Weekly Roundup, 23rd March 2020

Today’s Weekly Roundup is once again about the coronavirus and its impact on the markets.

Market outlook

There’s not much change for last week (other than the schools and pubs are now closed, and there’s not much in the shops where I live).

- There’s a lot of speculation about how bad the virus might get, but the actual data remains pretty confusing.

The infection rate and death rate remain hard to predict, and economically speaking we could be in for either a mild recession that is beginning to reverse by year-end or a bigger Depression that the 1930s.

- Government actions develop by the day and seem ever more likely to involve some kind of helicopter money/MMT.

But since I can’t influence them, it seems the most sensible thing is to keep my head down, prepare some plans for the most likely alternative outcomes, and sit tight.

The markets feel like they ought to be close to the bottom now, but I think we have at least another two to four weeks of bad news coming from the UK and the US.

- Despite this, I’ve been thinking about how to play the next phase of the crisis, and I’ve put together a watch list of stocks which I will share tomorrow.

It goes without saying that these will not be tips or recommendations.

- The priority for most people should be making sure they have enough cash to last through the next six to eighteen months.

Lessons from history

In the FT, Merryn Somerset Webb was looking for lessons from stock market crashes in history.

- She notes that the US market has still only lost 15 months of gains, and remains expensive.

So what might turn all this around? Another 20 per cent-odd fall that makes things so cheap everyone buys. A vaccine. An efficient treatment.

She also thinks that negative rates and helicopter money/MMT are possible, and even some form of debt jubilee.

- And she reminds us to buy gold whilst the current liquidity crisis is suppressing its price.

Stock picking

In The Economist, Buttonwood provided the fictitious thoughts of a fund manager trying to stock-pick in a falling market.

- For his personal portfolio, he welcomes the lower prices, but as a professional, he is worried.

Clients tend not to be as patient as private investors (though at the same time, PIs often sell at the bottom).

Asset prices are set at the margin. The stock price on the screen is the one at which the most desperate seller and the bravest buyer are willing to do business. When the ranks of the first group overwhelm the second, the result is a rout—or capitulation.

He notes that there will be a lot of forced sellers – fund managers mandated to deliver promised low volatility, and people with debts to repay.

- But there are also fund managers keen to hide their biggest mistakes.

And there are opportunities ahead:

I have an eye on mining companies. If China’s economy rebounds, they will benefit. And, yes, I am absolutely looking at airlines. A national champion or two is bound to be saved. People will want to fly, stay in hotels and go to restaurants and coffee bars again.

Dislocation on this scale will take out the weaker players in every industry. The best companies will emerge even stronger.

Recoveries

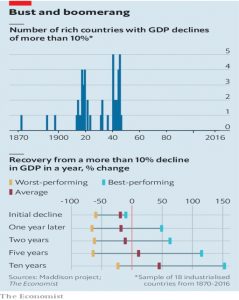

Free Exchange looked at how quickly economies can recover from massive slumps in GDP.

- Falls of 10% or more are not uncommon in developing economies, but there have only been 13 instances since 1960 where a rich country’s GDP fell by more than 5%.

There have been no falls of more than 10%.

- The two world wars and the Depression of the 1930s have been the main drivers for such events.

Among the rich economies which experienced annual drops in gdp of more than 5% since 1960, output took an average of four years to return to its previous level.

Which is not great news. And as The Economist points out:

A dangerous pandemic working its way across a highly integrated global economy is an unprecedented event.

For fast recovery from the coronavirus shock, we will most likely need lots of government stimulus and the rapid repair of international trade networks.

Which firms?

The newspaper also speculated on which firms might never recover.

- The two key factors are liquidity and business model.

Non-financial firms in America will see $394bn in investment-grade debt and $87bn in junk debt fall due this year; the figures for next year are $461bn and $195bn. Potential trouble spots include construction ($30bn), media and entertainment ($35bn), and energy and utilities ($56bn).

With the oil price at $25 per barrel and the median break-even price for exploration and production firms at $51, oil companies are in trouble.

Problematic business models are those where lost sales cannot be recovered in the future:

- the arts (eg. cinema), hotels and restaurants

Arts, in particular, depend on a few large events each year (eg. international art fairs and film markets).

On the other hand, supermarkets and video-conferencing firms are doing well, as are many online stores.

- And virus vaccine, treatment and testing firms are also popular.

One lasting consequence of the pandemic will almost certainly be further concentration of corporate power in the hands of a few superstar firms.

Apple, Berkshire Hathaway and a few national champion airlines are amongst the candidates.

Quick links

I have just four for you this week, the first two from Musings on Markets:

- He looked at the Viral Market Meltdown (part 3)

- And provided Data Update 7 (on debt)

- ERN speculated about what kind of bear market it will be

- And Klement on Investing reminded us to Invert, always invert.

Until next time.