Weekly Roundup, 6th July 2020

We begin today’s Weekly Roundup in the FT with Merryn Somerset Webb, who was hailing a V-shaped recovery.

V-Shape

Merryn’s evidence for the V-shaped recovery began with the crowded beaches of the south coast and the US, which she sees as a symbol of pent-up demand.

- She also quotes rising pollution and public transport and car use.

It’s certainly the case that the generous furlough arrangements provided by governments on both sides of the Atlantic mean that a lot of people have more spare cash than three months ago.

- But some things (especially food and drink, but also haircuts) don’t really go with “pent-up” – you can’t buy three haircuts to catch up on the two you missed, or eat out 25 times to catch up on your 3-month backlog.

Nor have the original services been restored – haircuts and art galleries which required mask-wearing don’t hold the same attraction as the mask-free versions of February.

- And the risk of a second wave of infections – and/or a wall of job losses when the furlough arrangements cease – will be with us for at least the rest of the year.

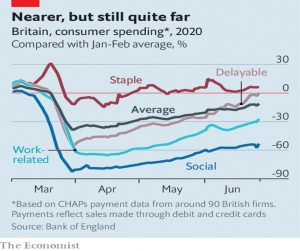

The Economist was less bullish than Merryn.

- It noted that Andy Haldane of the BoE is optimistic, but that many disagree.

Haldane said:

It is early days, but my reading of the evidence is so far, so V.

He was mostly looking to payment data, which shows a decent recovery so far.

- But the threat of unemployment may lead to more precautionary saving from here, and the data so far might be flattered by the infection-driven move away from cash.

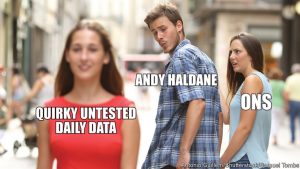

Here’s a good Twitter response (from Samuel Tombs of Pantheon Macroeconomics):

Making up that last 10% might be harder than some people think.

HL Wealth 50

The Hargreaves Lansdown (HL) Wealth 50 (formerly the Wealth 150) has been renamed to the Wealth Shortlist – and extended to 67 funds.

- The list was in the papers this week for still excluding Fundsmith and Scottish Mortgage.

The original row with Terry Smith was over his refusal to offer a discount to HL customers.

- Ironically, 12 of the 17 recently added funds do not have a discount – yet Fundsmith is still missing.

HL’s lists have always struck me as too commercially-driven as has the platform in general.

- For example, for a long time, they ignored ITs in favour of higher-paying OIECs.

- And they also offered support to Woodford long after his period of outperformance was over.

I was a big fan when they launched, but over 25 years they drifted from the best option in the market to one of the most expensive.

I also tired of the “glossy magazine” infrastructure around the OIEC ecosystem – there’s always a fund available for whatever emotional reaction the market is eliciting this month.

- They used to the platform where I held more money than any other, but by the start of this year, they were down to number seven.

Today I want to pick up on a report I spotted a few weeks ago, courtesy of David Stevenson – the Adventurous Investor.

- It’s a review of the old Wealth 50 by research firm Yodelar.

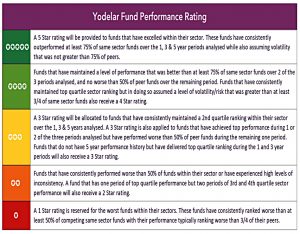

The first table shows how Yodelar classifies funds.

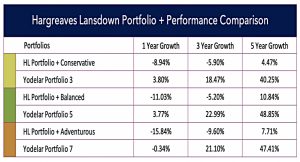

The second chart gives the ratings for the Wealth 50.

- 43% of funds have underperformed.

In fact, across all the ratings, the list looks pretty much like a random selection of funds.

HL’s in-house “multi-manager” funds do even worse.

- 8 out of 10 have performed below their sector averages.

HL’s Portfolio+ offering – a set of “robo-portfolios” constructed entirely from the multi-manager funds have not surprisingly massively underperformed their Yodelar equivalents.

- The moral of the story is – be careful where you source your fund shortlists from.

Our own lists can be found in the footer of this page, under Stock & Fund Lists.

Pandemic resource allocation

The Economist examined the likely impact of the pandemic on resource allocation.

- The increased production of ventilators in 1H20 is likely to fall below pre-pandemic levels (since more people now have more than they need), but growth in online shopping, learning and medicine might be here to stay.

One new study looked at a monthly survey of business uncertainty from January to April and concluded that 42% of lay-offs will be permanent.

- Upfront (an online labour exchange) reported that 62% of hiring managers also expect their workforce to be more remote in future.

The study also examined equity return dispersion, which in March reached dot come and financial crisis levels.

