Reforming UK Share Ownership

It’s the day after the UK General Election, and I’m operating on a few hours sleep, so it’s a gentle post for today.

We’re going to look at a report published by ShareSoc back in February on how share ownership could be reformed in this country, in order to give private investors full shareholder rights.

Contents

ShareSoc is the UK Individual Shareholders Society, a non-

ShareSoc believes that the long-term decline in the UK of direct holdings of shares in favour of collective investment vehicles (mainly unit trusts / OEICs) has made investing more expensive (management charges) and has reduced corporate governance and shareholder democracy.

Nominee accounts

The key problem that the document aims to address is the almost universal adoption of nominee accounts. These are mandatory for ISAs and SIPPs, and are usually the only taxable share account offering for a new customer at most stockbrokers.

Under the nominee system, the broker is named in the company share register, and receives all communications from the company. Rights such as voting and attendance at AGMs is handled through the broker, by whatever system they devise. They may decide not to pass on the rights at all.

Nominees accounts have their uses (eg. “blind trusts” for politicians), but as currently constructed they are not ideal for private investors.

To be personally named on the share register, a private investor has two options:

- to use a personal Crest account (offered by few brokers)

- to use paper certificates (expensive, slow, insecure and about to be outlawed by the EU – the “Dematerialisation Requirement”)

Not being on the share register means that individual investors have no easy way to contact each other, and band together to form a single voice on important issues affecting the company.

In 2012, the government-sponsored Kay Review of Equity Markets recommended that “the Government should explore the most cost effective means for individual investors to hold shares directly on an electronic register.” This recommendation was accepted by the Government, but no proposals on how it should be adopted have been developed.

Meeting the Dematerialisation Requirement

There are three basic options under discussion:

- Personal Crest Accounts (PCAs) – these would needto be low-cost and widespread

- Corporate Nominee Accounts – like the existing broker nominee accounts, but held in the name of the Company itself and probably managed by aregistrar

- these have been used for large public share offerings in the past, but suffer all the same disadvantages from the perspective of the private investor as broker nominee accounts

- Name Register – this option was proposed in an industry Working Group paper called An Industry Proposed Model for Dematerialisation

- this is simply a low-cost electronic registration system for all holdings of all investors via all brokers

- brokers would need to be legally compelled to offer name register accounts under the same terms as nominee accounts

Systems aound the world

A Computershare/Georgson report compares the share registration systems around the world, looking at fourteen markets. They used three measures to rate the systems:

- Transparency – how effectively can companies identify their investors?

- Shareholder communications – how effectively is key corporate information communicated to investors?

- Shareholder voting – how effectively do voting processes on corporate matters operate?

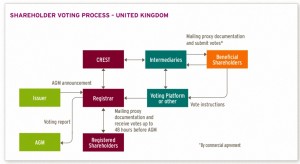

Here’s their model of the UK voting system:

Unfortunately the report draws no conclusions of the relative merits of the 14 systems.

Back to basics

ShareSoc note that all of the systems reviewed by Computershare have developed piecemeal from pre-existing

manual systems and company law. They would prefer the UK to go back to first principles and produce a simple system to support:

- Trade recording, clearance and settlement, with a proper audit trail.

- Handling of “corporate actions”.

- Information distribution to all investors.

- Electronic distribution of dividends.

- Shareholder rights to all investors (voting with audit trails, meeting attendance, information etc.)

- Shareholder democracy by providing electronic contact information for all investors.

The system should support all markets (eg. AIM) and ISA and SIPP accounts.

Multiple levels of beneficial owners

One potential difficulty is multiple layers of beneficial owners. A broker holding may be in the name of a foreign trust or company, which represents in turn multiple individuals or corporations. In the past this was often why nominees were used, to disguise who was the real beneficial owner.

Money laundering regulations now require the ultimate beneficial owner to disclosed to the share-issuing company, so this should no longer be a problem. Details could be withheld from the public record so long as the Company held the information.

ShareSoc make seven recommendations:

- A modern low-cost system of share registration for direct use by retail investors should be established

- This should be expedited

- Retail clients must be informed of their loss of rights under nominee accounts and offered a direct alternative (an opt-in)

- All nominee operators must provide options with full rights

- Tax-beneficial accounts (SIPPs and ISAs) must support direct holdings as well as nominees

- Low-cost communication to all beneficial holders of shares in a company should be possible

- The Companies Act should be revised to match the above recommendations

Conclusions

There’s not much to argue with here. More power to small shareholders would be a good thing, and ShareSoc’s recommendations are reasonable.

Perhaps it’s something that the new Tory-only government could take a look at. And perhaps they could get rid of stamp duty (at least on small transactions, say for less than £10K) at the same time.

Until next time.