Options 5 – Dennis McCain

Today’s post is the fifth in our series on options trading. We look at the options strategy used by blogger Dennis McCain.

Contents

The story so far

Skew

In the first article, we looked at a paper from Antti Ilmanen of Expected Returns fame:

- People have an aversion to negative skew, which means that they overpay for insurance and lottery tickets.

- This seems to be related to the over-weighting of salient but unlikely events (which does not contradict Taleb’s assertion that we underweight “impossible” events).

- So selling insurance and/or lottery tickets can be profitable.

- Selling insurance (writing options) is the easier of these two strategies for private investors to implement.

Definitions

Most of these are from Dom of the Gen Y Finance Guy blog:

- Option = derivative based on another asset’s price

- Strike price = price at which the option can be exercised

- Expiry day is the date that the option must be exercised before

- Long = buying

- Short = selling (something you don’t have)

- Call = as a buyer, the right but not the obligation to buy something the future at a pre-arranged price

- As a seller, you get paid upfront but are obligated to do the deal if the buyer exercises the option.

- Put = as a buyer, the right but not the obligation to sell something the future at a pre-arranged price

- As a seller, you get paid upfront but are obligated to do the deal if the buyer exercises the option.

- In the money (ITM) = the option is worth exercising because the current price is above (call) or below (put) the strike price.

- Out of the money (OTM or OOTM) = the option is NOT worth exercising because the current price is below (call) or above (put) the strike price.

- At the money (ATM) = market price is the same as the strike price

- Intrinsic value = money to be made from exercising the option

- Only applies to ITM options

- Time value (extrinsic value) = cost of option – intrinsic value

Brokers

All of the bloggers we’ve looked at so far are from the US, so they use a couple of US brokers:

- ERN uses Interactive Brokers as they have the cheapest per contract commissions.

- Fritz uses TD Ameritrade (ThinkOrSwim) rather than Interactive Brokers, as does Dom of Gen Y FInance Guy.

I know that Interactive Brokers operate in the UK, but I’m not sure about TD Ameritrade.

Account sizes

ERN’s account size is more than $660K and is now 35% of ERN’s net worth, and around half of his net worth outside retirement accounts.

- Fritz’s options account is less than 10% of his net worth.

Expiry dates

ERN uses the shortest contract possible, which means that he normally writes options that expire in one or two trading days.

- He thinks this means that he gets bigger premiums per unit of risk.

- He also likes to have the maximum number of independent bets in order to access the “house edge”.

Fritz uses three-month options rather than weekly or daily ones.

- Dom uses six-month options for both strategies.

Strategy 1 – selling puts

This strategy was introduced to use by ERN of the Early Retirement Now blog.

- ERN says that options are not as complicated or (necessarily) as risky as most people imagine.

He successfully uses a strategy of selling ATM index puts in large size:

- ERN uses leverage for two reasons:

- To boost the return from the likely base rate

- To overcome taxes – ERN uses a 1/(1-tax rate) approach as a minimum.

- For a 20% tax rate, this would mean gearing of 1/0.8 = 1.25 times.

- The delta on a typical put that ERN writes is 0.15, which means it is 15% as volatile as the underlying.

- So even with say three times leverage, the volatility would be much less than the underlying.

- Long-term, ERN expects a 12% gross return (8.5% after-tax) with around 7% volatility, which is a lot better than the index.

- From 2000 to 2018, through two bear markets and two bull markets, the strategy outperformed the S&P 500.

- It also had lower volatility (10% pa, cf. 15% for the S&P 500) and it had smaller and shorter-lived drawdowns.

- The strategy also traded successfully through October 2018 – the worst month for the S&P 500 for seven years, down 7%.

- The market never dropped much below ERN’s strike prices.

- At the time of the last update, ERN was using reduced leverage of 2-2.5 times.

- The time value of the options had been reduced from 7% down to 5-5.5% pa.

- Using a $300 premium target on a nominal option value of $280K gives an unleveraged return of 5.57%.

- ERN now targets strikes that are 5 Delta or 1.5 to 2 standard deviations below the index level.

- The loss allowance (how much premium will need to be given back) has been increased from 50-55% up to 60%.

- Returns are 4.7% from the options and 4.6% from the margin cash portfolio.

- That’s a 9%+ return overall, or more than 7% above 2% inflation expectations.

- That’s better than long-run stocks with better drawdowns and lower volatility.

Strategy 2 – selling covered calls

This was introduced to us by Fritz from The Retirement Manifesto.

Fritz uses Strategy 1 to enter positions – he sells a put below the money on a stock he likes.

- This is repeated until finally the option is exercised, and he owns the stock.

- Fritz calculates the returns from this strategy at around 8% pa.

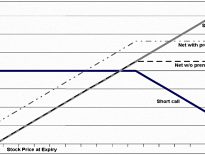

Once he has a position, he sells a covered call against it, above the money by perhaps 10%

- This strategy might produce an annualised return of around 7%, and he also still gets the dividends from the stock.

He repeats the covered call sales until the call is exercised and he no longer has the stock.

- Then he goes back to step one and sells a put.

Sometimes Fritz will roll his position into the next quarter.

- He does this when the stock price is above the strike and a call expiry is looming, but he doesn’t want to sell.

The roll is two trades – buying back the near call and selling a far call.

- Fritz might also roll the initial put if the stock is trading below the strike price and he would rather not have to buy the stock.

Fritz didn’t provide any backtesting/data on historical returns for his strategy.

- I think ERN mentioned that covered calls had a similar return to his out of the money puts, but I’d rather hear this from someone who is using the technique.

Dennis McCain

From Dennis’ bio:

I’m a dividend growth investor who seeks out companies with a long history of increases in revenue, earnings and dividends.

I then enhance those dividends and increase my income through the use of a proactive option strategy.

Dennis uses both of the strategies we’ve met before.

- Unfortunately, he offers few details on how his implementation of the strategies operates.

He doesn’t mention his broker, account size or the expiry periods he favours.

Time decay

One thing that Dennis does articulate more clearly than the other bloggers is the effect of time decay, which is positive on both of the strategies.

First, the covered calls:

The passage of time has a positive impact on this strategy. It reduces the time value (and therefore overall price) of the short call, which would make it less expensive to close out if desired. As expiration approaches, an option tends to converge on its intrinsic value, which for out-of-money calls is zero.

And for puts:

As expiration approaches, the option tends to move toward its intrinsic value, which for out-of-money puts is zero.

Conclusions

We’ve now looked at the way that four bloggers use a couple of options strategies:

- Selling puts

- Selling covered calls

I remain sold on the strategies, but we have a few more bloggers to look at before I get started on how to implement these techniques here in the UK.

- Until next time.