Weekly Roundup, 10th March 2015

Today’s weekly roundup begins as usual in the FT.

Contents

Tax Avoidance

Adam Palin had a couple of articles about tax. The first was about tax avoidance, where we left off last week.

Users of employee benefit trusts (EBTs) have been warned by HMRC that if they don’t settle by the end of March, they should be prepared to litigate. EBTs worked by employers putting money into offshore trusts, which then made tax-free, interest-free, non-repayable loans to the employee.

The dilemma facing such beneficiaries is that if they settle, the results of any future court cases won’t affect their payment. If they hold out, they may face more severe tax and interest penalties in the future.

HMRC warned that EBTs were tax avoidance schemes back in 2009 and have been trying to settle liabilities since 2011. Eight hundred schemes have settled, raising around £1bn, but another 5,000 schemes have not settled.

VCT and EIS relief

Adam’s second article was the Chart that tells a story, this week about high-earners’ relief via venture capital schemes (VCT and EIS). The end of the year is upon us once again, and the chart shows just how much sales of these products are driven by tax-relief.

In total £16bn of investments have been made since the launch of the products 20 years ago. Both schemes offer 30% tax relief up front, with gains exempt from CGT. EIS shares need to be held for 3 years (compared with five for VCT) but are more risky.

VCT funds offer a spread of investments and are listed, so have some (limited) liquidity. VCT dividends (often 5-8% pa) are tax-free. VCT investment is “limited” to £200K pa, whereas the EIS limit is £1M pa. EIS also offer CGT deferral (for 3 years) and become exempt for inheritance tax after two years.

These extra benefits and higher limits explain the greater overall investment in EIS. The peaks and troughs of investment reflect economic conditions (EIS is more popular during booms like dot-com in 2000) and the tax-regime changes.

In 2011-12 EIS relief was increased from 20% to 30% and investment almost doubled. VCT investment multiplied by seven times when relief increased from 20% to 40% in 2004-5. When it was reduced to 30% in 2006-07, investment fell by two-thirds.

Both products are currently in an uptrend as recent reductions to annual and lifetime pension allowances have made them more attractive. EIS has also been boosted recently by solar projects with feed-in tariffs or renewable obligation certificates (effectively a second government subsidy). These have now been excluded, and EIS investment may suffer.

Pensioners again

Merryn’s column continued the weekly media onslaught on pensioners. Her core point was that pensioner income has risen by 150% from 1977 to 2011. Incomes rose in real terms every year regardless of economic conditions, whereas the incomes of working households rose and fell with the business cycle. Half of the pensioner gains came from private pensions, the other half from the state.

The average pensioner household income was around £22K, ((Hardly a fortune, and significantly less than the average wage and the benefits cap)) of which almost £11K came from the state. Even the highest income quintile of pensioners (on £42K) got almost £11K. But when you consider that the basic state pension is now almost £6K in itself, this doesn’t seem so surprising. A married couple is entitled to almost £12K in pension from the state, regardless of how high this might seem relative to their private income.

Old people have pensions because they are no longer able to work. If we take away the pension, are they supposed to re-enter the workplace to replace the lost income? What would that do for those of working age? The young need to work and the old need to have pensions. Let’s give both groups what they need.

Equity crowdfunding

Judith Evans wrote a special feature on equity crowdfunding.

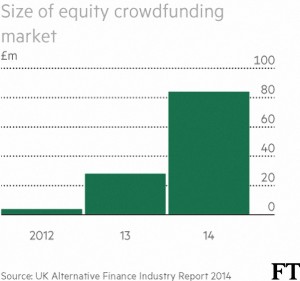

The market – much of which qualifies for EIS / SEIS tax-breaks – was up to £84M in 2014 and there are now 35 platforms in the UK. But there is no track record of returns, and several crowdfunded companies have already gone bust (Ovivo, Bubble & Balm). The FCA says that investors are “very likely” to lose all their money, and insist that non-“sophisticated” investors certify that they won’t invest more than 10% of their assets.

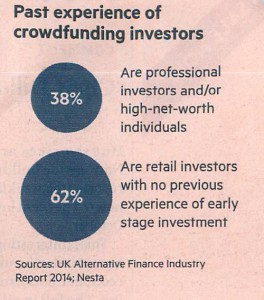

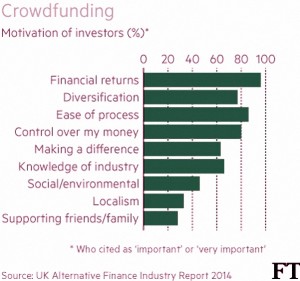

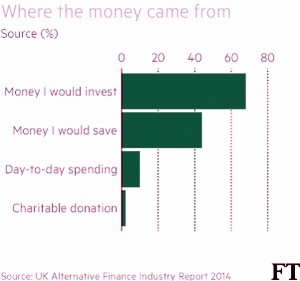

The story becomes more worrying when we look at where the money is coming from. Only 38% of investors are previously experienced and despite buzz / spin to the contrary, the majority are motivated as much by financial returns than by local/industry knowledge or activism.

Disturbingly, the simplicity of the online crowdfunding process also seems to be a factor too. There is also the message that this is a clean start away from the greedy, untrustworthy and tarnished traditional financial world. The combination of emotional connection and financial goals is rarely a winning one.

The big three platforms have different approaches when it comes to dealing with thousands of small investors:

- Crowdcube typically offers non-voting shares to investors below £5K, and most have no protection against future dilution

- Syndicate Room uses a lead investors (usually an experienced “angel”) to negotiate terms for the crowd

- Seedrs uses a nominee structure where the platform manages the investment (including voting on behalf of investors)

Valuations are also an issue: the recent fundraising for Camden Town Brewery on Crowdcube valued the firm at £70M on target sales for 2015 of £9m. By comparison, Adnams has sales of £38M and is valued at £53M. Nevertheless, Camden raised more than £1M.

