Weekly Roundup, 18th December 2018

We start today’s Weekly Roundup in the FT with Merryn Somerset Webb, who thinks that the UK market is cheap.

Contents

UK is cheap

It’s a thin roundup this week, as many people seem to be in Christmas mode already.

Merryn thinks that Brexit fears mean that the UK market is cheap.

Thanks to the “long dark shadow” of Brexit, UK investor confidence is now lower than it was even in the depths of the financial crisis, a time when the entire global economy was genuinely threatened with implosion.

An index from HL is now at 52, compared to a low 61 during the 2008 crisis, and an average over the last ten years of 94.

Bestinvest reports that eight of the most popular 10 funds with UK investors and the other two are internationally rather than domestically focused UK funds.

Merryn also notes the high yield of the UK stock market:

The UK market is currently yielding 4.9%, which is more than inflation and much more than all other developed markets. While you might have to wait for some of the value in the market to be realised, you will at least be paid for that wait.

Prepare for a bear

By way of contrast, Simon Edelsten from Artemis warned us to prepare for a bear market.

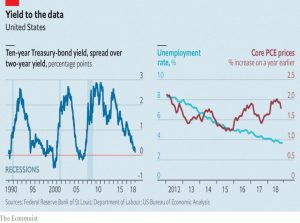

- He’s talking of course about the flattening US yield curve.

It’s the best indicator of an oncoming recession. If the measure turns negative, this suggests an economic slowdown is approaching in which inflation will fall, and the Fed will have to cut rates. A yield curve inversion has preceded every recession in the US since the second world war.

It should be noted that there have also been inversions that weren’t followed by a recession.

Simon looks back at the five big crashes of the past century (two were before my time as an investor) for “portents of doom”:

- high levels of borrowing and high personal debt combined with lax banking regulation and rapid growth in the money supply (2008)

- high valuations (2000, 1987, 1929)

- yield gap – equities had a lower yield than gilts (1973)

Bull markets do not die of old age but, usually, from debt and shocks. At the time of writing, debt is less of an issue than it has been historically.

But there’s plenty of scope for shocks – the trade war, the return of inflation and possibly the breakup of the euro.

Simon notes that the S&P 500 usually continues to rise after an inversion, and that the signalled recession usually arrives around 21 months later.

- The greater level of Central Bank control of the bond market (via QE etc) also means that inversion might not be the signal that it used to be.

Simon suggest getting of big winners in portfolios that are now on stretched valuations.

Property tax cuts

Emma Agyemang warned landlords to plan now in order to beat the chancellor’s property tax relief cuts.

- The “final exemption period” – a CGT holiday – is being cut from 18 months to 9 in April 2020 (having been cut from 36 months in 2014).

- Lettings relief (of £80K for a married couple) is being restricted to landlords who are in “shared occupancy” with their tenant.

Family offices

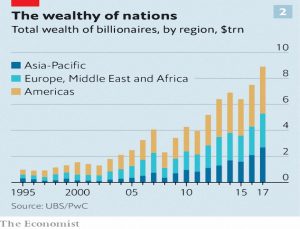

The Economist had two articles on how the rich invest, using family offices.

Largely unnoticed, family offices have become a force in investing, with up to $4trn of assets—more than hedge funds and equivalent to 6% of the value of the world’s stock markets.

Somewhere between 5,000 and 10,000 are based in America and Europe and in Asian hubs such as Singapore and Hong Kong. They generally make sense only for those worth over $100m, the top 0.001% of the global pile

The most interesting part for me was the breakdown of the average family office portfolio, based on 311 responses to a UBS survey earlier this year.

- 23% cash and bonds (7% cash, 16% bonds)

- 28% listed stocks

- 22% private equity

- 18% property

- 6% hedge funds

- 3% commodities

Not a bad spread.

Fed policy

The newspaper thinks that the Fed needs a new strategy for 2019.

Mr Powell is rooting around for a doctrine because the one he inherited when he took over the job in February, which calls for monetary policy to tighten roughly once a quarter, is becoming obsolete.

As the horizon darkens, rate rises will need weightier justification than an inflation risk that has been perennially exaggerated. The central bank has a record of dangerous complacency late in economic cycles.

The Economist would like to see a rate rise at the December 19th meeting of the Fed, but also a signal that there will be a change of direction in 2019 (no more raises).

Productivity

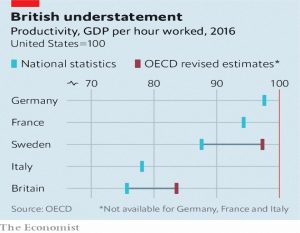

The Economist also reported on a new study which suggests that British productivity might not be as bad as it looks.

- From 1950 to 2007, UK productivity increases averaged 2.5% pa.

- From 2010 to 2016 the average was 0.2%.

UK productivity is also usually held to be much lower than say in France.

But it turns out that other countries make adjustments for the tendency of workers to underestimate their holidays.

- France marks down the numbers by close to 20%, boosting apparent productivity.

The OECD has produced revised figures for various countries.

- UK productivity is up 10%, putting it above Italy and halving the shortfall to France.

Growth is still slow, but now reaches 1% pa since 2010.

- This is a good match for real wage increases, which have just reached 1.1%.

Timing the market

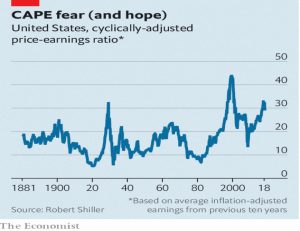

Buttonwood looked at the perils of trying to time the market.

Whilst measures of fair value like the CAPE seem promising, investors often sell too early, missing out on the large late gains.

- They then have to find the nerve to buy stocks when everyone else is panic-selling them.

A 2017 study by AQR found than since 1958, market timing using the current CAPE against a rolling 60-year average didn’t out-perform buy and hold.

- The main problem was that CAPE has trended higher since the 1950s, which meant that the strategy was out of stocks for too much of the time.

Combining the “value” of CAPE with a momentum signal works better.

A simpler approach for private investors is annual rebalancing back to a fixed asset allocation.

- This is another form of value plus momentum.

Quick links

I have five for you this week:

- Alpha Architect reported that ETFs have not screwed up correlations, liquidity or alpha.

- Mauldin Economics said that the flattening yield curve is misunderstood.

- The Economist reported that PayPal is thriving.

- And that time-tested ways of holding business to account are crumbling.

- The Times said that devaluation is the drug that Britain can’t kick.

Until next time.