Weekly Roundup, 20th February 2023

We begin today’s Weekly Roundup with kickbacks.

Kickbacks

Joachim Klement looked at yet another example of regulation not having the desired effect.

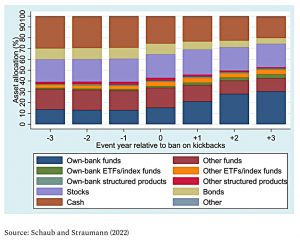

- He wrote about the banning of kickbacks from investment funds.

Swiss private banks offer both in-house and third-party funds, but they make more profit from the in-house funds.

In the past, third-party funds could make it into the portfolios of clients of large private banks by offering kickbacks to the distributors. These kickbacks were typically not disclosed to the customers who bought the funds, nor did the customers get any of that money.

Then in 2012, the courts decided that the kickbacks needed to be passed on to the customers, which led to the end of kickbacks.

Of course, this meant that the share of third-party funds dropped.

Banks followed their incentives and replaced third-party funds with in-house funds to protect their margins. The problem is that banks don’t always have the best fund in the market for every asset class.

Portfolio performance dropped by 0.9% to 1.6% pa.

- The average pre-ban kickback was around 0.4% pa, so the net effect for clients was a loss of 0.5% to 1.1%.

Every regulation has unintended consequences.

Older workers

There’s been quite a bit of speculation that the Chancellor might include some tax breaks in the Budget designed to encourage the over-50s to work for longer.

- I have no need nor desire to go back to work, but if I could point to one thing that would have made me work for longer, it would have been the abolition of the LTA.

I doubt very much that that will happen, and I have no idea what else might help.

- A higher tax-free personal allowance for the over-50s, perhaps?

In the FT, Camilla Cavendish wrote about what it would take to get older workers back into the office.

- Before Xmas, Camilla had predicted a “Great Unretirement”, but the postbag provoked by that article has made her change her mind.

What took me by surprise was the vehement dislike expressed for many jobs. “If you could press a button and delete everything I’d ever done in every corporate job I’ve had”, wrote one man, “I would feel nothing at all”.

I feel almost the same – you could delete close to 20 of the 25 years I spent at work without hurting my feelings.

Talking to my own friends who still work, I think that wokery also has something to do with it.

While companies focus on race and gender discrimination, and the needs of Gen Z, workplace age discrimination seems to be increasing. Employers in Brazil, India, Italy, Singapore, Spain, UK and the US prefer staff under 45, who are a “better fit” with their company culture.

Older workers also cost more and don’t like low-staus roles.

But we probably need to do something to fix the UK employment market.

- I used to think that part-time mentoring and consulting roles were the way to go after 50.

But my experiences with trying the bring the financial good news from Aix to Ghent – and more chats with my friends who still work – lead me to believe that only a tiny minority of the youth are able to be mentored.

VCTs

In the FT, Moira O’Neill tried to dissuade would-be investors from putting their money into VCTs.

- The funds (which invest in early-stage companies) are definitely a niche product, but I’ve been very happy with the 13.8% CAGR on my portfolio over the last six years.

That said, I’m not necessarily expecting the same level of returns over the next six years.

VCTs have two attractions for someone in my situation (in decumulation, with a full pension that I am taking money from each year):

- Up-front income tax relief

- Tax-free dividends each year, which include the profits from successful exits

They are cash flow positive for basic rate taxpayers (relief at 30%) and once you have a large enough portfolio, the dividends will pay for your annual investment (I’m about halfway there at present).

- But they are risky and expensive (annual charges are high) and they shouldn’t make up a large part of your portfolio.

Moira notes that 2022 was a bad year for VCTs:

After 13 consecutive years of positive returns, the average VCT delivered a total return loss of 8.5 per cent.

And she is concerned by their increasing popularity:

Anything with a wall of money flowing towards it makes me nervous. [Whilst] many investors shied away from risk — retail investors took £25.7bn out of UK based open-ended funds in 2022 — a small subset of investors have piled into the riskiest type of funds of all. The number of VCT investors increased by 9 per cent to 19,475 in the 2020-21 tax year.

Twenty thousand is not that many people from a population of 60 million plus.

