Weekly Roundup, 16th August 2016

We begin today’s weekly roundup in the FT, where Claer Barrett looked at the proposed reforms to the consumer banking market.

Contents

Open banking

After a two-year review, the UK competition authorities have proposed something called Open Banking, which they hope to have in place by summer 2018.

- UK consumers are notoriously loathe to change banks, even when there is a better – if confusing – offer on the table, and a bribe of up to £150 to make the switch.

The idea of Open Banking is that all banks will have to allow you to share your data with financial apps which both make it easier to manage your finances, and also to switch providers.

- The apps will come with built-in “nudges” to help people behave better financially.

- And once they learn your spending habits, they will be able to recommend the best account for you, as well as transfer cash between accounts to avoid overdraft charges.

Similar apps (such as Money Dashboard) currently exist, but they require people to manually share their usernames and passwords, which puts most people off.

- The hope is that if the data had already been exchanged in the background, people will have nothing to lose by taking advantage of the service.

It’s not a bad idea, especially if it helps people to budget properly so that they have money left over at the end of each month which they can save towards their retirement.

- But only 56% of Britons bank online, and the services have been around long enough to suggest that the other 44% are unlikely to develop a sudden enthusiasm.

- And there will be security concerns to begin with.

Trust

Tim Harford wrote about trust.

- He quotes Steve Knack – an economist at the World Bank – as saying that trust “would explain basically all the difference in per capita income between the US and Somalia.”

In low-trust societies, people spend all their time guarding what they’ve got, and they don’t take complicated risks that involve the future.

- There’s a feedback loop in the other direction, too – in a rich country, most people are too well-off to see stealing as the way forward.

Tim also quotes Colin Turnbull’s study of the Ik, a Ugandan tribe displaced by drought in the 1960s.

With no future to look forward too, the Ik had no reputation to defend.

“Parents would abandon their own children and children betray their own parents.”

In modern society, the “circle of trust” has been extended and depersonalised, mostly through the much maligned banking system.

- The best example is the credit card, which means that you are good for a small debt in almost any corner of the globe.

In recent times, review-based services like Uber and AirBnB have developed. ((In fact this system was pioneered by eBay more than two decades ago ))

- Here users rate the service to keep providers honest.

- Providers also rate the users.

The next problem is to transfer credit from one system (say Uber) to another (say AirBnB).

- Cynics think that any such system would be manipulated by con-men , and that the reason the current systems work is that most people aren’t crooks.

Tim also notes that trust is not fairly distributed – even on AirBnB, both hosts and guests discriminate against groups they don’t like.

- It will take more than an online rating system to fix that problem.

Record highs in US stocks

Also in the FT, John Authers looked at record highs in the US stock indices.

- The last time the S&P 500, the Dow and the Nasdaq were each at all-time highs was in the dot-com boom.

On a total return basis, the S&P has doubled since 2000.

- But if we subtract inflation, the total return falls from 100% to 40%, and the index was still below its 2000 peak in 2011.

Against bonds, things look even worse – the S&P 500 has under-performed by 50% since 2000.

So are stocks expensive or cheap?

- John’s answer is that they are expensive on almost all sensible historical measures, but cheap compared to bonds.

The sting in the tail is that the high price of bonds is supporting the less high price of stocks.

P2P fund returns

Over in MoneyWeek, David Stevenson looked at the poor recent returns from P2P funds.

- Most of these funds promised to return 6% to 10% pa, but they are falling short.

VPC Speciality Lending has returned 1.5% for the 1H2016, and 7.3% since listing in March 2015.

- It also appears to be changing strategy, investing more in balance sheet lenders – like Borro and Avant – than in the better-known marketplace lenders (Zopa and Lending Club).

- Balance sheet lenders invest alongside investors, sharing risk rather than acting as middlemen.

- The switch suggests that VPC is preparing for defaults.

P2P Global Investments – the biggest fund in the sector – returned only 1.08% in 2Q2016.

- It also has 20% of the portfolio (36% of net assets) still in cash.

- P2PGI’s share price has also fallen by 13% over the last quarter.

David still thinks that the sector will do well, once investors realise that interest rates could remain low for decades to come.

- And a rise in defaults might kill off some of the weaker lenders, leaving the remainder in a stronger position.

Triple lock

Chris Dillow argued in support of the triple lock on the state pension, which has come under fire from the ex-pensions minister Baroness Altmann, and from the Inter-Generational Foundation.

