Warren Buffett’s Annual Letters – 2011

Today we’re going to look at another of Warren Buffett’s Annual Letters, this time covering 2011.

Contents

Buffett’s Annual Letters

We’ve previously looked at Warren Buffett’s letters that cover 2014, 2013 and 2012. Today we’ll examine the 2011 letter, which was published in 2012.

I won’t repeat anything that we’ve come across before – there is always a lot of overlap between the letters.

Performance

From 1965 to 2011, Berkshire Hathaway (BH) performance was as follows:

- Compounded annual gain:

- in BH book value per share: 19.8%

- in S&P 500 (dividends included): 9.2%

- difference in the two (BH excess gain): 10.6%

- Total gain for the period:

- in BH book value per share: 5,130 times

- in S&P 500 (dividends included): 64 times

Note that the BH share price isn’t being used as a performance measure.

The 4.6% gain for BH was much smaller than usual, but still ahead of S&P 500 (up 2.1%). No absolute figure (ie. in dollar terms) was provided for the 2011 gain.

2011 events

- Two investment managers – Todd Combs and Ted Wechler – joined BH. Each will run a few billion dollars in 2012, but the plan is for them to manage the whole portfolio when Warren and Charlie are no longer around.

- A successor to Warren as CEO has been selected (but not named) and there are two “superb” back-up candidates as well.

- BH acquired Lubrizol, a global producer of additives and specialty chemicals. Many opportunities for “bolt-on” acquisitions are expected in this area, and three have been found already, at a total cost of $493M.

- Earnings from the “fabulous five” largest non-insurance companies (which included Lubrizol) reached $9 bn, and were expected to top $10 bn in 2012.

- BH invested $8.2 bn in property, plant and equipment – more than $2 bn higher than the previous annual record. Ninety-five per cent of this was in the US.

- The insurance business produced their ninth consecutive year of underwriting profits, totaling $17 billion over the period. During the same period the insurance float has increased from $41 bn to $70 bn.

- BH made two major investments:

- $5 bn of 6% preferred stock from Bank of America, which included warrants allowing BH to buy 700M common shares at $7.14 before September 2, 2021; and

- 63.9M shares of IBM for $10.9 bn.

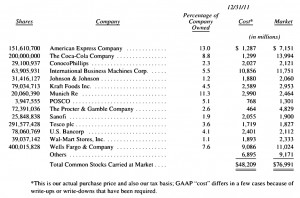

- BH now owns 13.0% of American Express, 8.8% of Coca-Cola, 5.5% of IBM and 7.6% of Wells Fargo.

- $2 bn invested in bond issues of Energy Future Holdings, a Texas electric utility, has turned out to be a big mistake:

- the company’s prospects were tied to the price of natural gas, which tanked shortly after the purchase

- annuall interest payments of $102M have been received up to now, but the company is almost out of cash

- the investment was written down by $1 bn in 2010 and by another $390 M in 2011

- the bonds have a market value of $878M, but continued weakness in gas prices may wipe out all of this

- Three large fixed-income investments were redeemed by Swiss Re, Goldman Sachs and General Electric. BH received $12.8 bn but lost an ongoing $1.2 billion of earnings.

- Warren’s prediction of a US housing recovery turned out to be wrong. BH has five business affected by this:

- the largest is Clayton Homes, the leading builder of homes in the country, with a 7% share

- Acme Brick, Shaw (carpets), Johns Manville (insulation) and MiTek (building products, mostly roof connector plates) are the others

- profits across the five firms were flat at $513M, down from $1.8 bn in 2006

- Warren still expects the market to recover, as households are now forming more quickly than homes are being built

- BH bought back $67M of its stock at prices up to 110% of book value – well below intrinsic value

- more stock will be bought whenever it is priced attractively and BH has more than $20 bn in cash

Stock prices

Warren explained that when BH buys stock in a company that is repurchasing shares, he hopes for two things:

- that earnings will increase

- that the stock underperforms the market

He used IBM as an example:

- IBM has 1.16 bn shares outstanding, of which BH own about 63.9M or 5.5%

- over the next five years IBM will likely spend $50 bn to repurchase shares

- BH want IBM’s stock price “to languish throughout the five years”

If the stock price averages $200, IBM will buy 250M shares with its $50bn. There would then by 910 million shares outstanding, and the BH hold would increase to 7%.

