Weekly Roundup, 25th April 2022

We begin today’s Weekly Roundup with inflation.

Inflation

John Authers took a deep dive into the latest inflation figures from the US.

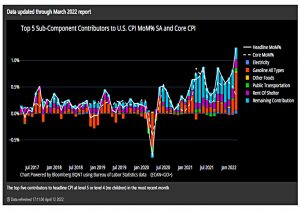

- The headline figure hit 8% for the first time in 40 years, but this was expected so there was little market reaction.

The trimmed mean rate is now at a record high of over 6% pa, which John takes to mean that inflation is broadening.

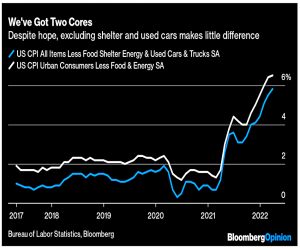

The odd new measure of core inflation – excluding energy, food, shelter and used cars and trucks (the “transitory” categories) – remains lower than the old core, but the two measures are now moving in step.

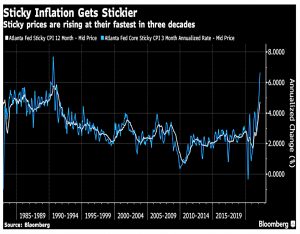

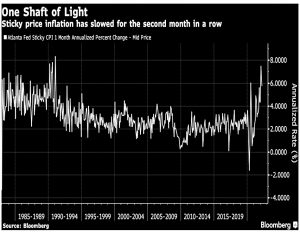

Year on year, “sticky” prices are rising at the fastest rate in 30 years, but John is encouraged that the numbers from the last two months have been smaller.

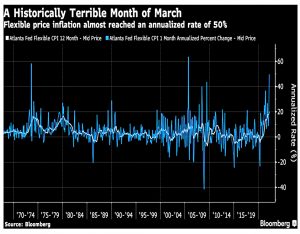

One bright spot is that the March spike in flexible prices has only been beaten in August 1973 and 2005 (after Hurricane Katrina).

- So there is likely to be downward pressure ahead, and March could even have been the inflation peak.

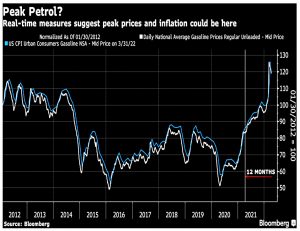

The outsize contribution of gasoline to the month’s data suggests the same.

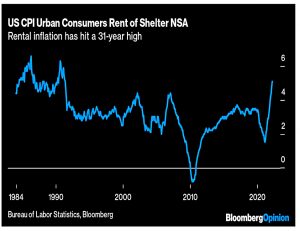

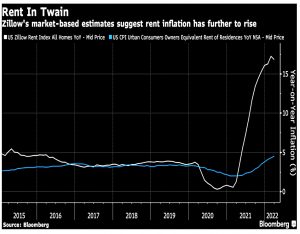

As to the future, John focused on shelter, which is a third of CPI and was below average in 2021.

- Rent inflation is now at a 31-year high.

Zillow’s market-based estimates (from more newly signed leases) suggest that there might be a bit more to come.

Energy and the car market are more hopeful areas.

Petrol prices may have passed their peak.

Can rental prices went up but stayed below their peak, whilst used car prices fell back.

However:

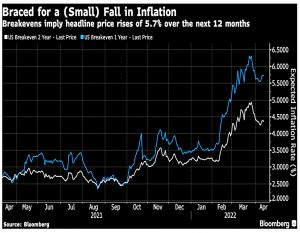

The TIPS market is saying headline inflation will still be as high as 5.7% 12 months from now, and will barely be below 4.5% in another 12 months after that.

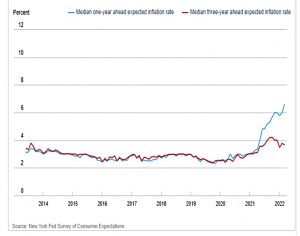

Consumer expectations are more encouraging.

In the second part of his newsletter, John looked at the requirement for the Fed to raise rates.