- Until 2020 at least, the state pension will increase each year by the highest of inflation (CPI), earnings or 2.5%.

The first argument against it is the inter-generational one.

- Chris rejects the idea that it favours the old, since they will only benefit from a few years of gains.

- If the lock is maintained, today’s young will have decades of growth to look forward to.

The second way this argument is expressed is that young people are paying twice.

- They are funding their own private pensions (through workplace auto-enrolment)

- as well as cashflowing the state pension scheme for those already over 65.

So that would be exactly the same situation as everyone else who has passed through the pension system.

Chris sees the triple lock as “creeping nationalisation” of pension provision – shifting the burden from the individual to the state.

- Since the current jobs and housing markets offer fewer opportunities for people to make and save enough for themselves, this is probably a good thing.

- It also protects people from themselves, and in particular their psychological biases which might make them save too little or too much.

- And it insures people against market risk.

Nor is it expensive, or more precisely, it’s not more expensive than the alternative.

- With interest rates (and therefore annuity rates) at record lows, all pension provision is expensive.

- State funding is probably cheaper, since it can sidestep the high management charges of private pensions.

- The government can also borrow at record low rates, and if growth doesn’t return in the future, it can make money on the bonds it issues instead.

I also think we should consider the absolute level of the pension.

- The triple lock was brought in to counter decades of shrinkage in the state pension from the 1960s, and the UK still has one of the lowest pensions in the civilised world.

I bring the argument back once more to a comparison between the minimum wage (now £13K), the benefits cap (£23K in London, £20K elsewhere) and the state pension (£8K).

- Is the state pension really too high?

Term funding

The Economist had more on the term funding scheme (TFS) announced by the Bank of England earlier this month.

As we noted last week, low interest rates squeeze bank profits.

- As the rates they can lend cash out at fall, they are unable to charge depositors (offer a negative rate) in case they withdraw their cash for the stability of the mattress.

- This in turn makes them less likely to lend (which is the whole point of cutting rates).

The TFS lets banks borrow 5% of their current loan book – plus any new loans – at close to the base rate.

- This is cheaper than the 1% they pay depositors or wholesale markets for money.

It’s a watered down version of the “funding for lending” (FFL) scheme from 2012.

- But without the severe penalties for not lending out more cash, will TFS be as successful as FFL?

Were the TFS rate to go below zero, it would look like “helicopter money”, with the Bank paying retail banks to borrow from it and lend to consumers and businesses.

Emerging markets

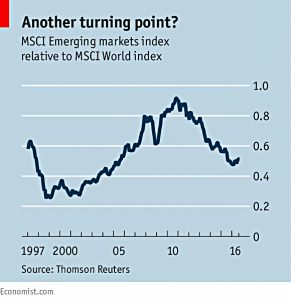

Buttonwood noted that emerging stockmarkets are back in favour, and up 13% so far this year.

- The mood from 2010 has been negative, with faltering growth rates (especially China) and commodity prices to blame.

Emerging markets still trade at a 30% PE discount to developed markets.

- Growth forecasts have moved upwards.

- And apart from oil, raw materials prices appear to have stabilised.

Institutional exposure is starting to creep up again, though it’s nowhere near pre-2008 levels.

- EM currencies and bonds have also been bouyed by the search for a decent return from somewhere / anywhere.

Whether the rally could survive a Trump presidency is another matter.

Bank crime

The Economist also noted that the legal issues faced by banks appear to be drawing to a close.

- Barclays is settling over LIBOR manipulation.

- Goldmans is paying the Fed for “improper receipt of confidential information.”

- and JP Morgan is settling allegations it bribed Chinese officials with internships for their children.

There have been 188 settlements since 2009, to a total value of $219 bn.

- Eleven firms have paid out more than 10% of their market cap.

- Bank of America has paid out $77 bn (50%).

Banks are no longer recording “favours” in candid emails, and are pulling out of shadier countries where the costs of compliance exceed potential profits.

- But although a lot of money has been extracted from the banks, there has been little individual accountability.

Global trade

The newpaper also looked at the growing US opposition to free trade.

- Both Trump and Clinton are now opposed to the Trans-Pacific Partnership (TPP), reflecting popular opinion.

Booming Chinese exports to America since 2000 have reduced US manufacturing jobs and lowered pay for the less-skilled.

- Yet the TPP excludes China, so there must be other drivers.

It seems to be that supply chains have become “unbundled”, with production now spread across many disparate locations.