If the stock averages $300, IBM would only purchase 167M shares. That would leave 990M shares outstanding and the BH share would be 6.5%.

If IBM earns $20 bn in the fifth year, BH’s share of those earnings is $100M greater with the low share price than with the high one.

If you plan to be a net buyer of shares in the future, you want them to be at low prices as you buy them.

Insurance

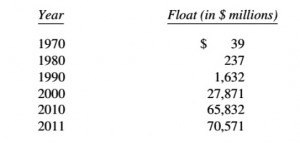

The insurance float has grown once more:

The float is now large relative to the premium volume of BH’s insurance businesses, and Warren doesn’t expect it to grow much from here. It may decline, but very gradually, and should not require a material amount of funds from BH.

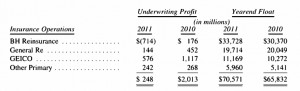

The insurance businesses generated an underwriting profit for the ninth year running.

In calculating the BH book value, the $70.6bn float is deducted as a liability. Warren views it as a revolving fund with no long-term cost (since BH usually makes an underwriting profit), and it should therefore act as a much smaller liability.

$15.5 bn of the liability is offset by a “goodwill” asset based on the purchase price of acquired insurance businesses. Warren feels that this goodwill is undervalued, since it would cost much more than this to buy an insurance float of the size and quality of BH’s in particular. ((Warren feels that there is not much”Berkshire-quality” float in the industry))

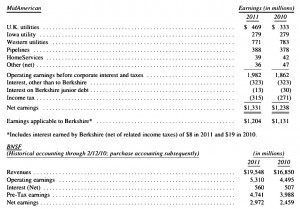

Regulated, Capital-Intensive businesses

As previously noted, BNSF (a railroad) and Mid American Energy invest heavily in long-life, regulated assets and have large amounts of long-term debt which does not need to be guaranteed by BH.

The book value of these business includes goodwill totaling $20 bn. Warren and Charlie believe that the intrinsic value is far greater than book value.

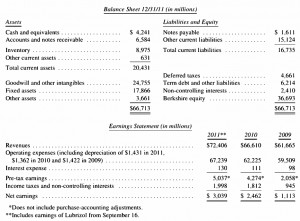

Manufacturing, Service and Retail

These figures are non-GAAP and exclude amortization of intangibles; Warren and Charlie believe this more accurately reflects the expenses and profits of the businesses.

Returns on these businesses vary widely. Warren went into some detail on why BH doesn’t sell its laggards, which Warren believes mostly lag because of industry factors rather than managerial shortcomings.

More importantly, BH makes a commitment to the people it buys businesses from that it will retain those firms through thick and thin. Warren believes the cost of this policy is outweighed by the goodwill it builds amongst future prospective sellers.

BH will sell only under two conditions:

- the business is likely to be a long-term cash drain

- it is strike-prone

This has only happened a couple of times in the 47 years of BH.

Financials

This is the smallest section of the BH breakdown, and includes rentals of trailers (XTRA) and furniture (CORT) plus Clayton Homes – the US’s largest home builder – and it’s $13.7bn mortgage portfolio.

For the first time in the letters we have looked at, there are no financial tables for this section. This may reflect the continuing lack of a recovery in the housing sector.

Warren states that the intrinsic value of the three businesses is not materially different from their book value.

Investments

As usual, the table below lists only investments with a year-end market value of greater than $1 bn.

The major changes were:

- buying IBM

- buying Bank of America

- buying another $1 bn of Wells Fargo

Todd Combs has built a $1.75 bn portfolio during 2011, and Ted Weschler will do the same during 2012.

Derivatives portfolio

There is little news on the derivatives portfolio, other than a rule change. BH’s existing positions required little collateral, but any new positions would.

Consequently, we will not be initiating any major derivatives positions.

The insurance-like derivatives contracts, where BH pays out if certain high-yield bonds default, are coming to an end. Those with most exposure have already expired.

In 2011 BH paid out $86M, bringing total payments to $2.6 bn. The initial premiums were $3.4 bn, and a final profit is expected. The contracts have also provided an average float of $2 bn over their five-year life.

The choices for investors

To conclude the letter, Warren went through the options available to investors, and the approach favoured at BH.

To begin with, a couple of over-arching principles:

Investing is the transfer to others of purchasing power now with the reasoned expectation of receiving more purchasing power – after taxes have been paid on nominal gains – in the future.

