Risk Parity Radio Lazy Portfolios

Today’s post looks at the Lazy Portfolios on the Risk Parity Radio Website.

Contents

Risk Parity Radio

My guilty pleasure during the Covid lockdowns has been podcasts.

- I don’t consume them on the move like many people (in the car, or out running) but instead, just let them play in the background as I work – the way that factories used to use Radio 1.

I feel guilty because they are much easier to listen to than reading reports.

- Like everything else, you will have heard most of it before, but you do find a few nuggets each week, which makes the process worthwhile.

Podcasts at the moment remind me of Twitter in the early days – immediate access to active practitioners, without intermediaries from the mainstream media.

- Let’s hope they don’t go the way of Twitter.

I follow a few dozen podcasts, but one that I only found recently is Risk Parity Radio (RPR).

- At the time of writing, it’s up to Episode 107 and I’m working my way through the backlog.

The purpose of the RPR podcast is to explore risk-parity inspired portfolios comprised of uncorrelated or negatively correlated asset classes — stocks, selected bonds, gold, REITs, preferreds, commodities, and other easily accessible fund options for the DIY investor.

The goal is to construct portfolios that are robust and can be drawn down on in perpetuity, and to maximize projected Safe Withdrawal Rates regardless of projected overall returns.

So this is a Lazy Portfolio approach to Risk Parity, aimed at investors who are already in decumulation.

- Frank favours simplicity and low maintenance over regular activity and the highest possible returns.

The podcast is hosted by (and based on the 80 episodes I’ve listened to, solely hosted by) Frank Vasquez.

[Frank] is a mostly retired lawyer with over 30 years of experience in investing for his own accounts.

RPR portfolios

Although primarily a podcast rather than a website, RPR does report on a number of model portfolios.

- The main drawback is that the podcast is quite new (started in 2020) and so the portfolios don’t have much of a track record.

We have seven real-time sample risk-parity inspired portfolios maintained at Fidelity that we monitor and track each week. Each of them was funded with $10,000 on July 13, 2020, except for the All-Weather, which was funded on July 21, 2020, and the Levered Golden Ratio, which was funded on July 1, 2021.

We are drawing down on them monthly at [varying] rates. The withdrawal rates are intentionally aggressive to demonstrate that these types of portfolios can withstand higher safe withdrawal rates than ordinary stock/bond mixes.

Frank also reports on his own dynamic risk-parity style portfolio going back to 2016.

- This is based on the Golden Ratio and Risk Parity Ultimate portfolios, which we’ll look at in a moment.

It also uses leverage and has some options trading around the core positions.

- Frank uses Jack Schwager’s Fund Seeder monitoring platform for reporting.

All Seasons

This is based on the bastardised version of Ray Dalio’s All-Weather portfolio as described by motivational speaker Tony Robbins in one of his books:

- 30% US stocks (VTI)

- 40% long-term treasuries (TLT)

- 15% intermediate treasuries (VGIT)

- 7.5% gold (GLDM)

- 7.5% commodities (PDBC)

The expected SWR is 3.8% and the CAGR since 1970 is 5.6% real.

- Frank distributes 4% pa from this portfolio.

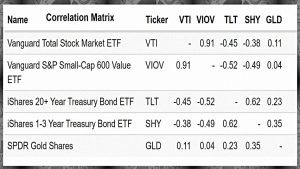

Golden Butterfly

This is from Tyler at portofliocharts.com (the site Frank uses for backtests):

- 20% US stocks

- 20% US small-cap value (VIOV)

- 20% long-term treasuries

- 20% short-term treasuries

- 20% gold

The expected SWR is 5.3% and the CAGR since 1970 is 6.4% real.

- Frank distributes 5% pa from this portfolio.

