Weekly Roundup, 8th November 2021

We begin today’s Weekly Roundup with green stuff.

Green bonds

People are rightly disappointed with the government’s 3-year “green bond”, which is capped at £100K per person.

Chancellor Rishi Sunak said:

Our world-first green savings bonds give savers across the UK the chance to back the Government’s green projects and put their money to work in the fight against climate change.

The UK is already a world leader in green finance and these innovative new savings bonds will deliver both financial returns and environmental benefits, in a transparent and secure way.

The bonds are taxable and pay just 0.65% pa, way below the market rate. (( The market rate is around 1.8% pa, which still sounds like terrible value to me ))

- But as a trendy, virtue-signalling asset – and one backed by the Treasury – why would anyone expect it to pay as much as less cool stuff?

And I wouldn’t be surprised if they can find enough people to buy the green bond in any case.

- The Government said that around 80% of people aged 25-44 would be very or fairly interested in a green savings product, and 42% of 18 -34 year-olds would accept a lower return on money being put towards green projects.

I should point out the amount of attention people pay to interest rates on their savings is wildly disproportionate.

- Most people should have 5% to 10% of their assets in cash.

Losing 1% pa on a proportion of that (no-one will plonk it all into mean green bonds, will they?) will have a much smaller impact on your terminal wealth than:

- Upping your earnings (particularly in your twenties)

- Increasing your savings rate

- Sorting out your asset allocation (make sure you have enough risky bonds)

- Minimising your costs and taxes

Getting back to the green bonds, I think the three-year lockup is a bigger problem than the anaemic rate.

- Premium bonds don’t pay that much more than green bonds and they remain popular (though they also bundle the infinitesimal chance of winning the jackpot, and winnings are tax-free).

But now that inflation is mentioned in the mainstream press on a daily basis, so fixed-term accounts won’t sound so attractive.

If the government are successful with this initiative, expect a lot of similar products.

- Getting people to hold “good” bonds that pay less than inflation is a halfway house on the continuum of financial repression.

It’s somewhere between the low key work of QE and the full-on forcing of savings institutions and asset managers to hold government debt whether they want to or not.

- This is known as yield curve control.

The government wants inflation (to shrink its debt) but doesn’t want higher interest rates (which would increase its annual interest bill).

- Getting pension funds to own green bonds that pay too little will help with that.

The Economist looked at Britain’s wider climate change plans and uncovered two problems.

Britain may move quickly away from fossil fuels and to electricity provided by wind turbines and new nuclear-power stations. Alternatively, it could rely on hydrogen, capturing the carbon released when it is created from natural gas.

The first problem is the Treasury.

The Treasury sees its job as collecting money from the public and distributing it to other departments, to be spent (often unwisely, it fears) on their projects. It does not regard taxes as devices to help departments achieve their objectives.

So things like a higher fuel tax to nudge petrol and diesel cars off the road (and support tax revenue as they go) probably won’t happen.

The second problem is the PM’s reluctance to deliver bad news and to require “hairshirtery” to achieve net zero.

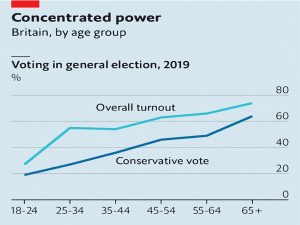

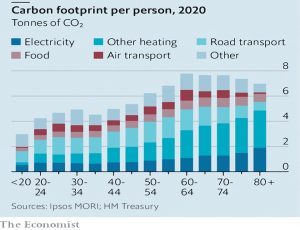

The old have bigger carbon footprints than the young, largely because they tend to live alone or with one other person.

They also vote more regularly and prop up the government.

- The Economist’s insistence that “their consumption patterns will have to change” is about to be tested.

The Spectator also looked at the Net Zero strategy and was not impressed.

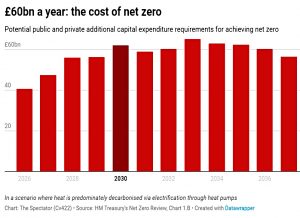

The commitment to reach ‘net zero’ emissions by 2050 is the most expensive government proposal in modern history. Yet it was rushed through parliament with minimal debate or scrutiny. It has taken the government two-and-a-half years to come up with a proposal.

The plan will cost £60 bn a year and will hit the poor the most. The Treasury review admits:

Policies to support the adoption of electric vehicles may disproportionately benefit higher-income groups, and the costs of any policies that affect the remaining drivers may fall disproportionately on low-income groups.

More worrying than the government’s track record on big projects (eg. HS2) is the lack of the necessary technology (decent air pumps, new nuclear reactors, hydrogen tech).

- And even worse than that is the likely pointlessness of it all.

Without commitments from China and India (which would essentially require them not to become rich like the West), swapping our 1% contribution to global CO2 for zero won’t move the needle on climate change.

