Weekly Roundup, 9th August 2021

We begin today’s Weekly Roundup with a look at pensions.

Pensions

Martin Wolf had a couple of articles in the FT about pensions.

- We’ll start with the less controversial of the two, which was about the use of equities.

According to Martin:

The tragedy of British pension arrangements is that the attempt to force safety on private arrangements is forcing them into collapse.

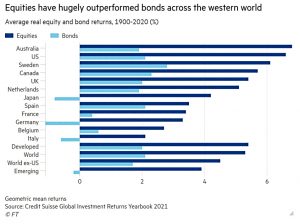

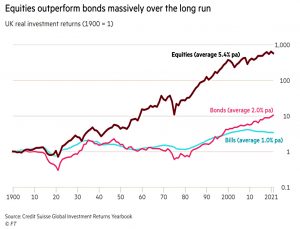

Over the last 120 years, stocks have done very well.

- Long-term investment goals are best served by risky assets (depending on your definition of risky).

Holding a widely-diversified portfolio of equities is far and away the best long-term investment strategy in our uncertain world.

But regulators continue to push pensions into bonds.

The massive long-term outperformance of equities in the major markets occurred despite two world wars, communist revolutions, the Depression, hyper-inflations, the great inflation of the 1970s and the global financial crisis of the 2000s.

To this, we can now add a pandemic.

- Martin concedes that nuclear war or catastrophic climate change might cause problems.

But bonds would not save you.

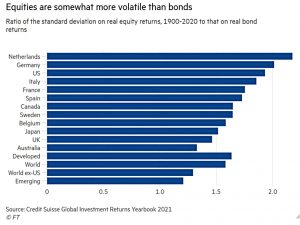

The downside of stocks is their volatility and in particular their ability to deliver negative returns over quite long periods.

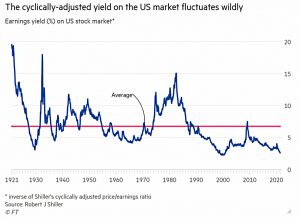

The cyclically-adjusted earnings yield on the S&P 500 is only 2.6 per cent. This is at crash-warning levels, by historical standards. Should a prolonged bear market occur, equity valuations might collapse. The valuations of the mid-1960s did not return for 30 years.

But for a (DB) pension fund with an unlimited lifetime, this kind of volatility should not matter.

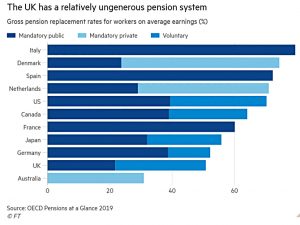

The second article was about CDC pensions but started with a look at how mean the UK pension system is.

- The state pension is only worth 22% of average earnings. (( This is my usual argument against scrapping the triple lock on the State Pension ))

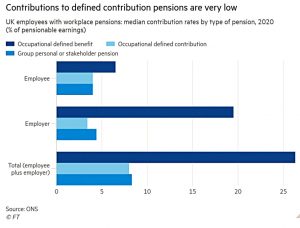

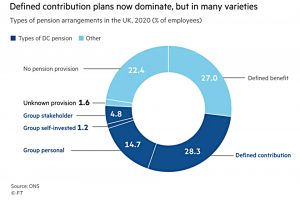

There’s also a big difference between the old DB pensions (now largely available only within the public sector) and the new DC system (which includes the recent workplace auto-enrolment campaign).

While the median contribution of employers to a DB plan was 19.5 per cent of pensionable earnings in 2020, their median contribution to a DC plan was only 3.4 per cent.

Martin calculates that DC contributions would support a non-indexed annuity worth less than 30% of career average earnings at age 65.

- Which is clearly inadequate.

Martin also worries that shifting to bonds to reduce risk in advance of retirement will further impact returns.

- And he thinks that Collective Defined Contribution (CDC) plans can solve some of the problems.

