarce.

I agree with all of these points to an extent.

- When you have a place, you won’t swap it for somewhere worse (unless you are in a financial fix), so all of these 2-bed hutches they build these days are not the answer – what works for people on their way up the ladder won’t suit those on the way down.

- Stamp duty is an obstacle, but an exception for downsizers might be politically difficult. And how are we defining downsizing? What if I want to move to a smaller place in a more expensive (nicer) area?

The real problem is that those in favour of getting old people out of big houses would like the elderly to use fewer resources (in this case, principally space).

- But the kinds of places they would like to move to are likely to be more “wasteful” than the properties currently being built.

A lot of old people are rich, and they would like to see nicer places to move to.

Quick Links

I have seven for you this week, the first three from The Economist:

- The Economist asked Are passive funds to blame for market mania?

- And said that Activist investing is no longer the preserve of hedge-fund sharks

- And explained How businesses are actually using generative AI

- Ray Dalio asked Are We in a Stock Market Bubble?

- Of Dollars And Data made The Case For and Against Dividend ETFs

- A Wealth of Common Sense asked What If You Invested at the Peak Right Before the 2008 Crisis

- And HL reported that Apple is cancelling its plans to build an electric car

Until next time.