LTAFs

The FCA has announced the rules for its new fund type, the Long Term Assets Fund (LTAF).

- The apparent need for such a structure was prompted the lock-ups of OIECs holding illiquid assets like property.

When the underlying assets can’t be quickly sold (for example, during a price crash) then high levels of requests for redemptions (for example, during a price crash) can’t be met.

- Personally, I can’t see why the OIECs should just convert into ETFs (if passive) or investment trusts (if active) – both structures seem better-suited to holding illiquid assets.

Nikhil Rathi, chief executive of the FCA, was pretty impressed:

We are supporting fresh collaborative thinking designed to improve the effectiveness of UK markets while protecting standards.

If this innovative fund structure, created by our rules, is taken up by the asset management industry, it may provide alternative routes to returns for investors, while supporting economic growth and the transition to a low carbon economy.

The LTAF comes with a minimum 90-day notice period and will (initially, at least) be restricted to institutions and sophisticated/wealthy private investors.

- They must have at least 50% of their assets invested in unlisted securities or other “long-term” assets (private equity, private credit, venture capital, infrastructure, real estate, and forestry were the asset classes mentioned).

They seem like deliberately limited OEICs to me, and I shall be steering clear.

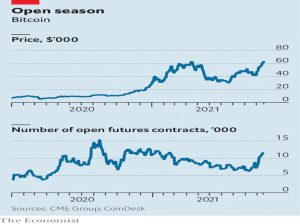

Bitcoin

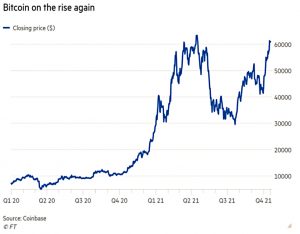

In the FT, Joshua Oliver wrote that UK investors are missing out on the bitcoin craze due to ETF rules.

- We had the first US ETF recently (albeit based on BTC futures), and Canada, Sweden and Germany have already approved exchange-traded products.

Almost 50 exchange-traded products linked to crypto assets are on offer globally, with combined assets of $14bn. The largest Canadian fund, the Purpose Bitcoin ETF listed in Toronto, has grown to $1.7bn since its launch in February.

But here in the UK:

The Financial Conduct Authority has said it would not authorise a fund that has exposure to crypto until it is satisfied with integrity of the underlying market. The FCA has repeatedly voiced concerns about cryptocurrencies including their extreme

volatility and the lack of a solid basis for their value.

A survey of UK investors aged under 30 found that six in 10 think there are not enough regulated entities providing access to cryptocurrencies.

It’s possible to buy crypto directly, and via custodial exchanges like Coinbase and Gemini, but transaction costs and spreads remain high, especially for the small amounts required for “sensible diversification”.

- According to FAC research, 4% of UK adults (2.3M people) own some.

The Economist also took a look at the new US ETF.

Depending on whom you ask, the launch is either a landmark, a way for regulators to retain control, or a disappointment.

Many crypto entrepreneurs and conventional finance types expect the ETF to lure in retail traders.

[But] new investors may not come in the droves that bulls expect. For years now individuals have been able to buy bitcoin through mobile wallets, such as PayPal, or brokers, such as Robinhood. Institutions can gain exposure through vehicles like the Grayscale Bitcoin Trust.

Purists in particular will wait for an ETF that directly holds bitcoin.

Spitznagel

The FT had a profile of contrarian fund manager Mark Spitznagel.

- He’s the friend of Nassim Nicholas Taleb who runs Universa Investments.

Spitznagel trades options on tail-risks and aims for explosive returns during market crises like the Covid crash of March 2020.

When someone wants to bet against a crash, I will take the other side. I can’t have everyone agree with me. I need to be the contrarian, crazy guy that everyone sniggers at.

The strategy means small losses for long periods (when markets are doing well) then huge returns during occasional blow-ups.

- As a standalone strategy, it’s the opposite of what most investors want, but when blended with buy and hold (and possibly trend following) it makes more sense.

His fund made average annual returns between the start of 2008 and the end of 2019 of 105.2 per cent. However, these returns are based on gains from the hedges themselves, rather than the wider portfolio they are protecting, and therefore are hard to compare with the performance of funds in other sectors.

He also has a new book out – Safe Havens – which I haven’t yet read.

- I can recommend his earlier book The Dao of Capital, but it’s more of a philosophical read than an investing guidebook.

The idea behind the new book is that most “safe” havens don’t work.

[There are] frighteningly many ways that the investment industry regularly smokes people with complicated and unfalsifiable (and thus pseudoscientific) theories and cherry-picked market data.

You won’t be surprised to hear that he thinks we are near the limits of how much debt can be taken on, and therefore close to a crash.

Quick Links

I have just one for you this week:

- On his Moontower substack, Kris Abdelmessih used TSLA to explain options.

Until next time.