- As we have all noticed by now, tech products and services and pizza-delivery firms are doing much batter than miners (and travel and hospitality).

Differential movements in share prices provide a gauge of market sentiment about firms’ prospects. As a higher stock price makes it easier for companies to raise funds in order to expand, they also represent a mechanism by which capital flows from endangered firms to flourishing ones.

Superficially more interesting is the fact than when the analysis is extended back in time, the differential performance began in 2014 and accelerated in 2019 (pre-virus).

- In reality, this just reflects the long-standing bull market in tech stocks.

The data from the options market is also relevant:

Investors seem to have become steadily more cognisant of the risk of disasters. Options prices imply that over the next two years investors require a far higher expected return in order to accept exposure to vulnerable firms than to more disaster-resilient ones.

The difficult question is whether to keep struggling companies (and the jobs within them) afloat.

[The paper’s authors] warn that generous support could prove counterproductive, since it might discourage workers from seeking new jobs in expanding sectors. But withdraw stimulus too soon and the economy could remain mired in a slump, retarding the growth of frontier industries.

Negative rates

The Economist was also sceptical about the effectiveness of potential negative interest rates from the Fed.

- Japan and the Eurozone have had negative rates for some time, but the US and UK have resisted up to now.

Trump is in favour of the Fed using them, and signals from the derivatives markets suggest that they are a possibility.

- But Fed chairman Jay Powell says that negative rates are not “appropriate or useful”.

Based on inflation and the estimated slack in the economy, rates should have been negative for years (as low as -3% in the US in 2014 and -6.5% in the UK in 2014).

- But how to implement such rates, when bank customers can just stuff cash (paying an effective zero rate) under the mattress.

This is known as the “zero lower bound” problem.

- But since cash is difficult and costly to protect, modestly below-zero rates have been possible in Europe and Japan.

Ken Rogoff has suggested that fees on large transfers and the abolition of large demonstration notes would allow rates to be pushed even lower.

A second problem is that negative rates lower the value of banks’ own deposits (at the central bank).

- If banks can’t pass negative rates on in their entirety to their customers, their margins are squeezed and they may decide to lend less.

Thus there may exist a “reversal rate” below which interest rate cuts weaken demand.

- In practice, eurozone lending has increased since negative rates were imposed (but that could be in response to increased demand, or might just mean that the reversal rate is lower than -0.5%).

The newspaper concludes that another half a per cent of easing (which would take UK rates negative) would probably not have a significant enough effect to be worth the risks.

- And regulatory changes to enable seriously negative rates would be politically difficult.

Fiscal stimulus and further central-bank asset purchases is a better way forward.

Perpetual bonds

Buttonwood looked at perpetual bonds – bonds which cannot be redeemed – starting with Jane Austen.

- Darcy, the hero of Pride and Prejudice is famous for his annual income of £10K (from land in Derbyshire) – income counted for more than net worth in those days.

The book is set soon after the Napoleonic wars, financed by perpetuals called Consols.

- Now some Italian academics – supported by George Soros – have suggested that the euro-zone should issue a perpetual bond.

Governments have two goals when they issue public debt:

- Low costs (to them), which suggests short-term paper (with generally lower interest rates), and

- Stable and predictable costs (to them), which suggests long-term bonds.

Consols can achieve both.

Buttonwood quotes John Cochrane’s 2015 paper which suggests that the US needs only two bonds:

- One with a fixed value of $1 and a floating coupon, and

- One with a fixed coupon of $1 (inflation-protected) and a floating market price.

The fixed-value, floating-rate bond would meet the need for a safe, trusted and highly liquid security. The fixed-coupon security would have the character of long-term debt.

Since all perpetual bonds are identical, the switch to consols would also solve the growing problem of illiquidity in many bond issues.

- And the fixed coupon bond would be ideal for pension funds for matching of long-term liabilities.

Of course, irredeemable bonds carry a lot of credit (counterparty) risk, so they would be more suitable for the US, UK and Switzerland than for, say, Argentina.

- Since Germany would carry the can for Europe, I doubt that the EU console will get off the ground.

But it’s an interesting idea, and I hope that somebody tries it.

Quick Links

I have nine for you this week. The first four are from Alpha Architect and the next three from The Economist:

- Alpha Architect wrote about combining Momentum with Long-Term Reversal

- And about using Momentum to diversify Value Portfolios

- And about Time Series Momentum in general

- And about the impact of Trend Following on Return Distributions

- The Economist said that Facebook will weather its advertising boycott

- And that hydrogen power might at last bear fruit

- And explained why Games Workshop is worth more than M&S and Centrica

- Musing in Markets provided Viral update XI on the Flexibility Premium,

- And ERN gave his thoughts on the Passive Investing Bubble.

Until next time.