Irregular Roundup, 6th November 2023

We begin today’s Weekly Roundup with discount rates.

Discount Rates

Steve Russell of Ruffer said that discount rates no longer apply to tech stocks.

The relationship between bond yields and equity markets is normally a simple (and rational) one. As interest rates rise (particularly real rates), the discounted value of future profits drops, and so equity valuations tend to fall.

In the case of the Nasdaq leaders, this hasn’t been happening this year.

As real interest rates fell during and immediately after the pandemic, the valuation ascribed to technology stocks rose, driving strong returns. Last year as central banks moved to combat inflation, real interest rates rose and the valuation on the Nasdaq fell sharply.

But in 2023, bond yields have risen, and the sectors that should be vulnerable (tech) have thrived.

- High hopes for AI are part of the explanation, but we need to remember the dot com boom.

The internet did change the world, and some tech stocks grew massively – but it took another decade to happen.

- Most firms went bust, and even the winners had a bumpy ride, often losing 90% of their value at times.

Maybe the same thing will happen again – Steve thinks so:

We believe a significant downward repricing of equities is required as markets adjust to a world where cash rates of 5% are a viable alternative to investing in risk assets.

Ruffer has “significant protections” against a stock market crash.

Taking a cautious view can sometimes be painful. But history tells us that the risks emerge, leading to significant drawdowns in markets.

Buy British

In the FT, Lex reported on a UBS paper which said that investing in Britain is a good idea.

City declinism has been inspired by comparing British apples with American pears.

Before the 2016 Brexit referendum [the UK market]t traded in line with the global average at about 15 times forward earnings.

The UK now trades at 10, a discount of 20% against the world ex-US, and 40% against global stocks.

- The UBS report from James Arnold’s strategic team, says that the comparison is unfair.

His team paired 60 big UK blue-chips with US peers they judged to be closest in type. Pairs included caterers Compass and Aramark, and engineers Renishaw and Nvent.

British stocks were either in line with US peers or higher in two-fifths of the cases. A big chunk of discount evaporated simply through the exclusion of a handful of US tech giants, such as Meta and Amazon.

The remaining slim structural discount is due to higher US returns on capital, from a larger domestic market and lower taxes.

One useful takeaway is that investing in indices is not the same as investing in the economy of the country.

Some home bias can also be defended on the grounds of eliminating FX risk, lower trading costs and greater knowledge of local companies and their prospects.

Arnold believes an inflection point is near. Only a slim sliver of UK defined benefit pension money is still invested in UK stocks. Defined contributions and other alternative retirement savings should now start mounting up.

Which would help with valuations.

Investment trusts

In Investors Chronicle, Ales Newman wrote that George Soros called the investment trust bust long ago.

- The average investment trust discount to NAV is now 14%, which suggests that the sector is a buy.

This explains why trust buybacks are booming. But discounts are also an obstacle to growth because they hinder a trust’s ability to issue fresh equity at satisfactory prices.

This hits REITS particularly badly.

For years, closed-end property funds were able to sell new shares in line with (and sometimes at a premium to) NAV, thereby providing a ready and cost-effective alternative to debt financing. This allowed asset portfolios to grow without diluting existing shareholders or overleveraging the balance sheet.

Now issuing shares would force NAV to come closer to the market price – and the alternative of debt is much more expensive.

So long as investors doubt a fund can liquidate its assets at their audited value, or think asset values will decline, then a discount persists.

George Soros spotted this flaw in 1970 when REITs first became popular in the US.

Soros noted that the larger the premium to NAV, the easier it became for the trust to fulfil the expectation of higher earnings per share. All it had to do was issue new shares at the premium price, plough the capital back into high-yielding assets, and ride the wave higher.

This made pricing future earnings difficult:

The price that investors are willing to pay for the shares is an important factor in determining the future course of earnings.

Alex uses the self-storage firm Big Yellow (BYG) as an example.

- BYG returned 25% pa in the 10 years to end 2021.

The final leg of that rally, which followed a £100mn share sale at a 45 per cent premium to NAV in June of that year, culminated in a 70 per cent premium to NAV. Today, the stock changes hands for £9.29, a 25 per cent discount.

He is negative about the prospects for REITs:

Not only do interest rates need to come down and rental income prospects improve, but share prices need to get back towards NAV.

VCTs

VCTs have been in the news a lot in recent weeks.

- A group of 20 VC firms with £25 bn of AUM (including Octopus, the largest VCT manager) have signed a VC Investment Compact (VCIC) with the objective of getting pension funds to invest in their offerings (as requested by Chancellor Jeremy Hunt.

Just 0.5 per cent of defined contribution pension assets are invested in unlisted UK equities such as venture capital and growth equity.

