Irregular Roundup, 7th August 2023

We begin today’s Weekly Roundup with the soft landing.

Soft landing

The Economist said that it was still too early to count on a soft landing.

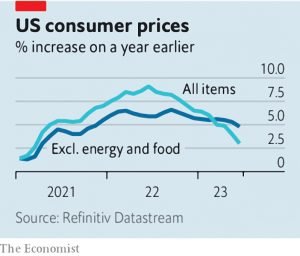

- Recent optimism stems from the June US inflation reading of 3%, which led t hopes that an expected rate rise at the end of July would be the last in the current cycle.

The surge of hope is all the more unusual because the world economy is slowing down.

China is already slowing and many forecasters expect the US to slow in the second half of the year.

- But they don’t expect it to shrink.

Growth cooling just enough to bring down inflation without a recession is the best-case scenario for overheated economies like America’s.

But there are three reasons to be cautious:

- Inflation is still much higher than central banks’ 2% targets, and recent falls have been driven by declines in energy and food prices.

- Wages are going up more than productivity, and core inflation is more than 4%

- There might be job cuts ahead, as “hoarded” workers that are no longer needed are finally let go.

- The divergence between economies could mean that the UK (and China and Japan) are unable to follow the path of the US.

There remains immense uncertainty about where inflation and interest rates will eventually settle. The world economy has not yet escaped unscathed.

Inflation

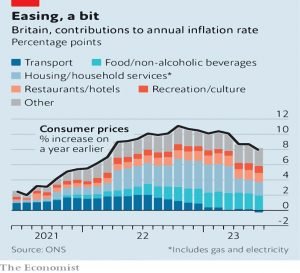

The Economist also reported that UK inflation might not be as sticky as we thought.

- The main driver of the fall in the June headline rate from 8.7% to 7.9% was petrol

Core and services inflation fell by less (7.1% to 6.9% and 7.4% to 7.2%, respectively), but at least they are moving in the right direction.

Figures published the previous week suggested the jobs market is at last starting to cool. The ratio of vacancies to unemployment, a measure of labour-market tightness, declined sharply thanks to a simultaneous reduction in labour demand (as measured by vacancies) and an increase in the number of people looking for jobs.

The combination means that markets are forecasting a lower peal in UK interest rates.

Markets had given [the BoE’s] rate-setting committee a roughly even chance of raising its main policy rate by half a percentage point at its next meeting on August 3rd. They now expect a quarter-point increase, from 5% to 5.25%. Markets now expect rates to peak at 5.8% in early 2024, rather than the 6.5% they had been predicting.

VCTs and EIS

The cross-party Parliamentary Treasury Committee has released its report on Venture Capital.

- The good news is that they recommend that the sunset clauses (which will come into effect in April 2025) should be extended.

It would have been nicer to have them abolished entirely since we are no longer in the EU nor subject to their State Aid regulations.

The report also says that the amount that companies can raise under each of the schemes should be increased.

- More worryingly, they suggest setting up a government-backed VC fund which would be specifically aimed “at promoting greater diversity in venture capital allocation”.

There are a few more diversity objectives in the report, but it’s hard to tell to what extent they would interfere with optimal capital allocation.

Nicholas Hyett of Wealth Club said:

The report is a ringing endorsement of the UK’s current tax efficient venture capital schemes. Evidence from across the industry and government shows widespread support for these schemes, which have now received cross-party political endorsement.

The planned extensions to the age at which companies can raise money under the schemes, and the amounts they can raise, have the potential to help address one of the major challenges facing the UK’s young businesses – transitioning from successful start-ups to global player.

In recent times UK companies have often had to turn to overseas acquirers to grow to global scale – depriving the UK economy of the benefits of a homegrown Apple or Nvidia.

We would have liked the committee to take advantage of the UK’s position outside the EU to recommend [the sunset clause] was scrapped altogether. VCTs and EIS have proven their value over nearly thirty years, and the regular uncertainty caused by repeat sunset clauses is unhelpful.

Pensions tax

It turns out that the repeal of the lifetime allowance (LTA) is not all good news.

