Irregular Roundup, 30th October 2023

We begin today’s Weekly Roundup with US exceptionalism.

US exceptionalism

The fifteenth anniversary of Lehman’s collapse passed in September, a fact noted at the time by John Authers in his newsletter.

Since then, growth has been sluggish and returns low.

- With one exception.

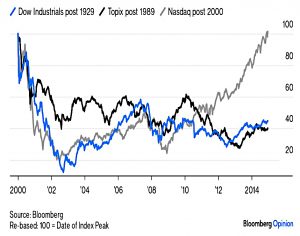

The Nasdaq has (eventually) recovered much better than indices after previous crashes.

Outside the US, we’ve had the traditional reaction to a crash – sideways markets.

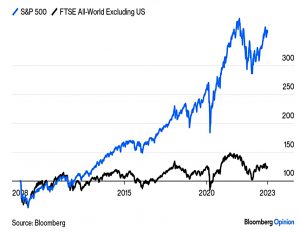

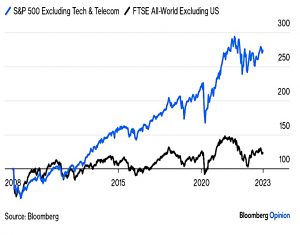

US outperformance can be observed even if we exclude Tech.

What exactly is going on here? Before anyone says “QE”, note that Japan and the eurozone have resorted to even more aggressively loose monetary policy for much of the post-Lehman era.

It’s also not about any great superiority in American economic growth. US growth has tended to lag the world as a whole in the years since Lehman.

Valuations are part of the story.

Exclude financials, and the US trades at 22.5 times this year’s earnings; the figure for Europe is 15.2. Exclude tech, and the US trades at 18.5 compared to 12.5 for Europe.

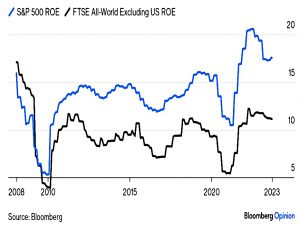

But the key driver is profitability.

US companies have comfortably increased the returns they make each year on their equity; companies in the rest of the world have seen their profitability decline.

This is partly due to an increase in capital’s share of earnings, and possibly also because of some monopoly rents in the US.

Monevator also looked at this topic.

Non-US markets – and in particular UK shares – look relatively far cheaper. Call me stubborn, but I cannot see this continuing forever.

The US CAPE is much higher.

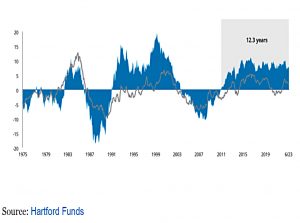

The US has been ahead for the past 12 years and is due a spell in the doldrums.

Perhaps we’re moving to some dystopia from the mind of Philip K. Dick where half a dozen $10 trillion companies rule the world? More likely the US market is out over its skis.

It’s hard to say, but the US has a lot riding on the promise of AI.

Dr Copper

Buttonwood said it’s time to retire Dr Copper – the idea that the metal’s price tells us what is happening in the global economy.

A surge in copper prices is taken as an early sign of an economic upswing; a big drop is a portent of recession, or at the very least a manufacturing downturn.

So what is the current prognosis?

Manufacturing looks peaky. Global industrial output is up by just 0.5% year on year, well below the average of 2.6% over the past two decades, and the rich world is in an industrial recession.

The last time this happened (in 2015), copper fell by 25%, but this year the price is only down by 6% (and 2026 futures are up).

China is half the market for copper, and though investment in property (a key driver of copper demand) is down 9%, copper demand is up 10%.

- That’s because China is installing a lot of solar panels and pumped-storage hydropower.

The energy transition will double the global demand for copper by 2035.

Sky-high copper prices will no longer be indicative of optimism on the part of industrial machinery-makers, construction firms, electronics manufacturers and the like.

Copper has a political driver instead, and it’s a drive for replacement, not for additional capacity.

The result may well be good for the planet, but it will not have much effect on aggregate economic activity.

So the price of copper will largely indicate the progress of the energy transition.

Investors wanting a hint about the state of the global economy will be replaced by policymakers wanting a sense of how their green policies are faring.

GDP bonds

In the Investor’s Chronicle, Hermione Taylor wondered whether GDP bonds might fix our debt problem.

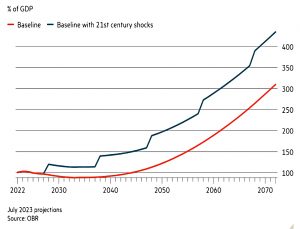

The UK’s debt-to-GDP ratio has breached 100 per cent, and the Office for Budget Responsibility (OBR) warns that it could reach 300 per cent of gross domestic product (GDP) by the 2070s.

The pandemic and the energy price rises have added 15% of GDP to the debt pile in the last three years.

Could GDP bonds help?

GDP-linked bonds tie debt repayments to an economy’s wellbeing. Just as the coupon on an index-linked gilt moves with inflation (in the UK, at least), the coupon on such a bond can be adjusted depending on a country’s GDP.

