Irregular Roundup, 12th December 2023

We begin today’s Weekly Roundup with NatWest.

NatWest

One of the less-expected announcements in the Autumn Statement was the plan to dispose of the Government’s 39% share of NatWest, which it has held since the 2008 financial crisis.

- The aspiration is to generate excitement on the scale of the “If you see Sid, tell him” campaign used to flog British Gas shares (to me, amongst many others) back in the 1980s.

More on the prospects for that plan below, but first, in his regular FT column, John Lee suggested that the shares could be used to trigger financial education.

Each of our 4,400 state secondary schools should be gifted, say, £5,000 worth of NatWest shares by the government, to be held for the long term. Each year, the question of what to do with the dividend of about £350 could be decided by avote among the pupils.

Alongside this, the government could create a small fund to cover the costs of approved individuals going into schools to help provide basic financial education.

It sounds nice, but the £22M cost of the first point might not educate as large a proportion of the school population as he hopes.

- My own experience in trying to teach finance leads me to believe that only a tiny proportion of people can ever grasp it, so most of that money would be wasted.

And much as I would like a slice of the second pie, John’s use of the word “approved” suggests that the usual suspects will be hoovering it up, again to little effect.

As for his own portfolio, John is optimistic:

I view the UK market as attractive and very undervalued — not only for high-yielding large-cap stocks but also for so many small-caps. With interest rates peaking and inflation heading down, my large-cap bloc [Aviva, Legal & General, M&G and Phoenix] is edging forward, but surely has some way to travel.

The news for the small-cap portion is all about takeovers – SCS, City Pubs and Hotel Chocolat.

Whenever I have available cash, in it [goes], topping up my holdings in Concurrent Technologies,Secure Trust, Vianet and VP.

He also remains hopeful for PZ Cussons (against all recent evidence) and for “super stock” Cerillion, which sells telecoms billing software.

Claer Barrett was sceptical that the Tell Sid campaign can be successfully cloned:

Even if the chancellor hired the best agency in ad land, he cannot get around the problem that investors can already buy shares in NatWest should they want to. This makes it much harder to whip up a frenzy about a future retail offer, unless the price is deeply discounted.

She also rightly points out that young people are more likely to want to invest in Netflix or Nvidoia than in NatWest.

- UK banks have dividends that are attractive to many older investors, but their UK focus is emblematic of the problems with the UK stock market – old, slow-growing firms in yesterday’s industry sectors.

You can tell Sid all you like, but he might not be very interested!

Claer welcomed the other bit of stock news in the Autumn Statement, that fractional shares will be allowed in ISAs.

- Many of the UK stocks the kids like are very expensive, and they often don’t have enough money to buy a full share.

I think that’s the universe’s way of telling them to buy funds instead, but established investment wisdom is old hat these days.

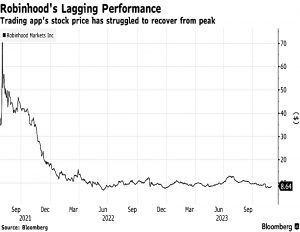

Robinhood

This brings us neatly to Robinhood (RH), the kind of share platform that young people favour.

- The company announced last week that it plans to try once more to launch in the UK.

A previous attempt was abandoned during Covid in 2020.

- There’s a waitlist right now, but trading of US stocks is expected to start in January 2024.

RH made its name in the US with options trading, but its reputation was battered during the Gamestop meme stock saga, during which it was accused of siding with the big bad hedge funds.

There are no plans to offer options (or ETFs or crypto) in the UK at present.

- Nor will there be an ISA to begin with.

Against that, it plans to offer commission-free trading, no FX charges and 5% interest on uninvested cash – so I have joined the list.

Vlad Tenev, co-founder and CEO, said:

We’d like to help lower fees for all customers in the UK, just like we did in the US back in 2019, right before Covid. The fact that we’ve built this platform from the ground up and we’re a technology company and financial services, not a brick and mortar institution, I think makes us more able to expand internationally in ways that traditional financial institutions can’t.

RH can’t use the sale of their order flow as a revenue stream in the UK, where it is banned.