- The government consultation paper on the topic says that inherited uncrystallised pensions will no longer be free of income tax (where the deceased was aged under 75):

Individuals will still be able to receive the benefits… but the values will no longer be excluded from marginal rate income tax under ITEPA [Income Tax Earnings and Pensions Act 2003], with effect from 6 April 2024.

This exemption was introduced in 2015 as part of the pension freedoms.

It looks as though inherited pensions which are taken as a lump sum (and are smaller than the new limit on tax-free lump sums of £268,275) will remain tax-free.

- And inherited pensions would still be exempt from IHT (which it is rumoured that the government will pledge to scrap before the next election).

Tom Selby from AJ Bell said:

Creating a tax on death in this way may push more beneficiaries to take a lump sum when an income is more suitable for their needs. Or encouraging the member to take their pension benefits earlier than planned to avoid their loved ones paying income tax.

I’m not sure this is a massively unfair change (as pensions are normally subject to income tax), but I think it’s been handled badly.

- It should have been announced last the same time as the LTA abolition and in the introduction of the tax-free lump sum limit.

But the legislation is yet to be finalised, as a government spokesman confirmed:

We look forward to working with stakeholders over the coming weeks to help us craft the

legislation which will ensure that our historic pensions tax cut [the LTA aboltion] delivers the right results for savers and the economy.

Interest on cash

Another week, another intervention in UK retail financial markets.

- The Financial Conduct Authority (FCA) wrote to 39 investment platforms and SIPP providers last month asking for details of their “client interest turn”.

That’s the profit they make by paying their customers a lower interest rate than they can obtain on the money markets.

- The FCA wants to know how much money the firms have made over the last 18 months.

Similar conversations have been held with the major UK banks (Barclays, HSBC, Lloyds and NatWest), but in that case, they were face-to-face with Jeremy Hunt and the BoE.

- This follows a March letter from the Treasury Committee to the FCA asking that it ensure that banks pass on interest rate rises.

Committee chair Harriett Baldwin said:

If the high street banks continue to pay poor savings rates on their instant access accounts, they should make sure their customers know that better rates are available.

The FCA claims that the current “squeeze on household finances” (or as we know it, high inflation and rising interest rates) means that it’s “more critical than ever” that investors get a fair rate of interest on their cash.

- They are also introducing consumer duty regulations this month which are intended to make firms put their customers’ needs first.

The FCA said:

We are looking to understand ingreater detail how interest on customers’ cash is treated in the investment platform market, and to understand how platform firms have considered their approach to this interest in line with the consumer duty.

CEO Nikhil Rathi added:

The way that banks handle this period, both in terms of supporting vulnerable customers and customers who are struggling and savers will be very deterministic of their reputation for many years to come. The pace has simply not been fast enough. We have stepped up our engagement and we were always expecting as the consumer duty comes into force, that the pace would accelerate.

Lloyds Bank said:

We take our obligations under the consumer duty seriouslyand have made a number of significant enhancements to support our customers, including improving and increasing our communications to help them make informeddecisions, such as on the maturity of fixed rate savings products.

NatWest CEO Alison Rose said:

We offer our customers a range of products and rates in what is a very competitive market, and we amend the price of products on an ongoing basis to reflect market conditions and our liquidity needs.

Barclays CEO Matt Hammerstein said:

We proactively contact customers to prompt them to consider whether their money is working as hard as it should and encourage them to explore their options with Barclays.

I couldn’t find any responses from investment platforms or SIPP providers.

There are two points here:

- The client turn is a commercial decision, and investors should move to more competitive platforms if they are unhappy

- Anyone who depends on interest on their cash to survive an inflationary episode will not do well.

It’s more virtue signalling and playing to the gallery from our financial regulator.

Quick Links

I have five for you this week, the first three from The Economist:

- The Economist listed Five things investors have learned this year

- And asked Can big tech keep getting bigger in the age of AI?

- And wondered Have scientists really found a room-temperature superconductor?

- The FT asked Are US stocks bulls right to be so optimistic?

- And Alpha Architect looked at The Quality Factor and the Low-Beta Anomaly.

Until next time.