This might not be a good thing – the inflation component of index-linked gilts is responsible for £4 bn of the £7.7 bn the government paid in bond interest in July.

- In contrast, GDP bonds would reduce the risk of default by becoming cheaper to service during a recession.

If they were available internationally (rather than just in the country whose GDP we all already have a massive stake in), they might be attractive to investors, allowing for another dimension of diversification.

In 2015, Angel Ubide, then a senior fellow at the Peterson Institute for International Economics, pointed out that “growth risk is exotic, difficult to price and hedge properly (no financial instrument has a high correlation to real growth)”.

He makes that sound like a bad thing, but I welcome instruments with low correlations to existing products.

Argentina issued GDP-linked gilts in 2005, as did Greece in 2012 and Ukraine in 2012. Investors demanded a premium for holding the debt, even once default and liquidity risk was taken into account.

But Argentina, Greece and Ukraine wouldn’t be at the top of my shopping list for GDP growth, so I would describe these as “the wrong kind of GDP bonds”.

Another potential problem is that GDP bonds incentivise governments to pursue low-growth, or even to put pressure on statisticians to under-report.

- I can’t see this being a major issue in developed economies.

Data revisions are also an issue, so some kind of trailing average might be needed in practice.

- Despite all these minor snags, I think they would be an interesting addition to the bonds already available.

Tax relief reviews

The government has decided against taking up the recommendation from the Treasury Committee that regular reviews of all existing tax reliefs would be a good idea.

- The committee had found that only 365 out of 1,180 active tax reliefs have been officially costed by HMRC.

Financial secretary to the treasury, Victoria Atkins said:

A full review of all tax reliefs would impose significant uncertainty on the tax system, putting revenue at risk and altering business behaviour whilst they waited for such a review to conclude. Any regular time-based assessment of whether reliefs should continue to exist creates inherent instability and uncertainty in the latter years of that cycle for all taxpayers claiming or considering claiming a relief.

I am of the view that ongoing activity already delivers the majority of the committee’s desired outcomes and that going further in the manner suggested would not always be the best use of resource and also have unintended consequences – whether that be the time of officials or the costs to external organisations and taxpayers.

Treasury committee chairwoman Harriet Baldwin said:

Our tax system is too complicated. It is disheartening to learn that the taxman has no plans to even measure the cost of benefit of hundreds of different tax reliefs – something that would help ministers simplify the tax system and target growth.

I think the government decision is good news on balance, but with the very real prospect of a Labour government in the next fifteen months, it might not mean much in the medium term.

Crypto

The FCA’s new rules on the marketing of crypto assets came into force earlier this month, and 146 alerts were issued on the first day of the new regime.

- Firms promoting crypto now need to be authorised or to have their marketing authorised in advance.

The FCA said:

We expect businesses including social media platforms, app stores, search engines, domain name registrars and payment firms to consider the alerts we have issued and play their part in protecting UK consumers from illegal promotions.

Consumers should check the warning list before making any investment in crypto. The list will help consumers understand where firms’ promotions may be breaking the law and to consider the promotion with the full information available.

This list will be continually updated as we identify firms which may be illegally communicating crypto asset promotions and are failing to engage with us constructively.

We also continue to remind people that purchasing crypto assets remains high-risk and that they should be prepared to lose all their money.

SJP

Very expensive and serially underperforming wealth adviser St James Place is scrapping exit fees on “investment bonds and pensions” for new clients.

- I’ve never read any of their documentation or been to one of their plush induction seminars, but I gather that their ISA and OEIC businesses don’t use exit fees.

They have also agreed to split out their charges into initial and ongoing advice, investment management, and product administration.

- That still sounds like a lot of charges to me.

CEO Andrew Croft said:

The changes announced today are about positioning our business for continued success by putting in place a future charging structure that reflects the evolution of consumer engagement with retail financial services and is aligned to the long-term value that we deliver to clients through the partnership.

We have always been confident that SJP offers its clients real value that helps individuals

and families achieve financial well-being.

Well, he would say that, wouldn’t he?

- The share price recovered on the announcement, after a previous fall on speculation that fees were about to be cut – but it’s still down 36% this year.

Induraty reaction was less positive, with observers questioning why the changes don’t come into effect until 2H25.

Mark Polson of the Lang Cat said:

This is bizarre and seems to me to be against both the letter and spirit of the new consumer duty rules – if something isn’t right it should be fixed for both new and existing clients, and as quickly as possible.

I feel sorry for investors who need expensive hand-holding from people like SJP.

- DIY is the way to go, and it’s never been easier.

Quick Links

I have four for you this week, the first two from The Economist:

- The Economist said Welcome to the age of the hermit consume

- And explained How healthcare costs stopped rising.

- Alpha Architect looked at Executives vs. Chatbots in Earnings Conference Q&as

- And Discipline Funds presented their Chart of the Week: Booming GDP?

Until next time.