Equity crowdfunding investors are letting their heart rule their head. Issues around valuation, liquidity, future dilution, entrepreneur “lifestyling”, ((Drawing a generous salary without expanding the business to the point where it can be sold)) and exit strategies make putting your money into this market the equivalent of buying a lottery ticket. For those with a sense of adventure, VCTs offer a similar exposure to real, unlisted UK firms with similar tax breaks but crucially with a 20-year record of returns.

Judith also wrote about the increasing preference of wealthy private investors for flat-fee platforms over those with percentage charges. The average size of accounts on the flat-fee platforms (Alliance Trust Savings, Interactive Investor and The Share Centre) has increased by 22% to £44,405 from Sep 2013 to Sep 2014. They still trail percentage fee platforms (eg. Hargreaves Lansdown) whose average account fell from £49,044 to £48,258.

Farmland on AIM

The FT also reported that on the back of a 277% increase in British farmland prices, Greenshields Agri plans to be the first farmland stock to float on AIM. The grain producer farms 6,400 acres in Northumberland and Scotland, and will use the proceeds of the float to buy another 220 acres.

Lessons from cycling

The Economist looked at the work that a former technical director of British cycling was doing with investment banks. Shane Sutton and his firm Inalytics have been training traders from GLG Partners, JO Hambro and Schroders. The firm analysed 12M trades across 900 portfolios going back to 2002 to find out what worked and what didn’t.

The biggest mistake was selling winners too quickly. The flip side was also the case, with traders hanging on to losers in the hope they would recover. And the half-way houses towards these two problems – top-slicing of winners, and building up positions in small tranches – were also found to lead to underperformance. ((Though they might possibly also lead to fewer sleepless nights))

Why Apple is cheap – or is it?

Buttonwood looked at the reasons behind Apple’s apparently low PE ratio. The company has grown by 300 times since flotation, and could pay off the Greek debt in three years. More that 1% of the global population bought an iPhone is the last quarter, and the company is about to move into watches and if some are to be believed, cars.

But its PE ratio is just 15. There are two related issues at work here: can the watch and / or the car replace the earnings from the iPhone (the most successful product ever); and can the world’s largest company continue to grow at its historical pace? As markets change, can it cannibalise its own products (see Nokia and Kodak as examples of companies that could not)? Or will it successfully diversify, say into cars? ((Some would argue with the new high-end watch and the recent Beats acquisition that Apple is already flirting with becoming a fashion / luxury goods company))

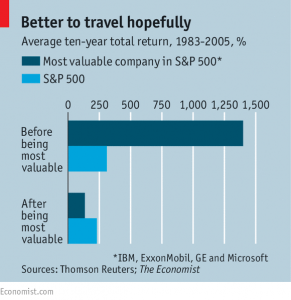

The lesson from history is that the biggest company in the world usually underperforms. In the 10 years before they became the largest firm, IBM, Exxon, GE and Microsoft returned 1,282% compared with 302% from the S&P 500. In the 10 years after reaching No 1, they returned 125%, compared with 199% for the S&P. Things may be different this time, but I doubt it.

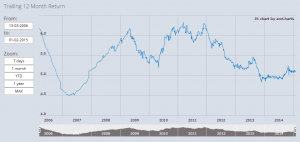

P2P lending returns index

Liberum has launched the Liberum AltFi Returns Index (LARI) which shows returns from P2P lending. In practice the data comes from Zopa, Funding Circle and RateSetter and goes back to the launch of Zopa in 2006. Returns have varied between 4.5% and 6.3%, and are currently just about 5%.

These are fairly impressive results in a low-interest rate environment and demonstrate some resilience through the 2008-9 crisis. Whether the sector can cope with rapid expansion following the impending ISA eligibility remains to be seen.

P2P & Equity Release vs Annuities

Over in the Guardian, Patrick Collinson looked at the possibility of replacing an annuity with a combination of P2P lending and home equity release. The basic idea is to delay equity release from age 55 to age 80.

At 55 you can borrow only 20% of your home value and the rolled up interest means that by 85 there is no equity left. At age 80, you can take almost half the value of the house and are unlikely to use up the remainder of the equity.

Comparing the P2P to an annuity, at age 65 the annuity returns around 4.7% – less than P2P. By drawing down the cash at the same time, a couple might enjoy double the annuity income and still make it to age 80 before they need to access the home equity. This all makes sense, but it’s unnecessarily restrictive.

Drawdown works best with a range of assets of various levels of risk and return. There’s no need to just use P2P. It’s also unduly pessimistic – those retirees who have saved correctly through their working lives should have enough in their drawdown pot to fund their lifestyles indefinitely.

They may never need to use the backstop of their house equity, or perhaps even the capital from the drawdown pot. In which case they might consider buying an annuity at age 75 or 80.

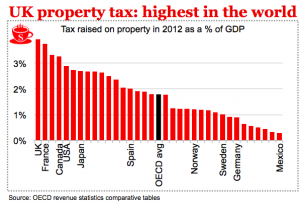

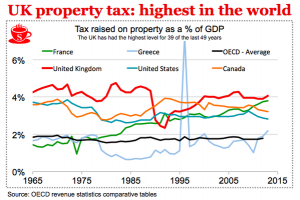

UK Property Taxes

We close this week with a couple of charts from my Twitter stream.((My apologies to whoever published them originally)) They claim to show how the UK already has the highest property taxes, and there is no need for a mansion tax. If anyone can tell me where the charts came from, we can investigate further.

Until next time.