Michael Moore, CEO of the British Private Equity and Venture Capital Association, said:

Many overseas investors have jumped at the chance to invest in – and benefit from – the performance of innovative UK firms. UK savers must have access to the same opportunity.

The VCIC builds on Hunt’s Mansion House speech in July. Hunt said:

This compact is a huge win – demonstrating that our world-renowned Venture Capital firms stand ready to help our pension providers allocate funding to our high growth companies. This could boost British pension pots to the tune of £1k.

Per pot, presumably – but over no disclosed timescale.

On Sifted, Amy O’Brien wrote that VCTs are proving resilient in the downturn.

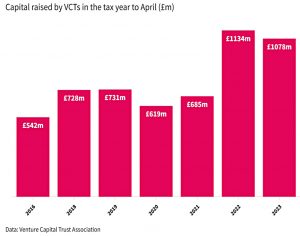

- VCT fundraising is only down by 4% in 2023 compared to a 50% fall for the venture sector as a whole.

Will Fraser Allen, Chair of the Venture Capital Trust Association and managing partner of Albion Capital said:

Our retail investors tend to invest with us for a long time as the tax incentive becomes very attractive over the long term. This means we have a very stable investor base that looks through the noise of individual years.

We’re very comfortable having a longer hold period than perhaps some LP-backed VCs might have, which means we can support companies through multiple rounds of funding.

William Horlick, head of VCT at Molten said:

As long as the economy is growing and people are generating wealth, then there’s always going to be the tax breaks — so it’s got a different cycle to it. There aren’t many places where you can get a yield and the chance of capital gain.

Despite this good performance, VCTs represent only 5% of the UK venture sector.

In a letter to the Treasury Committee, Treasury ministers have indicated that the life of VCTs (and ESI) will be extended beyond the sunset clauses in place for April 2025.

Christiana Stewart-Lockhart, DG of the Enterprise Investment Scheme Association (EISA) said:

The current challenge is that it is difficult for entrepreneurs to plan for the next three years without the certainty that the EIS would be available for their next fund raise. Typically, start-ups have an 18-month cash runway and that takes us past the current end to the EIS.

It would be good to have details of the extension in the November Budget.

The government also responded to the Treasury Committee’s July recommendations on VCT reforms:

- There will be no increase to qualifying company age limits, or to funding limits

- Nor will diversity statistics become a requirement for eligibility.

Chair of the committee Harriett Baldwin was disappointed:

As the current age limit is seven years, this effectively locks out some regional firms from accessing investment on a level playing field. Regional targeted funds under the British Business Bank will not be enough alone whilst the current rules remain in place.

Hipgnosis

The Hipgnosis Song Fund (SONG) saga rumbles on.

- At the AGM in October, 82.3% of shareholders voted against the continuation of the trust, and against the contentious proposal to sell off part of the catalogue to another Blackstone fund run by the same investment manager.

It’s a win for activist investors Asset Value Investors (AVI) and Metage, who objected to the board’s plan to sell a fifth of its assets at a discount.

Non-executive directors Andrew Wilkinson and Paul Burger resigned the night before the AGM, and 71.5% voted against the re-election of chair Andrew Sutch, so there will be a largely new board in place soon.

- Robert Naylor, outgoing chair of Round Hill Music (RHM) is a candidate for the new chairman.

Surviving non-exec Sylvia Coleman said:

The board and the investment adviser have each engaged widely with investors over recent months. While shareholders have not supported our proposed transaction or the continuation vote, it is clear that they share our belief in the inherent quality and potential of these assets.

The directors are now expediting the appointment of a new chair who will drive the strategic review we have already announced, with a clear focus on delivering improved shareholder value.

The focus has moved to avoiding an exit fee of £24M for founder Merck Mercuriadis, a former manager of Beyonce, Nile Rogers and Elton John.

- Mercuriadis is entitled to £8M as 12 months’ notice based on as a percentage of the trust’s average Mcap, and a £16M termination payment based on the NAV of $2.32bn.

The Times quoted an investor in the fund who believed that the fee could be avoided.

My suspicion is that once a new board starts going through this business there will be enough red flags to terminate his contract for cause.

Stifel analyst Sachin Saggar said:

We imagine the new board could explore the option of termination based on negligence, which would remove the need for a termination fee.

Quick Links

I have four for you this week, the first two from Alpha Architect.

- Alpha Architect was Dissecting the Idiosyncratic Volatility Puzzle

- And looking at how Technology Spillover Impacts Stock Returns.

- The Economist wrote about What a third world war would mean for investors

- And Discipline Funds presented their Chart of the Week: Is the Fed About to Fumble?

Until next time.

This post may be of some interest:

https://www.honest-broker.com/p/12-predictions-on-the-future-of-song