- And the average annual investment per person is “only” £33K (against an allowance of £200K).

But they are becoming more popular:

VCTs issued shares to the value of £1.122bn in the 2021-22 tax year. That’s a massive 68 per cent increase on the £668mn in the previous year and a 53 per cent increase on the previous record of £731mn invested in VCTs in the 2018-19 tax year.

It will be a similar story this year, and the more money comes in, the more will be invested in second-rate opportunities.

Probate

In the FT, Mary McDougall reported that probate delays are threatening to affect loss relief claims against IHT.

I don’t normally notice articles about probate, but my mother-in-law died last August, and six months later we have heard nothing from HM Courts & Tribunals Service (HMCTS).

- The helpline acknowledges the backlog but simply tells you to sit tight and wait for them to contact you.

Loss relief on shares can be claimed against the IHT bill only if the shares are sold within a year of the date of death (and for less money than their value at the date of death, which is used to calculate the IHT bill in the first place).

- Unfortunately, you can’t sell the shares until probate is granted.

Normally this isn’t a problem, as the SLA for the probate office is 13 weeks after you submit the forms.

- So normally you would expect to be granted probate within six months of the date of death.

But these are not normal times, and lawyers report that 50% of cases are not resolved within 12 months of death.

- Paper applications are taking six to eight months.

HMCTS data says that (simple) online claims take just four weeks to be processed.

- Claims that need to be checked now take an average of 17 weeks.

- Paper submissions take more than 20 weeks – an increase of 50% in a year.

HMCTS said:

The death rate has been considerably higher since 2020 causing a surge in probate applications but we are dealing with them in seven weeks on average — almost one week quicker than a year ago.

The Association of Taxation Technicians (ATT) has requested that a loss relief extension be granted in next month’s Budget.

Due to ongoing processing delays with probate applications, executors are losing the opportunity to claim relief from IHT. The ATT therefore considers that the current 12 month window is too short and needs to be extended to a two-year period, or at least an 18 month period from the date of death, on a permanent or temporary basis.

I hope we don’t need to wait two years for our (paper) claim to be processed.

Crypto

The Treasury has announced plans to bring crypto activities into the regulatory regime.

- This would mean that crypto firms would need to be authorised by the FCA and would need to comply with lots of files on how they run their businesses and how they deal with their customers.

Lots of crypto firms currently target UK customers from more crypto-friendly territories, but the Treasury has said that such firms would also be covered by the new regime.

- This is the first time that the FCA has been prepared to authorise firms that are located outside the UK.

Depending on the profits to be made, this could mean that some firms pull out of the UK market.

- It might also mean that some others just ignore the new rules, and hope that the FCA proves to be as ineffectual as it usually does.

The UK might not be keen on Bitcoin, but it remains in favour of “Britcoin”.

- Chancellor Hunt and BoE Governor Bailey recently laid out the roadmap to a central bank digital currency (CBDC) for the UK in the latter part of this decade.

Jeremy Hunt said:

While cash is here to stay, a digital pound issued and backed by the Bank of England could be a new way to pay that’s trusted, accessible and easy to use. That’s why we want to investigate what is possible first, whilst always making sure we protect financial stability.

Initially, people will only be allowed to hold few thousand in BC, to prevent runs on the high street banks.

- What is less clear is why anyone would want to.

The advantages of a CBDC lie with the authorities – greater control and transparency.

- The other side of the coin for the individual is loss of control and privacy.

Of course, the government says that it will be as private as a bank account.

- Which sounds like a lot less private than real cash.

And exactly like contactless payments today.

Quick Links

I have four for you this week.

- The Economist said that War and subsidies have turbocharged the green transition

- And noted that Cobalt, a crucial battery material, is suddenly superabundant

- And watched as Bob Iger makes big changes at Disney.

- Behavioural Investment wondered Are Fund Manager Meetings a Waste of Time?

Until next time.

You have my sympathy re probate.

FWIW, this problem is not unique to the UK; and here at least you get some info/feedback.

In another country stony silence is the modus operandi!

It might as well be silence, the helpline just says they are overloaded and we should wait for them to get in touch with us.