I should point out that I dislike CDCs as for me they combine the worst features of DB and DC:

- No control over how your pot is invested, plus

- No guarantee of the future payout level.

I’m not sure what kind of scheme member would vote for CDC over DB or DC, but that doesn’t mean that CDC can’t be attractive to regulators and/or scheme operators.

Because the [CDC] fund is permanent, multi-generational and, ideally, very large, it will have low costs, can hold a diversified portfolio and is not under pressure to de-risk its portfolio by arbitrary dates. The CDC fund can also provide pensions until death, again backed by its portfolio returns and the inflow of new contributions.

That sounds like DB to me, but CDC will be cheaper for the employer as it lacks the payout guarantee.

- Instead, the employer (sponsor) pays annual contributions, as with DC.

CDC (like DB) also comes with cross-generational subsidy, though this need not be a problem:

Generations whose investment returns turn out to be exceptionally good subsidise those whose returns are exceptionally bad. But nobody knows in advance which fate their generation will suffer.

Martin expects downward adjustments to CDC target payouts to be small:

People could have reasonable confidence that the pension they expected would be paid. The experience of the Dutch system supports this expectation: even after the 2008 financial crisis, it reduced pensions by only 2 per cent on average.

But the only way to square that circle is to have unambitious return targets and/or high contribution levels in the first place.

- And whatever risk level is chosen, it is chosen for all the members as a group.

Martin thinks that CDC pensions will be higher because the scheme can hold riskier assets than an individual.

- But the Royal Society of Arts study he quotes in support claims returns 30% higher than an annuity.

At the time of writing the yield on an index-linked annuity at age 55 is 1.7%.

- The 30% boost from CDC takes that to 2.2%

A DIY-invested SIPP could provide another 50% on top of that via drawdown.

- CDC might look good compared to a DB fund invested in bonds or a DC fund with inadequate contributions.

But why should I – or anyone else – pay an insurance company to reduce my retirement income by a third?

Tontines

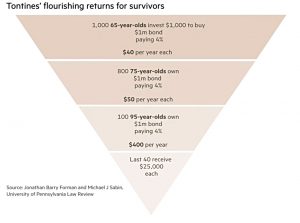

An alternative method of funding retirement that we have discussed several times before is the tontine, which was covered by Lex in the FT.

Members pool some money and receive an annual payment until they die; the entire pot goes to the last man or (actuarially more likely) woman standing.

The superficial big flaw is the incentive to murder other members (used in many a fictional plot) but in practice fraud, corruption and embezzlement lead to tontines being banned in the early 20th century.

- But perhaps they are due for a revival since advances in forensics and data analysis mean that the earlier issues should not arise.

And of course, there are more old people than ever.

Insurers in Japan, which has the highest rate of centenarians, have launched policies with tontine-style characteristics. They are deployed on Israeli kibbutzim and by wealthy French looking to reduce inheritance tax bills.

Canada introduced a variable payment life annuity (VPLA) in its 2019 budget which has similar characteristics. Tontine-like payouts also feature in Defined Contribution plans in the Netherlands and the UK’s Royal Mail.

Drawbacks include the inability to suspend payments when terminally ill and to pass on payments to a beneficiary upon death.

- It also helps if members have similar ages and life expectancies, to begin with.

But they should return more than an annuity, by saving residual capital from a middleman (the insurance company).

- So let’s give them a trial.

Investor Expectations

On Medium, Stephen Forester looked at investor return expectations.

- Stephen is a finance professor at the Ivey Business School in Canada and co-author of “In Pursuit of the Perfect Portfolio”.

As you might expect, investors are ridiculously optimistic.

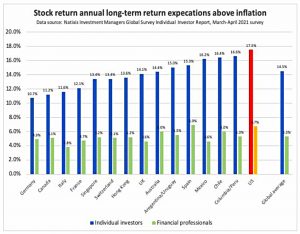

On average, investors expected long-term average returns of a whopping 14.5 percent above inflation. Germans had the most modest expectations of 10.7 percent above inflation, while Americans expected 17.5 percent above inflation.

