Warren Buffett’s Annual Letters – 2023

As part of our series on Warren Buffett’s Annual Letters, we look at the letter for 2023, which was released over the weekend.

Contents

Warren Buffett’s Annual Letters – 2023

We’ve previously looked at Warren Buffett’s letters that cover:

2022, 2021, 2020, 2019, 2018, 2017, 2016, 2015, 2014, 2013, 2012, 2011, 2010, 2009 and 2008.

Today we’ll examine the 2023 letter, which was published last week.

Charlie

The letter is prefixed with a tribute to Warren’s long-time partner Charlie Munger, who died in November 2002, just a few weeks before his 100th birthday.

Great buildings are linked to their architect while those who had poured the concrete or installed the windows are soon forgotten. Berkshire has become a great company. Though I have long been in charge of the construction crew; Charlie should forever be credited with being the architect.

Munger convinced Buffett to change his investing style.

Forget about ever buying another company like Berkshire. Add to it wonderful businesses purchased at fair prices and give up buying fair businesses at wonderful prices.

And he was modest with it:

Charlie never sought to take credit for his role as creator but instead let metake the bows and receive the accolades. In a way his relationship with me was part olderbrother, part loving father. Even when he knew he was right, he gave me the reins, andwhen I blundered he never—never—reminded me of my mistake.

Warren notes that BRK now has three million shareholders.

- He uses his sister Bertie as the kind of owner that BRK seeks.

Bertie is smart, wise and likes to challenge my thinking. Bertie, and her three daughters as well, have a large portion of their savings in Berkshire shares. Their ownership spans decades, and every year Bertie will read what I have to say. My job is to anticipate her questions and give her honest answers.

As you would imagine, Warren likes to flatter his shareholders:

Bertie understands many accounting terms. She follows business news but doesn’t consider herself an economic expert. Bertie understands the power of incentives, the weaknesses of humans. She knows who is “selling” and who can be trusted. In short, she is nobody’s fool.

Performance

Warren points out that official earnings show a loss because of unrealised capital losses.

- BRK prefers its own “operating earnings” which are $37 bn for 2023.

Warren notes that BRK is now close to 6% of the S&P 500, which means that they are now too big to double every five years.

Size did us in, though increased competition for purchases was also a factor. For a while,we had an abundance of candidates to evaluate. If I missed one — and I missed plenty — anotheralways came along. Those days are long behind us.

He still expects to do “slightly better” than the US market.

And, more important, [BRK] should alsooperate with materially less risk of permanent loss of capital.

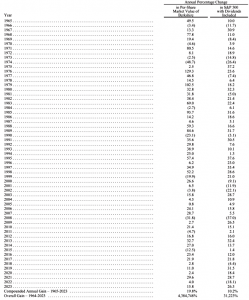

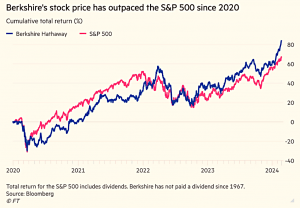

Over the 59 years to 2023, BRK has compounded its share price by 19.8% pa.

- During the same period, the S&P 500 has compounded at 10.2% pa (dividends included).

Total gains are 4.3M% for BRK and 31.2K% for the S&P – more than a hundredfold difference.

- In 2023, BRK was up 16% whilst the S&P went up by 26%.

The stock market

Warren did his usual cheerleading for the US stock market:

I can’t remember a period since March 11, 1942 – the date of my first stock purchase – that

I have not had a majority of my net worth in equities, U.S.-based equities. And so far, so

good.The Dow Jones Industrial Average fell below 100 on that fateful day. Now that index hovers around 38,000. America has been a terrific country for investors. All they have needed to do is sit quietly, listening to no one.

And was reassuring about market panics:

Though the stock market is massively larger than it was in our early years, today’s active participants are neither more emotionally stable nor better taught than when I was in school. For whatever reasons, markets now exhibit far more casino-like behavior than they did when I was young. The casino now resides in many homes and daily tempts the occupants.

Markets can – and will – unpredictably seize up or even vanish. Such instant panics won’t happen often – but they will happen. Berkshire’s ability to immediately respond to market seizures with both huge sums and certainty of performance may offer us an occasional large-scale opportunity.

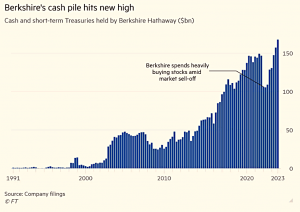

Cash

The lack of attractively priced deals means that the BRK cash pile continues to grow.

- It now stands at $168 bn, up $39 bn in 2023.

There remain only a handful of companies in this country capable of truly moving the

needle at Berkshire, and they have been endlessly picked over by us and by others. Some we can value; some we can’t. Outside the U.S., there are essentially no candidates that are meaningful options for capital deployment at Berkshire.

BRK does not issue dividends, but it bought back $9 bn of shares in 2023.

But it also sold $24 bn of publicly traded stocks.

At least the cash is earning some interest these days.

Conclusions

It’s a fairly short and quiet letter again this year

- Warren once again resisted the temptation to reduce BRK’s massive cash pile by paying a dividend.

- And there was no timetable for a handover to vice chairman Greg Abel.

Maybe things will be different next year.

- Until next time.