Irregular Roundup, 9th October 2023

We begin today’s Weekly Roundup with zero-sum thinking.

Zero-sum

In the FT, John Burn-Murdoch wondered whether we are destined for a zero-sum future.

- He notes that affirmative action advocates and anti-immigration nativists are strange bedfellows:

The former group skews young and is composed overwhelmingly of progressives, and the latter skews old and conservative. But they have one significant thing in common: a predilection for zero-sum thinking, or the belief that for one group to gain, another must lose.

In the US, at least, this is a strangely bipartisan way of thinking.

Roughly equal numbers of US Democrats and Republicans agree that “in trade, if one country makes more money, then another country makes less money”. And while Democrats are more likely to say “if one income group becomes wealthier, this comes at the expense of other groups”, a third of Republicans agree.

Unfortunately, zero-sum thinking is demotivating (since extra effort is not necessarily rewarded) and leads to lower rates of innovation.

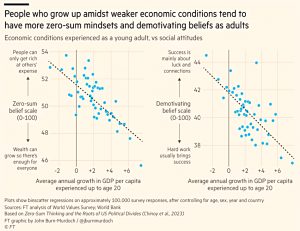

The Harvard study that John is referencing found a strong relationship between zero-sum thinking and growing up in a weak economic environment.

If someone’s formative years were spent against a backdrop of abundance, growth and upward mobility, they tend to have a more positive-sum mindset, believing it is possible to grow the pie rather than just redistribute portions of it.

The effect holds across good and bad countries during the same time period, and between generations born into differing conditions.

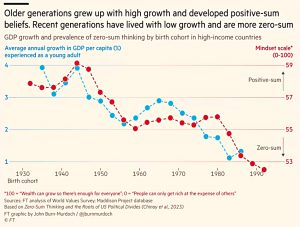

The World Values survey has found a 20% increase in zero-sum thinking in rich countries over the last century.

Two distinct rises in the prevalence of zero-sum attitudes have coincided with two slowdowns in gross domestic product growth, one in the 1970s and another in the past two decades.

The study worries about the side effects:

Populism, conspiracy theories and nativism are all rooted in the belief that one group gains at the expense of others. Zero-sum thinking predisposes people to downplay the potential benefits of trust and co-operation, and see others as potential rivals or threats rather than partners and collaborators.

I guess I must have picked up the zero-sum bug to some extent then, though I still believe in growth and free trade.

Rates and data

UK inflation data for August came in lower than expected (6.7%, down from 6.8% and against a forecast of 7%).

- Core inflation fell from 6.9% to 6.2%.

- The fall was largely down to food and drink.

This opened up a window for the BoE to pause its mammoth sequence of hikes, and they duly stepped through it.

- Whether this will turn out to be a good idea, or a premature move remains to be seen.

Inflation looks to be on the way out in the US, but I’m not quite convinced about the UK yet.

- If this is the peak of the interest rate cycle, it might be time to get back into the market, and even into bonds.

I’ll give it some more thought before next week’s Roundup.

Incentives

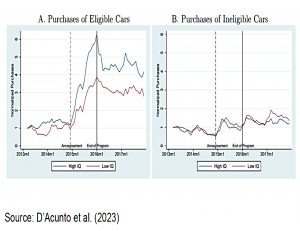

Joachim Klement reported that it takes brains to take advantage of incentives.

- He was looking at research from Finland, where men take IQ tests during their conscription process, and tax returns are quite detailed.

The study looked at two incentives:

- a “cash for clunkers” 2015 government reward for trading in a car for a less polluting model, and

- a reduction in borrowing rates by the ECB during the 2010s

Since choices depend on available capital and income, the study controlled for income and education etc.

The high IQ group reacted more to the government incentive to replace their car and also increased their borrowings to take account of the lower cost of debt.

Incentive schemes have to be designed to be as easy to understand as possible, so that the largest group of people can understand them without too much thought. The best incentive scheme is an automatic one where the customer doesn’t have to do anything or think about anything.

ARK Europe

ARK Invest, the actively managed ETF shop run by Cathie Wood that had a fantastic run during the Covid US tech boom, has made its first acquisition.

- ARK has picked up Rize ETF, which means it can offer UCITS ETFs to European investors before the end of 2023.

Rize offers 11 ETFs at present, with a combined AUM of $452m.

- These will be rebranded as ARK Invest Europe.

Over the past two years, ARK has been attempting to diversify away from its core focus of active tech ETFs into index ETFs, a venture fund, and an application for a crypto ETF.

- Thematic funds are currently booming in Europe, whilst enthusiasm for them is waning in the US.

