Time for a UK Wealth Tax?

Today’s post looks at a recent report from the LSE and the University of Warwick analysing whether we need a wealth tax in the UK.

Contents

Background

The report has been issued in the midst of the Covid-19 pandemic, the response to which is expected to push the UK’s debt-to-GDP ratio back up towards World War Two levels.

- The gap between revenues (from fewer employed people) and spending (on more unemployed people) will be closed in part by cheap borrowing (exploiting historically low interest rates and bond yields).

But new taxes might also form part of the mix, and according to the authors, a direct wealth tax (since we already have indirect taxes on wealth) could be one of them.

- It’s an initial rather than final report, so I don’t expect too much in the way of conclusions, but it includes some good data on wealth distribution.

Wealth trends

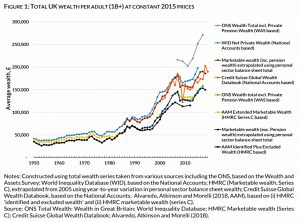

Private wealth after inflation has been rising since the 1950s, though different sources produce different results.

- Average wealth per person seems to be somewhere in the range of 6x to 10x the average salary, which doesn’t seem too horrific to me.

This chart would also look less impressive with a log scale.

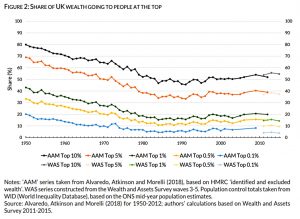

After falling sharply from 1950 to 1980, wealth concentration has begun to rise again, though things remain significantly better than in 1950.

Wealth levels

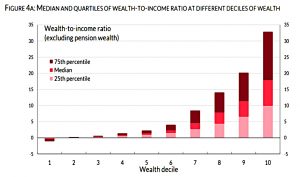

Wealth levels vary from less than 5x income for the bottom 70% of the population to around 15 times for the top decile.

- This is another misleading graph, since the lower quartile, median and upper quartile numbers are “stacked” – the central red band is the one to pay attention to.

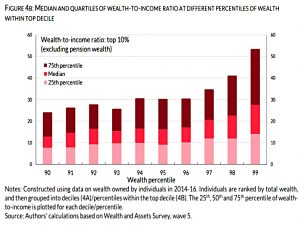

The top 1% has a median wealth of around 15x to 25x income.

- That such levels of wealth are seen as worrying had implications for the FIRE movement, and for investors on general.

The standard advice is that to retire, you need to save up 25x your income (a 4% withdrawal rate).

- I would personally suggest that you need 33x (a 3% SWR) – a level of wealth that not even the top 1% can claim.

I must say that I find these numbers somewhat low.

- This is presumably because the top 1% are dominated by captains of industry and by music and sports stars – all of whom will have very high incomes – rather than by DIY investors.

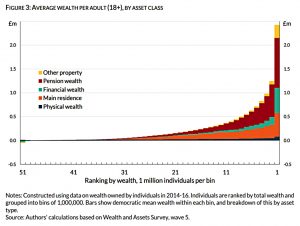

Asset classes

Property and pensions are the main sources of wealth, with other financial assets (ISAs and taxable accounts?) becoming significant for the very richest.

- This is another graph that might have benefited from a log scale.

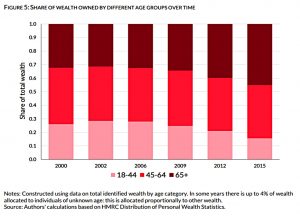

Age

Older people have become relatively wealthier in recent years, which is not surprising of the key sources of wealth are pensions and property.

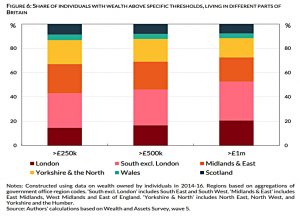

Geography

Wealth is also concentrated in London and the South (where the expensive houses, well-apid jobs and big pensions are).

Wealth taxes

There are three kinds of wealth taxes:

- On transfers of wealth (IHT on bequests and stamp duty on property and shares).

- On returns on wealth (capital gains tax, and income tax on dividends and savings interest).

- Direct wealth taxes – usually an annual levy on some or all asset classes, but sometimes a one-off levy.

The UK already has the first two taxes, and so the report is focused on the possible introduction of the third kind of tax (which we have never had, other than the recent tax on residential properties held within corporate structures (enveloped dwellings – ATED).

- Only Norway, Spain and Switzerland have such a direct wealth tax currently.

Six OECD countries have abolished their direct wealth tax in the last two decades, most recently France.