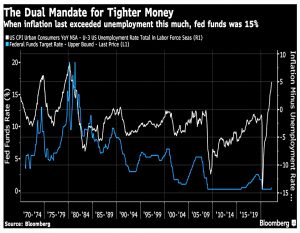

The Fed is required to minimize both inflation and unemployment. To reduce inflation, it’s generally necessary to raise rates, and to reduce unemployment it’s generally necessary to cut them.

The last time that inflation was so much higher than unemployment, the fed funds rate was fifteen percentage points higher.

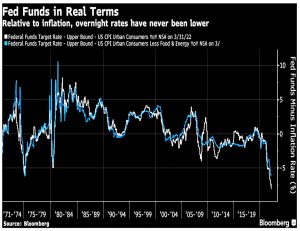

In real terms (against the headline CPI rate), the fed funds rate has never been lower.

- Rates have been held too low for too long, and a credible Fed needs to raise aggressively.

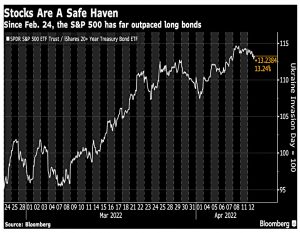

This might mean the end of TINA – there is no alternative (to stocks).

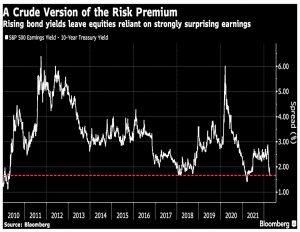

The earnings yield of stocks over the 10-year Treasury yield is now below 2%, making stocks unattractive unless we expect bumper future earnings.

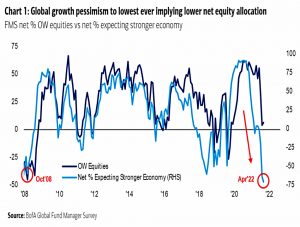

Fund managers don’t, though they remain overweight stocks.

Fund managers really hate bonds with inflation rising, and so are staying in equities despite their bearishness about the economy.

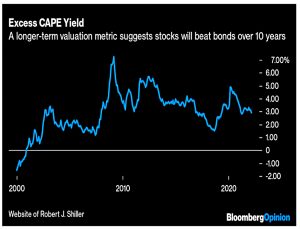

Shiller’s Excess CAPE Yield still favours stocks over 10 years, but it usually does.

Phew, we made it through all those charts.

- I only wish that John had better news for us.

Diversification, real assets, and companies with enough pricing power to avoid suffering from inflation seem to be about the best havens out there.

Disinflation

In The Economist, Buttonwood looked at the chances of the Fed pulling off an “immaculate disinflation“.

- We’ve had a quarter-point rise in March, and two more points are expected by the end of 2021.

The neutral level of interest rates is seen by many as around 2%-2.5%, and the Fed plans to overshoot that only slightly.

In the 1980s Paul Volcker’s Fed vanquished inflation by inducing recessions that pushed the unemployment rate to 10.8%. Nobody accuses it of having done so inadvertently; rather, it chose to pay the high price of disinflation.

But today, central bankers target jobs support as much as price stability.

The Fed has pulled off “soft landings” in 1964, 1984 and 1993, but perhaps this time conditions are different.

- Certainly, the Fed didn’t let inflation rise this far before raising rates – its inaction during 2021 looks increasingly difficult to explain.

But whilst the Fed may have stopped using the word “transitory”, it still believes in itself:

The central bank’s latest projections are rosy, portraying three years of steadily falling inflation, despite GDP growth remaining above its long-run trend and both the unemployment rate and the Fed’s policy rate remaining unusually low.

More likely is a recession, followed by interest rate cuts.

- Perhaps that will end inflation.

Dodl

AJ Bell has launched its “low-cost” brand, Dodl, which is available as a phone app.

- All of the accounts (ISA, GIA, LISA and SIPP) are offered.

Platform charges are 0.15% (excluding fund fees) and are uncapped, but there are no transaction charges.

- This works out at £120 (the current SIPP fee) on an account worth £80K.

Above that size, you’d need to weigh up the number of trades you make each year against the extra charges from Dodl.