Cathie, who owns a majority of ARK, said:

Today’s acquisition advances ARK Invest’s commitment to offering high-quality thematic investment solutions to a global investor audience, particularly European investors who have not been able to access our products.

We believe the European ETF market presents a strong growth opportunity as new and younger investors continue to gain access to ETFs via the growth of digital platforms, and as active ETFs increase market share by meeting the demand for innovative investment exposures.

ARK has purchased Rize from AssetCo, which also runs the River and Mercantile funds, and ARK Europe will launch some ETFs based around these products.

Hipgnosis

We wrote a few weeks ago about a bid for the Round Hill Music Royalties Fund (RHM).

- Now the similar Hipgnosis Songs Fund (SONG – in which I have a small position) has announced the sale of 20% of its net asset value (29 song catalogues) for £372M.

The money will be used for share buybacks and to reduce debt.

- The funds describe the disposals (which include the Kaiser Chiefs, Barry Manilow, Nelly and Shakira) are “of the smallest magnitude possible that would provide the required capital to execute on this strategy.”

Unfortunately, the sale is to a related party – Hipgnosis Songs Capital, a joint venture between Hipgnosis Songs Management (HSM, the manager of the fund) and Blackstone, the asset manager that owns a majority stake in HSM.

- So there are governance questions to be answered ahead of a looming continuation vote.

Liberum analysts commented:

It leaves us with the question of where the really good investment team members at the investment advisor are going to sit. Are they going to be on the team that advises the company or on the team that advises Hipgnosis Song Capital?

The sale price is an 18.3 times multiple of the historical net revenue and a 26% premium to the price paid by SONG for the catalogues.

- But SONG trades at a 37% discount to the reported NAV, and so the sale is at a 17.5% discount to NAV (lower than the 11.5% discount on the RHM offer).

It is, however, a 51% premium to the 30-day trailing share price average.

Numis said:

It is disappointing that the manager does not trust the most recent valuation.

Stifel added:

How do investors know that Blackstone has not cherry picked the portfolio?

The deal is backdated to the beginning of the year with SONG giving back $15.3m in revenue received since then.

HSM CEO Mark Mercuriadis said:

Earlier this year we initiated consultations with shareholders, in contemplation of the continuation vote and our concerns that the true value of our iconic songs was not being reflected in our share price.

It was clear that shareholders shared our belief in the continuing long-term opportunity ofHipgnosis Songs Fund and wished to see a significant share buy back programme andreduction of our leverage in order to deliver a re-rating in the share price.

Overall, I’m not over the moon about this deal, or the fund in general any more.

- Investors appear to have lost patience with what was always going to be a long-runway opportunity, which is a shame.

ISAs

Speculation is mounting that Chancellor Jeremy Hunt is planning a shake-up of ISA rules in the November budget (perhaps alongside a reduction in IHT rates/increase in IHT allowances/abolition of IHT).

- It’s true that the multiple overlapping ISA schemes are messy, but whilst the £20K annual contribution cap is annoyingly small for me, I’m sure I’m in the minority on that one.

Around 12M ISAs were opened in 2020-21 ( the last year for which there is data) but the large majority were Cash ISAs.

- The Treasury is keen to promote investment in the UK, and also to increase share ownership by individuals, which has fallen from 50% of the market in the 1960s to just 12% now.

More than 4.2M people have more than £10K of investable assets in cash.

- I have a lot more than that, and it seems like a reasonable investment choice given current economic conditions (though obviously, the macro backdrop will not be the key driver for most).

The latest wheeze appears to be an extra allowance (£5K pa?) to be invested exclusively in UK stocks.

- I’ve no idea how that restriction would be enforced, and whilst the extra £5K of annual capacity would be welcome, having to hold a separate ISA account with a few £K in it is not.

The other change could be the merger of Cash and Stocks and Shares ISAs, which is probably a good idea.

- Getting rid of LISAs and Innovative Finance ISAs would also be positive news.

Quick Links

I have eight for you this week, the first three from the Economist:

- The Economist asked Are free markets history?

- And said that A surge in global bond yields threatens trouble

- And particularly that Rising bond yields are exposing fiscal fantasy in Europe.

- Discipline Funds wrote about The Bond Market Sweet Spot

- And also had some Weekend Thoughts – SBF, Interest Rates & Jobs

- Alpha Architect saw ESG Preferences Negatively Affecting Market Efficiency

- Mauldin Economics wrote about The Big Cycle

- And UK Dividend Stocks gave us their Top 40 High-Yield Blue-Chip UK Stocks: Autumn 2023.

Until next time.

Interesting news re Hipgnosis.

Interesting, but not good.