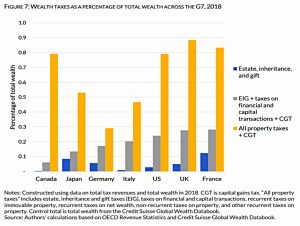

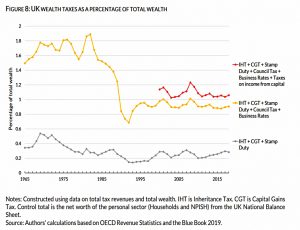

The UK already has the highest taxes on wealth within the G7 countries, at 0.88% pa.

- The authors note however that most of our property taxes (council tax and business rates) are paid by the occupier of the property, which is not always the owner.

- How much of this statutory incidence is transferred to an economic incidence on the owners (eg. through producing lower rents) is hard to calculate.

UK wealth taxes are somewhat lower than they were in the 1960s and 1970s before domestic rates were replaced by the community charge and then by council tax.

- The report claims that restoring taxes to 1960s levels could raise £76 bn pa in tax (though this ignores mitigation by the individuals targeted and the difficulties of taxing eg pensions, where a lot of the growth in wealth has occurred).

Scope

After subtracting any debts (including mortgages), there are two obvious exclusions from the asset base to which any wealth tax would be applied:

- Equity in your primary residence

- Pensions

I would also argue that products specifically designed and sanctioned by the government as tax shelters (primarily ISAs) should also be outside the tax.

- The problem with this approach is that as we have seen above, this is where the money is.

Certainly, the vast majority of my wealth would fall into those three categories.

Human capital – a person’s future earning capacity – is also almost certain to be ignored.

- This advantages the working over the retired, and the young over the old.

An alternative approach would be to use absolute wealth rather than products and assets.

- Using the withdrawal rate maths above, it’s easy to defend the accumulation of, say, £800K by an individual as protection into retirement.

Add in a house, and we can get to the nice round number of £1M of morally defensible assets for an individual, or £2M for a couple.

- In London, that might have to rise to £3M or £4M for a couple.

Anything above that might be plausibly described as “excess wealth”, but that doesn’t leave many people to aim at.

The report’s authors would like the wealth tax base to be the same as for IHT, which means that DB pensions would be excluded (as they cease on death) but DC pensions would be included.

Public opinion

According to YouGov polls from 2019 and 2020:

- 69% feel that wealth should be taxed as much as income

- 52% would support a tax on assets above £750K plus an average home (so, say £1M in total) and excluding pensions

- 61% would support a tax on assets above £750K, other than homes and pensions

That sounds like the £2M to £3M range of exclusions (per couple) discussed above.

Objectives

Two common objectives of a wealth tax (for those on the left) are to reduce inequality and to specifically reduce generational inequality.

- It should be noted that depending on implementation (and payee mitigation) a wealth tax need not achieve either of these goals.

There are, of course, more direct ways of achieving these goals, should a political party wish to base a manifesto around them.

Implementation

Implementation of wealth taxes is not straightforward since the prime targets (the richest in society) are the most mobile.

- International coordination might help, but international competition is more common (see the corporate taxation of the US tech giants for more detail).

This could be fixed by some approach similar to that of the US, which pursues its citizens around the globe for taxes as if they were still resident, but this would be hard to defend morally.

Its also the case that not all of those with assets are generating significant income from them, and so finding the liquidity to pay the tax might be problematic.

There are also valuation issues – the valuation of many assets is subjective and expensive.

The taxation of trusts (and indeed, shares in non-listed companies) would also be complicated (and would raise issues of double taxation).

Conclusions

My primary objection to a wealth tax is a moral one – like IHT, it’s double taxation of money that has already been taxed (as income).

- It’s true that VAT is the same thing, but to a large extent, you can choose your level of spending and hence your annual VAT bill.

It also falls unfairly on the old and those living in the South.

From an investor perspective, there are two issues, one reputation and one seriously practical:

- The levels of wealth needed to achieve financial independence (33x income, or £1M to £2M) are apparently seen as excessive and not morally defensible

- The likely future real returns on a diversified portfolio are in the region of 3% pa at the moment.

- A 1% pa wealth tax would in effect be a 33% tax on those returns.

Investors would need to target a pot some 50% larger than at present.

- Alternatively, they might relocate to a jurisdiction without a wealth tax.

Which brings me to my third objection:

- A wealth tax would be hard to implement and is unlikely to be effective since – as other countries have usually found – the people who are supposed to pay it will go and live somewhere else.

So at this stage, it’s a no from me, Simon – though we’ll take a look at the final report (due in December 2020).

- Until next time.