- Trade in “intermediate inputs” has grown rapidly.

- Instead of choosing between US and Japanese goods, we now have iPhones, built abroad with cheap foreign labour.

This leads to a boom for cities like San Francisco and New York, where the HQ of profitable firms are located.

- This in turn leads to opposition to trade from Republicans in states that don’t profit from it, and Democrats opposed to the inequality it leads to.

Proponents of free trade face an uphill struggle in persuading voters that pacts don’t pander to a global elite.

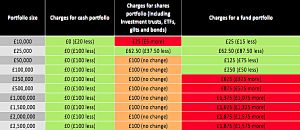

AJ Bell charges

Money Observer looked at the winners and losers under the new charges announced by AJ Bell YouInvest.

- For shares investors (including ETFs and investment trusts) there’s not much change, and none at all for portfolios larger than £40K.

For fund investors, things look good up to £100K but get worse above that, with some shocking increases above £250K:

- Charges on a £500K fund portfolio rise from £300 to £875

- Charges on a £1M portfolio rise from £300 to £1,375

We’ve discussed previously that there are few cheap platforms for holding funds.

- Investors with large portfolios and long time horizons should think seriously about switching to stocks, ETFs and ITs.

Salary sacrifice

HMRC published its consultation paper on salary sacrifice schemes this week.

- The paper seems to be generally targeting benefits in kind.

- Life insurance and things like providing a mobile phone look set to be hit.

The good news is the confirmation that – as stated in the Budget – pension contributions are specifically not being targeted by the new regime.

- Pension advice, childcare, nurseries, bicycles and payroll giving to charities are also safe.

Don’t copy Buffett

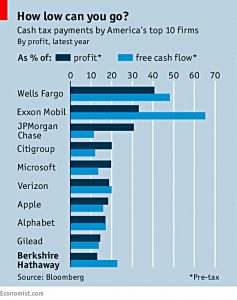

And finally, the Economist noted that Warren Buffet is not a good role model for how to run America.

- They found that his actions often don’t match his words.

First the good news:

- He has done very well for his investors and shareholders.

- He likes to hold shares for a very long time.

- He avoids firms with dodgy practices as much as he can.

- He plans to give the vast majority of his wealth to charity – mostly to the Bill Gates foundation.

Now the bad.

As a first example, his sympathy for workers doesn’t explain his partnership – in Kraft and Heinz – with Brazilian private eqiuity firm 3G.

- 10% of the workforce has been lost since the firms were bought and merged.

And then there is tax. As Dan Loeb says:

He thinks we should all pay more taxes but he loves avoiding them.

This is more true of Berkshire Hathaway than of Buffet himself.

In the 2008 crisis he stepped in to help Goldman’s (albeit on very favourable terms for himself) and he was a big shareholder in Moody’s – one of the credit rating agencies that fuelled the sub-prime disaster.

Last month he was one of 13 bosses to recommend that corporate accounts should follow GAAP (“generally accepted accounting principles”).

- Yet his annual letter to Berkshire shareholders criticises GAAP and uses “intrinsic value” a lot.

Then there is his fondness for business “moats”, in firms like Gillette and Coca-Cola.

- Looked at from another direction, these are oligopolies and monopolies, with the power to set high prices and extract “rents”.

The newspaper concludes that like Steve Jobs before him, Buffett seems able “to create a reality-distortion field around him”.

I wish I could do the same.

Until next time.

Thanks for the roundup Mike. Not sure how the Economist thinks Coca-Cola is a monopoly though… last time I checked there were a million cola drinks, mostly cheaper and virtually identical to Coke. Ditto for Gillette.

I recently bought some Tesco Value toothpaste for 25p. Looking at the fluoride content it should do virtually the same job as Colgate toothpaste for considerably less cost!

If people want to pay top dollar for branded goods then that’s up to them, but it’s slightly embarrassing to see them labelled as “monopolies”.

You’re very wise to buy value toothpaste. I haven’t bought a real Coke for 20 years, and I shave with Tesco blades. But we’re a minority I think.

Monopoly power was definitely stronger in Western society 20 to 30 years ago (when Buffett was buying into these firms), but brands still count for a lot, especially in the developing world. People do want to pay top dollar for a brand because they think it says something about them.

Coke and Gillette would be impossible to displace from their number one positions in their markets, so I’d argue than they are at least oligopolies. It’s not like the car market for example.