In other words, we forego consumption now in order to have the ability to consume more later.

Risk is not beta (volatility relative to the market) but rather the probability of an investment causing its owner a loss of purchasing-power over his contemplated holding period.

Prices can fluctuate greatly, but so long as an asset is likely to deliver increased purchasing power in the end, it’s not risky. Similarly, non-fluctuating assets can very risky.

There are three kinds of investment.

The first is “safe”, currency-based investments – money-market funds, bonds, mortgages, bank deposits

- they have zero beta, but are very risky

- they regularly destroy purchasing power, often because they fail to grow with inflation

The dollar has fallen 86% since 1965, when Warren took over BH. It now takes $7 to buy what $1 did then. An investor would need 4.3% pa after tax just to stand still; taxable investments would need to yield even more.

Current interest rates do not come close to offsetting the purchasing-power risk that investors assume. Bonds should come with a warning label.

Bonds promoted as offering risk-free returns are now priced to deliver return-free risk. (Shelby Cullom Davis)

BH still holds lots of short-term currency-based investments (mostly T-bills), simply for liquidity. They aim to have $10 bn to $20 bn of “cash”.

Outside this, BH will buy only when something is mispriced (eg. periodic junk-bond crises) rates rise high enough that there will be capital gains on high-grade bonds when rates eventually fall.

The second kind of investment is the “greater fool” investment.

These are things that will never produce anything, but which the buyer hopes that he can sell on to someone else for more money than he paid. Tulips in the 17th century are a famous example.

This is usually a misguided form of momentum investing, where the pool of buyers expands as news of rising prices spreads. ((Note that momentum investing can be very successful in the stock market over a period of months to years))

The current major asset of this type is gold. Gold has some industrial and decorative uses, but supply exceeds this demand. Gold fans dislike other assets, particularly paper money (correctly in Warren’s view).

Previous recent examples include internet stocks and houses.

The world’s gold stock (at the time of Warren’s letter) is about 170,000 metric tons – a cube 68 feet on each side. At the current price of $1,750 per ounce, it is worth $9.6 trn.

This would pay for:

- all U.S. cropland (400 million acres with output of about $200 billion annually),

- plus 16 Exxon Mobils (the world’s most profitable company at the time, with annual earnings of $40 bn)

- and $1 trn “walking-around money”

Who would buy gold instead?

Beyond the non-sensical valuation, Warren points out that annual production of $160 bn must be absorbed to support the price.

The third kind of investment is in productive assets: businesses, farms and real estate.

These should be able to retain their purchasing-power through periods of inflation while delivering output each year and requiring a minimum of new capital investment.

Firms like regulated utilities are less preferred on this analysis, since they will have large capital requirements, particularly during periods of inflation. They are still better than the other two classes of asset, though.

Over any extended period of time this category of investing [productive assets] will prove to be the runaway winner … more important, it will be by far the safest.

Some quotes to end with

It’s not what you look at that matters, it’s what you see. (Thoreau)

What the wise man does in the beginning, the fool does in the end. (Proverb)

The quotable statements from Warren himself have already been included in the main text above.

Lessons for BH

- When BH buys stock in a company that is repurchasing shares, they hope for two things:

- that earnings will increase

- that the stock underperforms the market

- BH will not be initiating any major derivatives positions, because of the requirements for collateral

- BH will sell firms only under two conditions:

- the business is likely to be a long-term cash drain

- it is strike-prone

Lessons for the private investor

Until the section on investment at the end, this year’s letter was not looking promising. But that part has saved the day.

- If you plan to be a net buyer of shares in the future, you want them to be at low prices as you buy them.

- Investing involves forgoing consumption (purchasing power) now, so as to have the ability to consume more later (to have greater purchasing power) in the future.

- Risk is not beta / volatility, it is the chance that purchasing power might be destroyed.

- There are three kinds of investment:

- currency-based investments

- “greater fool” investments

- productive assets

- Don’t buy “greater fool” investments ((I personally believe that momentum trading works, but the general point stands))

- Only buy currency-based investments when they are mispriced (junk-bond crisis) or when interest rates rise high enough to lead to capital gains on high-grade bonds when rates eventually fall.

- Productive assets will retain their purchasing-power through periods of inflation

- they are the best investments and the safest.

Until next time.

This post is one of a series on the Warren Buffet Annual Letters. To read the other summaries, go to the Warren Buffet Quotes and Annual Letters page.