- A pension worth £1M works out at a hefty £1,500 pa.

An alternative comparison would be with the Freetrade ISA, which costs £36 pa (AJ Bell’s ISA is capped at £42 pa, but I use several other providers that have no platform charge).

- The breakeven point here is £24K, so one year of ISA contributions would save you a princely £6 pa.

Dodl also has a restricted investment universe, with a few dozen unit trusts, very few ETFs, and a selection of UK stocks from the FTSE-350.

- Dealing is only processed once per day, and you also can’t transfer in existing accounts yet.

So this app is aimed at newbie investors with very small accounts.

- Aj Bell is targeting Vanguard and the robo-advisors, I would imagine, and to a lesser extent Freetrade and Trading 212.

I don’t have any interest in this personally, but I’ll report back again if things change.

Kevin Doran, AJ Bell’s managing director of investments, said:

We’re creating the advised clients of the future. Dodl is about extending the reach of AJ Bell. We’re focusing on people who haven’t invested yet.

FCA data suggests there are around 8.6M with more than £10K in a deposit account.

Around 20% of those people will begin their investment journey in the next three years. In the app-based investment platform, we ought to take at least 7 per cent, or more like 10 per cent, of this market over the next three years.

Robinhood

Robinhood is buying UK crypto broker Ziglu for an undisclosed, two years after it decided not to expand into the UK.

- Ziglu is crypto-only, and I haven’t used the platform because it has a 1.25% transaction fee, which is too steep for me.

Vlad Tenev, CEO of Robinhood said:

Ziglu’s impressive team of deeply experienced financial services and crypto experts will help us accelerate our global expansion efforts. We’ll work to leverage the best of both companies, exploring new ways to innovate and break down barriers for customers across the UK and Europe.

Ziglu was founded way back in 2014 by Mark Hipperson, who was previously involved with Starling and is one of the few FCA-approved UK crypto firms.

Hipperson said:

Ziglu and Robinhood share a common DNA, working to reduce the barriers to entry for a new generation of investors, and we’re looking forward to pursuing that mission together.

Ziglu raised £7M in November 2021 at a valuation of £85M, but investor enthusiasm for crypto was a lot higher back then.

- Robinhood itself warned a couple of months ago that the pandemic trading boom was over, and its shares are down 30% in 2022.

Buffett

It’s been a bad few days for Warren Buffett.

- At the crypto conference in Miami earlier this month, billionaire PayPal co-founder Peter Thiel described Warren as ” Enemy number one: the sociopathic

grandpa from Omaha”.

Enemy of crypto that is, which perhaps Warren wouldn’t mind too much, though he might object to being called sociopathic.

Thiel said:

The finance gerontocracy that runs the country through whatever silly virtue-signaling slash hate-factory term like ESG they have versus what I would call—what we have to think of as a revolutionary youth movement.

When they choose not to allocate to Bitcoin, that is a deeply political choice, and we need to be pushing back against them.

And now CalPERS, the largest US public pension fund, has announced that it will vote for a shareholder proposal to remove Warren as Chairman of Berkshire Hathaway (though he would remain as CEO).

- CalPERS has $2.3bn in BRK, but that’s only a small allocation within its $450 bn pot.

The nonprofit National Legal and Policy Center (which made the proposal) said the roles of CEO and chairman are “greatly diminished” when one person holds both.

- Berkshire plans for Buffett’s son Howard to become non-executive chairman after

his father’s death, while Vice Chairman Greg Abel becomes CEO.

Buffett himself controls 32% of BRK voting power (from 16% of its stock), so the motion may not pass.

CalPERS is also in favour of diversity and climate change plans which BRK opposes.

Quick Links

I have seven for you this week, the first six from The Economist:

- The Economist wondered whether Silicon Valley can still dominate global innovations

- And explained what bigger military budgets mean for the economy.

- The newspaper said that the push for shareholder democracy should be accelerated

- And provided a guide to Britain’s cost-of-living crunch.

- The Economist also reported on Netflix losing subscribers and market cap

- And looked at new research which shows the benefits of diverse supply chains.

- Musings on Markets looked at Elon’s Twitter play.

Until next time.