The average inflation-adjusted long-term expected stock returns by financial professionals was a much more modest 5.3 percent or approximately only one-third of individual investors.

UK investors are expecting an amazing 14.1% real pa.

- I’ll settle for 3%, though I hope for 5% pa.

For comparison, the historical real return for US stocks is 6.8% pa (and somewhat lower for UK stocks).

Stephen also notes a worrying trend:

The average expected inflation-adjusted return for the next year in 2014 was 8.9 percent. There has been an almost steady — and in my opinion, dramatic — increase through 2021, with the most recent next-year forecast of 13.0 percent. I suspect a lot was influenced by recent returns during a strong bull market.

The same thing happened during the dot com boom.

- And back then, investors expected their own portfolio to outperform their ridiculously high “average” forecast.

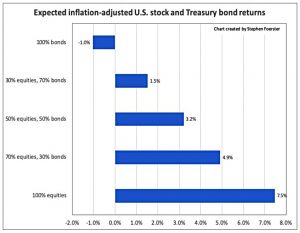

Stephen also produces his own forecasts:

He thinks stocks will return 7.5% pa, and a 70/30 portfolio will produce 4.9% pa.

- I’ll take that.

Crypto

This weeks crypto warning from the FCA was about CoinBurp and its $BURP tokens. (( Stupid and/or childish names are pretty common in crypto land ))

- The firm has applied to the FCA for registration but hasn’t yet been approves (which means that appears on the Temporary Registration register, the TRR).

Being on the TRR doesn’t allow firms to claim FCA authorisation.

- They still have to clear the money laundering bar and their directors need be approved as “fit and proper”.

CoinBurp has raised $6m (£4.3m) to build a platform that trades non-fungible tokens (NFTs). Their spokesman said:

Building this product means that CoinBurp – as a regulated broker – will have NFTs listed on the market and can be made available for investors in large and small quantities.

The FCA commented:

The FCA has very limited powers to protect you if you invest in cryptoassets. We have warned previously that investing in cryptoassets (and investments and lending products linked to them) usually involves very high risks.

Crypto tokens can become very difficult to sell or may significantly reduce in value – and consumers that invest in them should be prepared to lose all their money. It is unlikely that you will have recourse to the Financial Ombudsman Service or Financial Services Compensation Scheme if something goes wrong.

This time I think I agree with them – the attraction of NFTs is hard to fathom.

Quick Links

I have five for you this week, the first two from The Economist:

- The newspaper said that semiconductors are an unwelcome roadblock for carmakers

- And wondered whether Nvidia’s huge bet on AI chips would pay off.

- Alpha Architect looked at combining smart factors with a market portfolio

- Musings on Markets had a DIY valuation of Zomato

- And Not A Yes Man’s Economics noted that even the FT is worried about house prices.

Until next time.

According to the 2020 Purple Book (private sector DB pension schemes) some 24% of members of such schemes are in schemes that are open – where new members can join and accrue benefits. By way of comparison, the open figure was some 66% back in 2006. Thus, the vast majority of private sector DB schemes no longer have “an unlimited lifetime”.

Public sector DB schemes are a totally different kettle of fish, for want of a better phrase!

Having said that, I do have some sympathy with the lack of Equities argument being made.

Sure, individual schemes have to run off, but DB pensions needn’t be organised like that. We could have a sovereign wealth fund accessible to both DB and DC pension schemes. Bonds are not the best approach to long-term liabilities.

Unless and until such an alternative exists I suspect the trend for private sector DB schemes to ‘de-risk’ away from Equities will continue. Having said that, the Purple Book also highlights another trend that is much less commented upon – the growth in recent years of leveraged hedging (see Fig 7.2 on page 36). IMO this flies in the face of de-risking and could be more akin to re-risking. Time will tell.