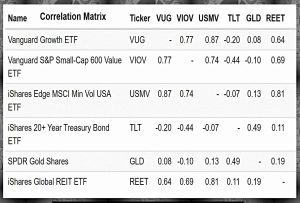

Golden Ratio

This portfolio is based on the mathematical golden ratio of 1:1.618 – each successive asset class has a weight that is 1.6 times lower than the previous one:

- 42% stocks, split three ways:

- 14% large-cap growth (VUG)

- 14% small-cap value

- 14% low volatility (USMV)

- 26% long-term treasuries

- 16% golf

- 10% REITS (REET)

- 6% money market funds

The expected SWR is 5.0% and the CAGR since 1970 is 7.0% real.

- Frank distributes 5% pa from this portfolio.

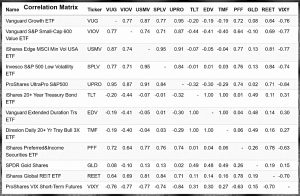

Risk Parity Ultimate

This is a more complex portfolio with 12 funds:

- 40% stocks, split five ways

- 12.5% VUG

- 12.5% VIOV

- 6.25% USMV

- 6.25% SPLV (more low-vol)

- 2.5% UPRO (leveraged)

- 25% long-term treasuries split three ways:

- 15% TLT

- 5% EDV (extended duration)

- 5% TMF (levered 20-year plus bonds)

- 12.5% preferred stock funds (PFF)

- 10% gold

- 10% REITs

- 2.5% stock volatility (VXX)

Frank doesn’t declare a historical performance for this portfolio (presumably because a lot of the funds are relatively new) but he distributes 6% pa from it.

Accelerated Permanent

This is one of Frank’s experimental portfolios, which uses some leveraged funds to juice up Harry Browne’s Permanent portfolio:

- 25% UPRO – leveraged stocks

- 27.5% TMF – leverage bonds

- 25% PFF – preferred stocks

- 22.5% gold

Frank expects this portfolio to return 10% pa and he distributes a heroic 7.5% pa from it.

I have my own experiments planned with leveraged risk parity portfolios.

- I’m not very keen on the leveraged ETFs because of their daily rebalancing

I plan to use plain leverage (via spread-bets or CFDs) instead, perhaps also with a trend-following approach.

Aggressive Fifty Fifty

This is another leveraged portfolio, based on a 50/50 stock/bond portfolio:

- 33% leverage stocks (UPRO)

- 17% preferred stocks (PFF)

- 33% leveraged bonds (TMF)

- 17% intermediate treasuries (VGIT)

Frank expects this portfolio to return 10% pa and he distributes 8% pa from it.

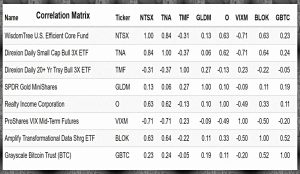

Levered Golden Ratio

This is another leveraged portfolio:

- 55% in leveraged funds, split three ways:

- 35% NSTX (stocks)

- 10% TNA (small cap)

- 10% TMF (treasuries)

- 25% GLDM (gold)

- 15% O (Realty Income Corp, a REIT)

- 3% VIXM (volatility)

- 1% BITQ (crypto)

- 1% BITW (crypto)

Realty Income Corporation is a real estate investment trust that invests in free-standing, single-tenant commercial properties in the United States.

I can’t say I really understand this one.

- Frank expects it to match the S&P 500 with lower volatility, and he’s distributing 7% pa from it.

Conclusions

I’m not really into Lazy Portfolios, though I think they can work well for smaller portfolios.

- But it’s refreshing to see a Risk Parity approach to them, which focuses on decumulation.

Apart from the leverage concept (which I plan to approach in a different way, and which I will cover in a subsequent article), the element which stood out to me was the use of preferred stocks, which I need to investigate further.

- The use of crypto is also interesting, but I don’t think I can access those funds from the UK.

We’ve come across the other asset classes before.

The podcast itself is great, and I recommend it to those of you who like that format.

- Until next time.

IIRC, ERN talks about (and uses?) preferred stocks.