The goal for the UK is to take advantage of all the other ways we have of generating revenue, sans payment for order flow. Because we’re leveraging the same platform that we have in the US that we’re building to be applicable globally, the incremental costs of servicing each new market should be low.

Tenev praised the government’s business tax cuts:

It’s clear that there’s a desire and there’s a plan to make the UK the best place for business. It’s a sophisticated customer base with a long history of being a financial hub. There’s definitely an embrace of technology and innovation that I think will make the UK

continue to be a great place to do business.

He also pointed to the high commissions charged by more traditional brokers like HL.

The re-launch also led to my discovery that RH rival Public.com launched over here in July, so I will take a look at them, too.

- They seem to offer a dollar-denominated account, so FX fees of 0.3% only apply on transfers in and out.

Crypto

HMRC has launched a campaign to encourage crypto investors to come forward and disclose their gains (and pay their taxes).

- They have introduced a separate disclosure process for tokens and NFTs.

Apparently, HMRC believes that crypto bros are not aware of the tax implications of their gambling/investing.

Only in exceptional circumstances will HMRC accept that buying and selling of crypto amounts to a trade for tax purposes.

This campaign is likely to be as successful as Tell Side Take Two.

HMRC has also signed a 48-country agreement – The Crypto-Asset Reporting Framework – to receive crypto data to combat criminals using these assets to evade tax.

- This won’t come into effect until 2027 however.

Treasury secretary Victoria Atkins said:

I am proud that the UK is once again demonstrating leadership on tackling global tax evasion, helping to secure the revenue that’s essential for the public services we all use. Wwe are sending out a strong message that we will not allow criminals to use crypto to

avoid paying their fair share.

Let’s see if crypto is still around in 2027.

LTA

Following the Autumn Statement, the Government has introduced a new Finance Bill which will formally abolish the Lifetime Allowance.

- For the current tax year, the LTA remains in place, but breaches will not be penalised.

The new bill also introduces the £268K limit on tax-free lump sums (for those who don’t already have pension protection).

Charlie Munger

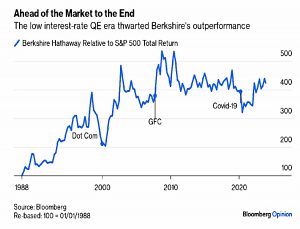

Since our last roundup was written, Charlie Munger died, and John Authers wrote about him in his Bloomberg newsletter, pointing out his influence on Buffett:

Buffett’s central skill, gained from studying under Benjamin Graham himself, was in classic value investing — finding companies that the market was undervaluing, and not worrying too much about whether they were great engines for growth.

Munger prodded him toward applying the Graham philosophy more broadly, to include good and widely recognized companies. Berkshire’slong-term stakes in branded goods companies like Coca-Cola & Co., Gillette, or Procter & Gamble Co. weren’t inconsistent with what Graham had taught, but they also weren’t the kind of stocks that a classic value investor would ever seek out.

Which led to the Buffett quote:

It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price.

The end result is that from 1965 to 2022, BRK returned 19.8% pa, double the 9.9% pa of the S&P 500.

The outperformance disappeared in the low-interest rate era after the 2008 financial crisis, when winning in the markets just required buying large-cap US (tech) stocks.

- But as well as economic conditions, BRK also had the disadvantage of huge size by then.

Clever investments in startups would make no difference to it. Many a great investor fell victim to the curse of size, perhaps most notoriously the Fidelity MagellanF und that made

Peter Lynch famous in the 1970s. It’s also notable that while Berkshire isn’t beating the S&P any more, it’s keeping up with it nicely, while keeping lots of cash and offering a smoother ride.

Munger and Buffett use a style/styles that is difficult for most of us to follow, and perhaps they would not have achieved such enormous success had they started from here.

- But they have inspired several generations of investors and their no-BS style is very welcome in an industry of very much BS.

RIP, Charlie.

Quick Links

I have four for you this week, the first two from The Economist:

- The Economist warned that Bashing hedge funds that trade Treasuries could cost taxpayers money

- And asked Who made millions trading the October 7th attacks?

- Alpha Architect looked at Diseconomies of Scale in Investing

- And Mauldin Economics looked at Fair Shares of Debt.

Until next time.